Presentation - International Development Economics Associates

... But the stock market bubble burst in 2001 The US government responded with very expansionary fiscal and monetary policies—keeping interest rates low and fuelling, in effect, a larger ensuing financial crisis caused by the realestate bubble (exacerbated, indeed, by new complex forms of leveraging of ...

... But the stock market bubble burst in 2001 The US government responded with very expansionary fiscal and monetary policies—keeping interest rates low and fuelling, in effect, a larger ensuing financial crisis caused by the realestate bubble (exacerbated, indeed, by new complex forms of leveraging of ...

policy impact: emerging market opportunity

... As expected with developing economies, inherent risks tend to create greater economic and market swings than in mature countries. However, over time, many have seen substantial overall growth. Western-influenced monetary policies have enabled more free-floating currencies, and local stock and bond m ...

... As expected with developing economies, inherent risks tend to create greater economic and market swings than in mature countries. However, over time, many have seen substantial overall growth. Western-influenced monetary policies have enabled more free-floating currencies, and local stock and bond m ...

Slide 1

... Return to traditional trade finance terms and products that provide greater structure and control over transactions Working with financial providers that have capital strength ...

... Return to traditional trade finance terms and products that provide greater structure and control over transactions Working with financial providers that have capital strength ...

Stress-testing presentation

... ■ Oxford Economics has developed the world’s leading globally integrated economic model, relied on by over 100 leading organisations around the world. ■ Our model replicates the world economy by interlinking 46 countries, 6 regional blocs and the Eurozone. It is available with 5, 10 and 25-year fore ...

... ■ Oxford Economics has developed the world’s leading globally integrated economic model, relied on by over 100 leading organisations around the world. ■ Our model replicates the world economy by interlinking 46 countries, 6 regional blocs and the Eurozone. It is available with 5, 10 and 25-year fore ...

CHAPTER 3

... b. Individuals are free to do whatever they want as long as it is legal. c. Prices coordinate individuals’ wants. If there’s not enough of something, its price goes up. If there’s too much, price goes down. 3. Most economists believe the market is a good way to coordinate individuals’ needs. The pri ...

... b. Individuals are free to do whatever they want as long as it is legal. c. Prices coordinate individuals’ wants. If there’s not enough of something, its price goes up. If there’s too much, price goes down. 3. Most economists believe the market is a good way to coordinate individuals’ needs. The pri ...

eThekwini SMME Strategy - eThekwini Municipality

... platform for them to do business. This means that government, parastatals and big business need to provide a list of business opportunities for the small business who will be profiled and matched with those opportunities. • SAPREF, MONDI, KZN Oils have all participated in our Business Linkages progr ...

... platform for them to do business. This means that government, parastatals and big business need to provide a list of business opportunities for the small business who will be profiled and matched with those opportunities. • SAPREF, MONDI, KZN Oils have all participated in our Business Linkages progr ...

How Much Decoupling? How Much Converging?

... in the United States and a number of industrial countries (see Chart 2). Some observers have even argued that the United States and other industrial countries have themselves become more dependent on demand from the fast-growing emerging markets. There is no doubt that financial markets around the ...

... in the United States and a number of industrial countries (see Chart 2). Some observers have even argued that the United States and other industrial countries have themselves become more dependent on demand from the fast-growing emerging markets. There is no doubt that financial markets around the ...

Bubbling Spanish Housing

... close relative that got into the housing business (at leas as a part time job) Taxi drivers tell you how much they are making in the last two houses they bought. Remember Joseph Kennedy and the tips of the shoe-shine boy Taking about the prices of housing and the incredible profits you can make has ...

... close relative that got into the housing business (at leas as a part time job) Taxi drivers tell you how much they are making in the last two houses they bought. Remember Joseph Kennedy and the tips of the shoe-shine boy Taking about the prices of housing and the incredible profits you can make has ...

Stimulus/Austerity

... money supply which changed the short run interest rates downward or upward, respectively. After the acceptance of Keynesian perspectives, governments countered drop in demand through monetary and fiscal policies. The drop in consumer and business demand was replaced by government demand or interest ...

