Covered Bonds in the European Union Reflections on the

... Fixed rate callable mortgage covered bonds Realkredit Danmark’s fixed rate callable mortgage covered bonds will normally reach a volume that fulfills the minimum requirements of the LCR. In bonds open for issuance the activity has been high which is counteracted by the frequent changes in interest ...

... Fixed rate callable mortgage covered bonds Realkredit Danmark’s fixed rate callable mortgage covered bonds will normally reach a volume that fulfills the minimum requirements of the LCR. In bonds open for issuance the activity has been high which is counteracted by the frequent changes in interest ...

15/RT/14 The effect of macroprudential policy on endogenous credit cycles

... build their balance sheets and conform to regulatory pressures (Figure 1). Due to both demand and supply factors, many households and firms have undertaken a wide-scale deleveraging (Figure 2) in order to pay-down some of the debt accrued during the bubble period (Holton and McCann, 2012; Gerlach-K ...

... build their balance sheets and conform to regulatory pressures (Figure 1). Due to both demand and supply factors, many households and firms have undertaken a wide-scale deleveraging (Figure 2) in order to pay-down some of the debt accrued during the bubble period (Holton and McCann, 2012; Gerlach-K ...

The Rise and Fall of Mortgage Securitization

... increased dramatically as interest rates declined and investors were seeking safe investments with high returns. During the 2001-2003 period, vertically integrated banks produced record profits by reaping fees at all parts of the process and making investments in these securities. Beginning in 2004, ...

... increased dramatically as interest rates declined and investors were seeking safe investments with high returns. During the 2001-2003 period, vertically integrated banks produced record profits by reaping fees at all parts of the process and making investments in these securities. Beginning in 2004, ...

Portland International Jetport

... Some HFA balance sheets have decreased 50% or more in recent years ...

... Some HFA balance sheets have decreased 50% or more in recent years ...

draft1 140212

... based utility company listed on the New York stock exchange resulting in returns of 11.39 , a risk of 1.43, thus a gradient of 7.91. The reason for excluding Anglo is that over the past years data they have generated negative returns and thus would hinder the portfolios gradient. There is greater r ...

... based utility company listed on the New York stock exchange resulting in returns of 11.39 , a risk of 1.43, thus a gradient of 7.91. The reason for excluding Anglo is that over the past years data they have generated negative returns and thus would hinder the portfolios gradient. There is greater r ...

Power Point - Minds on the Markets

... Key Economic Indicators The Bloomberg site provides a monthly Economic Calendar identifying when each of the reports are released. This calendar in the market data section of the site, allows the viewer to click on different reports and see how the different indicators can affect the economy. The c ...

... Key Economic Indicators The Bloomberg site provides a monthly Economic Calendar identifying when each of the reports are released. This calendar in the market data section of the site, allows the viewer to click on different reports and see how the different indicators can affect the economy. The c ...

Deterioration of Bank Balance Sheets and

... rate and 10-year Treasury bond increased by almost 1.5 percentage points. Meanwhile, the volume of mortgage originations dropped by almost 50%. Higher cost of credit led to further contraction in economic activity, lowering income of households and raising the cost of buying a house. Demand for hous ...

... rate and 10-year Treasury bond increased by almost 1.5 percentage points. Meanwhile, the volume of mortgage originations dropped by almost 50%. Higher cost of credit led to further contraction in economic activity, lowering income of households and raising the cost of buying a house. Demand for hous ...

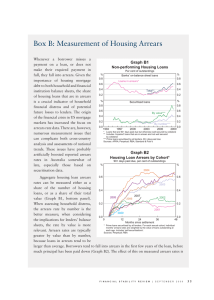

Box B: Measurement of Housing Arrears Graph B1

... The criteria for defining a given loan as being in arrears can differ across countries and lenders. In Australia, housing loans are defined as non-performing if they are either ‘past due’ – where repayments are at least 90 days past due, but the loan is well covered by collateral – or ‘impaired’ – a ...

... The criteria for defining a given loan as being in arrears can differ across countries and lenders. In Australia, housing loans are defined as non-performing if they are either ‘past due’ – where repayments are at least 90 days past due, but the loan is well covered by collateral – or ‘impaired’ – a ...

Vacancy rate of Budapest`s office market dropped to a

... in Budapest, the capital city of Czech Republic will also face the risk of overcapacity as early as next year. The Budapest office market, which in size is similar to that of these two cities – being between 3 and 4 million square metres, whereas Bucharest’s market is significantly smaller and that ...

... in Budapest, the capital city of Czech Republic will also face the risk of overcapacity as early as next year. The Budapest office market, which in size is similar to that of these two cities – being between 3 and 4 million square metres, whereas Bucharest’s market is significantly smaller and that ...

Debt As % of GDP III

... system is less than it would be if all had been income-dependant. Very important to note as well, the families that bought homes substituted mortgage payments for rents--their monthly costs generally stayed the same. However, the mortgage loan adds substantial debt to the total credit market debt ra ...

... system is less than it would be if all had been income-dependant. Very important to note as well, the families that bought homes substituted mortgage payments for rents--their monthly costs generally stayed the same. However, the mortgage loan adds substantial debt to the total credit market debt ra ...

Understanding the global financial crisis

... buyers of CDSs on such securities to demand the corresponding payment. These financial instruments are the derivatives that Warren Buffet termed ‘financial weapons of mass destruction’ in his famous 2002 warning. The financial crisis became acute on 9-10 August, 2008, when money market interest rate ...

... buyers of CDSs on such securities to demand the corresponding payment. These financial instruments are the derivatives that Warren Buffet termed ‘financial weapons of mass destruction’ in his famous 2002 warning. The financial crisis became acute on 9-10 August, 2008, when money market interest rate ...

United States housing bubble

The United States housing bubble was an economic bubble affecting many parts of the United States housing market in over half of American states. Housing prices peaked in early 2006, started to decline in 2006 and 2007, and reached new lows in 2012. On December 30, 2008, the Case-Shiller home price index reported its largest price drop in its history. The credit crisis resulting from the bursting of the housing bubble is—according to general consensus—the primary cause of the 2007–2009 recession in the United States.Increased foreclosure rates in 2006–2007 among U.S. homeowners led to a crisis in August 2008 for the subprime, Alt-A, collateralized debt obligation (CDO), mortgage, credit, hedge fund, and foreign bank markets. In October 2007, the U.S. Secretary of the Treasury called the bursting housing bubble ""the most significant risk to our economy.""Any collapse of the U.S. housing bubble has a direct impact not only on home valuations, but the nation's mortgage markets, home builders, real estate, home supply retail outlets, Wall Street hedge funds held by large institutional investors, and foreign banks, increasing the risk of a nationwide recession. Concerns about the impact of the collapsing housing and credit markets on the larger U.S. economy caused President George W. Bush and the Chairman of the Federal Reserve Ben Bernanke to announce a limited bailout of the U.S. housing market for homeowners who were unable to pay their mortgage debts.In 2008 alone, the United States government allocated over $900 billion to special loans and rescues related to the U.S. housing bubble, with over half going to Fannie Mae and Freddie Mac (both of which are government-sponsored enterprises) as well as the Federal Housing Administration. On December 24, 2009, the Treasury Department made an unprecedented announcement that it would be providing Fannie Mae and Freddie Mac unlimited financial support for the next three years despite acknowledging losses in excess of $400 billion so far. The Treasury has been criticized for encroaching on spending powers that are enumerated for Congress alone by the United States Constitution, and for violating limits imposed by the Housing and Economic Recovery Act of 2008.