How to Discount Cashflows with Time

... and Stambaugh (1986)), and consumption–asset–labor deviations (Lettau and Ludvigson (2001)), have forecasting power for market excess returns. Second, the CAPM assumes that the riskless rate is the appropriate oneperiod, or instantaneous, riskless rate, which in practice is typically proxied by a 1- ...

... and Stambaugh (1986)), and consumption–asset–labor deviations (Lettau and Ludvigson (2001)), have forecasting power for market excess returns. Second, the CAPM assumes that the riskless rate is the appropriate oneperiod, or instantaneous, riskless rate, which in practice is typically proxied by a 1- ...

ETF Trading and Execution in the European MarketsPDF

... additional liquidity beyond what might be shown in the secondary market. For example, if a pension fund is interested in acquiring €50 million of ETF XYZ, they may consider working with an AP to facilitate a creation. Arbitrage: APs can create or redeem ETF shares in order to take advantage of arbit ...

... additional liquidity beyond what might be shown in the secondary market. For example, if a pension fund is interested in acquiring €50 million of ETF XYZ, they may consider working with an AP to facilitate a creation. Arbitrage: APs can create or redeem ETF shares in order to take advantage of arbit ...

Chapter 5. Classifications

... The objectives of classification of financial instruments will be spelled out. The potential dimensions by which instruments can be classified are numerous, so the classification involves identifying the most economically crucial features. The implications of a high degree of financial innovation wi ...

... The objectives of classification of financial instruments will be spelled out. The potential dimensions by which instruments can be classified are numerous, so the classification involves identifying the most economically crucial features. The implications of a high degree of financial innovation wi ...

Improving international access to credit markets report

... Credit markets enable the free exchange of a ...

... Credit markets enable the free exchange of a ...

Armour Residential REIT, Inc.

... reporting period. Actual results could differ from those estimates. Significant estimates affecting the accompanying financial statements include the valuation of Agency Securities and interest rate contracts. Cash Cash includes cash on deposit with financial institutions and investments in high qua ...

... reporting period. Actual results could differ from those estimates. Significant estimates affecting the accompanying financial statements include the valuation of Agency Securities and interest rate contracts. Cash Cash includes cash on deposit with financial institutions and investments in high qua ...

Liquidity Patterns in the U.S. Corporate Bond Market

... market crisis. Illiquidity is found to have pricing implications, to the extent that it is an important factor in explaining the time variation in bond indices and the cross-section of individual yield spreads. Dick-Nielsen et al. (2012) use a principal component analysis of eight liquidity measures ...

... market crisis. Illiquidity is found to have pricing implications, to the extent that it is an important factor in explaining the time variation in bond indices and the cross-section of individual yield spreads. Dick-Nielsen et al. (2012) use a principal component analysis of eight liquidity measures ...

"The Alpha and Omega of Hedge Fund Performance Measurement"

... merely serves the purpose of benchmarking the results of further, more advanced, performance measures. We also test a pragmatic version of the market model, where an equally-weighted portfolio of all assets is used as the single index. ...

... merely serves the purpose of benchmarking the results of further, more advanced, performance measures. We also test a pragmatic version of the market model, where an equally-weighted portfolio of all assets is used as the single index. ...

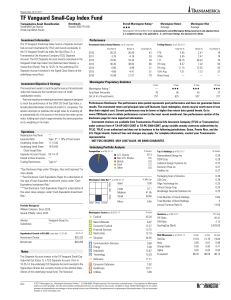

TF Vanguard Small-Cap Index Fund

... and/or its content providers; (2) may not be copied or distributed and (3) is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of information. Past performance is no guarantee of future perf ...

... and/or its content providers; (2) may not be copied or distributed and (3) is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of information. Past performance is no guarantee of future perf ...

Challenges of Financing Infrastructure

... and cash. Infrastructure is generally described as an alternative investment, a grouping of growth investments that also includes hedge funds. There is currently a debate in the superannuation industry around the definition of risk. There is broad recognition that there is a limitation to describing ...

... and cash. Infrastructure is generally described as an alternative investment, a grouping of growth investments that also includes hedge funds. There is currently a debate in the superannuation industry around the definition of risk. There is broad recognition that there is a limitation to describing ...

