Estimating Equity Risk Premiums Report

... The historical equity risk premium (ERP), also referred to as the realized ERP, ex post ERP or the excess return, can be defined as the return of a stock market index minus the risk free return calculated as an annual percent over some historical period. The term ex ante ERP (or just ERP) will be us ...

... The historical equity risk premium (ERP), also referred to as the realized ERP, ex post ERP or the excess return, can be defined as the return of a stock market index minus the risk free return calculated as an annual percent over some historical period. The term ex ante ERP (or just ERP) will be us ...

Read now

... In the United States only about 1% of farmland changes hands yearly, while timberland’s annual turnover rate is also low. Farm and timber assets also generally enjoy a stable group of owners who invest for the long term. Timber ownership is dominated by financial institutions—Timber Investment Manag ...

... In the United States only about 1% of farmland changes hands yearly, while timberland’s annual turnover rate is also low. Farm and timber assets also generally enjoy a stable group of owners who invest for the long term. Timber ownership is dominated by financial institutions—Timber Investment Manag ...

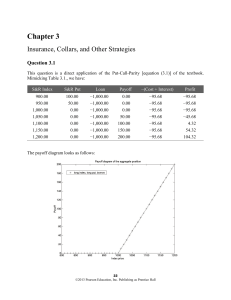

Chapter 3

... b) We sold a collar with no difference in strike prices. The profit diagram will be a straight line, which means that we effectively created a long forward contract. c) Remember that you are buying at the ask and selling at the bid, and that the bid price is always smaller than the ask. Suppose we h ...

... b) We sold a collar with no difference in strike prices. The profit diagram will be a straight line, which means that we effectively created a long forward contract. c) Remember that you are buying at the ask and selling at the bid, and that the bid price is always smaller than the ask. Suppose we h ...

Self-Adjusting Binary Search Trees DANIEL DOMINIC

... this way was also discovered independently by Huddleston [ 171. The weights of the items are parameters of the analysis, not of the algorithm: Lemma 1 holds for any assignment of positive weights to items. By choosing weights cleverly, we can obtain surprisingly strong results from Lemma 1. We shall ...

... this way was also discovered independently by Huddleston [ 171. The weights of the items are parameters of the analysis, not of the algorithm: Lemma 1 holds for any assignment of positive weights to items. By choosing weights cleverly, we can obtain surprisingly strong results from Lemma 1. We shall ...

from + 1

... Running time: O(m+z), where z is the number of answers Just O(1) I/Os if the text is in external-memory (independent of z)! ...

... Running time: O(m+z), where z is the number of answers Just O(1) I/Os if the text is in external-memory (independent of z)! ...

Skip list - Computer Science and Engineering

... A skip list is built in layers. The bottom layer is an ordinary ordered linked list. Each higher layer acts as an "express lane" for the lists below, where an element in layer i appears in layer i+1 with some fixed probability p (two commonly used values for p are 1/2 or 1/4). On average, each eleme ...

... A skip list is built in layers. The bottom layer is an ordinary ordered linked list. Each higher layer acts as an "express lane" for the lists below, where an element in layer i appears in layer i+1 with some fixed probability p (two commonly used values for p are 1/2 or 1/4). On average, each eleme ...

Visualization Techniques for Trees, Graphs, and Networks

... depth (e.g., the furthest node from the root). Trees that are significantly coilstraiiled in one or both of these aspects, such as a binary tree or a tree with only three or four levels, tend to be much easier to draw than those with fewer constraints. When designing an algorithm for drawing any nod ...

... depth (e.g., the furthest node from the root). Trees that are significantly coilstraiiled in one or both of these aspects, such as a binary tree or a tree with only three or four levels, tend to be much easier to draw than those with fewer constraints. When designing an algorithm for drawing any nod ...

Linked Lists - Computer Science@IUPUI

... Conventions of Linked List There are several conventions for the link to indicate the end of the list. 1. a null link that points to no node (0 or NULL) 2. a dummy node that contains no item 3. a reference back to the first node, making it a circular list. ...

... Conventions of Linked List There are several conventions for the link to indicate the end of the list. 1. a null link that points to no node (0 or NULL) 2. a dummy node that contains no item 3. a reference back to the first node, making it a circular list. ...

Reference manual - Index derivatives

... > Equity indices and sectorial indices: what are they and why are they important? ...................4 > What is a futures contract and how does it work? ......................................................................5 > What is an equity index futures contract?............................... ...

... > Equity indices and sectorial indices: what are they and why are they important? ...................4 > What is a futures contract and how does it work? ......................................................................5 > What is an equity index futures contract?............................... ...

Indexing Structure for File

... Defined on an ordered data file The data file is ordered on a non-key field unlike primary index, which requires that the ordering field of the data file have a distinct value for each record. Includes one index entry for each distinct value of the field; the index entry points to the first data blo ...

... Defined on an ordered data file The data file is ordered on a non-key field unlike primary index, which requires that the ordering field of the data file have a distinct value for each record. Includes one index entry for each distinct value of the field; the index entry points to the first data blo ...

large-scale music similarity search with spatial trees

... of hashes, the ratio of near and far distances, and collision probabilities — and the resulting index structure can become quite large due to the multiple hashing of each data point. Cai, et al.’s implementation scales to upwards of 105 audio clips, but since their focus was on playlist generation, ...

