Business Cycles

... shortages would have had widespread economic effects. Economists long ago dismissed Jevons’s sunspot theory, but they embraced his notion that the economy undergoes periodic changes. A modern industrial economy repeatedly experiences cycles of good times, then bad times, and then good times again. B ...

... shortages would have had widespread economic effects. Economists long ago dismissed Jevons’s sunspot theory, but they embraced his notion that the economy undergoes periodic changes. A modern industrial economy repeatedly experiences cycles of good times, then bad times, and then good times again. B ...

Post Keynesian Macroeconomics

... provisional stability (fixed expectations) • Using the Open System Ceteris Paribus method developed by Mark Setterfield ...

... provisional stability (fixed expectations) • Using the Open System Ceteris Paribus method developed by Mark Setterfield ...

Business Cycles

... Four Phases of the Business Cycle If a contraction is long and deep enough, it can develop into a recession, two consecutive quarters of no growth, or negative growth in Real GDP. A Recession can develop into a depression, characterized by extremely high unemployment and many business failures. ...

... Four Phases of the Business Cycle If a contraction is long and deep enough, it can develop into a recession, two consecutive quarters of no growth, or negative growth in Real GDP. A Recession can develop into a depression, characterized by extremely high unemployment and many business failures. ...

Introduction to Macroeconomics

... • They propose a money-growth rule: The Fed should be required to target the growth rate of money such that it equals the growth rate of real GDP, leaving the price level unchanged. ...

... • They propose a money-growth rule: The Fed should be required to target the growth rate of money such that it equals the growth rate of real GDP, leaving the price level unchanged. ...

This PDF is a selection from an out-of-print volume from... Bureau of Economic Research

... The paper by John Cochrane is perhaps the one that is most directly addressed to policy analysis. Applying the so-called fiscal theory of the price level to the postwar United States, Cochrane asks to what degree the history of U.S. inflation can be explained by fiscal factors alone, and how fiscal ...

... The paper by John Cochrane is perhaps the one that is most directly addressed to policy analysis. Applying the so-called fiscal theory of the price level to the postwar United States, Cochrane asks to what degree the history of U.S. inflation can be explained by fiscal factors alone, and how fiscal ...

International Insolvency Law Organisational matters

... Money multiplier maximum money creation possible from a specified monetary base. Money multiplier is the inverse of the reserve requirement. Actual creation of money depends on the credit expansion - actual volume of lending by commercial banks and of the resulting deposits. Lending by commercial ...

... Money multiplier maximum money creation possible from a specified monetary base. Money multiplier is the inverse of the reserve requirement. Actual creation of money depends on the credit expansion - actual volume of lending by commercial banks and of the resulting deposits. Lending by commercial ...

Preparing for the AP Macroeconomics Test

... Rule: Bond prices are inversely related to interest rates Adds depth to the reasons that interest rates change Expansionary fiscal policy (G up, AD up) leads to deficit spending, which causes the government to sell bonds (increasing the supply in this graph), causing the price of bonds to drop and t ...

... Rule: Bond prices are inversely related to interest rates Adds depth to the reasons that interest rates change Expansionary fiscal policy (G up, AD up) leads to deficit spending, which causes the government to sell bonds (increasing the supply in this graph), causing the price of bonds to drop and t ...

Reviewed - Heterodox Economics Newsletter

... interests and politics, rather than economic theories, have driven U.S. monetary policy over time. Again, Wood begins in England. The Bank of England was granted a charter in 1694 in return for a loan to the government, and for many years the Bank’s operations and privileges were intertwined with it ...

... interests and politics, rather than economic theories, have driven U.S. monetary policy over time. Again, Wood begins in England. The Bank of England was granted a charter in 1694 in return for a loan to the government, and for many years the Bank’s operations and privileges were intertwined with it ...

Chapter 9 - Foothill College

... expressed as A/P or nominal assets over the price level (P). Moving down (to a lower price level) in the AD diagram is associated with more output demanded since the real value of people’s wealth (assets) has increased. Some of that increase in purchasing power will stimulate increased goods and ser ...

