Short-Term Income Fund - Investor Fact Sheet

... The holdings percentages are based on net assets at the close of business on 3/31/17 and may not necessarily reflect adjustments that are routinely made when presenting net assets for formal financial statement purposes. Because this is a managed portfolio, the investment mix will change. Total retu ...

... The holdings percentages are based on net assets at the close of business on 3/31/17 and may not necessarily reflect adjustments that are routinely made when presenting net assets for formal financial statement purposes. Because this is a managed portfolio, the investment mix will change. Total retu ...

Introduction - Missouri Center for Career Education

... the entire balance each month to avoid costly interest charges. One should not have a credit card until they will be able to meet this standard. ...

... the entire balance each month to avoid costly interest charges. One should not have a credit card until they will be able to meet this standard. ...

Document

... Tremendous losses Now know the facts and learning more Less risk adverse than GSE’s, but will want similar protections, still perceive many problems Probably will partner with GSE’s, which would provide substantial increased liquidity Both have lost their MH naivete ...

... Tremendous losses Now know the facts and learning more Less risk adverse than GSE’s, but will want similar protections, still perceive many problems Probably will partner with GSE’s, which would provide substantial increased liquidity Both have lost their MH naivete ...

Review PowerPoint

... Bad purchases may cause loss of income and property Credit does not give you more money – still have to pay later May have trouble paying bills ...

... Bad purchases may cause loss of income and property Credit does not give you more money – still have to pay later May have trouble paying bills ...

Mortgage Lending Discrimination - Fair Housing Center of West

... Majority non‐white tracts are three times as likely to receive subprime loans as the Whitest tracts Majority of subprime loans are government‐backed Are qualified people of color being steered away from conventional loans? ...

... Majority non‐white tracts are three times as likely to receive subprime loans as the Whitest tracts Majority of subprime loans are government‐backed Are qualified people of color being steered away from conventional loans? ...

Chapter 10

... In the early 1960s, South Korea’s interest rates on deposits were very low at a time when the country was experiencing high inflation. So savers didn’t want to save by putting money in a bank, fearing that much of their purchasing power would be eroded by rising prices. Instead, they engaged in curr ...

... In the early 1960s, South Korea’s interest rates on deposits were very low at a time when the country was experiencing high inflation. So savers didn’t want to save by putting money in a bank, fearing that much of their purchasing power would be eroded by rising prices. Instead, they engaged in curr ...

File

... Simple Interest When banks use simple interest, they consider the principal, the interest rate, and the length of time of the loan. ...

... Simple Interest When banks use simple interest, they consider the principal, the interest rate, and the length of time of the loan. ...

Lesson: "Applications: Growth and Decay"

... Andy invests $2,700.00 in a CD at an interest rate of 4.6% for 9 months. If the interest gets compounded continuously, how much will he have at the end of the term? How many years will it take for an initial investment of $7,000.00 to grow to $9,500.00 at a rate of 6% compounded quarterly? ...

... Andy invests $2,700.00 in a CD at an interest rate of 4.6% for 9 months. If the interest gets compounded continuously, how much will he have at the end of the term? How many years will it take for an initial investment of $7,000.00 to grow to $9,500.00 at a rate of 6% compounded quarterly? ...

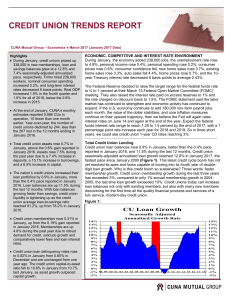

credit union trends report

... Credit union borrowings grew $17.7 billion in January, (Figure 7), the biggest one-month gain in credit union history, in order to take advantage of a recent riskless arbitrage profit opportunity. In December 2016, the Federal Reserve increased the interest rate paid on excess reserves to 0.75%. Thi ...

... Credit union borrowings grew $17.7 billion in January, (Figure 7), the biggest one-month gain in credit union history, in order to take advantage of a recent riskless arbitrage profit opportunity. In December 2016, the Federal Reserve increased the interest rate paid on excess reserves to 0.75%. Thi ...

