Regulator Use of Market Data to Improve the Identification of Bank

... For the purposes of this study, the first two hurdles can be overcome by focusing on elements of longer-term trend in stock prices, returns, and other market-related variables. Since stock prices and returns of firms in the same industry are correlated, short-term informational messages for specific ...

... For the purposes of this study, the first two hurdles can be overcome by focusing on elements of longer-term trend in stock prices, returns, and other market-related variables. Since stock prices and returns of firms in the same industry are correlated, short-term informational messages for specific ...

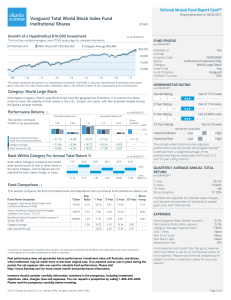

Vanguard Total World Stock Index Fund Institutional Shares

... intended to address any individual's investment objectives, financial situation or personal circumstances. We recommend that investors define their goals, risk tolerance, time horizon and investment objectives in addition to researching possible investment choices. Target date funds are built for in ...

... intended to address any individual's investment objectives, financial situation or personal circumstances. We recommend that investors define their goals, risk tolerance, time horizon and investment objectives in addition to researching possible investment choices. Target date funds are built for in ...

Monetary Policy, Financial Conditions, and Financial Stability

... potential for widespread financial externalities, such as from asset sales and contagion, that can result in large negative outcomes for output. In this paper, we argue that macroprudential and monetary policy transmission channels are intertwined, and central banks should consider effects on both f ...

... potential for widespread financial externalities, such as from asset sales and contagion, that can result in large negative outcomes for output. In this paper, we argue that macroprudential and monetary policy transmission channels are intertwined, and central banks should consider effects on both f ...

Goldman Sachs India Equity Portfolio

... This information is intended for viewing only by the intended recipient and may not be reproduced or distributed to any person in whole or in part without the prior written consent of GSI. Goldman Sachs International accepts no liability for the misuse or inappropriate distribution of this material. ...

... This information is intended for viewing only by the intended recipient and may not be reproduced or distributed to any person in whole or in part without the prior written consent of GSI. Goldman Sachs International accepts no liability for the misuse or inappropriate distribution of this material. ...

L - Spring Branch ISD

... 2. Current equilibrium output and price level B. Now assume a Significant increase in the world price of oil, a major production input fo.- the United States. Show on your graph in part (A) how the increase in the oil price affects each of the following in the short run. 1. Short·run aggregate suppl ...

... 2. Current equilibrium output and price level B. Now assume a Significant increase in the world price of oil, a major production input fo.- the United States. Show on your graph in part (A) how the increase in the oil price affects each of the following in the short run. 1. Short·run aggregate suppl ...

The United Kingdom`s quantitative easing policy

... their views on the economy. Portfolio balance effects: Central bank asset purchases, through this channel, push up the prices of the assets bought and also the prices of other assets. When the central bank purchases assets, the money holdings of the sellers are increased. Unless money is a perfect s ...

... their views on the economy. Portfolio balance effects: Central bank asset purchases, through this channel, push up the prices of the assets bought and also the prices of other assets. When the central bank purchases assets, the money holdings of the sellers are increased. Unless money is a perfect s ...

The Tragedy of the Mortgage Commons

... than perfect credit, is not necessarily bad. It can permit those who had been closed out of the housing finance system to enter it, although at a higher cost. The issue in many cases, was not just about who received the mortgage, it was about what type of mortgage was originated and how it was origi ...

... than perfect credit, is not necessarily bad. It can permit those who had been closed out of the housing finance system to enter it, although at a higher cost. The issue in many cases, was not just about who received the mortgage, it was about what type of mortgage was originated and how it was origi ...

FREE Sample Here - We can offer most test bank and

... LOC: Understand the role of the finance function TOP: Expensive and unnecessary corporate diversification ...

... LOC: Understand the role of the finance function TOP: Expensive and unnecessary corporate diversification ...

The Discount Rate for Wrongful Death and Injury Cases

... It is generally accepted that the rate of return on conservative investments is to be used to discount future earnings to present value in cases involving injury or wrongful death. In determining the discount rate to use the period from 1953-1990 or some sub-period is usually used. This paper sugges ...