THE NATIONAL DEBT AND ECONOMIC POLICY IN THE MEDIUM

... However, tile combination of risk aversion on the part of investors with uncertainty concerning tile future movement of exchange rates alters this situation. In a situation of uncertainty concerning the future, the "expectation" concerning tile movement of exchange rates is only the mid point of a ...

... However, tile combination of risk aversion on the part of investors with uncertainty concerning tile future movement of exchange rates alters this situation. In a situation of uncertainty concerning the future, the "expectation" concerning tile movement of exchange rates is only the mid point of a ...

Chap7 - John Zietlow

... • Growth in fixed-income mutual funds increase need for reliable benchmarks for evaluating performance • Increasing interest in bond index funds, which require an index to emulate – Many managers have not matched aggregate bond market return, so think about passive rather than actively-managed bond ...

... • Growth in fixed-income mutual funds increase need for reliable benchmarks for evaluating performance • Increasing interest in bond index funds, which require an index to emulate – Many managers have not matched aggregate bond market return, so think about passive rather than actively-managed bond ...

Local Markets Compendium 2014

... savings pools will become more important sources of demand. Shifting these savings pools from potential to actual sources of demand requires an assessment of two factors: the ability and willingness to provide that demand. In contrast with developed markets, we find that aggregate allocations to fix ...

... savings pools will become more important sources of demand. Shifting these savings pools from potential to actual sources of demand requires an assessment of two factors: the ability and willingness to provide that demand. In contrast with developed markets, we find that aggregate allocations to fix ...

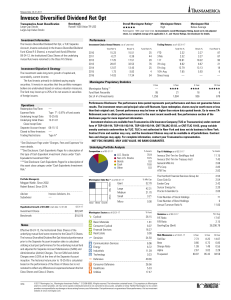

Invesco Diversified Dividend Ret Opt

... and/or its content providers; (2) may not be copied or distributed and (3) is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of information. Past performance is no guarantee of future perf ...

... and/or its content providers; (2) may not be copied or distributed and (3) is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of information. Past performance is no guarantee of future perf ...

essays on market frictions in the real estate market

... liquidity to the market at the most necessary time. Thus, segmentation and liquidity are closely related. However, a number of subtle differences should be accounted for: Segmentation prevents investors from sharing investment risks across different asset ...

... liquidity to the market at the most necessary time. Thus, segmentation and liquidity are closely related. However, a number of subtle differences should be accounted for: Segmentation prevents investors from sharing investment risks across different asset ...

INVESTORLIT Research Private Equity vs. Public Equity

... Here, I summarize six studies supporting that assertion. These studies, listed below in chronological order of publication, generally use a common methodology which: • excludes or minimizes investments carried at cost (residual values), and • calculates the equivalent return if invested in public ma ...

... Here, I summarize six studies supporting that assertion. These studies, listed below in chronological order of publication, generally use a common methodology which: • excludes or minimizes investments carried at cost (residual values), and • calculates the equivalent return if invested in public ma ...

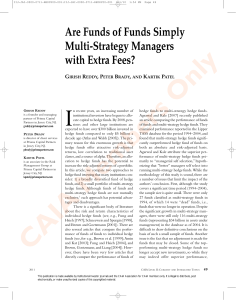

Are Funds of Funds Simply Multi-Strategy

... methodology of this study is sound, there are a number of issues that limit the impact of the authors’ conclusion. First, although the study covers a significant time period (1994–2004), the sample size is quite small. There were only 27 funds classified as multi-strategy funds in 1994, of which 14 ...

... methodology of this study is sound, there are a number of issues that limit the impact of the authors’ conclusion. First, although the study covers a significant time period (1994–2004), the sample size is quite small. There were only 27 funds classified as multi-strategy funds in 1994, of which 14 ...

Liquidity transformation in asset management

... impact, bank loans cannot be traded before maturity without creating substantial price impact. For asset managers, however, there is no comparable measure. Their assets are typically tradeable securities, though with varying levels of liquidity. Furthermore, some price impact can be passed on to inv ...

... impact, bank loans cannot be traded before maturity without creating substantial price impact. For asset managers, however, there is no comparable measure. Their assets are typically tradeable securities, though with varying levels of liquidity. Furthermore, some price impact can be passed on to inv ...

