consequences - ucsc.edu) and Media Services

... programs, hedge funds, derivatives, “subprime CDOs” CDFs Solutions: Global Central Bank: Keynes, Soros, Stiglitz Nov 15th ...

... programs, hedge funds, derivatives, “subprime CDOs” CDFs Solutions: Global Central Bank: Keynes, Soros, Stiglitz Nov 15th ...

The Federal Reserve

... ___________________________________________________ ___________________________________________________ Write at least 2-3 sentences describing a time when… ___________________________________________________ ___________________________________________________ you relied and/or hoped for someone to ...

... ___________________________________________________ ___________________________________________________ Write at least 2-3 sentences describing a time when… ___________________________________________________ ___________________________________________________ you relied and/or hoped for someone to ...

2011-3Q Quarterly Review and Outlook

... most of them reversed after relatively brief periods. During the last significant dip in mid-2010, ERCI’s Chief Operations Officer, Lakshman Achuthan, correctly predicted that we would avoid a double dip. This time, however, during a Bloomberg interview on September 30, Achuthan said the U.S. is "go ...

... most of them reversed after relatively brief periods. During the last significant dip in mid-2010, ERCI’s Chief Operations Officer, Lakshman Achuthan, correctly predicted that we would avoid a double dip. This time, however, during a Bloomberg interview on September 30, Achuthan said the U.S. is "go ...

YouTube Title: “White Nerds Attempting to Rap (Mixed Economy

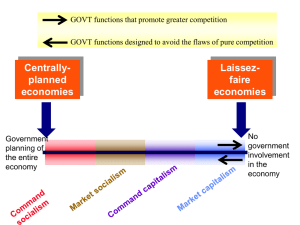

... A rap featuring two men, Brendan and Drew, each defending a type of policy: Monetary and Fiscal. They are also discussing other aspects of economics, such as mixed economies, central planning (government intervention), and the invisible hand, with slight mention to the GDP. ...

... A rap featuring two men, Brendan and Drew, each defending a type of policy: Monetary and Fiscal. They are also discussing other aspects of economics, such as mixed economies, central planning (government intervention), and the invisible hand, with slight mention to the GDP. ...

Type Programme Name or Title Here

... • Bank bail outs and guarantees for loans – toxic asset “dump” to come? • Fiscal stimulus packages – agreed at G20 in November 2008, possibly more? • “Unconventional monetary policy” – such quantitative easing “QE” – notice slightly differing ways of implementing this • Extra resources for internati ...

... • Bank bail outs and guarantees for loans – toxic asset “dump” to come? • Fiscal stimulus packages – agreed at G20 in November 2008, possibly more? • “Unconventional monetary policy” – such quantitative easing “QE” – notice slightly differing ways of implementing this • Extra resources for internati ...

46 The business cycle - Cambridge University Press

... When the economy is booming – growing fast – commentators start to talk about the risks or signs of overheating, with key indicators getting out of control, and a loss of economic stability. They talk about the need for a soft landing, with the government aiming to bring economic activity back to mo ...

... When the economy is booming – growing fast – commentators start to talk about the risks or signs of overheating, with key indicators getting out of control, and a loss of economic stability. They talk about the need for a soft landing, with the government aiming to bring economic activity back to mo ...

Macroeconomic Policy and the Euro Area after the Crisis

... Government Debt Before and After the Crisis ...

... Government Debt Before and After the Crisis ...

FT.com print article

... expected to spend their way into bankruptcy, while surplus countries condemn as profligacy the spending from which their exporters benefit so much. In the necessary attempt to reconstruct the global economic order, on which the new administration must focus, this will be a central issue. It is one K ...

... expected to spend their way into bankruptcy, while surplus countries condemn as profligacy the spending from which their exporters benefit so much. In the necessary attempt to reconstruct the global economic order, on which the new administration must focus, this will be a central issue. It is one K ...

The Global Economic Crisis and Alternatives to Rebuild the Economy

... Conflicts of interest—paid by those they rated Competition made it worse: race to the bottom Failed to assess risks accurately—flawed models • Underestimated correlations, likelihood of small probability events, risk of price declines • Reinforced mistakes of the banks • Failures were predictable an ...

... Conflicts of interest—paid by those they rated Competition made it worse: race to the bottom Failed to assess risks accurately—flawed models • Underestimated correlations, likelihood of small probability events, risk of price declines • Reinforced mistakes of the banks • Failures were predictable an ...

Indonesian and S. Korean Financial Crisis

... Korea was about to default on its foreign debt Korea was given $55 billion in new loans and credits by the IMF It was the largest bailout in history up to that point. ...

... Korea was about to default on its foreign debt Korea was given $55 billion in new loans and credits by the IMF It was the largest bailout in history up to that point. ...

Activity 9 - Answer key

... Broken Window Fallacy, do you think Dr. Krugman is right? Are acts of war and terrorism potentially good for the economy? Why or why not? “Ghastly as it may seem to say this, the terror attack -- like the original day of infamy, which brought an end to the Great Depression -- could even do some econ ...

... Broken Window Fallacy, do you think Dr. Krugman is right? Are acts of war and terrorism potentially good for the economy? Why or why not? “Ghastly as it may seem to say this, the terror attack -- like the original day of infamy, which brought an end to the Great Depression -- could even do some econ ...

American Government Unit Chapter 16: Financing Government

... taxes To dampen economy (Why?) – balance budgets and raise taxes Free enterprise says government shouldn’t do anything – Great Depression Keynesianism – says government deficit spend to stimulate economy – Bush (2008) and Obama ...

