Time to Take Stock Brochure - Franklin Templeton Investments

... All investments involve risk, including possible loss of principal. Stock prices fluctuate, sometimes rapidly and dramatically, due to factors affecting individual companies, particular industries or sectors, or general market conditions. Investing in dividend-paying stocks involves risks. Companies ...

... All investments involve risk, including possible loss of principal. Stock prices fluctuate, sometimes rapidly and dramatically, due to factors affecting individual companies, particular industries or sectors, or general market conditions. Investing in dividend-paying stocks involves risks. Companies ...

Sponsored by Capstone Asset Management

... David R. Kotok is the Chairman and Chief Investment Officer of Cumberland Advisors. He co-founded the firm in 1973 and has guided its investment strategy from inception. Mr. Kotok holds a B.S. degree in economics from The Wharton School as well as dual master’s degrees from the University of Pennsyl ...

... David R. Kotok is the Chairman and Chief Investment Officer of Cumberland Advisors. He co-founded the firm in 1973 and has guided its investment strategy from inception. Mr. Kotok holds a B.S. degree in economics from The Wharton School as well as dual master’s degrees from the University of Pennsyl ...

Active Management

... • Debt instrument that are not traded in money market • Mostly traded with fixed income capital market instruments • Either fixed stream of income • Stream of income that is determined from specific formula ...

... • Debt instrument that are not traded in money market • Mostly traded with fixed income capital market instruments • Either fixed stream of income • Stream of income that is determined from specific formula ...

Investment treaties: the emerging crisis

... Fourth, the treaties prohibit expropriation of the investments. The definition of ‘expropriation’ is very broad; it includes direct expropriation such as takeovers of property but also indirect expropriation including ‘regulatory takings’, or the implementation of new policy measures that affect the ...

... Fourth, the treaties prohibit expropriation of the investments. The definition of ‘expropriation’ is very broad; it includes direct expropriation such as takeovers of property but also indirect expropriation including ‘regulatory takings’, or the implementation of new policy measures that affect the ...

Merk Investments

... the Fund's portfolio will decline in value because of increases in market interest rates. As a non-diversified fund, the Fund will be subject to more investment risk and potential for volatility than a diversified fund because its portfolio may, at times, focus on a limited number of issuers. The Fu ...

... the Fund's portfolio will decline in value because of increases in market interest rates. As a non-diversified fund, the Fund will be subject to more investment risk and potential for volatility than a diversified fund because its portfolio may, at times, focus on a limited number of issuers. The Fu ...

Managing the IT Portfolio - MIT SeeIT Project

... business costs and increase productivity, weighting the IT portfolio with transactional investments more heavily than the 13% average makes sense (see the March 2003 briefing for benchmarks by industry). We estimate transactional investments have solid returns of 25–40% per dollar. Investments in th ...

... business costs and increase productivity, weighting the IT portfolio with transactional investments more heavily than the 13% average makes sense (see the March 2003 briefing for benchmarks by industry). We estimate transactional investments have solid returns of 25–40% per dollar. Investments in th ...

Tammy Kiely - Goldman Sachs

... ammy is global head of the Semiconductor Investment Banking Practice in the Technology, Media and Telecom (TMT) Group of the Investment Banking Division (IBD). She is also captain of the IBD Stanford Goldman Sachs Bank USA Recruiting Team. Tammy first served as head of the global semiconductor inves ...

... ammy is global head of the Semiconductor Investment Banking Practice in the Technology, Media and Telecom (TMT) Group of the Investment Banking Division (IBD). She is also captain of the IBD Stanford Goldman Sachs Bank USA Recruiting Team. Tammy first served as head of the global semiconductor inves ...

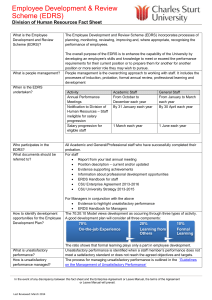

See some of the facts on EDRS

... planning, monitoring, reviewing, improving and, where appropriate, recognising the performance of employees. The overall purpose of the EDRS is to enhance the capability of the University by developing an employee’s skills and knowledge to meet or exceed the performance requirements for their curren ...

... planning, monitoring, reviewing, improving and, where appropriate, recognising the performance of employees. The overall purpose of the EDRS is to enhance the capability of the University by developing an employee’s skills and knowledge to meet or exceed the performance requirements for their curren ...

... bonds can still yield 3 - 4.5%, while lower quality high yield corporate bonds can yield 6-8% depending on ratings. An investment in a basket of corporate bonds (or bond funds) can be structured to pay monthly interest income / dividends and set up to be transferred to an investor's checking account ...

TIB Powerpoint - CP11/11

... > Some ‘clever stuff’ may be going on : removing market risk and pre-defining returns is challenging ...

... > Some ‘clever stuff’ may be going on : removing market risk and pre-defining returns is challenging ...

market risk - U of L Class Index

... You can also find the expected return by finding the portfolio return in each possible state and computing the expected value ...

... You can also find the expected return by finding the portfolio return in each possible state and computing the expected value ...

Liquidity in the Art Market

... It is a natural concern for any investor allocating capital in art to consider its relative illiquidity when compared to most other traditional financial vehicles. However, art’s qualities as an investable asset overcome any liquidity matters because of overall long-term benefits in an investment po ...

