Implicit Subsidies for Very Large Banks: A Primer

... • Litigation risks and other idiosyncratic factors. In the wake of the financial crisis, the largest banks have faced very large litigation risks, as well as multibillion dollar penalties. Smaller banks are generally much less exposed and therefore would be expected to borrow more cheaply, all else ...

... • Litigation risks and other idiosyncratic factors. In the wake of the financial crisis, the largest banks have faced very large litigation risks, as well as multibillion dollar penalties. Smaller banks are generally much less exposed and therefore would be expected to borrow more cheaply, all else ...

Slide 1

... between regulation and supervision of physical and financial markets of each commodity, at the EU level. ...

... between regulation and supervision of physical and financial markets of each commodity, at the EU level. ...

Statement of Risk - ACT Department of Treasury

... purposes will also change over time due to changes in interest rates. An increase in interest rates will generally lead to a decrease in the valuation of debt securities and vice versa. The degree of change in the valuation will depend on, amongst other things, the term to maturity and the coupon ra ...

... purposes will also change over time due to changes in interest rates. An increase in interest rates will generally lead to a decrease in the valuation of debt securities and vice versa. The degree of change in the valuation will depend on, amongst other things, the term to maturity and the coupon ra ...

icma euro commercial paper committee

... The ICMA ECP Committee believes that in the event of a firm specific liquidity event, the likelihood is that balance sheets will contract. This does not imply a fire sale or forced sale of assets will be necessary; but rather that, as assets mature, the ability for desks to reinvest will be diminis ...

... The ICMA ECP Committee believes that in the event of a firm specific liquidity event, the likelihood is that balance sheets will contract. This does not imply a fire sale or forced sale of assets will be necessary; but rather that, as assets mature, the ability for desks to reinvest will be diminis ...

real interest rate

... Financial Markets After the end of the high tech boom and the sharp decline in the stock market in 2000, individuals and firms began looking for other areas to invest and earn high returns. ...

... Financial Markets After the end of the high tech boom and the sharp decline in the stock market in 2000, individuals and firms began looking for other areas to invest and earn high returns. ...

economic outlook briefing

... cycle. This contrasts with the London market Meanwhile, demand in commercial property where a majority of respondents perceive continues unabated with investment enquiries valuations as above fair value and entering exceeding pre-financial crisis levels. The limited the peak stage of the upswing. pa ...

... cycle. This contrasts with the London market Meanwhile, demand in commercial property where a majority of respondents perceive continues unabated with investment enquiries valuations as above fair value and entering exceeding pre-financial crisis levels. The limited the peak stage of the upswing. pa ...

Liquidity stress testing

... liquidity impact on inflows & outflows & CBC Network models: indirect contagion via systemic liquidity more important than via networks of bilateral exposure ...

... liquidity impact on inflows & outflows & CBC Network models: indirect contagion via systemic liquidity more important than via networks of bilateral exposure ...

Chap010

... • Prices reflect all past market information such as price and volume • If the market is weak form efficient, then investors cannot earn abnormal returns by trading on market information • Implies that technical analysis will not lead to abnormal returns • Empirical evidence indicates that markets a ...

... • Prices reflect all past market information such as price and volume • If the market is weak form efficient, then investors cannot earn abnormal returns by trading on market information • Implies that technical analysis will not lead to abnormal returns • Empirical evidence indicates that markets a ...

Spring 2015 - The Wolf Group

... With apologies to Tolstoy, we would offer that bull markets are all alike; every bear market is unhappy in its own way. There is a tendency during a bear market for investors to quickly conclude that: 1) this time around it’s like nothing before, 2) it’s clearly worse than the last time and 3) thing ...

... With apologies to Tolstoy, we would offer that bull markets are all alike; every bear market is unhappy in its own way. There is a tendency during a bear market for investors to quickly conclude that: 1) this time around it’s like nothing before, 2) it’s clearly worse than the last time and 3) thing ...

banking sector statistical digest - Cayman Islands Monetary Authority

... performance. Branches reported negative shareholders equity, in most instances, from liabilities being greater than assets. Subsidiaries showed positive earnings, though slightly compressed due mainly to market volatility, higher levels of provisioning for credit losses and slow growth in the global ...

... performance. Branches reported negative shareholders equity, in most instances, from liabilities being greater than assets. Subsidiaries showed positive earnings, though slightly compressed due mainly to market volatility, higher levels of provisioning for credit losses and slow growth in the global ...

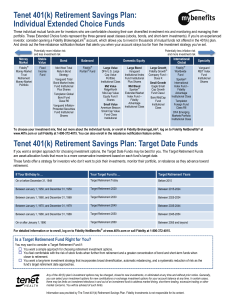

Tenet 401(k) Retirement Savings Plan: Individual Extended Choice

... You may want to consider a Target Retirement Fund if: You want a simple approach for choosing retirement investment options. You feel comfortable with the risk of stock funds when further from retirement and a greater concentration of bond and short-term funds when closer to retirement. You wa ...

... You may want to consider a Target Retirement Fund if: You want a simple approach for choosing retirement investment options. You feel comfortable with the risk of stock funds when further from retirement and a greater concentration of bond and short-term funds when closer to retirement. You wa ...

Interest Rate Risk Management for Commercial

... and re-pricing mismatches embedded in institutions‟ assets, liabilities, and off-balance-sheet positions. In general, those institutions whose assets are expected to re-price faster than their liabilities--referred to as “assetsensitive”--would be expected to benefit from a rise in rates, because hi ...

... and re-pricing mismatches embedded in institutions‟ assets, liabilities, and off-balance-sheet positions. In general, those institutions whose assets are expected to re-price faster than their liabilities--referred to as “assetsensitive”--would be expected to benefit from a rise in rates, because hi ...

