it`s not about

... to lower oil and commodity prices; the slowdown in regional trading partners; instances of political instability; and water and electricity shortages, although Kenya (home to I&M Group, a 50% shareholder in Bank One) was one of the few economies to show resilience against these headwinds. In Mauriti ...

... to lower oil and commodity prices; the slowdown in regional trading partners; instances of political instability; and water and electricity shortages, although Kenya (home to I&M Group, a 50% shareholder in Bank One) was one of the few economies to show resilience against these headwinds. In Mauriti ...

Quarterly Bulletin - Winter 2002

... performance and prospects reflect a number of developments. First, with the initial impetus to recovery predicated on an upturn in the global economy, the rise in uncertainty with regard to the international economic outlook has had a dampening influence. Second, the fall in euro area stock markets, ...

... performance and prospects reflect a number of developments. First, with the initial impetus to recovery predicated on an upturn in the global economy, the rise in uncertainty with regard to the international economic outlook has had a dampening influence. Second, the fall in euro area stock markets, ...

International Capital Flows and U.S. Interest Rates Francis E. Warnock

... estimates in our regressions, but because the flows are smaller, the overall impact is more muted. For example, had foreign official flows been zero over the last twelve months, long rates would currently be 60 basis points higher.5 Our results are robust to many alternative specifications. In robu ...

... estimates in our regressions, but because the flows are smaller, the overall impact is more muted. For example, had foreign official flows been zero over the last twelve months, long rates would currently be 60 basis points higher.5 Our results are robust to many alternative specifications. In robu ...

sovereign debt, domestic banks and the provision of public liquidity

... relevant, the balance-sheet effect is more important as it accounts for 65% of the output cost of default while the remaining 35% is due to the liquidity effect. Additionally, the balancesheet effect explains most of the government commitment. Without the balance-sheet effect, the average levels of ...

... relevant, the balance-sheet effect is more important as it accounts for 65% of the output cost of default while the remaining 35% is due to the liquidity effect. Additionally, the balancesheet effect explains most of the government commitment. Without the balance-sheet effect, the average levels of ...

Credit Access and Social Welfare in France and America

... reduce non-payment rates, but it also eliminated the discipline of repayment for consumers. Further, because revolving accounts offered households a line of credit up to a predetermined credit ceiling, customers had access to liquidity without actually borrowing. Had consumers been using credit as i ...

... reduce non-payment rates, but it also eliminated the discipline of repayment for consumers. Further, because revolving accounts offered households a line of credit up to a predetermined credit ceiling, customers had access to liquidity without actually borrowing. Had consumers been using credit as i ...

My Life in Finance - The University of Chicago Booth School of

... regresses the ex post inflation rate on the ex ante interest rate. On hindsight, this is the obvious way to run the forecasting regression, but again it wasn’t obvious at the time. There is a potential measurement error problem in the regression of the ex post inflation rate on the ex ante (T-bill) ...

... regresses the ex post inflation rate on the ex ante interest rate. On hindsight, this is the obvious way to run the forecasting regression, but again it wasn’t obvious at the time. There is a potential measurement error problem in the regression of the ex post inflation rate on the ex ante (T-bill) ...

chapter 1 overview of the research thesis

... Commercial bank is currency trading organization that operates primarily and regularly ...

... Commercial bank is currency trading organization that operates primarily and regularly ...

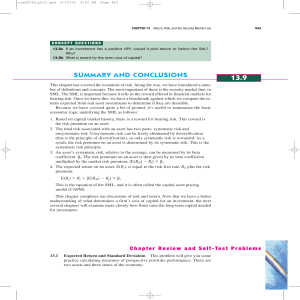

SUMMARY AND CONCLUSIONS

... a. If your portfolio is invested 40 percent each in A and B and 20 percent in C, what is the portfolio expected return? The variance? The standard deviation? b. If the expected T-bill rate is 3.80 percent, what is the expected risk premium on the portfolio? c. If the expected inflation rate is 3.50 ...

... a. If your portfolio is invested 40 percent each in A and B and 20 percent in C, what is the portfolio expected return? The variance? The standard deviation? b. If the expected T-bill rate is 3.80 percent, what is the expected risk premium on the portfolio? c. If the expected inflation rate is 3.50 ...