... It is generally accepted that the rate of return on conservative investments is to be used to discount future earnings to present value in cases involving injury or wrongful death. In determining the discount rate to use the period from 1953-1990 or some sub-period is usually used. This paper sugges ...

IBLLC Firm-Specific Disclosure 12-09-16

... Except as otherwise noted below, the information set out is as of November 30, 2016. Interactive will update this information annually and as necessary to take into account any material change to its business operations, financial condition or other factors that may be material to a customer’s decis ...

... Except as otherwise noted below, the information set out is as of November 30, 2016. Interactive will update this information annually and as necessary to take into account any material change to its business operations, financial condition or other factors that may be material to a customer’s decis ...

political influence on bank credit allocation: bank capital responses

... (2005)). The desire of politicians to be involved in the functioning of the credit market is not a radical idea. Politics has influenced banking for centuries, and many have written about how factors like politics and career concerns shape the actions of legislators and bank regulators.1 In their re ...

... (2005)). The desire of politicians to be involved in the functioning of the credit market is not a radical idea. Politics has influenced banking for centuries, and many have written about how factors like politics and career concerns shape the actions of legislators and bank regulators.1 In their re ...

Using the Bank Anti-Tying Provision to Curb Financial Risk

... London Interbank Offered Rate (LIBOR), highlights the act's limited ability to prevent future crises. 2 If anything, banks seem to have responded to greater regulation with greater risk-taking. 3 The act may therefore have the perverse effect of spurring another period of financial experimentation. ...

... London Interbank Offered Rate (LIBOR), highlights the act's limited ability to prevent future crises. 2 If anything, banks seem to have responded to greater regulation with greater risk-taking. 3 The act may therefore have the perverse effect of spurring another period of financial experimentation. ...

The long term equilibrium interest rate and risk premiums under

... consumption growth rate g must eventually become negative. Concerning the value of γ, a typical participant in the stock market is often estimated to have a relative risk aversion around 2, or perhaps larger, and accounting for those who are not participating presumably because they are even more ri ...

... consumption growth rate g must eventually become negative. Concerning the value of γ, a typical participant in the stock market is often estimated to have a relative risk aversion around 2, or perhaps larger, and accounting for those who are not participating presumably because they are even more ri ...

Insurance Asset Management Trends in 2014

... exchange control or tax regulations in such markets. Additionally, investments denominated in a foreign currency will be subject to changes in exchange rates that may have an adverse effect on the value, price or income of the investment. These risks are magnified in emerging markets and countries s ...

... exchange control or tax regulations in such markets. Additionally, investments denominated in a foreign currency will be subject to changes in exchange rates that may have an adverse effect on the value, price or income of the investment. These risks are magnified in emerging markets and countries s ...

Measuring the Banking System`s Resilience

... Banks 1 are a critical part of the financial system and play a vital role in the overall economy. At the same time, however, banking systems are also exposed to risks and shocks. As a result, banks must work to manage risks, such as credit and liquidity risk. An individual bank may experience proble ...

... Banks 1 are a critical part of the financial system and play a vital role in the overall economy. At the same time, however, banking systems are also exposed to risks and shocks. As a result, banks must work to manage risks, such as credit and liquidity risk. An individual bank may experience proble ...

(UNOFFICIAL TRANSLATION) Readers should be aware that only

... Notification of the Securities and Exchange Commission concerning exclusion of credit rating agency business from securities business in the category of securities investment advisory. Clause 2. In case credit rating agencies established under a foreign law under Clause 1(2) issue credit rating for ...

... Notification of the Securities and Exchange Commission concerning exclusion of credit rating agency business from securities business in the category of securities investment advisory. Clause 2. In case credit rating agencies established under a foreign law under Clause 1(2) issue credit rating for ...

Legal Origin, Creditors` Rights and Bank Lending

... governance indices that measure creditor protection; • O i denotes bank ownership variables, State or foreign controlled banks. • Z j, t is a vector of bank-level (bank capitalization, profitability, and loan quality) and country-level controls (level of economic development, competitiveness in the ...

