Introduction to Macroeconomics

... and in China (1948-1949) where the “Chinese Communist Party never forgets it seized power in 1949 following not just military victory, but also hyperinflation under the Kuomintang government…”v More recently, there was hyperinflation in the former Yugoslavia where Slobodan Milosevic engineered the ...

... and in China (1948-1949) where the “Chinese Communist Party never forgets it seized power in 1949 following not just military victory, but also hyperinflation under the Kuomintang government…”v More recently, there was hyperinflation in the former Yugoslavia where Slobodan Milosevic engineered the ...

Ch. 26 Comparing Economic Systems

... economy, but there were problems: State owned factories had to be switched to private ownership Stock markets had to be created Let the forces of supply and demand guide the market naturally ...

... economy, but there were problems: State owned factories had to be switched to private ownership Stock markets had to be created Let the forces of supply and demand guide the market naturally ...

Recession fears greatly intensified after the terror-

... determining the date of a business cycle peak, the NBER examines the individual peaks in these and similar series. If the slowdown in the economy affects many different sectors, then the peaks in these individual series tend to cluster together, and the monthly date of the central tendency of this ...

... determining the date of a business cycle peak, the NBER examines the individual peaks in these and similar series. If the slowdown in the economy affects many different sectors, then the peaks in these individual series tend to cluster together, and the monthly date of the central tendency of this ...

Global Recession: How Deep and for How Long?

... recovery assessments are based on the assumptions that the crisis in financial markets would be resolved soon and that there would be no negative feedback loops both between the real sector and the financial sector (which would exacerbate the financial crisis) and within the real sector (which woul ...

... recovery assessments are based on the assumptions that the crisis in financial markets would be resolved soon and that there would be no negative feedback loops both between the real sector and the financial sector (which would exacerbate the financial crisis) and within the real sector (which woul ...

globalisation advantages and disadvantages

... complementary is developed (Pricop and Tanţău, 2003, p. 23). This is due to the rapidity with which technological changes occur, given the sharp reduction in product life cycle and new orientations of leader organizations towards research and development, activity whose importance is growing. The ne ...

... complementary is developed (Pricop and Tanţău, 2003, p. 23). This is due to the rapidity with which technological changes occur, given the sharp reduction in product life cycle and new orientations of leader organizations towards research and development, activity whose importance is growing. The ne ...

Document

... innovation has also been associated with structural weaknesses and complacency in risk management. For instance, the low transparency of these complex products may have made it easier for investors to underestimate the risks they take on. In addition, with prudential regulation sometimes lagging beh ...

... innovation has also been associated with structural weaknesses and complacency in risk management. For instance, the low transparency of these complex products may have made it easier for investors to underestimate the risks they take on. In addition, with prudential regulation sometimes lagging beh ...

Learnings from the Global Financial Crisis

... recession followed, contributing to the emergence of a sovereign debt crisis in the euro area. European sovereign debt problems remain a dark cloud overhanging the world economy. These extreme events have provoked us to re-think what is known and where economic research should focus, in some cases f ...

... recession followed, contributing to the emergence of a sovereign debt crisis in the euro area. European sovereign debt problems remain a dark cloud overhanging the world economy. These extreme events have provoked us to re-think what is known and where economic research should focus, in some cases f ...

Economics - Klein Oak.org

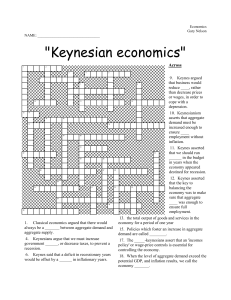

... 1. Classical economics argued that there would always be a _______ between aggregate demand and aggregate supply. 4. Keynesians argue that we must increase government ______, or decrease taxes, to prevent a recession. 6. Keynes said that a deficit in recessionary years would be offset by a ______ in ...

... 1. Classical economics argued that there would always be a _______ between aggregate demand and aggregate supply. 4. Keynesians argue that we must increase government ______, or decrease taxes, to prevent a recession. 6. Keynes said that a deficit in recessionary years would be offset by a ______ in ...

A Global Economic and Financial Outlook (Q2 2015)

... boosting the stock performance of the Euro Area. PE ratio of the MSCI Europe Index rose to 15 in the first quarter. However, the limited decline of the long-term interest rates in the Euro Area may constrain the PE ratio from further climbing. Bond market. Demand for European government bonds have e ...