... money supply which changed the short run interest rates downward or upward, respectively. After the acceptance of Keynesian perspectives, governments countered drop in demand through monetary and fiscal policies. The drop in consumer and business demand was replaced by government demand or interest ...

austerity vs. stimulus

... Lesson from history (that there are no lessons) • For the first time since the 1930s, the world is suffering from a persistent lack of adequate demand; people just aren’t spending enough to make use of the productive capacity we have. This was supposed to be a solved problem, one that may have bede ...

... Lesson from history (that there are no lessons) • For the first time since the 1930s, the world is suffering from a persistent lack of adequate demand; people just aren’t spending enough to make use of the productive capacity we have. This was supposed to be a solved problem, one that may have bede ...

Britain and the Global Financial Crisis: The Return of Boom and Bust

... developing house price bubble and, on the back of that, a consumer boom. Once inflated this was sustained and, increasingly, nurtured, by interest rates which remained historically low throughout the boom. ...

... developing house price bubble and, on the back of that, a consumer boom. Once inflated this was sustained and, increasingly, nurtured, by interest rates which remained historically low throughout the boom. ...

Presentation to the members of Parliament at the Conference on... by the European Economics and Financial Centre

... is very near its historical average. For the U.K., the ratio is more than double its long-run average, whereas in Japan it’s only about three-quarters of its normal level.1 Higher than normal ratios do not necessarily prove that there’s a house-price bubble. House prices could be high for some good, ...

... is very near its historical average. For the U.K., the ratio is more than double its long-run average, whereas in Japan it’s only about three-quarters of its normal level.1 Higher than normal ratios do not necessarily prove that there’s a house-price bubble. House prices could be high for some good, ...

Note: This seminar will be recorded by the instructor.

... small exporters to the practices of global companies ...

... small exporters to the practices of global companies ...

US rate rise impacts, G7 growth rankings Global Economy Watch

... in line with US policymakers’ expectations. We conclude that this impact will be relatively limited as households and businesses have restructured and brought down their dependency on debt. Instead, based on research in our May edition of the Global Economy Watch (GEW), we think that the biggest imp ...

... in line with US policymakers’ expectations. We conclude that this impact will be relatively limited as households and businesses have restructured and brought down their dependency on debt. Instead, based on research in our May edition of the Global Economy Watch (GEW), we think that the biggest imp ...

The 2004 Nobel Prize in Economics

... is best, given the current situation. [But] such behavior either results in [time-] consistent but suboptimal planning or in economic instability.” How then should policy be made, according to K&P? In their words, “Our answer is … that economic theory be used to evaluate alternative policy rules and ...

... is best, given the current situation. [But] such behavior either results in [time-] consistent but suboptimal planning or in economic instability.” How then should policy be made, according to K&P? In their words, “Our answer is … that economic theory be used to evaluate alternative policy rules and ...

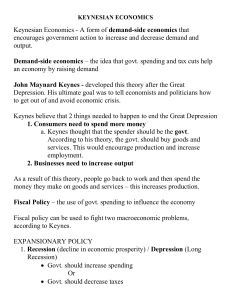

keynesian economics - Cabarrus County Schools

... economists and politicians how to get out of and avoid economics crisis. Keynes believe that 2 things needed to happen to end the Great Depression 3. Consumers need to spend more money a. Keynes thought that the spender should be the govt. According to his theory, the govt. should buy goods and serv ...

... economists and politicians how to get out of and avoid economics crisis. Keynes believe that 2 things needed to happen to end the Great Depression 3. Consumers need to spend more money a. Keynes thought that the spender should be the govt. According to his theory, the govt. should buy goods and serv ...

The demise of neoliberalism? Bill Lucarelli

... In terms of stock market capitalisation, the value of financial assets and financebased income has risen dramatically since the neoliberal era. In the US, for instance, stock market capitalisation as a percentage of GDP increased from its long-term average of about 50 per cent during the post-war er ...

... In terms of stock market capitalisation, the value of financial assets and financebased income has risen dramatically since the neoliberal era. In the US, for instance, stock market capitalisation as a percentage of GDP increased from its long-term average of about 50 per cent during the post-war er ...