... governance indices that measure creditor protection; • O i denotes bank ownership variables, State or foreign controlled banks. • Z j, t is a vector of bank-level (bank capitalization, profitability, and loan quality) and country-level controls (level of economic development, competitiveness in the ...

Financial Stability Reports - Federal Reserve Bank of Kansas City

... also helped keep interest rates low and provided funds to finance rising debt levels in other countries. Within financial markets, a number of developments and innovations led to a more fragile and vulnerable system. These included lax lending standards, misaligned incentives in the securitization p ...

... also helped keep interest rates low and provided funds to finance rising debt levels in other countries. Within financial markets, a number of developments and innovations led to a more fragile and vulnerable system. These included lax lending standards, misaligned incentives in the securitization p ...

The spillover effects of unconventional monetary policies in major

... with bond markets playing a relatively more important role in the US and the UK, and banks playing a relatively more important role in continental Europe and Japan. The unconventional monetary policy has had a significant impact on the economies of the US, the UK, the Euro Area and Japan. Through ...

... with bond markets playing a relatively more important role in the US and the UK, and banks playing a relatively more important role in continental Europe and Japan. The unconventional monetary policy has had a significant impact on the economies of the US, the UK, the Euro Area and Japan. Through ...

essen-ch18-presentat..

... The U.S. financial system is made up of many types of financial institutions, like the stock and bond markets, banks, and mutual funds. ...

... The U.S. financial system is made up of many types of financial institutions, like the stock and bond markets, banks, and mutual funds. ...

beyond banks and big government

... capital budgets. This has a knock-on effect for local government budgets, which have also experienced deep cuts. The 2010 spending review heralded a 74 per cent cut to the Department for Communities and Local Government capital budget, reducing it from £6.8 billion in 2010/11 to £2 billion in 2014/1 ...

... capital budgets. This has a knock-on effect for local government budgets, which have also experienced deep cuts. The 2010 spending review heralded a 74 per cent cut to the Department for Communities and Local Government capital budget, reducing it from £6.8 billion in 2010/11 to £2 billion in 2014/1 ...

Kingdom of Bahrain: Financial System Stability Assessment

... Profitability surged in 2004–05, but historically, return on equity has been moderate for many institutions. The insurance sector is also well-capitalized. Available indicators for nonfinancial sectors show that household debt relative to disposable income is low but rising, and the corporate sector ...

... Profitability surged in 2004–05, but historically, return on equity has been moderate for many institutions. The insurance sector is also well-capitalized. Available indicators for nonfinancial sectors show that household debt relative to disposable income is low but rising, and the corporate sector ...

Volume 72 No. 1, March 2009 Contents

... using the information in the HES regarding the original value of the mortgage and the date of origination, the mortgage type, and the interest rate applying to the latest mortgage payment. The estimated mortgage balance will over- or underestimate the actual principal outstanding depending on the le ...

... using the information in the HES regarding the original value of the mortgage and the date of origination, the mortgage type, and the interest rate applying to the latest mortgage payment. The estimated mortgage balance will over- or underestimate the actual principal outstanding depending on the le ...

Formosa Bonds

... Management risk is the risk that the investment techniques and risk analyses applied by PIMCO will not produce the desired results, and that certain policies or developments may affect the investment techniques available to PIMCO in connection with managing the strategy. Derivatives may involve cert ...

... Management risk is the risk that the investment techniques and risk analyses applied by PIMCO will not produce the desired results, and that certain policies or developments may affect the investment techniques available to PIMCO in connection with managing the strategy. Derivatives may involve cert ...

Risk and Return Analysis

... CAPM is however not a generally accepted model and the debate regarding it has raged ever since its inception almost 40 years ago. Finding the “market portfolio” is a difficult task, as it is supposed to include all risky assets in their relative proportion, of which only a fraction are traded and q ...

... CAPM is however not a generally accepted model and the debate regarding it has raged ever since its inception almost 40 years ago. Finding the “market portfolio” is a difficult task, as it is supposed to include all risky assets in their relative proportion, of which only a fraction are traded and q ...