Fiscal Rules and Discretion in a World Economy

... ex post, would like to borrow more than allowed by the imposed limit. If the government experienced a relatively low shock to the value of spending, it will be overborrowing compared to its ex-ante optimum, as the government is presentbiased ex post. On the other hand, if the government experienced ...

... ex post, would like to borrow more than allowed by the imposed limit. If the government experienced a relatively low shock to the value of spending, it will be overborrowing compared to its ex-ante optimum, as the government is presentbiased ex post. On the other hand, if the government experienced ...

Three Essays in Monetary Economics

... The fist paper studies the correlation between money and inflation. The main conclusion drawn from the literature is that money and inflation correlate only in the long run. There is very little precision as to the actual timing of the comovement. The analysis of US data suggests that not only very low ...

... The fist paper studies the correlation between money and inflation. The main conclusion drawn from the literature is that money and inflation correlate only in the long run. There is very little precision as to the actual timing of the comovement. The analysis of US data suggests that not only very low ...

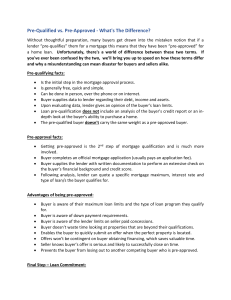

Pre-Qualified vs. Pre-Approved - What`s The

... Buyer is aware of the lender limits on seller paid concessions. Buyer doesn’t waste time looking at properties that are beyond their qualifications. Enables the buyer to quickly submit an offer when the perfect property is located. Offers won't be contingent on buyer obtaining financing, which saves ...

... Buyer is aware of the lender limits on seller paid concessions. Buyer doesn’t waste time looking at properties that are beyond their qualifications. Enables the buyer to quickly submit an offer when the perfect property is located. Offers won't be contingent on buyer obtaining financing, which saves ...

Denmark - nationalbanken.dk

... reflecting weak domestic demand, particularly in the euro area, and subdued international trade. The financial markets remained unstable over the summer despite important political steps, such as expansion of the international financial firewalls and loans for recapitalisation of the Spanish banking ...

... reflecting weak domestic demand, particularly in the euro area, and subdued international trade. The financial markets remained unstable over the summer despite important political steps, such as expansion of the international financial firewalls and loans for recapitalisation of the Spanish banking ...

Advanced arithmetic

... the chapters of books, on clock faces, etc. 10. The Arabs brought the present system, including the symbol for zero and place value, to Europe soon after the conquest of Spain. This is the reason that the numerals used to-day are called the Arabic numerals. The Arabs, however, did not invent the sys ...

... the chapters of books, on clock faces, etc. 10. The Arabs brought the present system, including the symbol for zero and place value, to Europe soon after the conquest of Spain. This is the reason that the numerals used to-day are called the Arabic numerals. The Arabs, however, did not invent the sys ...

Egypt`s Monetary Policy Regime - COMESA Monetary Institute (CMI)

... 1997). In this context, over the short-‐run, monetary policy can affect real activity and successively inflation given the existence of imperfections, but it has little direct effect on the suppl ...

... 1997). In this context, over the short-‐run, monetary policy can affect real activity and successively inflation given the existence of imperfections, but it has little direct effect on the suppl ...

Open-Market Operations in a Model of Regulated

... The government issues currency and one-period, zero-coupon bonds that are titles to specific amounts of currency. It also operates an insurance program for licensed intermediaries. The government behaves so that the stocks of currency, H, and of government bonds, B, are constant over time. At each d ...

... The government issues currency and one-period, zero-coupon bonds that are titles to specific amounts of currency. It also operates an insurance program for licensed intermediaries. The government behaves so that the stocks of currency, H, and of government bonds, B, are constant over time. At each d ...

A Critical Comparison of cash- and asset-based Microcredit

... the dispensation of loans to poor borrowers for specific assets demanded by the poor. These include, but are not limited, to assets such as solar home systems, greater efficiency cooking stoves, education, and mobile phones. Traditional cash-based microcredit focuses on the borrower’s entrepreneuria ...

... the dispensation of loans to poor borrowers for specific assets demanded by the poor. These include, but are not limited, to assets such as solar home systems, greater efficiency cooking stoves, education, and mobile phones. Traditional cash-based microcredit focuses on the borrower’s entrepreneuria ...

Alfjaneirtnjanjgahjktnm,brazjklhhjkznm

... 28. A corporate loan applicant has cash of $30, receivables of $20 and inventory of $50. The applicant also has current debts of $50. If the bank's policy requires a current ratio of 2 or better and an acid test ratio of 1.5 or better would the applicant receive the loan? A) Yes because the applican ...

... 28. A corporate loan applicant has cash of $30, receivables of $20 and inventory of $50. The applicant also has current debts of $50. If the bank's policy requires a current ratio of 2 or better and an acid test ratio of 1.5 or better would the applicant receive the loan? A) Yes because the applican ...