Investment Update December 2011 Quarter

... Debt servicing costs are still high Most of it relates to mortgage debt – creating stress for many households ...

... Debt servicing costs are still high Most of it relates to mortgage debt – creating stress for many households ...

MANSFIELD TOWNSHIP BURLINGTON COUNTY RESOLUTION

... This Cash Management Plan (the "Plan") is prepared pursuant to the provisions of N.J.S.A. 40A:514 in order to set forth the basis for the deposits ("Deposits") and investment ("Permitted Investments") of certain public funds of the Township of Mansfield, pending the use of such funds for the intende ...

... This Cash Management Plan (the "Plan") is prepared pursuant to the provisions of N.J.S.A. 40A:514 in order to set forth the basis for the deposits ("Deposits") and investment ("Permitted Investments") of certain public funds of the Township of Mansfield, pending the use of such funds for the intende ...

8. Overview of Main Changes in 2008 SNA (Financial)

... • Therefore, they should be recognized as households’ assets, irrespective of the fact that segregated schemes’ assets exist or not, and of the fact that the employer may have recorded an associated liability entry in his balance sheet or not • Consequently recommends recording of the liabilities of ...

... • Therefore, they should be recognized as households’ assets, irrespective of the fact that segregated schemes’ assets exist or not, and of the fact that the employer may have recorded an associated liability entry in his balance sheet or not • Consequently recommends recording of the liabilities of ...

Economic Activity and the Short-Term Credit Markets: An

... been to establish a satisfactorychoice-theoreticfoundationfor the imperfect flexibilitythat distinguishesthem from their classical counterparts. (Alternativeapproachesto achieving this result include models with "cash in advance" constraints on purchases, or even a role for money in directlyaffectin ...

... been to establish a satisfactorychoice-theoreticfoundationfor the imperfect flexibilitythat distinguishesthem from their classical counterparts. (Alternativeapproachesto achieving this result include models with "cash in advance" constraints on purchases, or even a role for money in directlyaffectin ...

Introduction to Management and Organisational Behaviour

... • Markets reduce risk via diversification: – pooling toegether assets with negative risk correlation reduce overall risk – example: • asset R pays € 100 if it rains today • asset S pays € 100 if it does not rain today • markets can bundle R and S into one riskless asset that pays € 50 everyday. © Ba ...

... • Markets reduce risk via diversification: – pooling toegether assets with negative risk correlation reduce overall risk – example: • asset R pays € 100 if it rains today • asset S pays € 100 if it does not rain today • markets can bundle R and S into one riskless asset that pays € 50 everyday. © Ba ...

3.1 - United Nations Statistics Division

... • Therefore, they should be recognized as households’ assets, irrespective of the fact that segregated schemes’ assets exist or not, and of the fact that the employer may have recorded an associated liability entry in his balance sheet or not • Consequently recommends recording of the liabilities of ...

... • Therefore, they should be recognized as households’ assets, irrespective of the fact that segregated schemes’ assets exist or not, and of the fact that the employer may have recorded an associated liability entry in his balance sheet or not • Consequently recommends recording of the liabilities of ...

commercial analytical services

... policy changes and impending healthcare reform implementation1, all still in flux. Many small businesses are directly affected by these regulations and laws, with some aspects still evolving, creating potentially higher costs, new operating challenges given the new costs and increased uncertainty. F ...

... policy changes and impending healthcare reform implementation1, all still in flux. Many small businesses are directly affected by these regulations and laws, with some aspects still evolving, creating potentially higher costs, new operating challenges given the new costs and increased uncertainty. F ...

PPB 106:Layout 1 - Levy Economics Institute of Bard College

... the same time, both central banks enter into a separate contract that requires them to buy back their own currency on a specified date at the initial exchange rate. Neither bank faces any exchange rate risk in the transaction. But this does not mean that swap lending is riskless. Indeed, central ban ...

... the same time, both central banks enter into a separate contract that requires them to buy back their own currency on a specified date at the initial exchange rate. Neither bank faces any exchange rate risk in the transaction. But this does not mean that swap lending is riskless. Indeed, central ban ...

Capital Markets

... has helped shape the market and set new standards. Together with the Swiss Structured Products Association (SSPA), it has sought to make structured products more transparent, serve as a source of information and create a basis of trust for market participants. Trading on SIX Structured Products Exch ...

... has helped shape the market and set new standards. Together with the Swiss Structured Products Association (SSPA), it has sought to make structured products more transparent, serve as a source of information and create a basis of trust for market participants. Trading on SIX Structured Products Exch ...

The Yield Curve

... curve tends to occur when interest rates in general are high. Accurately predicts this occurrence ...

... curve tends to occur when interest rates in general are high. Accurately predicts this occurrence ...

File - get all chapter wise notes

... Timely financial assistance : Commercial Bank provide timely financial assistance to business. ...

... Timely financial assistance : Commercial Bank provide timely financial assistance to business. ...

Test Presentation Line 2

... Food industry including Nestlé Israel/Palestine Media Military exposed companies including security services Mining and other extractive industries Political donations Prisons Voting ...

... Food industry including Nestlé Israel/Palestine Media Military exposed companies including security services Mining and other extractive industries Political donations Prisons Voting ...

Navigating 5 years of emerging market corporate debt

... For more information please visit aberdeen-asset.com Other important information Aberdeen Global is a Luxembourg-domiciled UCITS fund, incorporated as a Société Anonyme and organized as a Société d’Invetissement á Capital Variable (a “SICAV”). The information contained in this marketing document is ...

... For more information please visit aberdeen-asset.com Other important information Aberdeen Global is a Luxembourg-domiciled UCITS fund, incorporated as a Société Anonyme and organized as a Société d’Invetissement á Capital Variable (a “SICAV”). The information contained in this marketing document is ...