Week Four Review Questions and Problems

... 8-5. Systematic risk is the variability in a security’s total returns that is directly associated with overall movements in the general market or economy. Nonsystematic risk is firm-specific, meaning that it only affects one firm or a small number of firms. Proper diversification cannot reduce syste ...

... 8-5. Systematic risk is the variability in a security’s total returns that is directly associated with overall movements in the general market or economy. Nonsystematic risk is firm-specific, meaning that it only affects one firm or a small number of firms. Proper diversification cannot reduce syste ...

CFI-Letterhead Template

... Assume a company is valued at $1,000,000 and is generating $60,000 in net profits a year. The Return on Asset (ROA) is therefore 6%. Is the return adequate or not? Here is how people tend to answer this question: 1. Business is operating at above breakeven so return is adequate. 2. The return is gre ...

... Assume a company is valued at $1,000,000 and is generating $60,000 in net profits a year. The Return on Asset (ROA) is therefore 6%. Is the return adequate or not? Here is how people tend to answer this question: 1. Business is operating at above breakeven so return is adequate. 2. The return is gre ...

Compound Interest

... so that the interest computed at the end of the next payment period is based on this new amount (old principle + interest), the interest is said to have been compounded. Example 1: A great bank pays 10% interest per year compounded semi-annually on a certain savings account. If $5000 is deposited in ...

... so that the interest computed at the end of the next payment period is based on this new amount (old principle + interest), the interest is said to have been compounded. Example 1: A great bank pays 10% interest per year compounded semi-annually on a certain savings account. If $5000 is deposited in ...

Institute of Actuaries of India INDICATIVE SOLUTIONS November 2012 Examinations

... The indicative solution has been written by the Examiners with the aim of helping candidates. The solutions given are only indicative. It is realized that there could be other points as valid answers and examiner have given credit for any alternative approach or interpretation which they consider to ...

... The indicative solution has been written by the Examiners with the aim of helping candidates. The solutions given are only indicative. It is realized that there could be other points as valid answers and examiner have given credit for any alternative approach or interpretation which they consider to ...

Progress Towards Creating more Effective Resolution Regimes

... Interest Rate: LIBOR+1.8%( CBJ to banks) ...

... Interest Rate: LIBOR+1.8%( CBJ to banks) ...

Macroeconomic overview

... Good results and market position of subsidiaries Dynamic development of leasing subsidiaries Dom Maklerski – significant share in equity and futures turnover on the capital market ...

... Good results and market position of subsidiaries Dynamic development of leasing subsidiaries Dom Maklerski – significant share in equity and futures turnover on the capital market ...

Monetary Policy and the Risk-Taking Channel

... across different monetary policy environments. The authors combine loan information with firm- and bank-level balance-sheet data to account for the effects of credit demand and credit supply.12 They suggest that the risk-taking channel may be present in the syndicated loan market if the difference b ...

... across different monetary policy environments. The authors combine loan information with firm- and bank-level balance-sheet data to account for the effects of credit demand and credit supply.12 They suggest that the risk-taking channel may be present in the syndicated loan market if the difference b ...

PRESS RELEASE 11 July 2017 TIM PHILLIPS JOINS

... Sompo Canopius has made a number of hires recently in the Credit & Political Risk and Trade Credit areas, which form part of targeted plans for broader diversification and expansion of the group's specialty lines. ...

... Sompo Canopius has made a number of hires recently in the Credit & Political Risk and Trade Credit areas, which form part of targeted plans for broader diversification and expansion of the group's specialty lines. ...

Electronic Payment Systems

... An investment banker or investment company, a currency exchange, an issuer, redeemer, or cashier of travelers checks, checks money orders or similar instruments, credit card system operators, insurance companies, dealers in precious metals, stones or jewels, a pawn broker; a loan or finance company; ...