... boosting the stock performance of the Euro Area. PE ratio of the MSCI Europe Index rose to 15 in the first quarter. However, the limited decline of the long-term interest rates in the Euro Area may constrain the PE ratio from further climbing. Bond market. Demand for European government bonds have e ...

The Self Regulating Economy

... • If the economy is self-regulating, what happens in a recessionary gap? • If the economy is self-regulating, what happens in an inflationary gap? • Give an example to illustrate how the economy can operate below the natural unemployment rate. • If the economy is self-regulating, how do changes in a ...

... • If the economy is self-regulating, what happens in a recessionary gap? • If the economy is self-regulating, what happens in an inflationary gap? • Give an example to illustrate how the economy can operate below the natural unemployment rate. • If the economy is self-regulating, how do changes in a ...

Mozambique Business Forecast Report Q2 2011 Brochure

... The scene is set for Mozambique to flourish over the coming years. The country boasts a relatively stable political climate, an improving business environment and plentiful natural resources, all of which will bode well for strong economic growth. Indeed, the Southern African country is increasingly ...

... The scene is set for Mozambique to flourish over the coming years. The country boasts a relatively stable political climate, an improving business environment and plentiful natural resources, all of which will bode well for strong economic growth. Indeed, the Southern African country is increasingly ...

File - Mr. Henderson Social Studies.

... ideology written about by an 18th century thinker- Adam Smith in a book entitled “The Wealth of Nations.” Smith claimed that the more the people of different people trade with each other the less likely they are to go to war. Moreover, he claimed that the government must not interfere with the econo ...

... ideology written about by an 18th century thinker- Adam Smith in a book entitled “The Wealth of Nations.” Smith claimed that the more the people of different people trade with each other the less likely they are to go to war. Moreover, he claimed that the government must not interfere with the econo ...

Economic Highlights Presentation - PowerPoint Format

... 6 Israelis in the last 10 years have been awarded Nobel Prizes in the fields of Economics or Chemistry ...

... 6 Israelis in the last 10 years have been awarded Nobel Prizes in the fields of Economics or Chemistry ...

2. I E D

... the aim to bring inflation closer to the target range. Other emerging market central banks, particularly in Eastern Europe, continued to ease monetary policy in this period as inflation remained mostly below the target. The first quarter of 2014 was marked by policy rate hikes across countries such ...

... the aim to bring inflation closer to the target range. Other emerging market central banks, particularly in Eastern Europe, continued to ease monetary policy in this period as inflation remained mostly below the target. The first quarter of 2014 was marked by policy rate hikes across countries such ...

Chapter 15 - AP Macroeconomics

... The reduction in investment, or other component of GDP, in the long run caused by an increase in government spending. ...

... The reduction in investment, or other component of GDP, in the long run caused by an increase in government spending. ...

anatomy of a financial crisis

... “The characteristics of a Kondratieff B-phase are well-known and match what the worldeconomy has been experiencing since the 1970s. Profit rates from productive activities go down, especially in those types of production that have been most profitable. Consequently, capitalists who wish to make real ...

... “The characteristics of a Kondratieff B-phase are well-known and match what the worldeconomy has been experiencing since the 1970s. Profit rates from productive activities go down, especially in those types of production that have been most profitable. Consequently, capitalists who wish to make real ...

2. I D E nternational

... In the first quarter of 2015, global economic activity remained weak, and year-end global growth forecasts have contracted since the publication of the previous Inflation Report. The sluggish growth performance of emerging economies was sustained in this period, while economic activity followed a re ...

... In the first quarter of 2015, global economic activity remained weak, and year-end global growth forecasts have contracted since the publication of the previous Inflation Report. The sluggish growth performance of emerging economies was sustained in this period, while economic activity followed a re ...

The European Economic Recovery Plan

... eligibility: non-discriminatory so as to avoid undue distortive effects on neighbouring markets and the internal market as a whole types of liabilities covered: mainly depositors’ guarantees to avoid bank runs and contamination Temporal scope of guarantee scheme Aid limited to minimum-private sector ...

... eligibility: non-discriminatory so as to avoid undue distortive effects on neighbouring markets and the internal market as a whole types of liabilities covered: mainly depositors’ guarantees to avoid bank runs and contamination Temporal scope of guarantee scheme Aid limited to minimum-private sector ...

Introduction to Session III: Reducing Country

... Forbes, Kristin (2007), “One cost of the Chilean capital controls: Increased financial constraints for smaller traded firms,” Journal of International Economics, 71, no.2, April, Pages 294-323 Frankel, Jeffrey & George Saravelos (2010), “Are Leading Indicators of Financial Crises Useful for Assessin ...