... of hashes, the ratio of near and far distances, and collision probabilities — and the resulting index structure can become quite large due to the multiple hashing of each data point. Cai, et al.’s implementation scales to upwards of 105 audio clips, but since their focus was on playlist generation, ...

Benchmarks as Limits to Arbitrage: Understanding the Low

... large caps grew to $53.81 over 41 years, whereas a dollar invested in high-volatility large caps grew to $7.35. For beta, the numbers are $78.66 and $4.70, respectively. ©2011 CFA Institute ...

... large caps grew to $53.81 over 41 years, whereas a dollar invested in high-volatility large caps grew to $7.35. For beta, the numbers are $78.66 and $4.70, respectively. ©2011 CFA Institute ...

() - ETF Securities

... as illustrated by the wide gulf between soft and hard economic data. We expect the Euro to benefit as the European Central Bank ceases its asset purchases this year. The Bank of England will follow in the US Federal Reserve’s footsteps and raise rates while maintaining a stable but elevated balance ...

... as illustrated by the wide gulf between soft and hard economic data. We expect the Euro to benefit as the European Central Bank ceases its asset purchases this year. The Bank of England will follow in the US Federal Reserve’s footsteps and raise rates while maintaining a stable but elevated balance ...

Haksoz Kadam SPR Feb2009

... not a decision variable. Instead of deciding how to vary prices to induce demand, we would like to decipher how the changes in the spot market price affects the buyer’s profits and the seller’s likelihood of contract breach. Another relevant stream of literature is the Value-at-Risk literature, whi ...

... not a decision variable. Instead of deciding how to vary prices to induce demand, we would like to decipher how the changes in the spot market price affects the buyer’s profits and the seller’s likelihood of contract breach. Another relevant stream of literature is the Value-at-Risk literature, whi ...

Real Options Approach to Gas Plant Valuation

... consumption, whereas the gas consumption of a peak load plant varies. Thus, the nonfuel operational costs of a base load plant are lower. There are various alternatives in the design of CCGT plants, e.g. the steam cycle can be modified. Often base load plants can be upgraded into peak load plants. W ...

... consumption, whereas the gas consumption of a peak load plant varies. Thus, the nonfuel operational costs of a base load plant are lower. There are various alternatives in the design of CCGT plants, e.g. the steam cycle can be modified. Often base load plants can be upgraded into peak load plants. W ...

The cost of preferred stock is equal to the preferred

... Because preferred stock carries a differing amount of risk than other types of securities, we must calculate its asset specific cost of capital to work into our overall weighted average cost of capital. Similar to debt, this can be a relatively simple process since we can observe values needed as in ...

... Because preferred stock carries a differing amount of risk than other types of securities, we must calculate its asset specific cost of capital to work into our overall weighted average cost of capital. Similar to debt, this can be a relatively simple process since we can observe values needed as in ...

Ed Yardeni - EuroCapital

... depreciation of the yen, ideally through large open-market sales of yen. Through its effects on import-price inflation (which has been sharply negative in recent years), on the demand for Japanese goods, and on expectations, a significant yen depreciation would go a long way toward jump-starting the ...

... depreciation of the yen, ideally through large open-market sales of yen. Through its effects on import-price inflation (which has been sharply negative in recent years), on the demand for Japanese goods, and on expectations, a significant yen depreciation would go a long way toward jump-starting the ...

Prefix Based Numbering Schemes for XML: Techniques

... Many XML applications handle dynamic data that are frequently updated or queried via XPath or XQuery. With the amount of available data, it is not always possible to determine in advance the size of the data and the number of updates. So, both interval and bit-vector schemes are not appropriate for ...

... Many XML applications handle dynamic data that are frequently updated or queried via XPath or XQuery. With the amount of available data, it is not always possible to determine in advance the size of the data and the number of updates. So, both interval and bit-vector schemes are not appropriate for ...

an empirical determinant of equity share price of some quoted

... Researchers on corporate dividend policy over the years have optioned for one of the two different approaches commonly applied: the behavioural approach through survey research design. This ranges from interview to use of questionnaires on the opinions of corporate managers on determining those fact ...

... Researchers on corporate dividend policy over the years have optioned for one of the two different approaches commonly applied: the behavioural approach through survey research design. This ranges from interview to use of questionnaires on the opinions of corporate managers on determining those fact ...

The First Fundamental Theorem of Asset Pricing

... of assets without drawing on free lunches. Finally, Section 6 concludes. ...

... of assets without drawing on free lunches. Finally, Section 6 concludes. ...

Lattice model (finance)

For other meanings, see lattice model (disambiguation)In finance, a lattice model [1] is a technique applied to the valuation of derivatives, where, because of path dependence in the payoff, 1) a discretized model is required and 2) Monte Carlo methods fail to account for optimal decisions to terminate the derivative by early exercise. For equity options, a typical example would be pricing an American option, where a decision as to option exercise is required at ""all"" times (any time) before and including maturity. A continuous model, on the other hand, such as Black Scholes, would only allow for the valuation of European options, where exercise is on the option's maturity date. For interest rate derivatives lattices are additionally useful in that they address many of the issues encountered with continuous models, such as pull to par.