Advanced Accounting by Hoyle et al, 6th Edition

... VIEs bear relatively low economic risk, therefore equity investors are provided a small rate of return. Another party (often the sponsoring firm that benefits from the VIE’s activities) contributes substantial resources – loans and/or guarantees – to enable a VIE to secure financing needed to accomp ...

... VIEs bear relatively low economic risk, therefore equity investors are provided a small rate of return. Another party (often the sponsoring firm that benefits from the VIE’s activities) contributes substantial resources – loans and/or guarantees – to enable a VIE to secure financing needed to accomp ...

The euro zone: Falling into a liquidity trap?

... to stabilise their public debt. And although most of European countries (excluding Greece) continue to exhibit a positive inflation rate, the level of inflation is not high enough to allow them to inflate their way out of their debt problems8. Most critically, the interest rate that the governments ...

... to stabilise their public debt. And although most of European countries (excluding Greece) continue to exhibit a positive inflation rate, the level of inflation is not high enough to allow them to inflate their way out of their debt problems8. Most critically, the interest rate that the governments ...

Mankiw: Brief Principles of Macroeconomics, Second Edition

... What Is To Come? • We will concentrate on the long run. – Real GDP is given. • Labor, capital, technology. ...

... What Is To Come? • We will concentrate on the long run. – Real GDP is given. • Labor, capital, technology. ...

Interest Rates in Mexico The Role of Exchange Rate Expectations

... This paper investigates the recent behavior of interest rates in Mexico by exploring their links to expectations of exchange rate changes and perceptions about the default risk associated with holding Mexican financial assets. A central theme of the paper is the extent to which both the domestic and ...

... This paper investigates the recent behavior of interest rates in Mexico by exploring their links to expectations of exchange rate changes and perceptions about the default risk associated with holding Mexican financial assets. A central theme of the paper is the extent to which both the domestic and ...

Document

... deposits that exist within an economy, only indirect control though their power of adjusting the reserve ratio. As a result, the Fed only has rough control over the money supply. However, changes in the amount of demand deposits and changes in the demand for currency are fairly predictable so that t ...

... deposits that exist within an economy, only indirect control though their power of adjusting the reserve ratio. As a result, the Fed only has rough control over the money supply. However, changes in the amount of demand deposits and changes in the demand for currency are fairly predictable so that t ...

chap018_8e - Homework Market

... • Euros and British pounds normally quoted as direct quotations – “The pound is selling at 1.5961 USD” ...

... • Euros and British pounds normally quoted as direct quotations – “The pound is selling at 1.5961 USD” ...

Understanding the Term Structure of Interest Rates

... the Fed’s rate increases were foreseen some months in advance. Based on the July 2004 federal funds futures contract, in late 2003 the market anticipated a funds rate of 1.25 percent or above, but then the expected rate for July fell to nearly 1 percent (i) as the FOMC maintained its 1 percent targe ...

... the Fed’s rate increases were foreseen some months in advance. Based on the July 2004 federal funds futures contract, in late 2003 the market anticipated a funds rate of 1.25 percent or above, but then the expected rate for July fell to nearly 1 percent (i) as the FOMC maintained its 1 percent targe ...

Exchange-traded Treasury Bonds (TBs) - text version

... What are Exchange-traded Treasury Bonds? ......................................................................... 3 You have a choice of coupon rates and maturity dates ........................................................... 4 Topic 2: Income and price .......................................... ...

... What are Exchange-traded Treasury Bonds? ......................................................................... 3 You have a choice of coupon rates and maturity dates ........................................................... 4 Topic 2: Income and price .......................................... ...

Investment Basics: Inflation – Its Causes and Impacts

... Higher rates of inflation can be particularly damaging to investment assets that generate fixed cash flows, such as bonds, since the amount of cash flow does not increase despite rising prices elsewhere. The value of financial assets can also be affected by inflation because of how assets are valued ...

... Higher rates of inflation can be particularly damaging to investment assets that generate fixed cash flows, such as bonds, since the amount of cash flow does not increase despite rising prices elsewhere. The value of financial assets can also be affected by inflation because of how assets are valued ...

Investment Basics: Inflation – Its Causes and Impacts

... Higher rates of inflation can be particularly damaging to investment assets that generate fixed cash flows, such as bonds, since the amount of cash flow does not increase despite rising prices elsewhere. The value of financial assets can also be affected by inflation because of how assets are valued ...

... Higher rates of inflation can be particularly damaging to investment assets that generate fixed cash flows, such as bonds, since the amount of cash flow does not increase despite rising prices elsewhere. The value of financial assets can also be affected by inflation because of how assets are valued ...