... It is a natural concern for any investor allocating capital in art to consider its relative illiquidity when compared to most other traditional financial vehicles. However, art’s qualities as an investable asset overcome any liquidity matters because of overall long-term benefits in an investment po ...

2.1 Funding Objectives – Ongoing Plan

... granted a segregated account mandate or the Fund may invest in a pooled fund managed by that manager. The external managers appointed by the Fund are authorised under the Local Government Pension Scheme (Management and Investment of Funds) Regulations 2009(as amended) to manage the assets of the Fun ...

... granted a segregated account mandate or the Fund may invest in a pooled fund managed by that manager. The external managers appointed by the Fund are authorised under the Local Government Pension Scheme (Management and Investment of Funds) Regulations 2009(as amended) to manage the assets of the Fun ...

Oversight Policy for Deferred Compensation

... Morningstar Rating –The Morningstar Rating for mutual funds, commonly called the star rating, is a measure, published by Morningstar Inc., of a fund's risk-adjusted return, relative to other mutual funds in its category. Funds are rated from one to five stars, with the best performers receiving fiv ...

... Morningstar Rating –The Morningstar Rating for mutual funds, commonly called the star rating, is a measure, published by Morningstar Inc., of a fund's risk-adjusted return, relative to other mutual funds in its category. Funds are rated from one to five stars, with the best performers receiving fiv ...

Republic of Albania

... Development of the Albanian integrated State Treasury according to the best practices is a complex task, & Implementation of such wide spread changes would require: ...

... Development of the Albanian integrated State Treasury according to the best practices is a complex task, & Implementation of such wide spread changes would require: ...

The Koszyki Hall Will Emerge with Support of Bank Gospodarstwa

... President of the Management Board of the Griffin Group. “It is not the first time that we have had the opportunity to execute an investment project together with Bank Gospodarstwa Krajowego. The bank is a proven and experienced partner,” said Przemysław Krych, President of the Management Board of th ...

... President of the Management Board of the Griffin Group. “It is not the first time that we have had the opportunity to execute an investment project together with Bank Gospodarstwa Krajowego. The bank is a proven and experienced partner,” said Przemysław Krych, President of the Management Board of th ...

Investing in your Future

... provide investors with a return that includes tax effective income and capital growth from a diversified portfolio of Australian listed investments. All investments have an element of risk. One of the tools you can use to reduce the risk is to diversify your portfolio. The Pritchard Australian Share ...

... provide investors with a return that includes tax effective income and capital growth from a diversified portfolio of Australian listed investments. All investments have an element of risk. One of the tools you can use to reduce the risk is to diversify your portfolio. The Pritchard Australian Share ...

What Trading Teaches Us About Life

... Trading is a crucible of life: it distills, in a matter of minutes, the basic human challenge: the need to judge, plan, and seek values under conditions of risk and uncertainty. In mastering trading, we necessarily face and master ourselves. Very few arenas of life so immediately reward self-develop ...

... Trading is a crucible of life: it distills, in a matter of minutes, the basic human challenge: the need to judge, plan, and seek values under conditions of risk and uncertainty. In mastering trading, we necessarily face and master ourselves. Very few arenas of life so immediately reward self-develop ...

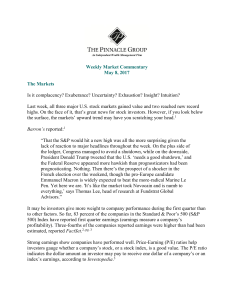

Carl Mahler`s Market Commentary

... maturity, offer a fixed rate of return and fixed principal value. However, the value of fund shares is not guaranteed and will fluctuate. * Corporate bonds are considered higher risk than government bonds but normally offer a higher yield and are subject to market, interest rate and credit risk as w ...

... maturity, offer a fixed rate of return and fixed principal value. However, the value of fund shares is not guaranteed and will fluctuate. * Corporate bonds are considered higher risk than government bonds but normally offer a higher yield and are subject to market, interest rate and credit risk as w ...

DFS-J3-1541 rev0413(Investment Policy).

... Morningstar Rating –The Morningstar Rating for mutual funds, commonly called the star rating, is a measure, published by Morningstar Inc., of a fund's risk-adjusted return, relative to other mutual funds in its category. Funds are rated from one to five stars, with the best performers receiving five ...

... Morningstar Rating –The Morningstar Rating for mutual funds, commonly called the star rating, is a measure, published by Morningstar Inc., of a fund's risk-adjusted return, relative to other mutual funds in its category. Funds are rated from one to five stars, with the best performers receiving five ...

Hedge Fund Vs Mutual Funds

... Hedge funds are like mutual funds in some ways. Investment professionals in a hedge fund pool in money from investors to be managed - exactly like the mutual funds do. And, subject to some minor restrictions, investors in hedge funds can withdraw their money as they can in a mutual fund. Nothing els ...

... Hedge funds are like mutual funds in some ways. Investment professionals in a hedge fund pool in money from investors to be managed - exactly like the mutual funds do. And, subject to some minor restrictions, investors in hedge funds can withdraw their money as they can in a mutual fund. Nothing els ...