Enhancing our platform for the future

... Daicel Corporation was founded in 1919 as Dainippon Celluloid Company Limited, created through the merger of eight celluloid producers. Deploying its original celluloid-related technological expertise, the Company has expanded into the fields of cellulose chemistry, organic synthesis chemistry, poly ...

... Daicel Corporation was founded in 1919 as Dainippon Celluloid Company Limited, created through the merger of eight celluloid producers. Deploying its original celluloid-related technological expertise, the Company has expanded into the fields of cellulose chemistry, organic synthesis chemistry, poly ...

Calculate - LessonPaths

... calculations and round your answers to the nearest whole number, e.g., 32. Input all amounts as positive values): ...

... calculations and round your answers to the nearest whole number, e.g., 32. Input all amounts as positive values): ...

Delay in the Expansion from 2.5G to 3G Wireless Networks

... Company announced it expected revenues for 2004 to decline as much as 12 percent , but it planned cost cuts. Having eliminated 15,000 jobs since 2002, the company will likely make several waves of layoffs during the year. Restatements for 2000-03 were the largest and most complex ever undertaken. Af ...

... Company announced it expected revenues for 2004 to decline as much as 12 percent , but it planned cost cuts. Having eliminated 15,000 jobs since 2002, the company will likely make several waves of layoffs during the year. Restatements for 2000-03 were the largest and most complex ever undertaken. Af ...

Risk Premiums in Slovak Government Bonds

... Overnight-Indexed Swap (OIS) is an interest rate swap whose floating rate leg is tied to the overnight rate, i.e. EONIA in the Eurozone. Unlike the swaps linked to the Libor rate, OIS do not reflect the credit risk of the banking system. Similar to conventional swaps, there is no exchange of the pri ...

... Overnight-Indexed Swap (OIS) is an interest rate swap whose floating rate leg is tied to the overnight rate, i.e. EONIA in the Eurozone. Unlike the swaps linked to the Libor rate, OIS do not reflect the credit risk of the banking system. Similar to conventional swaps, there is no exchange of the pri ...

lincoln national corporation

... assurance can be given, management believes that the approvals for the payment of dividends in amounts consistent with those paid in the past can be obtained. In the event such approvals are not obtained, management believes that LNC can obtain the funds required to satisfy its obligations from its ...

... assurance can be given, management believes that the approvals for the payment of dividends in amounts consistent with those paid in the past can be obtained. In the event such approvals are not obtained, management believes that LNC can obtain the funds required to satisfy its obligations from its ...

Emerging Countries Sovereign Rating Adjustment using Market

... S&P’s ratings can be explained by a number of well-defined economic criteria. Ferri et al.(1999)[12] used these indicators to compare the ratings pre- and post- East Asian crisis. They reached the conclusion that rating agencies failed predicting the emergence of the East Asian crisis and attributed ...

... S&P’s ratings can be explained by a number of well-defined economic criteria. Ferri et al.(1999)[12] used these indicators to compare the ratings pre- and post- East Asian crisis. They reached the conclusion that rating agencies failed predicting the emergence of the East Asian crisis and attributed ...

Best Practice Risk Management

... – Greater product Complexity – New businesses (e-banking, merchant banking,…) – Increasing competition – New players – Regulatory imbalances ...

... – Greater product Complexity – New businesses (e-banking, merchant banking,…) – Increasing competition – New players – Regulatory imbalances ...

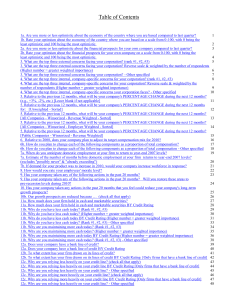

High-Level Results

... 9. Has your company taken any of the following actions in the past 20 months? Will you restore these areas to pre-recession levels during 2010? ...

... 9. Has your company taken any of the following actions in the past 20 months? Will you restore these areas to pre-recession levels during 2010? ...

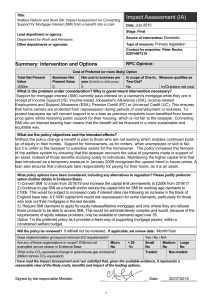

Impact Assessment (IA)

... The cost of SMI is dependent on interest rates. If the average mortgage rate were to double, so would the cost of SMI, but converting to a loan will reduce the risk of additional costs to the tax payer from interest rate rises. This lower financial risk makes the scheme sustainable. The policy will ...

... The cost of SMI is dependent on interest rates. If the average mortgage rate were to double, so would the cost of SMI, but converting to a loan will reduce the risk of additional costs to the tax payer from interest rate rises. This lower financial risk makes the scheme sustainable. The policy will ...

A Closer Look at Money Market Funds: Bank CD Alternatives

... fund invests in an assortment of highgrade money market instruments including commercial paper, U.S. government securities, certificates of deposit (CDs), and repurchase agreements. General-purpose portfolios normally provide the highest yield within the money fund arena. • Federally tax-free: These ...

... fund invests in an assortment of highgrade money market instruments including commercial paper, U.S. government securities, certificates of deposit (CDs), and repurchase agreements. General-purpose portfolios normally provide the highest yield within the money fund arena. • Federally tax-free: These ...

What Makes a Good ʽBad Bankʼ? The Irish, Spanish and German

... real-estate related assets from several banks, while FMS acquired different categories of assets, from real estate to structured products, from one banking group. The three AMCs are today at different stages of portfolio disposal. As in many countries public finances deteriorated strongly due to the ...

... real-estate related assets from several banks, while FMS acquired different categories of assets, from real estate to structured products, from one banking group. The three AMCs are today at different stages of portfolio disposal. As in many countries public finances deteriorated strongly due to the ...

Fraud Created the Market: Presuming Reliance in Rule 10(b)

... I. THE PRESUMPTION OF RELIANCE IN PRIVATE RULE 10B-5 ACTIONS This part addresses the judicial development and importance of the presumption of reliance under Rule 10b-5 in the Supreme Court. This part first lays out the Securities Act and Exchange Act and their purpose. Next, it discusses in general ...

... I. THE PRESUMPTION OF RELIANCE IN PRIVATE RULE 10B-5 ACTIONS This part addresses the judicial development and importance of the presumption of reliance under Rule 10b-5 in the Supreme Court. This part first lays out the Securities Act and Exchange Act and their purpose. Next, it discusses in general ...

american capital agency corp. - corporate

... that at the time of purchase, we designate a security as held-to-maturity, available-for-sale or trading depending on our ability and intent to hold such security to maturity. Securities classified as trading and available-for-sale are reported at fair value, while securities classified as held-to-m ...

... that at the time of purchase, we designate a security as held-to-maturity, available-for-sale or trading depending on our ability and intent to hold such security to maturity. Securities classified as trading and available-for-sale are reported at fair value, while securities classified as held-to-m ...