Is the Fund Transfer Pricing Ethical? An Interest Rate Swap

... decrease, the option is exercised and the difference between the exercised price (higher) and current spot price (lower) will hedge the loss from requirement to pay a higher interest rate for deposits than one at maturity on the market. The interest rate swaps are done between banking companies, and ...

... decrease, the option is exercised and the difference between the exercised price (higher) and current spot price (lower) will hedge the loss from requirement to pay a higher interest rate for deposits than one at maturity on the market. The interest rate swaps are done between banking companies, and ...

The Term Structure of Interest Rates, Real Activity and Inflation

... immediately (to I,) due to the liquidity effect. Rational investors realise that in the medium/long run output will rise, increasing the demand for money. The short term interest rate must thus be expected to rise over time. As a consequence the long interest rate does not fall by as much as the sh ...

... immediately (to I,) due to the liquidity effect. Rational investors realise that in the medium/long run output will rise, increasing the demand for money. The short term interest rate must thus be expected to rise over time. As a consequence the long interest rate does not fall by as much as the sh ...

Service Center Policy - Office for Sponsored Programs

... 6. Records should be maintained by the center to document 1) the actual direct operating costs of providing the service, 2) units of service provided, 3) revenues, billings and collections and 5) the annual surplus or deficit. 7. The billing rates should be reviewed at least every six months by the ...

... 6. Records should be maintained by the center to document 1) the actual direct operating costs of providing the service, 2) units of service provided, 3) revenues, billings and collections and 5) the annual surplus or deficit. 7. The billing rates should be reviewed at least every six months by the ...

ESTIMATINg pROBABILITY Of DEfAULT AND COMpARINg IT TO

... Banks are willing to finance higher risk borrowers if they have a close relationship with them. This seems not to hold in the case of Slovenia since firms in default have on aver- ...

... Banks are willing to finance higher risk borrowers if they have a close relationship with them. This seems not to hold in the case of Slovenia since firms in default have on aver- ...

Inflation and the Housing Market

... the capital gain rate otherwise), inflation should actually lower the real cost of home ownership. The Level of Inflation and the Ability of Households to Purchase Housing. Even though inflation does not increase the sum of discounted payments, it will have an effect on the value of housing which a ...

... the capital gain rate otherwise), inflation should actually lower the real cost of home ownership. The Level of Inflation and the Ability of Households to Purchase Housing. Even though inflation does not increase the sum of discounted payments, it will have an effect on the value of housing which a ...

A World with Higher Interest Rates

... The past ten years have been characterized by extraordinarily low interest rates around the industrialized world. These rates have persisted in the wake of the recent economic crisis, as central banks have loosened monetary policy significantly. While a dramatic increase in interest rates over the n ...

... The past ten years have been characterized by extraordinarily low interest rates around the industrialized world. These rates have persisted in the wake of the recent economic crisis, as central banks have loosened monetary policy significantly. While a dramatic increase in interest rates over the n ...

Form 10-Q - Town Sports International Holdings, Inc.

... condensed consolidated balance sheet and is being amortized as interest expense using the effective interest method. On May 11, 2011, debt issuance costs related to the 2011 Senior Credit Facility were $8,065, of which $7,288 are being amortized as interest expense, and are included in other assets ...

... condensed consolidated balance sheet and is being amortized as interest expense using the effective interest method. On May 11, 2011, debt issuance costs related to the 2011 Senior Credit Facility were $8,065, of which $7,288 are being amortized as interest expense, and are included in other assets ...

Certainty Equivalents and Risk-Adjusted Discount Rates

... 1. Flip a fair coin. If heads comes up, you receive $1 million, but if tails comes up, you get nothing. The expected value of the gamble is (0.5)($1,000,000) ⫹ (0.5)($0) ⫽ $500,000, but the actual outcome will be either $0 or $1 million, so this choice is risky. 2. Do not flip the coin and simply po ...

... 1. Flip a fair coin. If heads comes up, you receive $1 million, but if tails comes up, you get nothing. The expected value of the gamble is (0.5)($1,000,000) ⫹ (0.5)($0) ⫽ $500,000, but the actual outcome will be either $0 or $1 million, so this choice is risky. 2. Do not flip the coin and simply po ...

Chapter Two: LOW GROWTH, LOW INTEREST RATES, AND

... Previous studies have mainly examined the impact of falling interest rates. They have often focused on the short-term impact of monetary policy decisions, but not on the length of the low rate period and have not distinguished between the impact of falling short-term rates and that of the flattening ...

... Previous studies have mainly examined the impact of falling interest rates. They have often focused on the short-term impact of monetary policy decisions, but not on the length of the low rate period and have not distinguished between the impact of falling short-term rates and that of the flattening ...