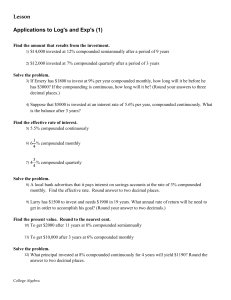

Lesson Applications to Log`s and Exp`s (1)

... Suppose that $5000 is invested at an interest rate of 5.6% per year, compounded continuously. What is the balance after 3 years? ...

... Suppose that $5000 is invested at an interest rate of 5.6% per year, compounded continuously. What is the balance after 3 years? ...

A New View of Mortgages (and life)

... – developer exercises the right to purchase the land for $Y and either develops the shopping mall or sells to another for $Z1 (profit = Z1-Y). ...

... – developer exercises the right to purchase the land for $Y and either develops the shopping mall or sells to another for $Z1 (profit = Z1-Y). ...

docx - Minds on the Markets

... investment has to its potential rate of return? 7. In bad economic times, what happens to the risk / return curve? 8. The most basic strategy for reducing risk is? 9. What is the ultimate goal for a portfolio? 10.What are the most common risks that can cause our expected return of an investment to b ...

... investment has to its potential rate of return? 7. In bad economic times, what happens to the risk / return curve? 8. The most basic strategy for reducing risk is? 9. What is the ultimate goal for a portfolio? 10.What are the most common risks that can cause our expected return of an investment to b ...

How to Invest for Income in a Low Interest Rate

... Without a risk factor the use of shares is clearly a better prospect. However as stated earlier, shares do carry a risk and the trade‐off is between the prospect of extra return and the added risk. The risk is – to a significant extent – measurable, through a number of methods. Although it can be m ...

... Without a risk factor the use of shares is clearly a better prospect. However as stated earlier, shares do carry a risk and the trade‐off is between the prospect of extra return and the added risk. The risk is – to a significant extent – measurable, through a number of methods. Although it can be m ...

MODEL MCQs – CAIIB, PAPER-2, MOD

... e. decision is inversely proportional to the number of estimates f. difficult to pinpoint the correct single estimate g. because it does not provide the extent of error h. a & c ...

... e. decision is inversely proportional to the number of estimates f. difficult to pinpoint the correct single estimate g. because it does not provide the extent of error h. a & c ...

COMMERCIAL INFORMATION AND CREDIT ANALYSIS

... A loan is the immediate possession of resources in exchange of a future payment promise involving also an interest payment that rewards the lender. Before granting any loan, it is necessary for the lender to know the purpose of the credit same as its legal purpose. On corporate segment, types of cre ...

... A loan is the immediate possession of resources in exchange of a future payment promise involving also an interest payment that rewards the lender. Before granting any loan, it is necessary for the lender to know the purpose of the credit same as its legal purpose. On corporate segment, types of cre ...

Chapter 15: Financial Markets and Expectations

... 1. Default risk, the risk that the issuer of the bond will not pay back the full amount promised by the bond. 2. Maturity, the length of time over which the bond promises to make payments to the holder of the bond. 1. Also called “term” (e.g., a long-term bond is one that matures many years after is ...

... 1. Default risk, the risk that the issuer of the bond will not pay back the full amount promised by the bond. 2. Maturity, the length of time over which the bond promises to make payments to the holder of the bond. 1. Also called “term” (e.g., a long-term bond is one that matures many years after is ...

Chapter 2

... • for debt securities, risk associated with changes in interest rates; consists of price risk and reinvestment rate risk Price Risk • a change in market interest rates produces an opposite change in the value of investments Reinvestment Rate Risk • risk as to what interest rate will be when income a ...

... • for debt securities, risk associated with changes in interest rates; consists of price risk and reinvestment rate risk Price Risk • a change in market interest rates produces an opposite change in the value of investments Reinvestment Rate Risk • risk as to what interest rate will be when income a ...

Interest

Interest is money paid by a borrower to a lender for a credit or a similar liability. Important examples are bond yields, interest paid for bank loans, and returns on savings. Interest differs from profit in that it is paid to a lender, whereas profit is paid to an owner. In economics, the various forms of credit are also referred to as loanable funds.When money is borrowed, interest is typically calculated as a percentage of the principal, the amount owed to the lender. The percentage of the principal that is paid over a certain period of time (typically a year) is called the interest rate. Interest rates are market prices which are determined by supply and demand. They are generally positive because loanable funds are scarce.Interest is often compounded, which means that interest is earned on prior interest in addition to the principal. The total amount of debt grows exponentially, and its mathematical study led to the discovery of the number e. In practice, interest is most often calculated on a daily, monthly, or yearly basis, and its impact is influenced greatly by its compounding rate.