The ECB`s securities markets programme

... studies and training specialised in European affairs. Its origins date back to the 1948 Hague Congress. Founded in Bruges (Belgium) in 1949 by leading European figures such as Salvador de Madariaga, Winston Churchill, Paul-Henri Spaak and Alcide de Gasperi, the idea was to establish an institute whe ...

... studies and training specialised in European affairs. Its origins date back to the 1948 Hague Congress. Founded in Bruges (Belgium) in 1949 by leading European figures such as Salvador de Madariaga, Winston Churchill, Paul-Henri Spaak and Alcide de Gasperi, the idea was to establish an institute whe ...

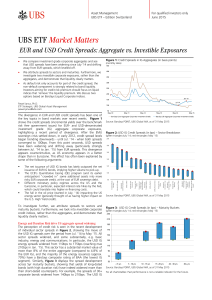

Market Matters EUR and USD Credit Spreads

... performance is not a reliable indicator of future results. The performance shown does not take account of any commissions and costs charged when subscribing to and redeeming units. Commissions and costs have a negative impact on performance. If the currency of a financial product or financial servic ...

... performance is not a reliable indicator of future results. The performance shown does not take account of any commissions and costs charged when subscribing to and redeeming units. Commissions and costs have a negative impact on performance. If the currency of a financial product or financial servic ...

the guide to understanding deflation

... with that buyer’s, then the value of the asset falls, and it falls for everyone who owns it. If a million other people own it, then their net worth goes down even though they did nothing. Two investors made it happen by transacting, and the rest of the investors made it happen by choosing not to dis ...

... with that buyer’s, then the value of the asset falls, and it falls for everyone who owns it. If a million other people own it, then their net worth goes down even though they did nothing. Two investors made it happen by transacting, and the rest of the investors made it happen by choosing not to dis ...

SEASONALITY IN STOCK MARKET LIQUIDITY AND ITS

... We believe that the presence of a broad investors’ base in more financially integrated countries should reduce the impact of a country specific factors such as the distance from the Equator, local vacation periods and religious holidays on the degree of liquidity in that financial market. The ration ...

... We believe that the presence of a broad investors’ base in more financially integrated countries should reduce the impact of a country specific factors such as the distance from the Equator, local vacation periods and religious holidays on the degree of liquidity in that financial market. The ration ...

- PuneICAI

... These advances need not be treated as NPA provided adequate margin is available. Advances against Gold loans, government securities are not covered in this criteria. (4.2.11) Central Government guaranteed advance to be classified as NPA only if Government repudiates the guarantee when invoked. ...

... These advances need not be treated as NPA provided adequate margin is available. Advances against Gold loans, government securities are not covered in this criteria. (4.2.11) Central Government guaranteed advance to be classified as NPA only if Government repudiates the guarantee when invoked. ...

The Importance of Emerging Capital Markets

... innovations (such as global offerings and changes to the financial infrastructure) helped to fuel the process. As dramatic as these changes have been, emerging financial markets still reflect a continuum of market conditions. Some markets are maturing and on course toward converging and integrating ...

... innovations (such as global offerings and changes to the financial infrastructure) helped to fuel the process. As dramatic as these changes have been, emerging financial markets still reflect a continuum of market conditions. Some markets are maturing and on course toward converging and integrating ...

Emergency Economic Stabilization Act of 2008

... Case Study: Sell 1.00% yielding investments or borrow at 0.60% Page 3 ...

... Case Study: Sell 1.00% yielding investments or borrow at 0.60% Page 3 ...

"Al. I. CUZA" UNIVERSITY of IAŞI DOCTORAL SCHOOL

... terms of a manageable level of credit risk can be achieved only by maintaining orderly credit conditions. To develop this idea should be encouraged orderly financing and long-term funding relationships and creditors must deal with more trust companies with financial difficulties, imposing bank credi ...

... terms of a manageable level of credit risk can be achieved only by maintaining orderly credit conditions. To develop this idea should be encouraged orderly financing and long-term funding relationships and creditors must deal with more trust companies with financial difficulties, imposing bank credi ...

