Macroeconomic Forces Chapter 2

... occurred August 1990 and public debate centered upon the impact of US involvement on domestic economic conditions. – Higher debt loads by households and business and financial industry imbalances were a fundamental reason for the economic downturn. The invasion of Kuwait was probably a ...

... occurred August 1990 and public debate centered upon the impact of US involvement on domestic economic conditions. – Higher debt loads by households and business and financial industry imbalances were a fundamental reason for the economic downturn. The invasion of Kuwait was probably a ...

Chapter 17 Test Review - Garden City Public Schools

... the MV = PQ equation provides a better understanding of the macroeconomy than does the Ca + Ig + Xn + G = GDP equation. most changes in the price level are explainable by changes in the money supply. the velocity of money is quite stable. ...

... the MV = PQ equation provides a better understanding of the macroeconomy than does the Ca + Ig + Xn + G = GDP equation. most changes in the price level are explainable by changes in the money supply. the velocity of money is quite stable. ...

the business cycle

... their period of office with a couple of years of austerity programmes, followed by tax cuts and monetary expansion in the two years before the elections. N.P. ...

... their period of office with a couple of years of austerity programmes, followed by tax cuts and monetary expansion in the two years before the elections. N.P. ...

PowerPoint: CHAPTER 2 – Business Cycles

... • Answer Activity 1 - pg 49 Q 1.1 – 1.4 • Answer Activity 2 - pg 52 Q 1.1 – 1.3 ...

... • Answer Activity 1 - pg 49 Q 1.1 – 1.4 • Answer Activity 2 - pg 52 Q 1.1 – 1.3 ...

Business Cycles

... – Aggregate Demand. If everyone decides to hide his money in his mattress, spending goes down and the economy contracts. If people decide to save less, production goes up. – Government activity. If the government increases the money supply, it can encourage expansion. If it increase the supply too ...

... – Aggregate Demand. If everyone decides to hide his money in his mattress, spending goes down and the economy contracts. If people decide to save less, production goes up. – Government activity. If the government increases the money supply, it can encourage expansion. If it increase the supply too ...

Presentation - International Development Economics Associates

... • “…the source of macroeconomic instability now is not instability in product markets but asset markets, and the main challenge for policy makers is not inflation, but unemployment and financial instability”. Akyüz (2006) ...

... • “…the source of macroeconomic instability now is not instability in product markets but asset markets, and the main challenge for policy makers is not inflation, but unemployment and financial instability”. Akyüz (2006) ...

Powerpoint Presentation

... Austrian business cycle theory is a bubble theory of business cycles. Government expansion of the money supply leads to lower interest rates. Companies re-orient their structure of production toward more roundabount production (more investment) as a result. ...

... Austrian business cycle theory is a bubble theory of business cycles. Government expansion of the money supply leads to lower interest rates. Companies re-orient their structure of production toward more roundabount production (more investment) as a result. ...

Powerpoint Presentation

... Austrian business cycle theory is a bubble theory of business cycles. Government expansion of the money supply leads to lower interest rates. Companies re-orient their structure of production toward more roundabount production (more investment) as a result. ...

... Austrian business cycle theory is a bubble theory of business cycles. Government expansion of the money supply leads to lower interest rates. Companies re-orient their structure of production toward more roundabount production (more investment) as a result. ...

(i) > 0

... •Are mature, market industrialized economies inherently stable—that is, are they selfequilibrating in nature and tend to the full employment of resources? •Should the powers of governments and central banks be deployed for purposes of countercyclical stabilization? ...

... •Are mature, market industrialized economies inherently stable—that is, are they selfequilibrating in nature and tend to the full employment of resources? •Should the powers of governments and central banks be deployed for purposes of countercyclical stabilization? ...

UNIT 15 REVIEW GAME

... when millions are out of work, many businesses fail, and the economy operates at far below capacity. depression ...

... when millions are out of work, many businesses fail, and the economy operates at far below capacity. depression ...

US Government AG 23.03 Notes Unit 7

... monetary policy is the best method of ensuring economic growth and stability. ...

... monetary policy is the best method of ensuring economic growth and stability. ...

