Handout

... where repeat(s, n) returns a string with n copies of s concatenated together. For example, repeat("a",3) returns "aaa". This function corresponds to the Google Closure library function goog.string.repeat. Instructor Solution: 4 lines (including 1 line for a closing brace). (b) In this exercise, we w ...

... where repeat(s, n) returns a string with n copies of s concatenated together. For example, repeat("a",3) returns "aaa". This function corresponds to the Google Closure library function goog.string.repeat. Instructor Solution: 4 lines (including 1 line for a closing brace). (b) In this exercise, we w ...

1 macroeconomics:modeling the behavior of

... statement more like “a one-unit permanent increase in X starting in period t (holding the paths of all other exogenous variables constant) would increase in endogenous variable Y by 1.6 units in period t, 2.2 units in period t + 1, …, and 3.4 units in the steady state of the new growth path.” In ord ...

... statement more like “a one-unit permanent increase in X starting in period t (holding the paths of all other exogenous variables constant) would increase in endogenous variable Y by 1.6 units in period t, 2.2 units in period t + 1, …, and 3.4 units in the steady state of the new growth path.” In ord ...

The yield curve as a predictor of recessions in the United States and

... measures confirm this. Particularly striking are the results for Germany which indicate that the German yield curve spread has been an accurate forecaster of German recessions; as in the United States, forecasted probabilities of recession are low during nonrecession periods and the probabilities re ...

... measures confirm this. Particularly striking are the results for Germany which indicate that the German yield curve spread has been an accurate forecaster of German recessions; as in the United States, forecasted probabilities of recession are low during nonrecession periods and the probabilities re ...

Binary Trees

... Case 2: Node to be deleted has no left subtree Case 3: Node to be deleted has no right subtree Case 4: Node to be deleted has nonempty left and right subtrees search left subtree of the node to be deleted to find its immediate predecessor ...

... Case 2: Node to be deleted has no left subtree Case 3: Node to be deleted has no right subtree Case 4: Node to be deleted has nonempty left and right subtrees search left subtree of the node to be deleted to find its immediate predecessor ...

Pushing further in search of return: The new private equity model

... This requires them to generate more value from the asset to meet their return objectives, which takes longer – holding periods have increased – and demands more investment in efficiency, channel effectiveness and other forms of operational improvement. In this paper, we look at how funding, value ge ...

... This requires them to generate more value from the asset to meet their return objectives, which takes longer – holding periods have increased – and demands more investment in efficiency, channel effectiveness and other forms of operational improvement. In this paper, we look at how funding, value ge ...

How to Model a Financial Bubble Mathematically Lecture 1 April 12, 2013

... 2. Harrison, J.M, Pliska, S.R. (1981) Martingales and Stochastic Integrals in the Theory of Continuous Trading, Stochastic Processes and their Applications 11, 215-260 3. Kreps, D.M. (1981) Arbitrage and Equilibrium in Economics with infinitely many Commodities, Journal of Mathematical ...

... 2. Harrison, J.M, Pliska, S.R. (1981) Martingales and Stochastic Integrals in the Theory of Continuous Trading, Stochastic Processes and their Applications 11, 215-260 3. Kreps, D.M. (1981) Arbitrage and Equilibrium in Economics with infinitely many Commodities, Journal of Mathematical ...

Search Trees in Practice - English

... Using this lower bound, it can be observed that it is always possible to make a search for which there is a transition at all nodes on the root-to-node path of the searched node. It’s search cost is thus worst-case no less than O(log n) time. ...

... Using this lower bound, it can be observed that it is always possible to make a search for which there is a transition at all nodes on the root-to-node path of the searched node. It’s search cost is thus worst-case no less than O(log n) time. ...

Valuation Methods and Banks` Takeover Premium: an

... How can we capture the intrinsic value of a bank looking both at its value creation capability and its risk management quality? Before answering to this question, it has to be asked whether current valuation methods of banks allow investors and managers to capture the complexity of banks’ value gene ...

... How can we capture the intrinsic value of a bank looking both at its value creation capability and its risk management quality? Before answering to this question, it has to be asked whether current valuation methods of banks allow investors and managers to capture the complexity of banks’ value gene ...

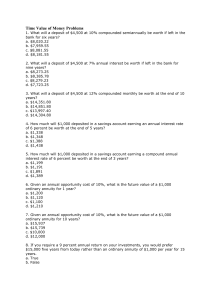

Time Value of Money Problems 1. What will a deposit of $4,500 at

... (the first one occurring 1 year from now) such that his account balance will be zero at the end of 10 years. How much will he be able to withdraw each year? a. $13,180.71 b. $13,614.50 c. $12,989.22 d. $13,019.63 32. Your parents have discovered a $1,000 bond at the bottom of their safe deposit box. ...

