NEWSLETTER CONTENTS Issue 2 ETHICS & COMPLIANCE HOTLINE-AN UPDATE

... understanding of those risks and the controls that may be in place to mitigate them. Audits include tasks such as interviewing personnel, performing a walkthrough of a process or transaction, and validating financial information. During an audit, observations and recommendations for improvement of p ...

... understanding of those risks and the controls that may be in place to mitigate them. Audits include tasks such as interviewing personnel, performing a walkthrough of a process or transaction, and validating financial information. During an audit, observations and recommendations for improvement of p ...

Current Client Newsletter - Creative Financial Solutions

... shorter-term mispricing at the individual stock level. These opportunities can allow us to generate long-term returns that are better than just “what the market gives us.” CFS Investment Newsletter ...

... shorter-term mispricing at the individual stock level. These opportunities can allow us to generate long-term returns that are better than just “what the market gives us.” CFS Investment Newsletter ...

Part C - Investment markets and banking crises

... If you ignore history then you’re doomed to make the same mistakes. The current uncertainty in the global economy is going to be around for a while. This will likely result in greater ongoing financial volatility coupled with more modest investment returns. Risky markets such as equities may be in a ...

... If you ignore history then you’re doomed to make the same mistakes. The current uncertainty in the global economy is going to be around for a while. This will likely result in greater ongoing financial volatility coupled with more modest investment returns. Risky markets such as equities may be in a ...

ECOWAS - Investment Policy and Promotion

... value chains in key sectors. FDI brings not only investment and jobs, but also increased exports, supply chain spillovers, and new technologies and business practices. These potential benefits require clear and effective implementation of investment strategies and policies that respond to the realit ...

... value chains in key sectors. FDI brings not only investment and jobs, but also increased exports, supply chain spillovers, and new technologies and business practices. These potential benefits require clear and effective implementation of investment strategies and policies that respond to the realit ...

Bond Strategies for Rising Rate Environments

... stocks performed well in rising rate environments, generating positive returns in seven such periods since 1948, high dividend stocks have outperformed the broad stock market in five of seven rising rate environments. It is quite possible that the future may be like the past. Surveying the factors t ...

... stocks performed well in rising rate environments, generating positive returns in seven such periods since 1948, high dividend stocks have outperformed the broad stock market in five of seven rising rate environments. It is quite possible that the future may be like the past. Surveying the factors t ...

See the Presentation

... Several financial institutions, including Deutsche Bank, Bank of America, Washington Mutual and AIG, have recently put money into the sub-prime market to keep at-risk loans from going into default. In this way, they hope to avoid larger crises in larger financial arenas – specifically, structured de ...

... Several financial institutions, including Deutsche Bank, Bank of America, Washington Mutual and AIG, have recently put money into the sub-prime market to keep at-risk loans from going into default. In this way, they hope to avoid larger crises in larger financial arenas – specifically, structured de ...

Investments: Analysis and Management, Second Canadian Edition

... • Sources of risk. • Methods of measuring returns. • Methods of measuring risk. • Measuring historical returns and risks of major financial assets. ...

... • Sources of risk. • Methods of measuring returns. • Methods of measuring risk. • Measuring historical returns and risks of major financial assets. ...

Investment products risk and fees disclosure

... position and experience in investing into securities) and investment objectives (incl. the desired temporal length of investment). Prior to investing into securities, Swedbank would recommend to visit an investment consultation, where customer will be assisted by investment adviser in making those e ...

... position and experience in investing into securities) and investment objectives (incl. the desired temporal length of investment). Prior to investing into securities, Swedbank would recommend to visit an investment consultation, where customer will be assisted by investment adviser in making those e ...

A-View-from-the-Desk

... the past two months. In addition, when Detroit filed for bankruptcy on July, 18, this sent some ripples through the market. In our opinion, this has created a great buying opportunity. It is truly amazing that anyone is surprised by Detroit’s decision to file for bankruptcy when they have been strug ...

... the past two months. In addition, when Detroit filed for bankruptcy on July, 18, this sent some ripples through the market. In our opinion, this has created a great buying opportunity. It is truly amazing that anyone is surprised by Detroit’s decision to file for bankruptcy when they have been strug ...

Portfolio Optimisation - Hearthstone Investments

... Consequently, there is limited total return data available, and in order to provide a realistic and informative long-term data series, it has been necessary to combine different sources of data. Our residential property total return is comprised of a capital return taken from the LSL Acad house pric ...

... Consequently, there is limited total return data available, and in order to provide a realistic and informative long-term data series, it has been necessary to combine different sources of data. Our residential property total return is comprised of a capital return taken from the LSL Acad house pric ...

Exploring the Investment Behavior of Minorities in America

... contrast, a much smaller proportion of Asians or Hispanics were using financial advisors in this capacity. The workplace was identified as a source of investment information only by a very small proportion of the respondents (slightly over 10% of African Americans, Asians, and whites, and 7% of Hisp ...

... contrast, a much smaller proportion of Asians or Hispanics were using financial advisors in this capacity. The workplace was identified as a source of investment information only by a very small proportion of the respondents (slightly over 10% of African Americans, Asians, and whites, and 7% of Hisp ...

Stock Market Tycoons

... 1. Your teacher will let you know who your stock partner will be for this project. 2. Meet with your partner to discuss several companies that you will be interested in finding out more about in the next few days. 3. At home talk to your family about companies and consider possible investments to ma ...

... 1. Your teacher will let you know who your stock partner will be for this project. 2. Meet with your partner to discuss several companies that you will be interested in finding out more about in the next few days. 3. At home talk to your family about companies and consider possible investments to ma ...

