interest rates - EESC European Economic and Social Committee

... 2. The Bank shall not grant any reduction in interest rates. Where a reduction in the interest rate appears desirable in view of the nature of the investment to be financed, the Member State concerned or some other agency may grant aid towards the payment of interest to the extent that this is compa ...

... 2. The Bank shall not grant any reduction in interest rates. Where a reduction in the interest rate appears desirable in view of the nature of the investment to be financed, the Member State concerned or some other agency may grant aid towards the payment of interest to the extent that this is compa ...

Provincial Government Banks: A Case Study of

... character. The fact that national banks with branches nation-wide make up the payments system ensures rapid transfer of funds to and from regions in response to competitive pressures. If anyone of these banks attempted to pursue a non-competitive policy and granted one region terms on loans or inter ...

... character. The fact that national banks with branches nation-wide make up the payments system ensures rapid transfer of funds to and from regions in response to competitive pressures. If anyone of these banks attempted to pursue a non-competitive policy and granted one region terms on loans or inter ...

Economics of Money, Banking, and Financial Markets, 8e

... corporations pay attention to what is happening to their stock in the secondary market? Answer: The existence of the secondary market makes their stock more liquid and the price in the secondary market sets the price that the corporation would receive if they choose to sell more stock in the primar ...

... corporations pay attention to what is happening to their stock in the secondary market? Answer: The existence of the secondary market makes their stock more liquid and the price in the secondary market sets the price that the corporation would receive if they choose to sell more stock in the primar ...

Market Linked Securities

... • Add a layer of partial protection against losses at maturity • Gain or increase exposure to different asset classes You can find a discussion of risks and investment considerations below and in the preliminary pricing supplement and other related offering documents for any Market Linked Security ...

... • Add a layer of partial protection against losses at maturity • Gain or increase exposure to different asset classes You can find a discussion of risks and investment considerations below and in the preliminary pricing supplement and other related offering documents for any Market Linked Security ...

in Central, Eastern, and Southern European

... fundamentals all played a role. Interestingly, the results suggest that while macroeconomic factors were important, particularly in the early phases of the crisis, bank fundamentals gained relevance over time. In particular, depressed credit levels appear to be related to an important extent to dome ...

... fundamentals all played a role. Interestingly, the results suggest that while macroeconomic factors were important, particularly in the early phases of the crisis, bank fundamentals gained relevance over time. In particular, depressed credit levels appear to be related to an important extent to dome ...

BANK OF JAMAICA Quarterly Monetary Policy Report

... Real GDP is estimated to have increased in the March 2015 quarter within the range of 0.0 to 1.0 per cent, following two consecutive quarters of contraction. The estimated outturn for the review quarter mainly reflected increases in tourism activity, domestic agriculture and Transport, Storage & Com ...

... Real GDP is estimated to have increased in the March 2015 quarter within the range of 0.0 to 1.0 per cent, following two consecutive quarters of contraction. The estimated outturn for the review quarter mainly reflected increases in tourism activity, domestic agriculture and Transport, Storage & Com ...

Monetary Policy Statement Contents

... period, and so on. Moreover, it is recognised that even if the 2:1 ratio is reasonable on average, the correct ratio may well vary over the course of a business cycle. Concerns have been expressed that the use of the TWI measure of the exchange rate in the MCI may be misleading insofar as it does no ...

... period, and so on. Moreover, it is recognised that even if the 2:1 ratio is reasonable on average, the correct ratio may well vary over the course of a business cycle. Concerns have been expressed that the use of the TWI measure of the exchange rate in the MCI may be misleading insofar as it does no ...

Margin-Based Asset Pricing and Deviations from the Law of One Price

... been binding, interest-rate spreads were wide and the CIP deviation was substantial since agents did not have enough capital to eliminate it. As another application of the model, we show how the Fed’s lending facilities affect asset prices, providing new insights on the monetary transmission mechani ...

... been binding, interest-rate spreads were wide and the CIP deviation was substantial since agents did not have enough capital to eliminate it. As another application of the model, we show how the Fed’s lending facilities affect asset prices, providing new insights on the monetary transmission mechani ...

