Efficient Risk Reducing Strategies by International Diversification

... Budapest Stock Exchange.’ To examine the potential gains from adding assets from mature financial markets into a local Hungarian stock portfolio we determined (similarly to other researchers in the field of international portfolio diversification) four investment strategies: the equally weighed port ...

... Budapest Stock Exchange.’ To examine the potential gains from adding assets from mature financial markets into a local Hungarian stock portfolio we determined (similarly to other researchers in the field of international portfolio diversification) four investment strategies: the equally weighed port ...

Teachers Guide Lesson Twelve

... Saving just 35 cents a day will result in more than $125 in a year. Small amounts saved and invested can easily grow into larger sums. However, a person must start to save. This lesson provides students with a basic knowledge of saving and investing. The process starts with setting financial goals. ...

... Saving just 35 cents a day will result in more than $125 in a year. Small amounts saved and invested can easily grow into larger sums. However, a person must start to save. This lesson provides students with a basic knowledge of saving and investing. The process starts with setting financial goals. ...

The Power of Forward Guidance Revisited

... the zero lower bound in our incomplete markets model than it is in standard macro models. We consider a shock that lowers the natural rate of interest enough that the zero lower bound binds for five years and the initial fall in output is −4 percent in the absence of forward guidance. If we assume m ...

... the zero lower bound in our incomplete markets model than it is in standard macro models. We consider a shock that lowers the natural rate of interest enough that the zero lower bound binds for five years and the initial fall in output is −4 percent in the absence of forward guidance. If we assume m ...

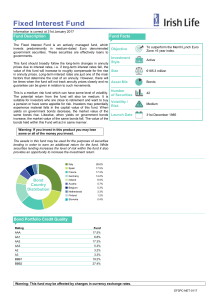

Fixed Interest Fund - Irish Life Corporate Business

... This fund should broadly follow the long-term changes in annuity Style prices due to interest rates, i.e. if long-term interest rates fall, the value of this fund will increase to roughly compensate for the rise Size in annuity prices. Long-term interest rates are just one of the main factors that d ...

... This fund should broadly follow the long-term changes in annuity Style prices due to interest rates, i.e. if long-term interest rates fall, the value of this fund will increase to roughly compensate for the rise Size in annuity prices. Long-term interest rates are just one of the main factors that d ...

NBER WORKING PAPER SERIES Randall Morck M. Deniz Yavuz

... results to be largely independent of general state intervention, as gauged by the scope of government transfers and subsidies, state-directed investment, and politically connected firms. One very specific dimension of state power, politicization of the central bank (Crowe and Meade 2008), might aff ...

... results to be largely independent of general state intervention, as gauged by the scope of government transfers and subsidies, state-directed investment, and politically connected firms. One very specific dimension of state power, politicization of the central bank (Crowe and Meade 2008), might aff ...

Choices and Best Practice in Corporate Risk Management Disclosure

... Sensitivity Analysis. The sensitivity analysis method expresses the potential loss in future earnings, fair values, or cash flows that could result from selected hypothetical changes in market rates and prices. Companies are required to provide a description of the model, assumptions, and parameters ...

... Sensitivity Analysis. The sensitivity analysis method expresses the potential loss in future earnings, fair values, or cash flows that could result from selected hypothetical changes in market rates and prices. Companies are required to provide a description of the model, assumptions, and parameters ...

Emerging Countries and Inconsistencies in Macroeconomic Policy

... both in Brazil and in international financial markets. The focus on the expectations and operations of financial market participants and their interaction with central bank operations is particularly justified by Brazil‘s rising financial integration and the constraints this integration imposed on c ...

... both in Brazil and in international financial markets. The focus on the expectations and operations of financial market participants and their interaction with central bank operations is particularly justified by Brazil‘s rising financial integration and the constraints this integration imposed on c ...

OVERVIEW OF THE GREEK FINANCIAL SYSTEM

... uncertainty in developed countries and emerging economies’ risks. These challenges could halt the economic upturn and reignite uncertainty, also affecting the financial system. ...

... uncertainty in developed countries and emerging economies’ risks. These challenges could halt the economic upturn and reignite uncertainty, also affecting the financial system. ...

F t (k)

... deposited in an escrow account in the investor’s name until the investor makes good on the promise to bring the shares back. Moreover, the investor must deposit an additional amount of at least 50% of the short sale’s proceeds in the escrow account. This additional amount guarantees that there is en ...