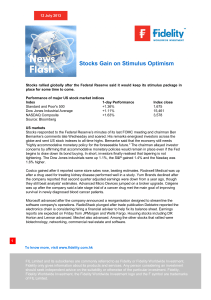

Stocks Gain on Stimulus Optimism

... concerns over tapering of Fed stimulus by reiterating his stance to maintain monetary policy. The FTSE was up 0.6%, the CAC gained 0.7%, the DAX advanced 1.4% and the SMI was 0.2% higher. European Central Bank Governing Council member and Germany’s Bundesbank’s President, Jens Weidmann said Thursday ...

... concerns over tapering of Fed stimulus by reiterating his stance to maintain monetary policy. The FTSE was up 0.6%, the CAC gained 0.7%, the DAX advanced 1.4% and the SMI was 0.2% higher. European Central Bank Governing Council member and Germany’s Bundesbank’s President, Jens Weidmann said Thursday ...

chinese bank`s credit risk assessment - STORRE

... In Chapter 2, the analysis begins with a discussion of money’s nature, banks’ role and the consequence of credit to the economy in both the mainstream and Post Keynesian approach, through which the universality of uncertainty is justified. Considering the importance of history in the banking sector, ...

... In Chapter 2, the analysis begins with a discussion of money’s nature, banks’ role and the consequence of credit to the economy in both the mainstream and Post Keynesian approach, through which the universality of uncertainty is justified. Considering the importance of history in the banking sector, ...

Trustee Corporations Association of Australia

... Problems can, of course, also arise with funds operated by Approved Trustees – the failure of Commercial Nominees of Australia Ltd (CNA) is clear testimony to this. In that case, investors in the 475 or so Small APRA Funds (SAFs) managed by CNA suffered significant losses, essentially as a result of ...

... Problems can, of course, also arise with funds operated by Approved Trustees – the failure of Commercial Nominees of Australia Ltd (CNA) is clear testimony to this. In that case, investors in the 475 or so Small APRA Funds (SAFs) managed by CNA suffered significant losses, essentially as a result of ...

2017 10K - The York Water Company

... authorities. Despite the Company’s adequate water supply, customers may be required to cut back water usage under such drought restrictions which would negatively impact revenues. The Company has addressed some of this vulnerability by instituting minimum customer charges which are intended to cover ...

... authorities. Despite the Company’s adequate water supply, customers may be required to cut back water usage under such drought restrictions which would negatively impact revenues. The Company has addressed some of this vulnerability by instituting minimum customer charges which are intended to cover ...

Capital requirements for MiFID investment firms

... Capital requirements for MiFID investment firms – all change? In a December 2015 report the European Banking Authority (EBA) recommends significant changes to the EU's regulatory capital rules for MiFID investment firms. The proposed changes are relevant to asset managers and a wide range of other n ...

... Capital requirements for MiFID investment firms – all change? In a December 2015 report the European Banking Authority (EBA) recommends significant changes to the EU's regulatory capital rules for MiFID investment firms. The proposed changes are relevant to asset managers and a wide range of other n ...

Treasury Bill Yields: Overlooked Information

... Ingersoll, and Ross (1985) term structure model, also conclude that “estimates based on only bills imply unreasonably large price errors for longer maturities.” However, there has been no precedent that compares Treasury bonds with Treasury bills in terms of the informativeness of risk premium. Many ...

... Ingersoll, and Ross (1985) term structure model, also conclude that “estimates based on only bills imply unreasonably large price errors for longer maturities.” However, there has been no precedent that compares Treasury bonds with Treasury bills in terms of the informativeness of risk premium. Many ...

Banking structures report, October 2014

... Sources: ECB Structural Financial Indicators and ECB calculations. Note: Branches refer to the local units of credit institutions. ...

... Sources: ECB Structural Financial Indicators and ECB calculations. Note: Branches refer to the local units of credit institutions. ...

Three essays on risk management and financial stability

... The global financial turmoil has shaped financial markets and brought many issues into the light. Three of them are covered in this thesis – financial stability, operational risk and lessons from failed risk management practices during the crisis. The first essay The JT Index as An Indicator of Fina ...

... The global financial turmoil has shaped financial markets and brought many issues into the light. Three of them are covered in this thesis – financial stability, operational risk and lessons from failed risk management practices during the crisis. The first essay The JT Index as An Indicator of Fina ...

Sparinvest White paper - Risk Containment in Emerging Markets

... markets is misguided. The courier cycling around in Kuala Lumpur, Malaysia with a briefcase full of financial securities is a thing of the past. The major risk today would seem to be changes in regulations whereby interpretation or enforcement of rules effectively gives the same result as an increas ...

