Oil Price Increase - Philippine Institute of Development Studies

... products were increased for quite a number of rounds. In January 1999, the average price of diesel fuel was P7.90 per liter. To date, it is averaging P12.58 per liter; an increase of 59 percent over the period. Similarly, pump price of gasoline products increased by about 46 percent. Because of the ...

... products were increased for quite a number of rounds. In January 1999, the average price of diesel fuel was P7.90 per liter. To date, it is averaging P12.58 per liter; an increase of 59 percent over the period. Similarly, pump price of gasoline products increased by about 46 percent. Because of the ...

Fulltext: english,

... also to the budget deficit and other related issues like social policy and inequality. For example, negative commodity prices shocks during recent financial crises can be considered as the key factors that led to significant welfare losses and poverty increase in Russia, while positive shocks have c ...

... also to the budget deficit and other related issues like social policy and inequality. For example, negative commodity prices shocks during recent financial crises can be considered as the key factors that led to significant welfare losses and poverty increase in Russia, while positive shocks have c ...

Oil Price Volatility Factors An Applied Research Project Presented in

... barrels per day, averaging net intake of 8 million barrels per day by 2012. In this study, Indonesia has also been included in the club of BRICS as BRICS+1. The growing economies of BRICS+1 will drive their respective governments to continue to influence the geopolitics for satisfying their energy s ...

... barrels per day, averaging net intake of 8 million barrels per day by 2012. In this study, Indonesia has also been included in the club of BRICS as BRICS+1. The growing economies of BRICS+1 will drive their respective governments to continue to influence the geopolitics for satisfying their energy s ...

The Impact of Lower Oil Prices in Kuwait, English

... To sum up, GDP contracted sharply by 15 percent between 1997 and 1998 as the value of oil production fell; and this resulted in a sharp decline in government revenue and a deficit of 15 percent in fiscal year 1998/99; yet non-oil related output, both government and private, remained largely unaffect ...

... To sum up, GDP contracted sharply by 15 percent between 1997 and 1998 as the value of oil production fell; and this resulted in a sharp decline in government revenue and a deficit of 15 percent in fiscal year 1998/99; yet non-oil related output, both government and private, remained largely unaffect ...

Oil Price Volatility and US Macroeconomic Activity

... Oil Price Volatility and U.S. Macroeconomic Activity Hui Guo and Kevin L. Kliesen Oil shocks exert influence on macroeconomic activity through various channels, many of which imply a symmetric effect. However, the effect can also be asymmetric. In particular, sharp oil price changes—either increases ...

... Oil Price Volatility and U.S. Macroeconomic Activity Hui Guo and Kevin L. Kliesen Oil shocks exert influence on macroeconomic activity through various channels, many of which imply a symmetric effect. However, the effect can also be asymmetric. In particular, sharp oil price changes—either increases ...

The US Economy and $150-Per-Barrel Crude Oil

... In December 2001, the spot price of West Texas Intermediate (WTI) crude oil averaged $19.33 per barrel. Shortly thereafter, oil prices started to trend higher. After a brief decline from $74 per barrel in July 2006 to about $55 per barrel in January 2007, oil prices then resumed their upward trajec ...

... In December 2001, the spot price of West Texas Intermediate (WTI) crude oil averaged $19.33 per barrel. Shortly thereafter, oil prices started to trend higher. After a brief decline from $74 per barrel in July 2006 to about $55 per barrel in January 2007, oil prices then resumed their upward trajec ...

Relationship between oil revenues and government expenditure

... heavily has influenced by external factors including fluctuations in world oil prices. Surely this dependence if not realize the anticipated revenues from oil exports, the government not only on various projects and economic will have problem, but on the economy and future government programs and pr ...

... heavily has influenced by external factors including fluctuations in world oil prices. Surely this dependence if not realize the anticipated revenues from oil exports, the government not only on various projects and economic will have problem, but on the economy and future government programs and pr ...

brief on fuel subsidy - Nigeria Embassy Germany

... Nigeria with its large population and small oil base is comparatively poor compared to other oil producers Therefore: ...

... Nigeria with its large population and small oil base is comparatively poor compared to other oil producers Therefore: ...

MENAP Full Text

... The OPEC+ agreement has helped improve the outlook for oil prices in the near term, but prices remain volatile. Under the baseline projection for oil prices, fiscal and external positions in oil-exporting countries of the Middle East, North Africa, Afghanistan, and Pakistan (MENAP) region are expect ...

... The OPEC+ agreement has helped improve the outlook for oil prices in the near term, but prices remain volatile. Under the baseline projection for oil prices, fiscal and external positions in oil-exporting countries of the Middle East, North Africa, Afghanistan, and Pakistan (MENAP) region are expect ...