Foreign investment - Offshore Petroleum Exploration Acreage Release

... Please note that the monetary values listed above are those for 2012. Thresholds are indexed annually on 1 January. Investors are advised to confirm notification requirements and relevant thresholds with the FIRB at the time of investment. The Government encourages potential investors to engage with ...

... Please note that the monetary values listed above are those for 2012. Thresholds are indexed annually on 1 January. Investors are advised to confirm notification requirements and relevant thresholds with the FIRB at the time of investment. The Government encourages potential investors to engage with ...

May 2014 Examinations Subject CT8 – Financial Economics INDICATIVE SOLUTIONS

... The efficient frontier is the part of this line above the point at which the variance is minimised. To find ...

... The efficient frontier is the part of this line above the point at which the variance is minimised. To find ...

in GDP

... Total inflow of foreign investment was reduced by 31.7% Highest value of FDI is in amount of KM 117 million which is investment capital from Austria. Investors which invested more in 2005 compared to 2004 are: Slovenia, Turky and USA. Regarding the sectorial structure the highest investment were rec ...

... Total inflow of foreign investment was reduced by 31.7% Highest value of FDI is in amount of KM 117 million which is investment capital from Austria. Investors which invested more in 2005 compared to 2004 are: Slovenia, Turky and USA. Regarding the sectorial structure the highest investment were rec ...

Appreciating Assets Part 1: Stocks and Bonds

... by David John Marotta | 04-05-2010 All assets are not equal. Some investments appreciate better on average than others. If you have $100,000 saved toward your retirement, how you invest it can make a difference in the likelihood and standard of living of your retirement. Let's look at various invest ...

... by David John Marotta | 04-05-2010 All assets are not equal. Some investments appreciate better on average than others. If you have $100,000 saved toward your retirement, how you invest it can make a difference in the likelihood and standard of living of your retirement. Let's look at various invest ...

Bond ladders may not be the best investment strategy

... For investors seeking income from municipal bond exposure, one of the most popular investment strategies employed by individual investors has been one of the least successful strategies—the bond ladder. It’s a simple investment plan—individually owned municipal bonds bought at increasing maturity ra ...

... For investors seeking income from municipal bond exposure, one of the most popular investment strategies employed by individual investors has been one of the least successful strategies—the bond ladder. It’s a simple investment plan—individually owned municipal bonds bought at increasing maturity ra ...

Oulu Uni of Applied Sci:s – School of Business and Info Management

... cover over fixed costs; less fixed costs is gross profit; less taxes is net profit); the possible amount of profit (% of turnover, and in euros): The network approach vs the marketing mix (toolbox) thinking. Do remember the 2x2 matrix, below ! - the old school of marketing vs a new one, or - the old ...

... cover over fixed costs; less fixed costs is gross profit; less taxes is net profit); the possible amount of profit (% of turnover, and in euros): The network approach vs the marketing mix (toolbox) thinking. Do remember the 2x2 matrix, below ! - the old school of marketing vs a new one, or - the old ...

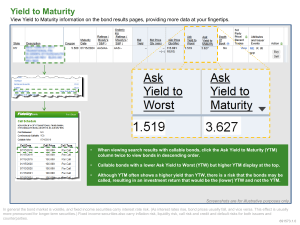

Yield to Maturity

... In general the bond market is volatile, and fixed income securities carry interest rate risk. (As interest rates rise, bond prices usually fall, and vice versa. This effect is usually more pronounced for longer-term securities.) Fixed income securities also carry inflation risk, liquidity risk, call ...

... In general the bond market is volatile, and fixed income securities carry interest rate risk. (As interest rates rise, bond prices usually fall, and vice versa. This effect is usually more pronounced for longer-term securities.) Fixed income securities also carry inflation risk, liquidity risk, call ...

Investment

... inputs like administration, management, R&D, marketing and human capital from the parent company. ...

... inputs like administration, management, R&D, marketing and human capital from the parent company. ...

FIN 331 Chapter 1

... throughout their entire market, operate depository facilities in certain neighborhoods, and collect data about lending habits to be periodically reported to federal supervisory agencies. These agencies use CRA ratings when evaluating applications for mergers and ...

... throughout their entire market, operate depository facilities in certain neighborhoods, and collect data about lending habits to be periodically reported to federal supervisory agencies. These agencies use CRA ratings when evaluating applications for mergers and ...

PRESS RELEASE 26th of May Astana The DBK changes the

... order to become the best bank in the country for long-term financing in tenge. Development Bank of Kazakhstan (hereinafter – the Bank, the DBK) has fostered its efforts to optimization of lending procedures for the purposes of more effective work with the borrowers. Thus, from the beginning of the y ...

... order to become the best bank in the country for long-term financing in tenge. Development Bank of Kazakhstan (hereinafter – the Bank, the DBK) has fostered its efforts to optimization of lending procedures for the purposes of more effective work with the borrowers. Thus, from the beginning of the y ...

Global Real Estate Fund

... (b) Commercial property transaction charges are higher than those which apply in other asset classes. A high volume of transactions would have a material impact on fund returns. (c) Property valuation is a matter of judgement by an independent valuer and is therefore a matter of the valuer's opinion ...

... (b) Commercial property transaction charges are higher than those which apply in other asset classes. A high volume of transactions would have a material impact on fund returns. (c) Property valuation is a matter of judgement by an independent valuer and is therefore a matter of the valuer's opinion ...

Electronically Traded Funds

... • Each company in the index is weighted based on it’s value or “market capitalization.” • If a company has 35 million shares outstanding, each with a market value of $100, the company's market capitalization is ...

... • Each company in the index is weighted based on it’s value or “market capitalization.” • If a company has 35 million shares outstanding, each with a market value of $100, the company's market capitalization is ...