... Forbes, Kristin (2007), “One cost of the Chilean capital controls: Increased financial constraints for smaller traded firms,” Journal of International Economics, 71, no.2, April, Pages 294-323 Frankel, Jeffrey & George Saravelos (2010), “Are Leading Indicators of Financial Crises Useful for Assessin ...

Business Cycles

... will be spent on programs that may be politically motivated, but not conducive to economic growth over the long term. Austrian economists also debunk the idea of the liquidity trap because they believe that the free market will drive down interest rates during recessions, giving investors more incen ...

... will be spent on programs that may be politically motivated, but not conducive to economic growth over the long term. Austrian economists also debunk the idea of the liquidity trap because they believe that the free market will drive down interest rates during recessions, giving investors more incen ...

This PDF is a selection from a published volume from... Economic Research Volume Title: NBER International Seminar on Macroeconomics 2007

... But perhaps the slope of the Phillips curve is a red herring.If globalization and other sources of increasedproductivitynarrowthe gap between potential output and the level of output to which the public aspires,it canbringdown the rateof inflation.Thisis trueregardlessof the slope of the Phillipscur ...

... But perhaps the slope of the Phillips curve is a red herring.If globalization and other sources of increasedproductivitynarrowthe gap between potential output and the level of output to which the public aspires,it canbringdown the rateof inflation.Thisis trueregardlessof the slope of the Phillipscur ...

The Economic Outlook and Monetary Policymaking

... Fiscal issues and fiscal austerity are still headwinds to recovery Concern over problems once again emerging in parts of Europe Higher market interest rates could slow down the strongest sectors of economy ...

... Fiscal issues and fiscal austerity are still headwinds to recovery Concern over problems once again emerging in parts of Europe Higher market interest rates could slow down the strongest sectors of economy ...

Presentation to the Utah and Montana Bankers Association Sun Valley, Idaho

... speed has reached what economists refer to as the “natural rate” of unemployment—that’s the lowest rate we can reasonably expect in a well-functioning, healthy economy. Obviously, that number will never be zero—in a dynamic, ever-changing economy like ours, people will get laid off and quit jobs, an ...

... speed has reached what economists refer to as the “natural rate” of unemployment—that’s the lowest rate we can reasonably expect in a well-functioning, healthy economy. Obviously, that number will never be zero—in a dynamic, ever-changing economy like ours, people will get laid off and quit jobs, an ...

Pr sentation (PDF, 324 KB)

... Borio, C and M Drehmann (2009): “Assessing the risk of banking crises – revisited”, BIS Quarterly Review, March, pp 29–46. Borio, C. and P. Lowe (2002). Asset prices, financial and monetary stability: exploring the nexus. BIS Working Papers, No. 114. ——— (2004): “Securing sustainable price stability ...

... Borio, C and M Drehmann (2009): “Assessing the risk of banking crises – revisited”, BIS Quarterly Review, March, pp 29–46. Borio, C. and P. Lowe (2002). Asset prices, financial and monetary stability: exploring the nexus. BIS Working Papers, No. 114. ——— (2004): “Securing sustainable price stability ...

Document

... Occasion to modify this model radically enough to make it sustainable Otherwise the process of development will become even more unsustainable and we are condemned to further crises bound to be even more destructive and uncontrollable We can break this vicious circle only by modifying immediately th ...

... Occasion to modify this model radically enough to make it sustainable Otherwise the process of development will become even more unsustainable and we are condemned to further crises bound to be even more destructive and uncontrollable We can break this vicious circle only by modifying immediately th ...

Nouriel Roubini

Nouriel Roubini (born March 29, 1958) is an American economist. He teaches at New York University's Stern School of Business and is the chairman of Roubini Global Economics, an economic consultancy firm.The child of Iranian Jews, he was born in Turkey and grew up in Italy. After receiving a BA in political economics at Bocconi University, Milan and a doctorate in international economics at Harvard University, he became an academic at Yale and a practising economist at the International Monetary Fund (IMF), the Federal Reserve, World Bank, and Bank of Israel. Much of his early research focused on emerging markets. During the administration of President Bill Clinton, he was a senior economist for the Council of Economic Advisers, later moving to the United States Treasury Department as a senior adviser to Timothy Geithner, who in 2009 became Treasury Secretary.