... deposited in an escrow account in the investor’s name until the investor makes good on the promise to bring the shares back. Moreover, the investor must deposit an additional amount of at least 50% of the short sale’s proceeds in the escrow account. This additional amount guarantees that there is en ...

Can mutual funds successfully adopt factor investing strategies?

... deliver economically and significantly better returns than non-factor investing funds. For funds engaging in momentum strategies, we find mixed evidence. While the majority of these funds earn positive excess returns, there are also quite a few of these funds that earn highly negative alphas. Appare ...

... deliver economically and significantly better returns than non-factor investing funds. For funds engaging in momentum strategies, we find mixed evidence. While the majority of these funds earn positive excess returns, there are also quite a few of these funds that earn highly negative alphas. Appare ...

Managed Floating and Intermediate Exchange Rate Systems: The

... In more recent years, however, the persuasive weight of such a consensus within the academic literature has diminished significantly. Indeed, there has since emerged an increasing number of studies, suggesting that intermediate exchange rate regimes might in fact be more robust and resilient than pr ...

... In more recent years, however, the persuasive weight of such a consensus within the academic literature has diminished significantly. Indeed, there has since emerged an increasing number of studies, suggesting that intermediate exchange rate regimes might in fact be more robust and resilient than pr ...

Interest Rates and Monetary Policy Uncertainty

... Ross (1985) popular in the finance literature.3 A government cum monetary authority is introduced in that model. The analysis allows for money growth to take place either through transfers to households or through open-market operations in the only produced commodity to finance government expenditur ...

... Ross (1985) popular in the finance literature.3 A government cum monetary authority is introduced in that model. The analysis allows for money growth to take place either through transfers to households or through open-market operations in the only produced commodity to finance government expenditur ...

challenges smes face in acquiring loans from banks

... Lenders of capital are more than investors in the corporate finance. Even though debt financing allows business owners to maintain their full ownership, it comes with interest which sometimes is higher if the business has higher risk. Business owners looking for debt capital to finance their busines ...

... Lenders of capital are more than investors in the corporate finance. Even though debt financing allows business owners to maintain their full ownership, it comes with interest which sometimes is higher if the business has higher risk. Business owners looking for debt capital to finance their busines ...

NBER WORKING PAPER SERIES SOME ESTIMATES FOR OECD COUNTRIES

... 4.5 percent of GDP, compared with 1.5 percent in 2000, and is projected to increase further in the future. Over the same period, Germany’s deÞcit rose to 3.75 percent of GDP from 1 percent; France’s to 3.5 compared with 1.5, and Italy’s to 2.5 from 0.75 percent; as a result, the Stability and Growth ...

... 4.5 percent of GDP, compared with 1.5 percent in 2000, and is projected to increase further in the future. Over the same period, Germany’s deÞcit rose to 3.75 percent of GDP from 1 percent; France’s to 3.5 compared with 1.5, and Italy’s to 2.5 from 0.75 percent; as a result, the Stability and Growth ...

Causes, Effects and Regulatory Implications of Financial and

... Table 7: Costs of Reducing Debt/Equity Ratio to 60% in Top 60 Firms.......................... 57 Table 8: Secondary market spreads on emerging market sovereign bonds (change in basis points from beginning to end of period) ............................................................ 58 ...

... Table 7: Costs of Reducing Debt/Equity Ratio to 60% in Top 60 Firms.......................... 57 Table 8: Secondary market spreads on emerging market sovereign bonds (change in basis points from beginning to end of period) ............................................................ 58 ...

Do Accounting Changes Affect the Economic Behavior of Financial

... sections of the balance sheet. SFAS 150, which was issued in May 2003, changed the balance sheet classification of trust preferred securities by requiring that mandatorily redeemable financial instruments be classified as a liability of the issuing company if the issuer is unconditionally obligated ...

... sections of the balance sheet. SFAS 150, which was issued in May 2003, changed the balance sheet classification of trust preferred securities by requiring that mandatorily redeemable financial instruments be classified as a liability of the issuing company if the issuer is unconditionally obligated ...

Bond Markets in Serbia: Regulatory Challenges for an Efficient Market

... most often used by governments of emerging market countries, as it allows the inflow of much needed capital to the emerging economy, and, at the same time, substantial profits for investors at the lowest possible risk which could be associated with the country. However, indirect effects on the emerg ...

... most often used by governments of emerging market countries, as it allows the inflow of much needed capital to the emerging economy, and, at the same time, substantial profits for investors at the lowest possible risk which could be associated with the country. However, indirect effects on the emerg ...

