Schilling Ch 7

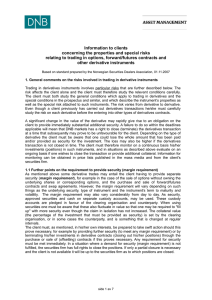

... Quantitative Methods for Choosing Projects • Real options are based on stock options – A call option on a stock enables an investor to purchase the stock at a specified price (the exercise price) in the future • If, in the future, the stock is worth more than the exercise price, the holder of the o ...

... Quantitative Methods for Choosing Projects • Real options are based on stock options – A call option on a stock enables an investor to purchase the stock at a specified price (the exercise price) in the future • If, in the future, the stock is worth more than the exercise price, the holder of the o ...

Midterm Solutions

... (a) Correctness. No. The correctness of a sorting algorithm means that the resulting array is in ascending order, and it contains exactly the same elements that you began with. Neither property is satisfied here because of a catastrophic off-by-one error that causes L[lo-1] and H[hi-1] to be lost. ( ...

... (a) Correctness. No. The correctness of a sorting algorithm means that the resulting array is in ascending order, and it contains exactly the same elements that you began with. Neither property is satisfied here because of a catastrophic off-by-one error that causes L[lo-1] and H[hi-1] to be lost. ( ...

Risk Measures Guide - The Albridge Resource Center

... Sharpe Ratio - Measures risk-adjusted performance. The Sharpe Ratio is calculated by subtracting the risk-free rate – such as that of the 10-year U.S. Treasury bond – from the rate of return for a portfolio and dividing the result by the standard deviation of the portfolio returns. The Sharpe Ratio ...

... Sharpe Ratio - Measures risk-adjusted performance. The Sharpe Ratio is calculated by subtracting the risk-free rate – such as that of the 10-year U.S. Treasury bond – from the rate of return for a portfolio and dividing the result by the standard deviation of the portfolio returns. The Sharpe Ratio ...

Information to clients concerning the properties and special

... The principal types of derivative instruments are options, forward/futures contracts and swap agreements. 3.1 Options An option is a contract that involves one party (the issuer (writer) of the option contract) undertaking to buy or sell the underlying asset to the other party (the holder of the con ...

... The principal types of derivative instruments are options, forward/futures contracts and swap agreements. 3.1 Options An option is a contract that involves one party (the issuer (writer) of the option contract) undertaking to buy or sell the underlying asset to the other party (the holder of the con ...

heap

... A heap is a complete binary tree, where the entry at each node is greater than or equal to the entries in its children. To add an entry to a heap, place the new entry at the next available spot, and perform a reheapification upward. To remove the biggest entry, move the last node onto the root, ...

... A heap is a complete binary tree, where the entry at each node is greater than or equal to the entries in its children. To add an entry to a heap, place the new entry at the next available spot, and perform a reheapification upward. To remove the biggest entry, move the last node onto the root, ...

Stock price

... The increase in equity price does not affect the straight bond value component of the Ytel convertible. The increase in equity price increases the option value component significantly, because the call option becomes deep “in the money” when the $51 per share equity price is compared to the converti ...

... The increase in equity price does not affect the straight bond value component of the Ytel convertible. The increase in equity price increases the option value component significantly, because the call option becomes deep “in the money” when the $51 per share equity price is compared to the converti ...

3. What determines the yields for treasury bills in Pakistan.

... preference theory by putting more weight on the risk preferences of investors on expected spot rates in future. Hicks theoretical assertion was that risk aversion of market participants in terms of increasing maturity amounts should place the expected spots greater than the forward rates. This work ...

... preference theory by putting more weight on the risk preferences of investors on expected spot rates in future. Hicks theoretical assertion was that risk aversion of market participants in terms of increasing maturity amounts should place the expected spots greater than the forward rates. This work ...

presentation

... which together represent a sequence • each node is composed of a data and a reference (in other words, a link) to the next node in the sequence • this structure allows for efficient insertion or removal of elements from any position in the sequence ...

... which together represent a sequence • each node is composed of a data and a reference (in other words, a link) to the next node in the sequence • this structure allows for efficient insertion or removal of elements from any position in the sequence ...

RESEARCH ON SENTIMENT-BASED SMART MONEY

... Combining the Insider model (value) with Price Momentum achieves better results than either alone, which matches well-known quant model behavior • Insiders tend to behave like value investors • When they violate this tendency, it is an especially powerful signal (e.g. when insiders sell a stock tha ...

... Combining the Insider model (value) with Price Momentum achieves better results than either alone, which matches well-known quant model behavior • Insiders tend to behave like value investors • When they violate this tendency, it is an especially powerful signal (e.g. when insiders sell a stock tha ...

CIAA2009

... • B. Courcelle, “Linear Delay Enumeration and Monadic SecondOrder Logic”, to appear in Discrete Applied Mathematics, 2009 ...

... • B. Courcelle, “Linear Delay Enumeration and Monadic SecondOrder Logic”, to appear in Discrete Applied Mathematics, 2009 ...

Chapter 5-3 - Computer Science

... the internal nodes represent actions, the arcs represent outcomes of an action, and the leaves represent final outcomes. The following figure represents the various possibilities for five coin tosses under the constraint that two heads in a row do not occur. Each internal node of the tree represents ...

... the internal nodes represent actions, the arcs represent outcomes of an action, and the leaves represent final outcomes. The following figure represents the various possibilities for five coin tosses under the constraint that two heads in a row do not occur. Each internal node of the tree represents ...

Document

... quantity demanded (for bonds) and the price of a bond, when all other factors are held constant. Demand for a 1 year discount bond can be show where for a given price, the investment yield can be calculated as follows (see investment yield formula, Lecture 2), ...

... quantity demanded (for bonds) and the price of a bond, when all other factors are held constant. Demand for a 1 year discount bond can be show where for a given price, the investment yield can be calculated as follows (see investment yield formula, Lecture 2), ...

Chapter 17: Indexing Structures for Files and Indexing Structures for

... • Check Fig 17.12 for examples on insertions and Fig 17.13 on deletions from a B+ tree 60‐315 Dr. C. I. Ezeife (2017) with Figures and some materials from Elmasri & Navathe, 7th Ed ...

... • Check Fig 17.12 for examples on insertions and Fig 17.13 on deletions from a B+ tree 60‐315 Dr. C. I. Ezeife (2017) with Figures and some materials from Elmasri & Navathe, 7th Ed ...

Building a greener society

... • Design in Passivhaus / air tightness specifications from the start • Consider your rules and terms of leases. Are they practical and “fundable”? • Talk to a few lenders and RICS approved valuers • Ask if there is a valuation panel policy at lenders ...

... • Design in Passivhaus / air tightness specifications from the start • Consider your rules and terms of leases. Are they practical and “fundable”? • Talk to a few lenders and RICS approved valuers • Ask if there is a valuation panel policy at lenders ...

Lattice model (finance)

For other meanings, see lattice model (disambiguation)In finance, a lattice model [1] is a technique applied to the valuation of derivatives, where, because of path dependence in the payoff, 1) a discretized model is required and 2) Monte Carlo methods fail to account for optimal decisions to terminate the derivative by early exercise. For equity options, a typical example would be pricing an American option, where a decision as to option exercise is required at ""all"" times (any time) before and including maturity. A continuous model, on the other hand, such as Black Scholes, would only allow for the valuation of European options, where exercise is on the option's maturity date. For interest rate derivatives lattices are additionally useful in that they address many of the issues encountered with continuous models, such as pull to par.