Credit Risk Transfer

... arrangements like L Street Securities (LSS). These and other types of arrangements provide Fannie Mae with multiple options to meet its objectives and help bring capital from diverse sources into the private markets. Program-to-date, 80-90% of the UPB transferred has been completed through Fannie Ma ...

... arrangements like L Street Securities (LSS). These and other types of arrangements provide Fannie Mae with multiple options to meet its objectives and help bring capital from diverse sources into the private markets. Program-to-date, 80-90% of the UPB transferred has been completed through Fannie Ma ...

German Financial System

... 11.3. Sources and uses of profits of non-financial corporations ................................................ 193 11.4. Real investment finance of non-financial corporations..................................................... 195 11.5. Real investment finance of small and medium-sized enterpris ...

... 11.3. Sources and uses of profits of non-financial corporations ................................................ 193 11.4. Real investment finance of non-financial corporations..................................................... 195 11.5. Real investment finance of small and medium-sized enterpris ...

The Norwegian Banking Crisis

... of measures and policy choices will always be complicated, given the political constraints and the information available when the policy decisions have to be made. In light of the experiences from the previous Norwegian banking crises – and the fact that many other countries have experienced similar ...

... of measures and policy choices will always be complicated, given the political constraints and the information available when the policy decisions have to be made. In light of the experiences from the previous Norwegian banking crises – and the fact that many other countries have experienced similar ...

- Columbia Business School

... of sophisticated mutual fund investors in the market. Mutual fund flows, on average, have been considered to proxy for investor sentiments. Teo and Woo (2004) and Frazzini and Lamont (2008) show the “dumb money” effect where investors’ reallocation of wealth across different mutual funds reduce the ...

... of sophisticated mutual fund investors in the market. Mutual fund flows, on average, have been considered to proxy for investor sentiments. Teo and Woo (2004) and Frazzini and Lamont (2008) show the “dumb money” effect where investors’ reallocation of wealth across different mutual funds reduce the ...

The Causes of Fraud in Financial Crises: Evidence

... securities issuers and underwriters have been implicated in regulatory settlements, and many have paid multibillion-dollar penalties. This paper seeks to explain why this behavior became so pervasive. We evaluate predominant theories of white-collar crime, finding that those emphasizing deregulation ...

... securities issuers and underwriters have been implicated in regulatory settlements, and many have paid multibillion-dollar penalties. This paper seeks to explain why this behavior became so pervasive. We evaluate predominant theories of white-collar crime, finding that those emphasizing deregulation ...

Private Equity Institutional Investor Trends for

... full-year total up to 2014’s level. The trends that underlie the top line numbers in Chart I: Funds targeting North America make up more than 50% of all fundraising. Mega buyout funds in the United States and Europe are raising large funds that are boosting overall commitments — but most of ...

... full-year total up to 2014’s level. The trends that underlie the top line numbers in Chart I: Funds targeting North America make up more than 50% of all fundraising. Mega buyout funds in the United States and Europe are raising large funds that are boosting overall commitments — but most of ...

Liquidity Squeeze, Abundant Funding and Macroeconomic Volatility

... accounted for around 10% of US banks total assets in the late 1990s dropped down to around 5% in 2007, at the onset of the financial crisis.1 , 2 This undoubtedly made US banks more vulnerable to financial distress, given that holding liquidity buffers is key for funding during adverse conditions.3 Y ...

... accounted for around 10% of US banks total assets in the late 1990s dropped down to around 5% in 2007, at the onset of the financial crisis.1 , 2 This undoubtedly made US banks more vulnerable to financial distress, given that holding liquidity buffers is key for funding during adverse conditions.3 Y ...

Babson Capital Management presentation

... Source: Barclays Capital as of March 6, 2013. PAST PERFORMANCE IS NOT INDICATIVE OF FUTURE RESULTS. It is not possible to invest directly in an index. ...

... Source: Barclays Capital as of March 6, 2013. PAST PERFORMANCE IS NOT INDICATIVE OF FUTURE RESULTS. It is not possible to invest directly in an index. ...