Why it pays to be diversified

... of portfolios returning less than the invested amount: 14.9% for the primary funds, and 11.3% for the simulated co-investment funds. In other words, the simulated co-investment funds exhibit less risk of not returning the full invested amount. Furthermore, the difference would be wider if fees were ...

... of portfolios returning less than the invested amount: 14.9% for the primary funds, and 11.3% for the simulated co-investment funds. In other words, the simulated co-investment funds exhibit less risk of not returning the full invested amount. Furthermore, the difference would be wider if fees were ...

Bachelor of Finance and Banking Thesis SOLVING BAD DEBTS AT

... topic of bad debts has already attracted many talks and discussions all over the world. For example, in Korea, the period from 1980 to the beginning of 1990s, even though the country gain many impressive economic achievements such as the annual average GDP growth rate of 9% and average investment le ...

... topic of bad debts has already attracted many talks and discussions all over the world. For example, in Korea, the period from 1980 to the beginning of 1990s, even though the country gain many impressive economic achievements such as the annual average GDP growth rate of 9% and average investment le ...

Meeting Financial Goals—Rate of Return

... items (e.g., poker chips or pieces of paper) in the bag in the following colors: one red, one white, two blue ...

... items (e.g., poker chips or pieces of paper) in the bag in the following colors: one red, one white, two blue ...

(Textbook) Behavior in Organizations, 8ed (A. B. Shani)

... • Liquidity – A liquid financial asset is readily marketable. • Moreover, its price tends to be stable over time and it is reversible. • Popular measures of liquidity include the bid-ask spread, trading volume, frequency of trades, and average trade size. ...

... • Liquidity – A liquid financial asset is readily marketable. • Moreover, its price tends to be stable over time and it is reversible. • Popular measures of liquidity include the bid-ask spread, trading volume, frequency of trades, and average trade size. ...

Bulletin Contents Volume 76 No. 3, September 2013

... CPI. This measure aims to capture changes in prices for a basket of goods and services that reflect the broad spending patterns of households. The CPI can be split into two broad groups: tradables (which account for around 44 percent of the CPI) and non-tradables (which account for around 56 percent ...

... CPI. This measure aims to capture changes in prices for a basket of goods and services that reflect the broad spending patterns of households. The CPI can be split into two broad groups: tradables (which account for around 44 percent of the CPI) and non-tradables (which account for around 56 percent ...

The Macroeconomic Effects of Large-Scale Asset Purchase Programs

... Introduction In response to the recent financial crisis, the major central banks around the world ...

... Introduction In response to the recent financial crisis, the major central banks around the world ...

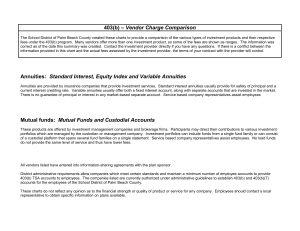

403(b) – Vendor Charge Comparison Annuities

... The School District of Palm Beach County created these charts to provide a comparison of the various types of investment products and their respective fees under the 403(b) program. Many vendors offer more than one investment product, so some of the fees are shown as ranges. The information was corr ...

... The School District of Palm Beach County created these charts to provide a comparison of the various types of investment products and their respective fees under the 403(b) program. Many vendors offer more than one investment product, so some of the fees are shown as ranges. The information was corr ...

Chapter 10

... This would require perfect markets in which all information is cost-free and available to everyone at the same time (which is clearly not the case) Implication: Not even “insiders” would be able to “beat the market” on a consistent basis ...

... This would require perfect markets in which all information is cost-free and available to everyone at the same time (which is clearly not the case) Implication: Not even “insiders” would be able to “beat the market” on a consistent basis ...

financial_markets_and_institutions(1)

... Asymmetric information and Financial Market Failure Moral Hazard in Financial Markets Financial Market Failure Credit Rationing in Financial Markets Adverse Selection: Screening with Market Power Mechanism Money Laundering in Financial Markets Approaches to Outside Finance and Capital ...

... Asymmetric information and Financial Market Failure Moral Hazard in Financial Markets Financial Market Failure Credit Rationing in Financial Markets Adverse Selection: Screening with Market Power Mechanism Money Laundering in Financial Markets Approaches to Outside Finance and Capital ...