Chapter 4 "Foreign Exchange Markets and Rates of Return"

... the forward contract will likely be different from the current spot ER. In part, its value will reflect market expectations about the degree to which currency values will change in the next two months. Suppose the current sixty-day forward ER is 1.25 $/€, reflecting the expectation that the U.S. dol ...

... the forward contract will likely be different from the current spot ER. In part, its value will reflect market expectations about the degree to which currency values will change in the next two months. Suppose the current sixty-day forward ER is 1.25 $/€, reflecting the expectation that the U.S. dol ...

designated market makers - The New York Stock Exchange

... volume events of the trading day. DMMs contribute capital in the auctions to satisfy market demand, and provide human judgment and communication. Volatility is typically the highest during the first hour of trading as participants digest overnight news. DMMs help to establish the right opening price ...

... volume events of the trading day. DMMs contribute capital in the auctions to satisfy market demand, and provide human judgment and communication. Volatility is typically the highest during the first hour of trading as participants digest overnight news. DMMs help to establish the right opening price ...

Is U.S. Monetary Policy “Punishing Saving”?

... C ONCLUSION In this talk I looked at a model environment that contains some interesting features. The features include a vital economic role for borrowing and lending. The amount of desired borrowing depends on future income, leaving it susceptible to news shocks. Too much borrowing can occur if the ...

... C ONCLUSION In this talk I looked at a model environment that contains some interesting features. The features include a vital economic role for borrowing and lending. The amount of desired borrowing depends on future income, leaving it susceptible to news shocks. Too much borrowing can occur if the ...

interest rate, exchange rate and inflation in romania

... Empirical tests done to demonstrate this theory were numerous, however have provided different results depending on countries and currencies studied, some of them behaving according to the theory, and others not. Interest rates parity theory shows that the exchange rate is on par, if the difference ...

... Empirical tests done to demonstrate this theory were numerous, however have provided different results depending on countries and currencies studied, some of them behaving according to the theory, and others not. Interest rates parity theory shows that the exchange rate is on par, if the difference ...

Basel Committee on Banking Supervision Basel III: The Liquidity

... more resilient banking sector: the Liquidity Coverage Ratio (LCR). The objective of the LCR is to promote the short-term resilience of the liquidity risk profile of banks. It does this by ensuring that banks have an adequate stock of unencumbered high-quality liquid assets (HQLA) that can be convert ...

... more resilient banking sector: the Liquidity Coverage Ratio (LCR). The objective of the LCR is to promote the short-term resilience of the liquidity risk profile of banks. It does this by ensuring that banks have an adequate stock of unencumbered high-quality liquid assets (HQLA) that can be convert ...

Investment advisory and Treasury Management Services

... To devise, review & monitor the investment portfolios and investment avenues, and advise the management in a professional manner on a periodic basis. To apprise the management of the continued effectiveness of the investments from time to time. Constantly monitor the portfolio to identify any risks ...

... To devise, review & monitor the investment portfolios and investment avenues, and advise the management in a professional manner on a periodic basis. To apprise the management of the continued effectiveness of the investments from time to time. Constantly monitor the portfolio to identify any risks ...

3.1 Profile of Dashen Bank SC - Ethiopian Economic Association

... custody of money, which it plays out on a customer order”. This however is not satisfactory definition as it ignores the most important function of a bank that is creating money or creating credit. As many reliable sources indicate, the history of banking begins with the first prototype banks of mer ...

... custody of money, which it plays out on a customer order”. This however is not satisfactory definition as it ignores the most important function of a bank that is creating money or creating credit. As many reliable sources indicate, the history of banking begins with the first prototype banks of mer ...

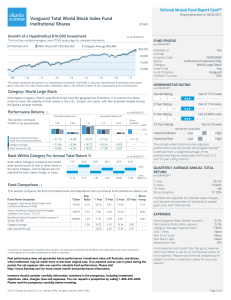

Vanguard Total World Stock Index Fund Institutional Shares

... intended to address any individual's investment objectives, financial situation or personal circumstances. We recommend that investors define their goals, risk tolerance, time horizon and investment objectives in addition to researching possible investment choices. Target date funds are built for in ...

... intended to address any individual's investment objectives, financial situation or personal circumstances. We recommend that investors define their goals, risk tolerance, time horizon and investment objectives in addition to researching possible investment choices. Target date funds are built for in ...