Systemic Risk and Hedge Funds

... forced liquidation of large positions over short periods of time can lead to widespread financial panic, as in the aftermath of the default of Russian government debt in August 1998. The more illiquid the portfolio, the larger the price impact of a forced liquidation, which erodes the fund’s risk ca ...

... forced liquidation of large positions over short periods of time can lead to widespread financial panic, as in the aftermath of the default of Russian government debt in August 1998. The more illiquid the portfolio, the larger the price impact of a forced liquidation, which erodes the fund’s risk ca ...

AMENDMENT NO. 1 DATED JULY 21, 2016 TO

... survive the hard times and are likely to lead the rebound of their industries when supply/demand conditions improve. The Bankable Deal strategy takes an in-depth look at the current assets and cash flow of a company to reveal value that is not reflected in the stock’s price. ...

... survive the hard times and are likely to lead the rebound of their industries when supply/demand conditions improve. The Bankable Deal strategy takes an in-depth look at the current assets and cash flow of a company to reveal value that is not reflected in the stock’s price. ...

& PURPOSES FUNCTIONS The Federal Reserve System

... tem: depository institutions, through which monetary policy operates, and advisory committees, which make recommendations to the Board of Governors and to the Reserve Banks regarding the System’s responsibilities. Board of Governors The Board of Governors of the Federal Reserve System is a federal g ...

... tem: depository institutions, through which monetary policy operates, and advisory committees, which make recommendations to the Board of Governors and to the Reserve Banks regarding the System’s responsibilities. Board of Governors The Board of Governors of the Federal Reserve System is a federal g ...

The incentive structure of the originate-to

... making loans. On the liabilities side of the balance sheet, depositors save money with banks and withdraw money when required. Meanwhile, banks make loans to borrowers, who promise to repay based on debt contracts, and banks hold these loans on the assets side of their balance sheets. It has been co ...

... making loans. On the liabilities side of the balance sheet, depositors save money with banks and withdraw money when required. Meanwhile, banks make loans to borrowers, who promise to repay based on debt contracts, and banks hold these loans on the assets side of their balance sheets. It has been co ...

R e s e r v e B... Vo l u m e 6 5 ... C o n t e n t s

... have more strings to their bow than monetary policy. This is certainly true for the Reserve Bank of New Zealand. In addition to having responsibility for monetary policy, we also have major responsibilities in a range of other areas, including oversight of the financial system, registration and supe ...

... have more strings to their bow than monetary policy. This is certainly true for the Reserve Bank of New Zealand. In addition to having responsibility for monetary policy, we also have major responsibilities in a range of other areas, including oversight of the financial system, registration and supe ...

CAPITAL MARKETS PRODUCT RISK BOOK

... An option contract giving the owner the right (but not the obligation) to sell a specified amount of an underlying at a specified price during/at a predetermined period or moment. To obtain this right, the buyer needs to pay a premium to the seller. ...

... An option contract giving the owner the right (but not the obligation) to sell a specified amount of an underlying at a specified price during/at a predetermined period or moment. To obtain this right, the buyer needs to pay a premium to the seller. ...

Order Exposure and Liquidity Coordination

... (i.e., overbidding). Our key results are therefore driven by the interaction of both mechanisms, liquidity competition in the primary exchange and order flow attraction from latent investors. A central finding of our study is that due to mis-coordination (large) hidden orders can significantly harm ...

... (i.e., overbidding). Our key results are therefore driven by the interaction of both mechanisms, liquidity competition in the primary exchange and order flow attraction from latent investors. A central finding of our study is that due to mis-coordination (large) hidden orders can significantly harm ...

Capital and profitability in banking

... specification that attempts to address this problem and provide a more robust test of the “expected bankruptcy costs” hypothesis. We estimate long run target capital ratios for US banks, using a dynamic panel specification, and include these in an extended version of Berger (1995) in order to separa ...

... specification that attempts to address this problem and provide a more robust test of the “expected bankruptcy costs” hypothesis. We estimate long run target capital ratios for US banks, using a dynamic panel specification, and include these in an extended version of Berger (1995) in order to separa ...