Long-Term Investment Policy - American Speech

... modifications or exceptions (temporary or otherwise) in writing to the FPB when they deem it appropriate. Only the FPB may approve such requests. 11. The FPB will report to the Board at least annually on the status of the Fund. ...

... modifications or exceptions (temporary or otherwise) in writing to the FPB when they deem it appropriate. Only the FPB may approve such requests. 11. The FPB will report to the Board at least annually on the status of the Fund. ...

Revenue Strategy - Shire of Esperance

... highlighted that a number of local governments including the Shire of Esperance has considerable challenges in ensuring assets are replaced at the optimum time whilst balancing that with an appropriate service level. This revenue strategy will be used as an informing document to the Corporate Busine ...

... highlighted that a number of local governments including the Shire of Esperance has considerable challenges in ensuring assets are replaced at the optimum time whilst balancing that with an appropriate service level. This revenue strategy will be used as an informing document to the Corporate Busine ...

risks associated with financial instruments (glossary)

... In its simplest form, risk could be described as the volatility or fluctuation of a financial instrument over a period of time. The higher the volatility or fluctuation of a financial instrument, the higher the risks of capital loss for an investor. In its simplest form, the return of a financial in ...

... In its simplest form, risk could be described as the volatility or fluctuation of a financial instrument over a period of time. The higher the volatility or fluctuation of a financial instrument, the higher the risks of capital loss for an investor. In its simplest form, the return of a financial in ...

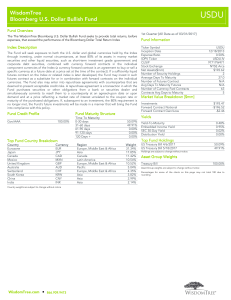

WisdomTree Bloomberg U.S. Dollar Bullish Fund

... The Fund will seek exposure to both the U.S. dollar and global currencies held by the Index through investing, under normal circumstances, at least 80% of its assets in money market securities and other liquid securities, such as short-term investment grade government and corporate debt securities, ...

... The Fund will seek exposure to both the U.S. dollar and global currencies held by the Index through investing, under normal circumstances, at least 80% of its assets in money market securities and other liquid securities, such as short-term investment grade government and corporate debt securities, ...

2003 Report as a word document

... For 2003: 87 For 2002: 118 So, summing debtors For 2003: 4,964 For 2002: 6,527 Included in other debtors are amounts falling due after more than one year. They include non-interest bearing equity loans to employees for housing assistance amounting to £0.1m (in 2002 £0.2m) and a loan of £0.2m (in 200 ...

... For 2003: 87 For 2002: 118 So, summing debtors For 2003: 4,964 For 2002: 6,527 Included in other debtors are amounts falling due after more than one year. They include non-interest bearing equity loans to employees for housing assistance amounting to £0.1m (in 2002 £0.2m) and a loan of £0.2m (in 200 ...

Bank Capital: Lessons from the Financial Crisis

... We find support for the hypothesis that better capitalized banks experienced a smaller decline in their equity value during the crisis. However, the effect is large and robust only for a subsample comprising the larger banks. For this group, we also find that stock returns during the crisis were mor ...

... We find support for the hypothesis that better capitalized banks experienced a smaller decline in their equity value during the crisis. However, the effect is large and robust only for a subsample comprising the larger banks. For this group, we also find that stock returns during the crisis were mor ...

Private Sector Financing and the role of Risk

... well as oil companies. Oil wealth helped mitigate the negative impact of the global financial crisis, with solid growth observed from 2008 to 2010. Real GDP growth was slow in 2011 (0.1%) and 2012 (2.2%), but these weak results were driven by repairs on the main oil pipeline, which limited total ...

... well as oil companies. Oil wealth helped mitigate the negative impact of the global financial crisis, with solid growth observed from 2008 to 2010. Real GDP growth was slow in 2011 (0.1%) and 2012 (2.2%), but these weak results were driven by repairs on the main oil pipeline, which limited total ...