... expressed as A/P or nominal assets over the price level (P). Moving down (to a lower price level) in the AD diagram is associated with more output demanded since the real value of people’s wealth (assets) has increased. Some of that increase in purchasing power will stimulate increased goods and ser ...

Review Sheet - Syracuse University

... 1. Monetary policy: How would the Fed slow the U.S. economy? Write out the linkages between monetary policy and changes in the economy (as we did in lecture and as it is in Ch. 12). Relate those changes to the money market and the market for planned investment. 2. Is monetary policy better at slowin ...

... 1. Monetary policy: How would the Fed slow the U.S. economy? Write out the linkages between monetary policy and changes in the economy (as we did in lecture and as it is in Ch. 12). Relate those changes to the money market and the market for planned investment. 2. Is monetary policy better at slowin ...

Word

... distribution by Smith, Ricardo and Marx; second, the critique of classical theory by the early neoclassical economists, Edgeworth, Walras and Marshall; third the revival of classical theory following the critique of neoclassical capital theory by Sraffa; and finally, the implications of the these th ...

... distribution by Smith, Ricardo and Marx; second, the critique of classical theory by the early neoclassical economists, Edgeworth, Walras and Marshall; third the revival of classical theory following the critique of neoclassical capital theory by Sraffa; and finally, the implications of the these th ...

Bank Lending to Businesses in a Jobless Recovery

... stage for high default rates at some future date (Berger and Udell 2002). This view would be consistent with persistent weakness in the volume of business loans as the economy enters the recovery phase of an economic business cycle. Credit rationing—when banks restrict the quantity of credit availab ...

... stage for high default rates at some future date (Berger and Udell 2002). This view would be consistent with persistent weakness in the volume of business loans as the economy enters the recovery phase of an economic business cycle. Credit rationing—when banks restrict the quantity of credit availab ...

Economics for International and Public Affairs I (U4200)

... Course Description This course continues the one-year sequence initiated with U4200 and focuses on macroeconomics. The goal of this course is to provide you with the analytical framework to examine and interpret observed economic events in the global economy. We will first familiarize with the meas ...

... Course Description This course continues the one-year sequence initiated with U4200 and focuses on macroeconomics. The goal of this course is to provide you with the analytical framework to examine and interpret observed economic events in the global economy. We will first familiarize with the meas ...

Macroeconomics (AGEC 512)

... with a marginal propensity to spend (on all forms of demand) less than unity. This means that aggregate demand depends on income: at low levels of income aggregate demand is greater than income, and at high levels of income it is less. Aggregate supply or output is simply equal to national income, ...

... with a marginal propensity to spend (on all forms of demand) less than unity. This means that aggregate demand depends on income: at low levels of income aggregate demand is greater than income, and at high levels of income it is less. Aggregate supply or output is simply equal to national income, ...

Macroeconomics, Monetary Policy, and the Crisis

... age, which have to be weighed against the costs, but the discussions of the presumptive benefits of leverage ignore the insights provided by Franco Modigliani and Merton Miller.6 The Modigliani- Miller theorem7 argues that corporate financial structure doesn’t matter—changes in leverage or debt equi ...

... age, which have to be weighed against the costs, but the discussions of the presumptive benefits of leverage ignore the insights provided by Franco Modigliani and Merton Miller.6 The Modigliani- Miller theorem7 argues that corporate financial structure doesn’t matter—changes in leverage or debt equi ...

IS-LM-BP

... • Clearly in the simple model of the last section the equilibrium level of output – (a) can be influenced by fiscal policy (changes in G and T) – (b) is not necessarily at capacity, or full employment ...

... • Clearly in the simple model of the last section the equilibrium level of output – (a) can be influenced by fiscal policy (changes in G and T) – (b) is not necessarily at capacity, or full employment ...

post-lucas macroeconomics - Centro de Estudios Públicos

... Depression of the 1930s. In particular, his research has had a tremendous influence on the thinking and research program in two areas of macroeconomics: namely, the theory of cycles and the theory of growth. 2. For many economists Lucas’ contribution basically relates to the introduction of the conc ...