Demand for Energy and the Revenue Impact of Changes in Energy

... electricity by about 1.6 percent. The impact of a rise in number of consumers is highest and statistically significant. Increase in number of consumer can double the demand for electricity implying no economies of scale in the domestic use of electricity. The effect of changes in FAS (Fuel adjustmen ...

... electricity by about 1.6 percent. The impact of a rise in number of consumers is highest and statistically significant. Increase in number of consumer can double the demand for electricity implying no economies of scale in the domestic use of electricity. The effect of changes in FAS (Fuel adjustmen ...

NBER WORKING PAPER SERIES OIL PRICES, EXHAUSTIBLE RESOURCES, AND ECONOMIC GROWTH

... costs in some other form of productive capital, and thereby accumulate benefits over time at the rate of interest earned on productive capital. An alternative is to save the resource so it can be used in the future. Optimal use of the resource over time calls for equating these two returns. This soc ...

... costs in some other form of productive capital, and thereby accumulate benefits over time at the rate of interest earned on productive capital. An alternative is to save the resource so it can be used in the future. Optimal use of the resource over time calls for equating these two returns. This soc ...

Paper published in Journal of Global Commerce Research, 2(3) and... Annual International

... The oil market has gone through a number of structural changes in the last five decades. In the 1960s the focus was on the role of large multinational oil companies and their control of the market both physically and politically. In the 1970s the focus shifted to the role of OPEC in managing the oil ...

... The oil market has gone through a number of structural changes in the last five decades. In the 1960s the focus was on the role of large multinational oil companies and their control of the market both physically and politically. In the 1970s the focus shifted to the role of OPEC in managing the oil ...

Proposal 5: Eliminating Fossil Fuel Subsidies

... Since 1926, firms have been able to employ preferential depreciation rules under percentage depletion that allow them to deduct a percentage of their revenues (as opposed to their costs) of developing a well. In contrast to the principle that capital costs should be depreciated over the economic lif ...

... Since 1926, firms have been able to employ preferential depreciation rules under percentage depletion that allow them to deduct a percentage of their revenues (as opposed to their costs) of developing a well. In contrast to the principle that capital costs should be depreciated over the economic lif ...

Oil Prices, Exhaustible Resources, and Economic Growth*

... costs in some other form of productive capital, and thereby accumulate benefits over time at the rate of interest earned on productive capital. An alternative is to save the resource so it can be used in the future. Optimal use of the resource over time calls for equating these two returns. This soc ...

... costs in some other form of productive capital, and thereby accumulate benefits over time at the rate of interest earned on productive capital. An alternative is to save the resource so it can be used in the future. Optimal use of the resource over time calls for equating these two returns. This soc ...

Oil Shocks and Economic Growth in OPEC countries

... shocks and economic activity in order to check whether the observed recession (1970s) was be attributable the oil shock of 1973. Hamilton (1983) is the most influential paper in this field; h ...

... shocks and economic activity in order to check whether the observed recession (1970s) was be attributable the oil shock of 1973. Hamilton (1983) is the most influential paper in this field; h ...

What is an oil shock? Panel data evidence

... seminar participants at Korea University, University of Manchester, and 2007 Hitotsubashi Econometrics Conference for helpful comments and suggestions and Wun Ho Lee for research assistance. The Institute of Economic Research at Korea University and the Korea University Research Grant are also ackno ...

... seminar participants at Korea University, University of Manchester, and 2007 Hitotsubashi Econometrics Conference for helpful comments and suggestions and Wun Ho Lee for research assistance. The Institute of Economic Research at Korea University and the Korea University Research Grant are also ackno ...

What does it imply for commodity markets?

... Of the five BRICS economies (Brazil, China, India, Russian Federation, and South Africa), four slowed or even contracted in 2015. China’s economy continued to slow, and its rebalancing away from commodityintensive activities toward services has weighed on global trade and commodity prices. Brazil an ...

... Of the five BRICS economies (Brazil, China, India, Russian Federation, and South Africa), four slowed or even contracted in 2015. China’s economy continued to slow, and its rebalancing away from commodityintensive activities toward services has weighed on global trade and commodity prices. Brazil an ...

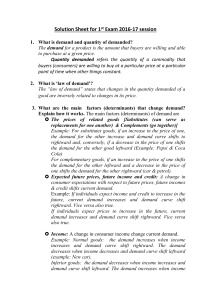

Solution Sheet for 1st exam-2016

... 12. Consider the figure above showing demand curves for fruit snacks. Suppose the economy is at point ‘a’. Which movement reflects an increase in the price of a substitute for fruit snacks? When the price of substitute good increase then demand will increase for the fruit snakes. So it reflects the ...