Outside Liquidity, Rollover Risk, and Government Bonds

... public claims are free from such risk. Satisfying liquidity needs by selling government securities in exchange for outside liquidity (referred to as public outside liquidity) may thus enhance efficiency and stability. We derive our results from a banking model in the tradition of Diamond and Dybvig ...

... public claims are free from such risk. Satisfying liquidity needs by selling government securities in exchange for outside liquidity (referred to as public outside liquidity) may thus enhance efficiency and stability. We derive our results from a banking model in the tradition of Diamond and Dybvig ...

guide to absolute return investing

... over time, regardless of the prevailing market conditions. Even when markets are falling, an absolute return fund still has the potential to make money. Producing consistent positive returns is the key objective for ...

... over time, regardless of the prevailing market conditions. Even when markets are falling, an absolute return fund still has the potential to make money. Producing consistent positive returns is the key objective for ...

CI Money Market Fund - Mutual Fund Search

... Commissions, trailing commissions, management fees and expenses all may be associated with mutual fund investments. Please read the prospectus before investing. The indicated rates of return are the historical annual compounded total including changes in unit value and reinvestment of all distributi ...

... Commissions, trailing commissions, management fees and expenses all may be associated with mutual fund investments. Please read the prospectus before investing. The indicated rates of return are the historical annual compounded total including changes in unit value and reinvestment of all distributi ...

Vo l u m e 6 6 ... C o n t e n t s

... the Bank, including by reference to the devices we use to identify, monitor and control the risks associated with our two main functions – monetary policy and banking ...

... the Bank, including by reference to the devices we use to identify, monitor and control the risks associated with our two main functions – monetary policy and banking ...

IEF 213 - Portfolio Management

... Portfolio management is both an art and a science. It is a dynamic decision making process, one that is continuous and systematic but also requires a great deal of judgment. The objective of this class is to blend theory and practice to achieve a consistent portfolio management process. This dynamic ...

... Portfolio management is both an art and a science. It is a dynamic decision making process, one that is continuous and systematic but also requires a great deal of judgment. The objective of this class is to blend theory and practice to achieve a consistent portfolio management process. This dynamic ...

IMF Global Financial Stability Report (GFSR) April 2013

... The report benefited from comments and suggestions from staff in other IMF departments, as well as from Executive Directors following their discussion of the Global Financial Stability Report on April 1, 2013. However, the analysis and policy considerations are those of the contributing staff and sh ...

... The report benefited from comments and suggestions from staff in other IMF departments, as well as from Executive Directors following their discussion of the Global Financial Stability Report on April 1, 2013. However, the analysis and policy considerations are those of the contributing staff and sh ...

Another Look at Risks in Financial Group Structures

... large integrated financial services groups. There are many mechanisms for regulating risks in large complex financial institutions. They may be preventive or corrective. Some are market-based, either in design or in implementation; others are imposed directly by regulation. Some measures focus on re ...

... large integrated financial services groups. There are many mechanisms for regulating risks in large complex financial institutions. They may be preventive or corrective. Some are market-based, either in design or in implementation; others are imposed directly by regulation. Some measures focus on re ...

Distribution of the national debt: March 1971

... ment of assistance given under foreign central bank swap facilities, the sterling counterpart of which was held in U.K. Treasury bills. All such swap transactions were finally paid off by end-March 1971; overseas holdings of Treasury bills were more than halved, falling to just over £450 million. Ne ...

... ment of assistance given under foreign central bank swap facilities, the sterling counterpart of which was held in U.K. Treasury bills. All such swap transactions were finally paid off by end-March 1971; overseas holdings of Treasury bills were more than halved, falling to just over £450 million. Ne ...

Corporate Governance and Risk Management at Unprotected Banks

... we are able to examine the relationship between ownership and governance choices, as well as the impact of both on risk preferences at the bank. The richness of the data permits us to provide an integrated picture of the linkages among ownership, governance, and financial stability. For our ana ...

... we are able to examine the relationship between ownership and governance choices, as well as the impact of both on risk preferences at the bank. The richness of the data permits us to provide an integrated picture of the linkages among ownership, governance, and financial stability. For our ana ...