... taxes To dampen economy (Why?) – balance budgets and raise taxes Free enterprise says government shouldn’t do anything – Great Depression Keynesianism – says government deficit spend to stimulate economy – Bush (2008) and Obama ...

China home prices rise by a record in four major cities

... The Australian government has said it plans to raise the country's debt limit by twothirds to allay concerns it could face a future fiscal crisis. The newly-elected conservative government is looking to raise the borrowing limit to A$500bn ($486bn; ...

... The Australian government has said it plans to raise the country's debt limit by twothirds to allay concerns it could face a future fiscal crisis. The newly-elected conservative government is looking to raise the borrowing limit to A$500bn ($486bn; ...

economics and politics.ppt

... Business cycle fluctuations result from imbalances between aggregate demand and productive capacity • Aggregate demand is the total amount of money available in the economy to be spent on goods and services • Productive capacity is the total value of goods and services that can be produced by the ec ...

... Business cycle fluctuations result from imbalances between aggregate demand and productive capacity • Aggregate demand is the total amount of money available in the economy to be spent on goods and services • Productive capacity is the total value of goods and services that can be produced by the ec ...

PDF Download

... national to regional oligopolies. While in the beginning of the 1990s the biggest seven suppliers commanded a 60 percent share of the global market, this has changed within a decade. Nowadays their share is around 80 percent and competition has become more intensive. The EU is in a specific situatio ...

... national to regional oligopolies. While in the beginning of the 1990s the biggest seven suppliers commanded a 60 percent share of the global market, this has changed within a decade. Nowadays their share is around 80 percent and competition has become more intensive. The EU is in a specific situatio ...

The world economy and financial markets

... intermediation before the outbreak of the financial crisis, is still not functioning, other than for those securities, such as mortgage-backed securities, covered by the government purchase programme. The banks may be able to raise additional capital after the stress tests, but they are using it lar ...

... intermediation before the outbreak of the financial crisis, is still not functioning, other than for those securities, such as mortgage-backed securities, covered by the government purchase programme. The banks may be able to raise additional capital after the stress tests, but they are using it lar ...

Please read our Full Economic outlook here

... the overall corporate default rate will rise and will be much higher in the energy sector. Europe and a weak Euro will continue to be challenging. This balanced scenario could be put in jeopardy by the international tensions, the debt and political crisis in Europe and much less growth in China. Bra ...

... the overall corporate default rate will rise and will be much higher in the energy sector. Europe and a weak Euro will continue to be challenging. This balanced scenario could be put in jeopardy by the international tensions, the debt and political crisis in Europe and much less growth in China. Bra ...

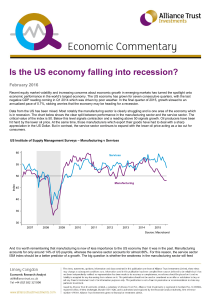

Is the US economy falling into recession?

... Recent equity market volatility and increasing concerns about economic growth in emerging markets has turned the spotlight onto economic performance in the world’s largest economy. The US economy has grown for seven consecutive quarters, with the last negative GDP reading coming in Q1 2014 which was ...

... Recent equity market volatility and increasing concerns about economic growth in emerging markets has turned the spotlight onto economic performance in the world’s largest economy. The US economy has grown for seven consecutive quarters, with the last negative GDP reading coming in Q1 2014 which was ...

Recession in Advanced Economies: A View from the United States

... Payroll employment series Source: Bureau of Labor Statistics ...

... Payroll employment series Source: Bureau of Labor Statistics ...

THE GLOBAL ECONOMY IN THE AFTERMATH OF THE IRAQ WAR

... – Will the world be willing to continue to finance these deficits – Potential changes in sentiments could have major effects on exchange rates • Only weaknesses in Europe, elsewhere have prevented further decline in dollar ...

... – Will the world be willing to continue to finance these deficits – Potential changes in sentiments could have major effects on exchange rates • Only weaknesses in Europe, elsewhere have prevented further decline in dollar ...

The Triumph of Authoritarian Crisis Management: Europe’s

... • “Hysteresis” effect – permanent economic damage that will not be repaired even if there is a full recovery. ‘Austerity could well leave an economic and social scar across the eurozone’ • (Wolfgang Münchau, 24 Feb 2013, Financial Times) • C.f. Gregg & Tominey 2004: ‘wages scar’ left by youth unempl ...

... • “Hysteresis” effect – permanent economic damage that will not be repaired even if there is a full recovery. ‘Austerity could well leave an economic and social scar across the eurozone’ • (Wolfgang Münchau, 24 Feb 2013, Financial Times) • C.f. Gregg & Tominey 2004: ‘wages scar’ left by youth unempl ...

Nouriel Roubini

Nouriel Roubini (born March 29, 1958) is an American economist. He teaches at New York University's Stern School of Business and is the chairman of Roubini Global Economics, an economic consultancy firm.The child of Iranian Jews, he was born in Turkey and grew up in Italy. After receiving a BA in political economics at Bocconi University, Milan and a doctorate in international economics at Harvard University, he became an academic at Yale and a practising economist at the International Monetary Fund (IMF), the Federal Reserve, World Bank, and Bank of Israel. Much of his early research focused on emerging markets. During the administration of President Bill Clinton, he was a senior economist for the Council of Economic Advisers, later moving to the United States Treasury Department as a senior adviser to Timothy Geithner, who in 2009 became Treasury Secretary.