... (the first one occurring 1 year from now) such that his account balance will be zero at the end of 10 years. How much will he be able to withdraw each year? a. $13,180.71 b. $13,614.50 c. $12,989.22 d. $13,019.63 32. Your parents have discovered a $1,000 bond at the bottom of their safe deposit box. ...

Worth the risk? The appeal and challenges of high

... offered yields above those offered by investment-grade bonds. In addition, they offer the chance for significant price appreciation should the issue or issuer be upgraded by the credit-rating agencies. Given these characteristics, is there a place in a diversified portfolio for high-yield bonds? The ...

... offered yields above those offered by investment-grade bonds. In addition, they offer the chance for significant price appreciation should the issue or issuer be upgraded by the credit-rating agencies. Given these characteristics, is there a place in a diversified portfolio for high-yield bonds? The ...

Day Effects in Korean Stock Market

... all futures and options is halted for five minutes. As well, the futures and options markets are automatically halted if the cash stock market is halted. Trading in the stock market is halted for twenty minutes if the KOSPI falls 10% or more from the previous day’s closing price and this continues f ...

... all futures and options is halted for five minutes. As well, the futures and options markets are automatically halted if the cash stock market is halted. Trading in the stock market is halted for twenty minutes if the KOSPI falls 10% or more from the previous day’s closing price and this continues f ...

Priority queues, binary heaps

... The main task is not how to implement the operations, but choosing the right representation and invariant These are the main design decisions – once you choose them, lots of stuff falls into place Understanding them is the best way to understand a data structure, and checking invariants is a very go ...

... The main task is not how to implement the operations, but choosing the right representation and invariant These are the main design decisions – once you choose them, lots of stuff falls into place Understanding them is the best way to understand a data structure, and checking invariants is a very go ...

Advanced Data Structure

... • We need to store values between 0 to 99, but we have only 10 cells • We can compress the range [0, 99] to [0, 9] by taking the modulo 10. It is called Hash Value • Insert, Find and Deleting are O(1) ...

... • We need to store values between 0 to 99, but we have only 10 cells • We can compress the range [0, 99] to [0, 9] by taking the modulo 10. It is called Hash Value • Insert, Find and Deleting are O(1) ...

AOP – Purchased Material Price Planning

... BatchPipes, BladeCenter, System Storage, GPFS, HACMP, RETAIN, DB2 Connect, RACF, Redbooks, OS/2, Parallel Sysplex, MVS/ESA, AIX, Intelligent Miner, WebSphere, Netfinity, Tivoli and Informix are trademarks or registered trademarks of IBM Corporation. Linux is the registered trademark of Linus Torvald ...

... BatchPipes, BladeCenter, System Storage, GPFS, HACMP, RETAIN, DB2 Connect, RACF, Redbooks, OS/2, Parallel Sysplex, MVS/ESA, AIX, Intelligent Miner, WebSphere, Netfinity, Tivoli and Informix are trademarks or registered trademarks of IBM Corporation. Linux is the registered trademark of Linus Torvald ...

Purchased Material Price Planning

... BatchPipes, BladeCenter, System Storage, GPFS, HACMP, RETAIN, DB2 Connect, RACF, Redbooks, OS/2, Parallel Sysplex, MVS/ESA, AIX, Intelligent Miner, WebSphere, Netfinity, Tivoli and Informix are trademarks or registered trademarks of IBM Corporation. Linux is the registered trademark of Linus Torvald ...

... BatchPipes, BladeCenter, System Storage, GPFS, HACMP, RETAIN, DB2 Connect, RACF, Redbooks, OS/2, Parallel Sysplex, MVS/ESA, AIX, Intelligent Miner, WebSphere, Netfinity, Tivoli and Informix are trademarks or registered trademarks of IBM Corporation. Linux is the registered trademark of Linus Torvald ...

Lattice model (finance)

For other meanings, see lattice model (disambiguation)In finance, a lattice model [1] is a technique applied to the valuation of derivatives, where, because of path dependence in the payoff, 1) a discretized model is required and 2) Monte Carlo methods fail to account for optimal decisions to terminate the derivative by early exercise. For equity options, a typical example would be pricing an American option, where a decision as to option exercise is required at ""all"" times (any time) before and including maturity. A continuous model, on the other hand, such as Black Scholes, would only allow for the valuation of European options, where exercise is on the option's maturity date. For interest rate derivatives lattices are additionally useful in that they address many of the issues encountered with continuous models, such as pull to par.