Annual Equity-Based Insurance Guarantees Conference

... Milliman’s financial risk management business is the leading provider of hedging services to the retirement savings industry. Milliman’s work helps the clients of life insurance companies, banks, financial advisory platforms and mutual fund firms create strategies for success in retirement. In parti ...

... Milliman’s financial risk management business is the leading provider of hedging services to the retirement savings industry. Milliman’s work helps the clients of life insurance companies, banks, financial advisory platforms and mutual fund firms create strategies for success in retirement. In parti ...

Chapter 7: Quantitative vs. Credit Easing

... its aim was to increase the supply of reserves (or, equivalently, the monetary base), rather than to acquire any particular type of assets, the assets purchased consisted primarily in Japanese government securities and bills issued by commercial banks. In accordance with the model’s predictions, thi ...

... its aim was to increase the supply of reserves (or, equivalently, the monetary base), rather than to acquire any particular type of assets, the assets purchased consisted primarily in Japanese government securities and bills issued by commercial banks. In accordance with the model’s predictions, thi ...

Pre-Sale Fitch - The Paragon Group of Companies

... Fitch has considered several strengths and concerns in its lender adjustment (see also Appendix A - Origination, Underwriting and Servicing). Among others, the main concern is that due to the manual process used to underwrite the mortgages if the number of applications were to rise sharply then the ...

... Fitch has considered several strengths and concerns in its lender adjustment (see also Appendix A - Origination, Underwriting and Servicing). Among others, the main concern is that due to the manual process used to underwrite the mortgages if the number of applications were to rise sharply then the ...

Capital-Market Effects of Securities Regulation: Prior Conditions

... staggered introduction of the directives. At the same time, improvements in liquidity owing to reduced adverse selection should also manifest in a lower cost of capital, higher market valuations, and improved market efficiency (e.g., Amihud, Mendelson, and Pedersen 2005). Thus, liquidity effects hav ...

... staggered introduction of the directives. At the same time, improvements in liquidity owing to reduced adverse selection should also manifest in a lower cost of capital, higher market valuations, and improved market efficiency (e.g., Amihud, Mendelson, and Pedersen 2005). Thus, liquidity effects hav ...

Dreyfus Variable Investment Fund: Quality Bond Portfolio

... value of the fund's investments in these securities to decline. During periods of very low interest rates, which occur from time to time due to market forces or actions of governments and/or their central banks, including the Board of Governors of the Federal Reserve System in the U.S., the fund may ...

... value of the fund's investments in these securities to decline. During periods of very low interest rates, which occur from time to time due to market forces or actions of governments and/or their central banks, including the Board of Governors of the Federal Reserve System in the U.S., the fund may ...

strukture for the decree on minimum capital requirements for market

... (b) "stock financing" means positions where physical stock has been sold forward and the cost of funding has been locked in until the date of the forward sale; (c) "clearing member" means a member of the exchange or the clearing house which has a direct contractual relationship with the central coun ...

... (b) "stock financing" means positions where physical stock has been sold forward and the cost of funding has been locked in until the date of the forward sale; (c) "clearing member" means a member of the exchange or the clearing house which has a direct contractual relationship with the central coun ...

1. How Capital Markets Work

... 1.1.1. Why People Save ➤ Why do people save? ■ Making savings means ◆ “consumption today” is postponed in favor of ◆ “consumption in the future” ■ Why are people willing to give up “consumption today” in favor of “consumption in the future”? ■ Because they receive interest payments for their savings ...

... 1.1.1. Why People Save ➤ Why do people save? ■ Making savings means ◆ “consumption today” is postponed in favor of ◆ “consumption in the future” ■ Why are people willing to give up “consumption today” in favor of “consumption in the future”? ■ Because they receive interest payments for their savings ...

A Model of Liquidity Provision with Adverse Selection

... and markets with asymmetric information problems were most affected. I develop a model of liquidity provision that incorporates this features and demonstrates how a detrimental interaction between an asymmetric information friction in asset markets and a shortage of aggregate liquidity or a solvency ...

... and markets with asymmetric information problems were most affected. I develop a model of liquidity provision that incorporates this features and demonstrates how a detrimental interaction between an asymmetric information friction in asset markets and a shortage of aggregate liquidity or a solvency ...