... An investment banker or investment company, a currency exchange, an issuer, redeemer, or cashier of travelers checks, checks money orders or similar instruments, credit card system operators, insurance companies, dealers in precious metals, stones or jewels, a pawn broker; a loan or finance company; ...

Chapter 25

... income that households have left after paying their taxes and paying for their consumption. Public Saving is the amount of tax revenue that the government has left after paying for its spending. For the economy as a whole, saving must be equal to investment. Principles of Macroeconomics: Ch. 13 ...

... income that households have left after paying their taxes and paying for their consumption. Public Saving is the amount of tax revenue that the government has left after paying for its spending. For the economy as a whole, saving must be equal to investment. Principles of Macroeconomics: Ch. 13 ...

Loanable Funds

... The interest rate is determined by the supply and demand for loanable funds. The supply of loanable funds comes from households who want to save some of their income. The demand for loanable funds comes from households and firms who want to borrow for investment. National saving equals private savin ...

... The interest rate is determined by the supply and demand for loanable funds. The supply of loanable funds comes from households who want to save some of their income. The demand for loanable funds comes from households and firms who want to borrow for investment. National saving equals private savin ...

Trade Credit Supply, Market Power and the Matching of Trade Credit

... • consistent with evidence that firms in our sample have few disputes with trading partners (<30%) and only seldom rely on court action. ...

... • consistent with evidence that firms in our sample have few disputes with trading partners (<30%) and only seldom rely on court action. ...

Payment Mortgages

... loans that it will purchase from banks and other lenders. The action … will encourage those banks to extend home mortgages to individuals whose credit is generally not good enough to qualify for conventional loans. Fannie Mae officials say they hope to make it a nationwide program by next spring. Fa ...

... loans that it will purchase from banks and other lenders. The action … will encourage those banks to extend home mortgages to individuals whose credit is generally not good enough to qualify for conventional loans. Fannie Mae officials say they hope to make it a nationwide program by next spring. Fa ...

Measures in Ireland

... Designing macroprudential policy in mortgage lending: do first time buyers default less? ...

... Designing macroprudential policy in mortgage lending: do first time buyers default less? ...

Advertising Checklist - DOC

... If the simple interest rate applied to the unpaid balance is stated in the ad, is it stated only in conjunction with, and not more conspicuously than, the APR? Does the ad state the number of payments or period of repayment, the amount of any payment, or the amount or rate of any finance charge? If ...

... If the simple interest rate applied to the unpaid balance is stated in the ad, is it stated only in conjunction with, and not more conspicuously than, the APR? Does the ad state the number of payments or period of repayment, the amount of any payment, or the amount or rate of any finance charge? If ...

Credit Default Swaps and the synthetic CDO

... o The note issue will be of interest to investors who wish to hold credits but where opportunities are limited because of liquidity issues, or lack of market intelligence / expertise in analysis of high yield debt. o The class A, B and C notes pay from 55 bps to 275 bps over 3m euribor, (2008 expect ...

... o The note issue will be of interest to investors who wish to hold credits but where opportunities are limited because of liquidity issues, or lack of market intelligence / expertise in analysis of high yield debt. o The class A, B and C notes pay from 55 bps to 275 bps over 3m euribor, (2008 expect ...

Credit rationing

Credit rationing refers to the situation where lenders limit the supply of additional credit to borrowers who demand funds, even if the latter are willing to pay higher interest rates. It is an example of market imperfection, or market failure, as the price mechanism fails to bring about equilibrium in the market. It should not be confused with cases where credit is simply ""too expensive"" for some borrowers, that is, situations where the interest rate is deemed too high. On the contrary, the borrower would like to acquire the funds at the current rates, and the imperfection refers to the absence of equilibrium in spite of willing borrowers. In other words, at the prevailing market interest rate, demand exceeds supply, but lenders are not willing to either loan more funds, or raise the interest rate charged, as they are already maximising profits.