... markets is misguided. The courier cycling around in Kuala Lumpur, Malaysia with a briefcase full of financial securities is a thing of the past. The major risk today would seem to be changes in regulations whereby interpretation or enforcement of rules effectively gives the same result as an increas ...

DP2011/Draft The macroeconomic effects of a stable funding requirement

... volumes more steeply in less-liquid long-term funding markets than in shortterm funding markets and because rising long-term funding costs are passed through to retail deposit interest rates when deposits are explicit substitutes for long-term funding. The stable funding requirement, however, amplif ...

... volumes more steeply in less-liquid long-term funding markets than in shortterm funding markets and because rising long-term funding costs are passed through to retail deposit interest rates when deposits are explicit substitutes for long-term funding. The stable funding requirement, however, amplif ...

Small and Medium Enterprises Policy Research Working Paper 5538

... to customer needs as a means of competing with large-scale mass producers (see, for example, Hallberg, 2000, and Snodgrass and Biggs, 1996). ...

... to customer needs as a means of competing with large-scale mass producers (see, for example, Hallberg, 2000, and Snodgrass and Biggs, 1996). ...

GCD Discount Rate - Global Credit Data

... collateral), net present value calculations need only reflect the time value of money, and a risk free discount rate is appropriate.” Variations of these regulations and guidance notes are included in national guidance notes from prudential regulators. Examples are Australia (Austral ...

... collateral), net present value calculations need only reflect the time value of money, and a risk free discount rate is appropriate.” Variations of these regulations and guidance notes are included in national guidance notes from prudential regulators. Examples are Australia (Austral ...

Volume 67 No. 2, June 2004 Contents

... the target used to direct the Reserve Bank’s pursuit of price stability is expressed as “future CPI inflation outcomes between 1 per cent and 3 per cent on average over the medium term.” While the Reserve Bank has the independence to choose when and how to adjust policy settings so as to achieve the ...

... the target used to direct the Reserve Bank’s pursuit of price stability is expressed as “future CPI inflation outcomes between 1 per cent and 3 per cent on average over the medium term.” While the Reserve Bank has the independence to choose when and how to adjust policy settings so as to achieve the ...

The Long-Run Discount Rate Controversy

... consider a firm with a safe project. Competition in the capital market implies that the firm will offer its lenders a return on their capital that is not different from the risk-free market interest rate. To generate a profit, the return to the project must exceed this rate. Thus, firms should use t ...

... consider a firm with a safe project. Competition in the capital market implies that the firm will offer its lenders a return on their capital that is not different from the risk-free market interest rate. To generate a profit, the return to the project must exceed this rate. Thus, firms should use t ...

Staff Working Paper No. 594: Non-performing

... incurred loss model. This meant that impairment was only recognised when a loss event occurred. Such a model is by design reactive and backward-looking. Indeed some critics have argued that it fuelled pro-cyclical lending and asset price bubbles ahead of the GFC because it meant loans were under-pro ...

... incurred loss model. This meant that impairment was only recognised when a loss event occurred. Such a model is by design reactive and backward-looking. Indeed some critics have argued that it fuelled pro-cyclical lending and asset price bubbles ahead of the GFC because it meant loans were under-pro ...

Macroeconomics – Austrians vs. Keynesians

... college will read lofty books on economic thought? My hope is that students will gain an interest in economics and the world around them. If some students become active participants in our political and economic system, the book will have accomplished its purpose. Student engagement should be the ul ...

... college will read lofty books on economic thought? My hope is that students will gain an interest in economics and the world around them. If some students become active participants in our political and economic system, the book will have accomplished its purpose. Student engagement should be the ul ...

Quantifying Liquidity and Default Risks of Corporate Bonds over the

... of corporate bonds: (1) corporate bonds with higher credit ratings tend to be more liquid; (2) corporate bonds are less liquid during economic downturns, especially for riskier bonds.2 The interactions can also significantly raise the level of credit spreads and make them more volatile over the busi ...

... of corporate bonds: (1) corporate bonds with higher credit ratings tend to be more liquid; (2) corporate bonds are less liquid during economic downturns, especially for riskier bonds.2 The interactions can also significantly raise the level of credit spreads and make them more volatile over the busi ...