- Allama Iqbal Open University

... Q.2 Explain the process of shifts in marginal efficiency of investment (MEI) and marginal efficiency of capital (MEC) schedules and also explain how these shifts affect the interest- rates? ...

... Q.2 Explain the process of shifts in marginal efficiency of investment (MEI) and marginal efficiency of capital (MEC) schedules and also explain how these shifts affect the interest- rates? ...

business cycles - Ms. Soris` Website

... PHASES OF THE BUSINESS CYCLE Expansion and Recovery Peak Contraction or Recession Trough ...

... PHASES OF THE BUSINESS CYCLE Expansion and Recovery Peak Contraction or Recession Trough ...

Word Document

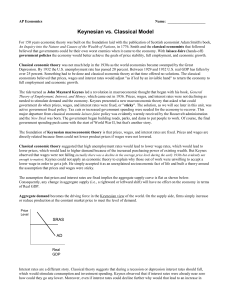

... Classicals and neoclassicals believed Say’s Law implies the economy must always be at full employment. Under new classical theory the economy is always at equilibrium: all unemployment is voluntary. Under real business cycle theory supply side shocks cause what appear to be business cycles. Th ...

... Classicals and neoclassicals believed Say’s Law implies the economy must always be at full employment. Under new classical theory the economy is always at equilibrium: all unemployment is voluntary. Under real business cycle theory supply side shocks cause what appear to be business cycles. Th ...

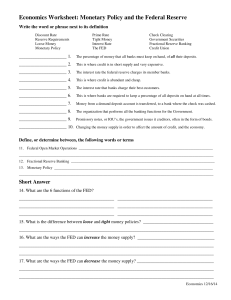

Economics Worksheet: Monetary Policy and the Federal Reserve

... The percentage of money that all banks must keep on hand, of all their deposits. ...

... The percentage of money that all banks must keep on hand, of all their deposits. ...

Classical – Neoclassical Economics

... •Military nihilist (Sweden can’t defend self disband army) •Jailed for sacrilege •Established marginal productivity theory of distribution • Competition: Linear homogeneous (Cobb-Douglas) production function ...

... •Military nihilist (Sweden can’t defend self disband army) •Jailed for sacrilege •Established marginal productivity theory of distribution • Competition: Linear homogeneous (Cobb-Douglas) production function ...

The implications of Mr. Sraffa for economic policy

... the short and in the long run. In the short-run by a fuller exploitation of existing capacity; in the long-run by increasing capacity. • In a demand-led theory, resources (capital and population) adjust to demand growth, not the other way round. • Monetary and fiscal policy affects output also in th ...

... the short and in the long run. In the short-run by a fuller exploitation of existing capacity; in the long-run by increasing capacity. • In a demand-led theory, resources (capital and population) adjust to demand growth, not the other way round. • Monetary and fiscal policy affects output also in th ...

The Business Cycle

... Business cuts causes a reduction in output & income in other sectors & GDP slows/contracts- recession ...

... Business cuts causes a reduction in output & income in other sectors & GDP slows/contracts- recession ...

Macroeconomics Lectures Stephen Jay Silver, Ph.D. The Citadel

... argues against the use of discretionary fiscal and monetary policies Most economists are unconvinced about the primacy of supply shocks over demand shocks in explaining the business cycle ...

... argues against the use of discretionary fiscal and monetary policies Most economists are unconvinced about the primacy of supply shocks over demand shocks in explaining the business cycle ...

Zarnowitz, Victor. Business Cycles Observed and Assessed

... stimulates the business activity in the economy. This activity can cause extreme recklessness, which can prompt it to produce feverish speculation, potentially leading to a crash in credit and widespread bankruptcy. One of the first economists to argue the importance of inflation was David Ricardo. ...

... stimulates the business activity in the economy. This activity can cause extreme recklessness, which can prompt it to produce feverish speculation, potentially leading to a crash in credit and widespread bankruptcy. One of the first economists to argue the importance of inflation was David Ricardo. ...

Booms and busts, the accelerator, and Keynesian fiscal policy

... • Thus, monetarists criticize demandmanagement as “the wrong cure for the wrong disease.” ...

... • Thus, monetarists criticize demandmanagement as “the wrong cure for the wrong disease.” ...