A factor portfolio

... An obvious case of an arbitrage opportunity arises when the law of one price is violated. When an asset is trading at different prices in two markets (and the price differential exceeds transaction costs), a simultaneous trade in the two markets can produce a sure profit (the net price differenti ...

... An obvious case of an arbitrage opportunity arises when the law of one price is violated. When an asset is trading at different prices in two markets (and the price differential exceeds transaction costs), a simultaneous trade in the two markets can produce a sure profit (the net price differenti ...

Adjusting to Capital Account Liberalization

... a¤ects their capacity to borrow. For the economy under …nancial suppression, a subsidy to production of unproductive entrepreneurs mitigates the loss of the workers following capital liberalization at the cost of prolonging the transition to e¢ cient production. Allowing foreign direct investment (F ...

... a¤ects their capacity to borrow. For the economy under …nancial suppression, a subsidy to production of unproductive entrepreneurs mitigates the loss of the workers following capital liberalization at the cost of prolonging the transition to e¢ cient production. Allowing foreign direct investment (F ...

Interest Rate, Credit to Private Sector, Inflation Rate, Money Supply

... comprises of middle class and upper middle class people. ...

... comprises of middle class and upper middle class people. ...

The Swaps Market: A Case Study Detailing Market

... on one currency and the other party is paying a floating rate on another currency. They can also be structured whereby both parties pay a fixed rate on different currencies or both parties pay a floating rate on different currencies. The structure of a currency swap is determined by the needs of the ...

... on one currency and the other party is paying a floating rate on another currency. They can also be structured whereby both parties pay a fixed rate on different currencies or both parties pay a floating rate on different currencies. The structure of a currency swap is determined by the needs of the ...

Bondch6s

... constantly trying to raise funds in the financial market. As we discussed in Chapter 3, the Treasury sells a number of short-term, intermediate, and long-term securities. Which securities the Treasury uses to finance federal deficit affects not only the yield curve for Treasury securities, but also ...

... constantly trying to raise funds in the financial market. As we discussed in Chapter 3, the Treasury sells a number of short-term, intermediate, and long-term securities. Which securities the Treasury uses to finance federal deficit affects not only the yield curve for Treasury securities, but also ...

The Only Spending Rule Article You Will Ever Need

... spending against the chance that the investor will run out of money, but we want an approach that guarantees that the portfolio will not be depleted, even if the investor is holding risky assets. Adjusting one’s spending is tolerable but ruin is not; therefore, we present an alternative to the proba ...

... spending against the chance that the investor will run out of money, but we want an approach that guarantees that the portfolio will not be depleted, even if the investor is holding risky assets. Adjusting one’s spending is tolerable but ruin is not; therefore, we present an alternative to the proba ...

A case for high-yield bonds

... those of other major asset classes, including equities, and with significantly less downside.1 As the name indicates, high-yield bonds are indeed a higher-yielding asset class that may offer both higher income and higher total return than other bonds. Even so, the high-yield bond market is often vie ...

... those of other major asset classes, including equities, and with significantly less downside.1 As the name indicates, high-yield bonds are indeed a higher-yielding asset class that may offer both higher income and higher total return than other bonds. Even so, the high-yield bond market is often vie ...

A Detailed Look into Peer to Peer Lending

... the car loan borrowers are mostly high quality and low risk of default. The most recent versions of FICO have been proven to be validated against economic cycle risk11. All told, this is a robust measure of riskiness that has been vetted by the financial industry for decades and is a continued commo ...

... the car loan borrowers are mostly high quality and low risk of default. The most recent versions of FICO have been proven to be validated against economic cycle risk11. All told, this is a robust measure of riskiness that has been vetted by the financial industry for decades and is a continued commo ...

Download attachment

... As a background for the proposed alternative model to benchmark pricing for Islamic banking, it is worth knowing the classical Muslim jurists’ opinion on the issue. The most relevant juristic discussion is on fixing a price in financial transactions. This is due to the construction of Islamic Pricin ...

... As a background for the proposed alternative model to benchmark pricing for Islamic banking, it is worth knowing the classical Muslim jurists’ opinion on the issue. The most relevant juristic discussion is on fixing a price in financial transactions. This is due to the construction of Islamic Pricin ...

Interest

Interest is money paid by a borrower to a lender for a credit or a similar liability. Important examples are bond yields, interest paid for bank loans, and returns on savings. Interest differs from profit in that it is paid to a lender, whereas profit is paid to an owner. In economics, the various forms of credit are also referred to as loanable funds.When money is borrowed, interest is typically calculated as a percentage of the principal, the amount owed to the lender. The percentage of the principal that is paid over a certain period of time (typically a year) is called the interest rate. Interest rates are market prices which are determined by supply and demand. They are generally positive because loanable funds are scarce.Interest is often compounded, which means that interest is earned on prior interest in addition to the principal. The total amount of debt grows exponentially, and its mathematical study led to the discovery of the number e. In practice, interest is most often calculated on a daily, monthly, or yearly basis, and its impact is influenced greatly by its compounding rate.