Introduction to International Business

... How do country differences, production technology, and product features affect the choice of where to locate production activities? How can the role of foreign subsidiaries in production be enhanced over time as they ...

... How do country differences, production technology, and product features affect the choice of where to locate production activities? How can the role of foreign subsidiaries in production be enhanced over time as they ...

Document

... expansion in U.S. history. Early in 2001, signs of contraction appeared, though the Bush administration denied it. The Sept. 11th 2001 terrorist attacks quickly caused the business cycle to shift into a contraction. ...

... expansion in U.S. history. Early in 2001, signs of contraction appeared, though the Bush administration denied it. The Sept. 11th 2001 terrorist attacks quickly caused the business cycle to shift into a contraction. ...

Globalization

... combination of rising protectionism and falling costs of advanced manufacturing technologies is instigating a structural change in global manufacturing. Under the old globalization paradigm, it made economic sense to build one or a few high-volume production facilities in lowcost economies and ship ...

... combination of rising protectionism and falling costs of advanced manufacturing technologies is instigating a structural change in global manufacturing. Under the old globalization paradigm, it made economic sense to build one or a few high-volume production facilities in lowcost economies and ship ...

Uncommon - SYM Financial Advisors

... than active management, and doesn’t rely on singlepersuasive and whether they should influence our curstock outlooks or “picks”) by forming constituent stock rent expectations, we observe value beating growth in 88 weights based on non-capitalization factors such as earnpercent of the 937 rolling 10 ...

... than active management, and doesn’t rely on singlepersuasive and whether they should influence our curstock outlooks or “picks”) by forming constituent stock rent expectations, we observe value beating growth in 88 weights based on non-capitalization factors such as earnpercent of the 937 rolling 10 ...

THE IMPACT AND LESSONS OF THE 2008 GLOBAL FINANCIAL CRISIS TO ZIMBABWE

... ABSTRACT The global financial crisis that has its epicenter in the United States of America did not directly affect the Zimbabwean economy. However, the falling commodity prices on the international market result in reduced income from exports in Zimbabwe. The Mining sector was the hardest hit since ...

... ABSTRACT The global financial crisis that has its epicenter in the United States of America did not directly affect the Zimbabwean economy. However, the falling commodity prices on the international market result in reduced income from exports in Zimbabwe. The Mining sector was the hardest hit since ...

18. Fiscal Policy - Annenberg Learner

... percent during the winter of 1954…the highest level since the Depression. Millions of workers were idle and angry. President Eisenhower went to the American people to urge confidence. He predicted that the economy would soon improve and he promised a series of spending programs if it did not. He was ...

... percent during the winter of 1954…the highest level since the Depression. Millions of workers were idle and angry. President Eisenhower went to the American people to urge confidence. He predicted that the economy would soon improve and he promised a series of spending programs if it did not. He was ...

are the pockets of opportunity Where ?

... The majority of CEE countries are small, relatively open and heavily dependent on exports for growth, notably to other EU countries. This makes them highly sensitive to developments in advanced economies. The CEE economies can be grouped into three camps. The smaller economies of the Baltic States w ...

... The majority of CEE countries are small, relatively open and heavily dependent on exports for growth, notably to other EU countries. This makes them highly sensitive to developments in advanced economies. The CEE economies can be grouped into three camps. The smaller economies of the Baltic States w ...

Nouriel Roubini

Nouriel Roubini (born March 29, 1958) is an American economist. He teaches at New York University's Stern School of Business and is the chairman of Roubini Global Economics, an economic consultancy firm.The child of Iranian Jews, he was born in Turkey and grew up in Italy. After receiving a BA in political economics at Bocconi University, Milan and a doctorate in international economics at Harvard University, he became an academic at Yale and a practising economist at the International Monetary Fund (IMF), the Federal Reserve, World Bank, and Bank of Israel. Much of his early research focused on emerging markets. During the administration of President Bill Clinton, he was a senior economist for the Council of Economic Advisers, later moving to the United States Treasury Department as a senior adviser to Timothy Geithner, who in 2009 became Treasury Secretary.