Monetary Policy, Financial Conditions, and Financial Stability

... As discussed in detail in this paper, when financial intermediation is added to these models, interest rate changes can also affect loan supply through credit market frictions, such as asymmetric information between borrowers and lenders that gives rise to an external finance premium. The size of t ...

... As discussed in detail in this paper, when financial intermediation is added to these models, interest rate changes can also affect loan supply through credit market frictions, such as asymmetric information between borrowers and lenders that gives rise to an external finance premium. The size of t ...

The Social Rate of Return to Investing in Character: An Economic

... IAF’s operating model is to partner with other agencies that have either experience with micro loan programs, or strong ties to the immigrant population in their community. These agencies—referred to as Loan Delivery Partners—accept and screen applications, present applications to the IAF Loan Revie ...

... IAF’s operating model is to partner with other agencies that have either experience with micro loan programs, or strong ties to the immigrant population in their community. These agencies—referred to as Loan Delivery Partners—accept and screen applications, present applications to the IAF Loan Revie ...

2010 - About KLP

... that each individual fire has been significantly larger in scope than similar claims in previous years. This will also vary over time, but as stated, this time the impact was unusually substantial. Some will remember some of these fires for the ensuing difficult and fundamental discussions that aros ...

... that each individual fire has been significantly larger in scope than similar claims in previous years. This will also vary over time, but as stated, this time the impact was unusually substantial. Some will remember some of these fires for the ensuing difficult and fundamental discussions that aros ...

Mercer Low Volatility Equity Fund M3 GBP

... The investment objective of the Fund is to seek long-term growth of capital and income. The Fund will primarily invest in a diversified range of global shares and equity interests, either directly, or it can invest up to 100% of its assets in other funds ('Underlying Funds') which are consistent wit ...

... The investment objective of the Fund is to seek long-term growth of capital and income. The Fund will primarily invest in a diversified range of global shares and equity interests, either directly, or it can invest up to 100% of its assets in other funds ('Underlying Funds') which are consistent wit ...

Volume 71 No. 2, June 2008 Contents monetary policy

... Don Oliver documents the analysis behind the physical specification of New Zealand’s new 10 cent, 20 cent and 50 cent coins. The new coins had to be durable and a convenient size, and also work reliably in vending machines – meaning both that genuine coins would be accepted, and fake coins rejected. ...

... Don Oliver documents the analysis behind the physical specification of New Zealand’s new 10 cent, 20 cent and 50 cent coins. The new coins had to be durable and a convenient size, and also work reliably in vending machines – meaning both that genuine coins would be accepted, and fake coins rejected. ...

SOUTHWEST BANCORP INC (Form: 10-Q, Received

... and timing of future changes in interest rates, market behavior, and other economic conditions , future laws , regulations and accounting principles; changes in effective tax rates or the expiration of favorable tax provisions; changes in regulatory standards and examination policies; and a variety ...

... and timing of future changes in interest rates, market behavior, and other economic conditions , future laws , regulations and accounting principles; changes in effective tax rates or the expiration of favorable tax provisions; changes in regulatory standards and examination policies; and a variety ...

stock market extremes - Towneley Capital Management

... or worst days - radically changed the outcome. For the entire 42 years of daily data, the index had a geometric average annual return of 10.84% and a cumulative gain of $73.99 on $1.00 invested at the start of the period. Excluding the 10 best trading days, or one-tenth of one percent (0.1%) of the ...

... or worst days - radically changed the outcome. For the entire 42 years of daily data, the index had a geometric average annual return of 10.84% and a cumulative gain of $73.99 on $1.00 invested at the start of the period. Excluding the 10 best trading days, or one-tenth of one percent (0.1%) of the ...

Public real estate and the term structure of interest rates

... interest rate sensitivity of REITs at various points in time. Nonetheless, the two latter papers find that these shifts do not affect REIT's interest rate sensitivity in general and both document the economic significance of interest rates. It is however imperative that a distinction is made between ...

... interest rate sensitivity of REITs at various points in time. Nonetheless, the two latter papers find that these shifts do not affect REIT's interest rate sensitivity in general and both document the economic significance of interest rates. It is however imperative that a distinction is made between ...