Have big banks gotten safer?

... Great Recession, major financial institutions in the United States and around the world are much safer and sounder today than they were prior to the financial crisis. This is a consequence of the landmark Dodd Frank legislation as well as major changes in regulatory policies. Among the changes made ...

... Great Recession, major financial institutions in the United States and around the world are much safer and sounder today than they were prior to the financial crisis. This is a consequence of the landmark Dodd Frank legislation as well as major changes in regulatory policies. Among the changes made ...

... bonds all serve this purpose. Lastly, the importance of improving the risk management culture of all economic agents has become more noticeable. In this respect, the steps to be taken for financial education are of great importance for the sound functioning of the system (Special Topic IV.7). The mo ...

The Real Effects of the Bank Lending Channel

... securitization at the firm aggregate level may be significantly lower due to “crowding out” of the credit at the firm level. Crowding out may occur for several reasons: First, some firms may not be credit constrained and, hence, may not want to increase their net borrowing. If a bank offers to incre ...

... securitization at the firm aggregate level may be significantly lower due to “crowding out” of the credit at the firm level. Crowding out may occur for several reasons: First, some firms may not be credit constrained and, hence, may not want to increase their net borrowing. If a bank offers to incre ...

The Re-emergence of Collective Investment Trust Funds | Manning

... assets remain invested in mutual funds as of 2013, based on the 2014 Cerulli Quantitative Update1. However, given the recent focus on retirement plan fees and full disclosure, and in light of technological advances, CITs may be gaining market share. Only available through certain qualified retiremen ...

... assets remain invested in mutual funds as of 2013, based on the 2014 Cerulli Quantitative Update1. However, given the recent focus on retirement plan fees and full disclosure, and in light of technological advances, CITs may be gaining market share. Only available through certain qualified retiremen ...

EDHEC and EuroPerformance release the Alpha League Table 2007 for the UK

... EDHEC is one of the leading French and European business schools. It ranked 7th in the Financial Times “Masters in Management” Rankings in 2006. With 35 professors, engineers and associate researchers, the EDHEC Risk and Asset Management Research Centre is the leading European research centre in ass ...

... EDHEC is one of the leading French and European business schools. It ranked 7th in the Financial Times “Masters in Management” Rankings in 2006. With 35 professors, engineers and associate researchers, the EDHEC Risk and Asset Management Research Centre is the leading European research centre in ass ...

EMH - Csulb.edu

... • Stock prices fully reflect all information from public and private sources • This implies that no group of investors should be able to consistently derive above-average riskadjusted rates of return • This assumes perfect markets in which all information is cost-free and available to everyone at th ...

... • Stock prices fully reflect all information from public and private sources • This implies that no group of investors should be able to consistently derive above-average riskadjusted rates of return • This assumes perfect markets in which all information is cost-free and available to everyone at th ...

Narrow Banking: An Overdue Reform That Could Solve the Too

... Consumer Protection of the Senate Committee on Banking, Housing and Urban Affairs. Portions of this article are adapted from two of my previous articles, which are cited in note 4.This article appears in two parts, with Part 2 scheduled for the April issue of the Banking & Financial Services Policy ...

... Consumer Protection of the Senate Committee on Banking, Housing and Urban Affairs. Portions of this article are adapted from two of my previous articles, which are cited in note 4.This article appears in two parts, with Part 2 scheduled for the April issue of the Banking & Financial Services Policy ...

HSI 12.31.16 - Stmt of Fin Condition

... As such, we have entered into a tax allocation agreement with HNAH and its subsidiary entities (the "HNAH Group") included in the consolidated return which governs the current amount of taxes to be paid or received by the various entities included in the consolidated return filings. Generally, such ...

... As such, we have entered into a tax allocation agreement with HNAH and its subsidiary entities (the "HNAH Group") included in the consolidated return which governs the current amount of taxes to be paid or received by the various entities included in the consolidated return filings. Generally, such ...