Lessons from history

... A rising rate environment does not mean investors should get rid of all their bonds and fixed income holdings. Instead, we believe investors can navigate volatile fixed income markets by managing exposure to income generating sectors and strategies. ...

... A rising rate environment does not mean investors should get rid of all their bonds and fixed income holdings. Instead, we believe investors can navigate volatile fixed income markets by managing exposure to income generating sectors and strategies. ...

AN ECONOMIC ANALYSIS OF THE DETERMINANTS OF

... specially money supply and exchange rate play main role to the Turkish inflation process. Public sector deficit and depreciation also contribute to inflation in Turkey. Khanam and Mohammad (1995) use data from 1972-73-1991-92 and show that money wage rate and import price positively influence over p ...

... specially money supply and exchange rate play main role to the Turkish inflation process. Public sector deficit and depreciation also contribute to inflation in Turkey. Khanam and Mohammad (1995) use data from 1972-73-1991-92 and show that money wage rate and import price positively influence over p ...

What this graph means?

... More simply, it equals the amount of borrowings made by the government in a year. FD = Total Expenditure – Revenue Receipts – Disinvestment Receipts – Recovery of loans Higher Fiscal Deficit leads to Increased Govt. Borrowing leads to Increased Spending leads to Greater Money Supply leads to Inflati ...

... More simply, it equals the amount of borrowings made by the government in a year. FD = Total Expenditure – Revenue Receipts – Disinvestment Receipts – Recovery of loans Higher Fiscal Deficit leads to Increased Govt. Borrowing leads to Increased Spending leads to Greater Money Supply leads to Inflati ...

The Transmission mechanism of monetary policy

... and loan rates. This margin can vary over time, according to, for example, changing competitive conditions in the markets involved, but it does not normally change in response to policy changes alone. Long-term interest rates Though a change in the official rate unambiguously moves other short-term ...

... and loan rates. This margin can vary over time, according to, for example, changing competitive conditions in the markets involved, but it does not normally change in response to policy changes alone. Long-term interest rates Though a change in the official rate unambiguously moves other short-term ...

www.lem.sssup.it

... We rule out (by construction) the possibility of avalanches of output due to the mismatch of demand and supply of intermediate goods along the supply chain (Bak, Chen, Scheinkman and Woodford, 1993) The financial side of the economy is characterized by two lending relationships: ...

... We rule out (by construction) the possibility of avalanches of output due to the mismatch of demand and supply of intermediate goods along the supply chain (Bak, Chen, Scheinkman and Woodford, 1993) The financial side of the economy is characterized by two lending relationships: ...

Bonds

... I simply do not agree with the concept of an “emergency fund” of three to nine months of living expenses. As long as you have access to cash via a home equity line of credit, for example, there is no good reason to keep $20,000 to $30,000 or more in a savings account earning 0.01%. Instead, use the ...

... I simply do not agree with the concept of an “emergency fund” of three to nine months of living expenses. As long as you have access to cash via a home equity line of credit, for example, there is no good reason to keep $20,000 to $30,000 or more in a savings account earning 0.01%. Instead, use the ...

Document

... More simply, it equals the amount of borrowings made by the government in a year. FD = Total Expenditure – Revenue Receipts – Disinvestment Receipts – Recovery of loans Higher Fiscal Deficit leads to Increased Govt. Borrowing leads to Increased Spending leads to Greater Money Supply leads to Inflati ...

... More simply, it equals the amount of borrowings made by the government in a year. FD = Total Expenditure – Revenue Receipts – Disinvestment Receipts – Recovery of loans Higher Fiscal Deficit leads to Increased Govt. Borrowing leads to Increased Spending leads to Greater Money Supply leads to Inflati ...

Aggregate Price Levels Inflation Consumer Price Index (CPI)

... Cost-Push Inflation: Profit Push – Because just a handful of firms dominate many industries, they have the power to administer prices rather than accept the dictates of the market forces of supply and demand – To the degree that they are able, these firms will respond to any rise in cost by passing ...

... Cost-Push Inflation: Profit Push – Because just a handful of firms dominate many industries, they have the power to administer prices rather than accept the dictates of the market forces of supply and demand – To the degree that they are able, these firms will respond to any rise in cost by passing ...

Aggregate Price Levels

... Cost-Push Inflation: Profit Push – Because just a handful of firms dominate many industries, they have the power to administer prices rather than accept the dictates of the market forces of supply and demand – To the degree that they are able, these firms will respond to any rise in cost by passing ...

... Cost-Push Inflation: Profit Push – Because just a handful of firms dominate many industries, they have the power to administer prices rather than accept the dictates of the market forces of supply and demand – To the degree that they are able, these firms will respond to any rise in cost by passing ...

How Homeowners Choose between Fixed and Adjustable Rate

... households with co-borrowers, married couples, and limited expected housing tenures were found to have the greatest probability of taking out ARM. In general, they found that borrower characteristics do not significantly influence the choice. Despite the vast amount of literature dealing with housin ...

... households with co-borrowers, married couples, and limited expected housing tenures were found to have the greatest probability of taking out ARM. In general, they found that borrower characteristics do not significantly influence the choice. Despite the vast amount of literature dealing with housin ...