... 12. Consider the figure above showing demand curves for fruit snacks. Suppose the economy is at point ‘a’. Which movement reflects an increase in the price of a substitute for fruit snacks? When the price of substitute good increase then demand will increase for the fruit snakes. So it reflects the ...

unit #9 - orange ws

... measured as the horizontal distance between the supply & demand curves (above / below) the equilibrium price. Shortages are where quantity (supplied / demanded) is greater than quantity (supplied / demanded), and it results from prices being (above / below) the e___________________ p__________. Pric ...

... measured as the horizontal distance between the supply & demand curves (above / below) the equilibrium price. Shortages are where quantity (supplied / demanded) is greater than quantity (supplied / demanded), and it results from prices being (above / below) the e___________________ p__________. Pric ...

NBER WORKING PAPER SERIES James D. Hamilton Working Paper 15002

... the bottom row of Figure 5). Because the Saudis had historically used their excess capacity to mitigate the effects of short-run supply shortfalls, many analysts had assumed that they would continue to do the same in response to the longer run pressure of growing world demand, and most forecasts call ...

... the bottom row of Figure 5). Because the Saudis had historically used their excess capacity to mitigate the effects of short-run supply shortfalls, many analysts had assumed that they would continue to do the same in response to the longer run pressure of growing world demand, and most forecasts call ...

Causes and Consequences of the Oil Shock of 2007-08*

... the bottom row of Figure 5). Because the Saudis had historically used their excess capacity to mitigate the effects of short-run supply shortfalls, many analysts had assumed that they would continue to do the same in response to the longer run pressure of growing world demand, and most forecasts call ...

... the bottom row of Figure 5). Because the Saudis had historically used their excess capacity to mitigate the effects of short-run supply shortfalls, many analysts had assumed that they would continue to do the same in response to the longer run pressure of growing world demand, and most forecasts call ...

No Slide Title

... a third round of ‘quantitative easing’ by the Fed (QE3), combined with the ECB’s proposed bond purchase program, propelled gold back to a high of US$1,791.75 on October 4, 2012 in London. Gold languished again in early 2013 due to 1) a shift of investor interest from gold to equities in anticipation ...

... a third round of ‘quantitative easing’ by the Fed (QE3), combined with the ECB’s proposed bond purchase program, propelled gold back to a high of US$1,791.75 on October 4, 2012 in London. Gold languished again in early 2013 due to 1) a shift of investor interest from gold to equities in anticipation ...

Decreasing oil prices impact the GCC RHC market

... Oil price volatility is anticipated to continue, and although the GCC governments expect to raise non-oil sector revenues to fund their spending programs and reinforce the regional economic growth, governments are reviewing their spending commitments and priorities on infrastructure projects. One of ...

... Oil price volatility is anticipated to continue, and although the GCC governments expect to raise non-oil sector revenues to fund their spending programs and reinforce the regional economic growth, governments are reviewing their spending commitments and priorities on infrastructure projects. One of ...

Petroleum Prices, Taxation and Subsidies in India

... population, flat-rate subsidies funded from the Government‟s budget were renewed, however these were to be phased out between 2005 and 2007 (they are yet to be phased out). Under the new pricing regime, it was expected that retail prices for petroleum products (including prices for domestic kerosene ...

... population, flat-rate subsidies funded from the Government‟s budget were renewed, however these were to be phased out between 2005 and 2007 (they are yet to be phased out). Under the new pricing regime, it was expected that retail prices for petroleum products (including prices for domestic kerosene ...

2000s energy crisis

.png?width=300)

From the mid-1980s to September 2003, the inflation-adjusted price of a barrel of crude oil on NYMEX was generally under $25/barrel. During 2003, the price rose above $30, reached $60 by 11 August 2005, and peaked at $147.30 in July 2008. Commentators attributed these price increases to many factors, including the falling value of the U.S. dollar, reports from the United States Department of Energy and others showing a decline in petroleum reserves worries over peak oil, Middle East tension, and oil price speculation.For a time, geo-political events and natural disasters indirectly related to the global oil market had strong short-term effects on oil prices, such as North Korean missile tests, the 2006 conflict between Israel and Lebanon, worries over Iranian nuclear plans in 2006, Hurricane Katrina, and various other factors. By 2008, such pressures appeared to have an insignificant impact on oil prices given the onset of the global recession. The recession caused demand for energy to shrink in late 2008, with oil prices falling from the July 2008 high of $147 to a December 2008 low of $32. Oil prices stabilized by October 2009 and established a trading range between $60 and $80.