Infraestructura Energética Nova, S. A. B. de C. V. and Subsidiaries

... gas in the states of Baja California, Sonora, Sinaloa, Coahuila, Chihuahua, Durango, Tamaulipas, Nuevo León and Jalisco, México. It also owns and operates a liquefied natural gas (“LNG”) terminal in Baja California, México for importing, storing and regasifying LNG. The Power segment owns and operat ...

... gas in the states of Baja California, Sonora, Sinaloa, Coahuila, Chihuahua, Durango, Tamaulipas, Nuevo León and Jalisco, México. It also owns and operates a liquefied natural gas (“LNG”) terminal in Baja California, México for importing, storing and regasifying LNG. The Power segment owns and operat ...

Bank of America 2016 Dodd-Frank Act Annual Stress Test Results

... 5 Commercial and industrial loans include small and medium enterprise loans and corporate cards. Other loans include international real estate loans. 6 Calculated by dividing the nine-quarter cumulative loan and lease losses by the average of the accrual loan and lease balances for each portfolio ov ...

... 5 Commercial and industrial loans include small and medium enterprise loans and corporate cards. Other loans include international real estate loans. 6 Calculated by dividing the nine-quarter cumulative loan and lease losses by the average of the accrual loan and lease balances for each portfolio ov ...

Is monetary policy less effective when interest rates are persistently

... has gone along with a fall in real (inflation-adjusted) rates to persistently negative levels. Long-term rates have also trended down, albeit more gradually, over this period: in nominal terms, they fell from between 3–4% in 2009 to below 1% in 2016, on average (Graph 1, centre panel); in real terms ...

... has gone along with a fall in real (inflation-adjusted) rates to persistently negative levels. Long-term rates have also trended down, albeit more gradually, over this period: in nominal terms, they fell from between 3–4% in 2009 to below 1% in 2016, on average (Graph 1, centre panel); in real terms ...

The Value of Fiat Money with an Outside Bank

... sell-all organization of market, thus depriving the players of strategic action concerning sales.8 We provide endowments of (0, a, m) and (a, 0, m) to make sure that there is strong incentive to purchase both goods. The so-called “cash-in-advance” condition is implicit in any simultaneous move model ...

... sell-all organization of market, thus depriving the players of strategic action concerning sales.8 We provide endowments of (0, a, m) and (a, 0, m) to make sure that there is strong incentive to purchase both goods. The so-called “cash-in-advance” condition is implicit in any simultaneous move model ...

Read Paper - Economics

... Instead of closing international capital markets, there are several other policy options that are more appealing. In particular we show that a natural answer to a secular stagnation scenario is fiscal policy, either in the form of direct spending financed by taxation on the working population or via ...

... Instead of closing international capital markets, there are several other policy options that are more appealing. In particular we show that a natural answer to a secular stagnation scenario is fiscal policy, either in the form of direct spending financed by taxation on the working population or via ...

The two period production economy

... this model, we are able to sketch out some key proposition of the business cycle model without worrying with the algebra too much. This note is organized as follows. In Section 2, we present the main model and the implied optimality conditions. In Section 3 we describe the aggregate demand, as a rel ...

... this model, we are able to sketch out some key proposition of the business cycle model without worrying with the algebra too much. This note is organized as follows. In Section 2, we present the main model and the implied optimality conditions. In Section 3 we describe the aggregate demand, as a rel ...

Chapter 7: The Demand for Money

... Suppose, on the other hand, the interest rate rose temporarily to 11%. Then the Joneses and others would find the cost of holding money had risen, and they would want to reduce their money balances in order to hold more of their assets in the form of bonds. As the Joneses and others try to purchase ...

... Suppose, on the other hand, the interest rate rose temporarily to 11%. Then the Joneses and others would find the cost of holding money had risen, and they would want to reduce their money balances in order to hold more of their assets in the form of bonds. As the Joneses and others try to purchase ...

Interest Rates and Monetary Policy Uncertainty

... the risk premium. To maintain equilibrium, the nominal rate of return of the bond must fall, so that the increase in the expected real rate of return of the bond is equal to the increase in the risk premium for a given real rate of return on safe real assets. While households act rationally in the m ...

... the risk premium. To maintain equilibrium, the nominal rate of return of the bond must fall, so that the increase in the expected real rate of return of the bond is equal to the increase in the risk premium for a given real rate of return on safe real assets. While households act rationally in the m ...

GMAC Demand Notes – What`s the Risk

... In our opinion, the actual risk of losing money in GMAC Demand Notes is very, very remote. First, GM must actually file bankruptcy for the scenario that some lay out to even occur. While GM may seek bankruptcy-court protection at some point in the distant future to reduce pension and healthcare burd ...