Chap008

... priced to yield about the same return, regardless of the coupon rate. If you know the price of one bond, you can estimate its YTM and use that to find the price of the second bond. This is a useful concept that can be transferred to valuing assets other than bonds. ...

... priced to yield about the same return, regardless of the coupon rate. If you know the price of one bond, you can estimate its YTM and use that to find the price of the second bond. This is a useful concept that can be transferred to valuing assets other than bonds. ...

A Call to ARMs: Adjustable Rate Mortgages in the 1980s

... reduction in interest rate risk may be achieved at the expense of increased default risk. When interest rates rise, borrowers faced with sharp increases in their mortgage payments are more likely to default than those with fixed-rate mortgages and level payments. ...

... reduction in interest rate risk may be achieved at the expense of increased default risk. When interest rates rise, borrowers faced with sharp increases in their mortgage payments are more likely to default than those with fixed-rate mortgages and level payments. ...

PDF Download

... of goods cannot satisfy the additional demand for goods at given prices. Therefore, Wicksell’s natural rate of interest is the interest rate at which inflation is zero (or at the target level). In contrast to Say, in Wicksell’s framework money is not neutral, but additional money supply affects deci ...

... of goods cannot satisfy the additional demand for goods at given prices. Therefore, Wicksell’s natural rate of interest is the interest rate at which inflation is zero (or at the target level). In contrast to Say, in Wicksell’s framework money is not neutral, but additional money supply affects deci ...

The Determinants of the Market Interest Rate Given the quoted

... them more willing to participate in reorganization even though their claims are greatly scaled back. Various groups of creditors vote on the reorganization plan. If both the majority of the creditors and the judge approve, company “emerges” from bankruptcy with lower debts, reduced interest charges, ...

... them more willing to participate in reorganization even though their claims are greatly scaled back. Various groups of creditors vote on the reorganization plan. If both the majority of the creditors and the judge approve, company “emerges” from bankruptcy with lower debts, reduced interest charges, ...

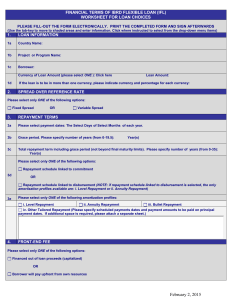

English - World Bank Treasury

... Cap/Collar premium to be financed out of the loan proceeds (as long as there are available funds to be disbursed) 5b Cap/Collar premium paid by the Borrower from own resources ...

... Cap/Collar premium to be financed out of the loan proceeds (as long as there are available funds to be disbursed) 5b Cap/Collar premium paid by the Borrower from own resources ...

Chapter 4

... Changes in bond prices result from changes in the expected rate of inflation. If buyers and sellers change their expectations, the nominal interest rate will adjust. Waiting until the nominal interest rate had risen would be too late to avoid the capital losses from owning bonds. Step 4 Answer part ...

... Changes in bond prices result from changes in the expected rate of inflation. If buyers and sellers change their expectations, the nominal interest rate will adjust. Waiting until the nominal interest rate had risen would be too late to avoid the capital losses from owning bonds. Step 4 Answer part ...

Monetary Policy under Global Imbalances: The Turkish Experience Hakan Kara

... Figure 1-b: Required Reserve Ratios (percent) ...

... Figure 1-b: Required Reserve Ratios (percent) ...

Policy Brief 1

... and indirectly subsidize strategic economic sectors or groups with limited or no access to credit. Interest rate ceilings, which have a long history and are set according to different definition methodologies (e.g. fixed rate versus changing with the prevailing market conditions), are nowadays used ...

... and indirectly subsidize strategic economic sectors or groups with limited or no access to credit. Interest rate ceilings, which have a long history and are set according to different definition methodologies (e.g. fixed rate versus changing with the prevailing market conditions), are nowadays used ...

Discussion on “Monetary Policy “Contagion” in the Pacific: A Historical Inquiry

... and lower sovereign bond yields in the EMEs; and U.S. credit expansions also stimulate the offshore bond issuance after 2010 • Choi et al. (2015): Quantify the effect of U.S. policy tightening, in comparison with EMEs’ own policy tightening, on their macro-fundamentals and capital flows – Explore ho ...

... and lower sovereign bond yields in the EMEs; and U.S. credit expansions also stimulate the offshore bond issuance after 2010 • Choi et al. (2015): Quantify the effect of U.S. policy tightening, in comparison with EMEs’ own policy tightening, on their macro-fundamentals and capital flows – Explore ho ...

Interest

Interest is money paid by a borrower to a lender for a credit or a similar liability. Important examples are bond yields, interest paid for bank loans, and returns on savings. Interest differs from profit in that it is paid to a lender, whereas profit is paid to an owner. In economics, the various forms of credit are also referred to as loanable funds.When money is borrowed, interest is typically calculated as a percentage of the principal, the amount owed to the lender. The percentage of the principal that is paid over a certain period of time (typically a year) is called the interest rate. Interest rates are market prices which are determined by supply and demand. They are generally positive because loanable funds are scarce.Interest is often compounded, which means that interest is earned on prior interest in addition to the principal. The total amount of debt grows exponentially, and its mathematical study led to the discovery of the number e. In practice, interest is most often calculated on a daily, monthly, or yearly basis, and its impact is influenced greatly by its compounding rate.