... Depression of the 1930s. In particular, his research has had a tremendous influence on the thinking and research program in two areas of macroeconomics: namely, the theory of cycles and the theory of growth. 2. For many economists Lucas’ contribution basically relates to the introduction of the conc ...

Insert title here

... • The demand-pull producers raise prices in theory states that order to meet increased inflation occurs costs. when demand for • Cost-push can lead goodsinflation and services to aexceeds wage-price spiral — the existing process by which rising supplies. wages cause higher prices, and higher prices ...

... • The demand-pull producers raise prices in theory states that order to meet increased inflation occurs costs. when demand for • Cost-push can lead goodsinflation and services to aexceeds wage-price spiral — the existing process by which rising supplies. wages cause higher prices, and higher prices ...

Monetary Policy

... – Demand-pull inflation? – Wage inflation? – Fears that there is too much velocity to the ...

... – Demand-pull inflation? – Wage inflation? – Fears that there is too much velocity to the ...

Chapter 4 A Review of .M. Keynes SECTION 2 MONETARY

... frequency theory, developed an ingenious theory of decision-making under uncertainty. Each managerial decision is a unique event, he pOSited, and this calls the choice-theoretic basis of reductionism into question. Without a stable basiS in choice logic the concept of market eqUilibrium collapses. B ...

... frequency theory, developed an ingenious theory of decision-making under uncertainty. Each managerial decision is a unique event, he pOSited, and this calls the choice-theoretic basis of reductionism into question. Without a stable basiS in choice logic the concept of market eqUilibrium collapses. B ...

Read this essay here.

... assets from banks floods them with liquidity, which will hopefully enable and encourage private lending, by giving banks reserves well above the levels they need, leaving them with little risk of a liquidity shortage. In the case of Japan, the assets the central bank bought up were mainly long term ...

... assets from banks floods them with liquidity, which will hopefully enable and encourage private lending, by giving banks reserves well above the levels they need, leaving them with little risk of a liquidity shortage. In the case of Japan, the assets the central bank bought up were mainly long term ...

Principles of Macroeconomics (Spring 2017) Masao Suzuki CRN

... Domestic Product (GDP), the business cycle, unemployment, and inflation; money, banking, and interest rates; households and consumption, businesses and investment, government taxes and spending, and international trade and exchange rates; models of supply and demand, aggregate expenditures, and aggr ...

... Domestic Product (GDP), the business cycle, unemployment, and inflation; money, banking, and interest rates; households and consumption, businesses and investment, government taxes and spending, and international trade and exchange rates; models of supply and demand, aggregate expenditures, and aggr ...

International Institute of Economics and Finance

... discusses models with microeconomic foundations, i.e. the models based on optimizing behavior of economic agents. The emphasis of the first part of the course is on analytical tools of modern dynamic macroeconomics and on the long-run issues, such as the economic growth. Students will learn standard ...

... discusses models with microeconomic foundations, i.e. the models based on optimizing behavior of economic agents. The emphasis of the first part of the course is on analytical tools of modern dynamic macroeconomics and on the long-run issues, such as the economic growth. Students will learn standard ...

EconomicPolicy AP2013

... Buying and selling bonds has two different effects on the economy and consumers. When the Fed BUYS bonds it is PUTTING MORE MONEY INTO the economy. How will banks respond to ...

... Buying and selling bonds has two different effects on the economy and consumers. When the Fed BUYS bonds it is PUTTING MORE MONEY INTO the economy. How will banks respond to ...

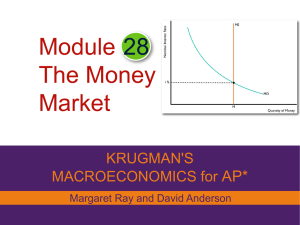

Macro_Module_28 money market

... • Nominal Interest Rate = Real Interest Rate • Rising Interest Rates = higher OC = Q of Money demanded falls • Movement along the curve is caused by a change in the Nominal Interest Rate ...

... • Nominal Interest Rate = Real Interest Rate • Rising Interest Rates = higher OC = Q of Money demanded falls • Movement along the curve is caused by a change in the Nominal Interest Rate ...