... In our opinion, the actual risk of losing money in GMAC Demand Notes is very, very remote. First, GM must actually file bankruptcy for the scenario that some lay out to even occur. While GM may seek bankruptcy-court protection at some point in the distant future to reduce pension and healthcare burd ...

Chapter 4 "Foreign Exchange Markets and Rates of Return"

... the risk. Invest in an oil wildcat endeavor and you might get a 1,000 percent return on your investment—that is, if you strike oil. The chances of doing so are likely to be very low, however. Thus a key concern of investors is how to manage the trade-off between risk and return. 3. Liquidity. Liquid ...

... the risk. Invest in an oil wildcat endeavor and you might get a 1,000 percent return on your investment—that is, if you strike oil. The chances of doing so are likely to be very low, however. Thus a key concern of investors is how to manage the trade-off between risk and return. 3. Liquidity. Liquid ...

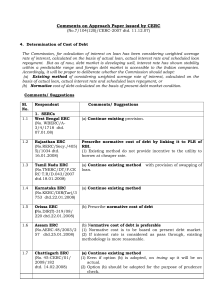

Comments on approach paper 04 - Central Electricity Regulatory

... (No.7/104(120)/CERC-2007 dtd. 11.12.07) 4. Determination of Cost of Debt The Commission, for calculation of interest on loan has been considering weighted average rate of interest, calculated on the basis of actual loan, actual interest rate and scheduled loan repayment. But as of now, debt market i ...

... (No.7/104(120)/CERC-2007 dtd. 11.12.07) 4. Determination of Cost of Debt The Commission, for calculation of interest on loan has been considering weighted average rate of interest, calculated on the basis of actual loan, actual interest rate and scheduled loan repayment. But as of now, debt market i ...

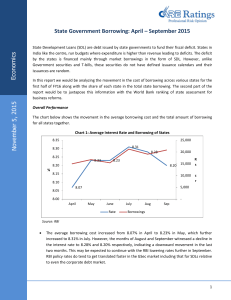

State Government Borrowing

... The overall trend in cost of borrowing varies with market conditions but is largely a function of the RBI policy rate. States do borrow at differential rates and hence perception matters. There are no clear trends whether smaller states (defined as those with lower requirements) source funds at a lo ...

... The overall trend in cost of borrowing varies with market conditions but is largely a function of the RBI policy rate. States do borrow at differential rates and hence perception matters. There are no clear trends whether smaller states (defined as those with lower requirements) source funds at a lo ...

29.00 - fimmda

... (b) Does the Exporter make a loss of 9.80 ? The Exporter’s Decision was to protect his business profit of Rs 10.00, which he has done by delivering the USD at the contracted rate of 1 USD= Rs 39.20. The Exporter suffers an “Opportunity Loss” by protecting himself against all Exchange Rate ...

... (b) Does the Exporter make a loss of 9.80 ? The Exporter’s Decision was to protect his business profit of Rs 10.00, which he has done by delivering the USD at the contracted rate of 1 USD= Rs 39.20. The Exporter suffers an “Opportunity Loss” by protecting himself against all Exchange Rate ...

Chapter 4

... In drawing the demand and supply curves for bonds, factors other than the prices of bonds are held constant. If the price of bonds changes, we move along the demand (supply) curve, so we have a change in quantity demanded (supplied). If any other relevant variable changes, then the demand (supply) c ...

... In drawing the demand and supply curves for bonds, factors other than the prices of bonds are held constant. If the price of bonds changes, we move along the demand (supply) curve, so we have a change in quantity demanded (supplied). If any other relevant variable changes, then the demand (supply) c ...

What Distinguishes Larger and More Efficient Credit Unions?

... loans, savings certificates, retirement accounts, and even credit cards a n d safe d e p o s i t boxes. A l t h o u g h full-service credit unions still t e n d t o be small c o m p a r e d w i t h c o m m u n i t y banks or w i t h savings and loan associations m o v i n g i n t o t h e c o m m u n ...

... loans, savings certificates, retirement accounts, and even credit cards a n d safe d e p o s i t boxes. A l t h o u g h full-service credit unions still t e n d t o be small c o m p a r e d w i t h c o m m u n i t y banks or w i t h savings and loan associations m o v i n g i n t o t h e c o m m u n ...

Four Fund Accounting Essentials

... ending balance, which may be a holdover from the days of manual calculations. A more equitable method is to use average daily balance. Some community foundations charge a fee based on contributions coming in or grants going out. Foundations can alternately charge a fee on the asset and on the activi ...

... ending balance, which may be a holdover from the days of manual calculations. A more equitable method is to use average daily balance. Some community foundations charge a fee based on contributions coming in or grants going out. Foundations can alternately charge a fee on the asset and on the activi ...