privatization process

... Voucher participants and investment privatization funds ordered shares. Investment funds could hold at most 20 % of company This orders was collected and processed in Center for voucher privatization It led to several situations ...

... Voucher participants and investment privatization funds ordered shares. Investment funds could hold at most 20 % of company This orders was collected and processed in Center for voucher privatization It led to several situations ...

NBER WORKING PAPER SERIES FIRM DYNAMICS AND FINANCIAL DEVELOPMENT Cristina Arellano Yan Bai

... growth rate and debt financing, after controlling for a large set of fixed effects. For additional robustness of the results, we also include in the investigation measures that control for the two other leading theories for firm dynamics, which are based on selection mechanisms and mean reversion in ...

... growth rate and debt financing, after controlling for a large set of fixed effects. For additional robustness of the results, we also include in the investigation measures that control for the two other leading theories for firm dynamics, which are based on selection mechanisms and mean reversion in ...

Manager-Led Group Meetings: A Context for Promoting Employee

... Voice in meetings refers to the degree to which managers encourage employees to speak up in workgroup meetings and provide them with adequate time to express their thoughts and ideas in that setting (Appelbaum, Hebert, & Leroux, 1999; Gordon & Infante, 1980). Instead of simply asking for feedback on ...

... Voice in meetings refers to the degree to which managers encourage employees to speak up in workgroup meetings and provide them with adequate time to express their thoughts and ideas in that setting (Appelbaum, Hebert, & Leroux, 1999; Gordon & Infante, 1980). Instead of simply asking for feedback on ...

Cost of capital and earnings transparency

... If greater earnings transparency is associated with lower cost of capital, we should observe a negative relation between our earnings transparency measure and subsequent returns. We test whether this is the case using two approaches. The first tests for a relation between earnings transparency and su ...

... If greater earnings transparency is associated with lower cost of capital, we should observe a negative relation between our earnings transparency measure and subsequent returns. We test whether this is the case using two approaches. The first tests for a relation between earnings transparency and su ...

Global perspectives: 2016 REIT report

... capital; rather, owners took advantage of the SOCIMI structure as a more favorable tax wrapper in which to hold existing assets. In 2014, four SOCIMIs listed on the Continuo (main) market, raising US$3.6b of equity capital.6 This group has seen its market cap grow 72% to US$6.2b7 today. Transaction ...

... capital; rather, owners took advantage of the SOCIMI structure as a more favorable tax wrapper in which to hold existing assets. In 2014, four SOCIMIs listed on the Continuo (main) market, raising US$3.6b of equity capital.6 This group has seen its market cap grow 72% to US$6.2b7 today. Transaction ...

reporting period

... An economic downturn leads to tension and pressure. Companies are currently under severe pressure. Thousands of people have lost their jobs this year. For that matter, the distribution sector experienced this as well. There was also tension and pressure within the food chain: the milk crisis and the ...

... An economic downturn leads to tension and pressure. Companies are currently under severe pressure. Thousands of people have lost their jobs this year. For that matter, the distribution sector experienced this as well. There was also tension and pressure within the food chain: the milk crisis and the ...

Atlantia Low risk, high return

... end-2008 for Autostrade per l’Italia or ASPI, representing ca. 90% of Atlantia Group’s revenues and EBITDA) of the first update of the relevant concessionaire’s financial plan, or, upon the first periodical revision of the concession contract subsequent to the entry into force of the new legislation ...

... end-2008 for Autostrade per l’Italia or ASPI, representing ca. 90% of Atlantia Group’s revenues and EBITDA) of the first update of the relevant concessionaire’s financial plan, or, upon the first periodical revision of the concession contract subsequent to the entry into force of the new legislation ...

DIVIDEND POLICY AND FIRMS` PERFORMANCE: A CASE OF

... that bank size, CEO duality banks age of listing since IPO, capital adequacy and growth in sales revenue are significant determinants of banks performance in Ghana. Surprisingly, inflation and leverage proved insignificant in determining banks performance for the present study. As way of robustness ...

... that bank size, CEO duality banks age of listing since IPO, capital adequacy and growth in sales revenue are significant determinants of banks performance in Ghana. Surprisingly, inflation and leverage proved insignificant in determining banks performance for the present study. As way of robustness ...

On the interplay between speculative bubbles and productive

... and production than at the bubbleless steady state. This result is consistent with empirical evidence showing that bubbles occur in periods of large GDP growth. The underlying mechanism is based on the interaction between two e¤ects, a credit e¤ect and a crowding-out e¤ect. The …rst one corresponds ...

... and production than at the bubbleless steady state. This result is consistent with empirical evidence showing that bubbles occur in periods of large GDP growth. The underlying mechanism is based on the interaction between two e¤ects, a credit e¤ect and a crowding-out e¤ect. The …rst one corresponds ...

The Good, the Bad, and the Ugly: An inquiry into the causes and

... creating a boom and leading to an improvement in borrower net worth. During a boom, with an improved net worth, the agents are now able to finance the Bad projects. The credit is now redirected from the Good to the Bad. This change in the composition of credit and of investment at the peak of the bo ...

... creating a boom and leading to an improvement in borrower net worth. During a boom, with an improved net worth, the agents are now able to finance the Bad projects. The credit is now redirected from the Good to the Bad. This change in the composition of credit and of investment at the peak of the bo ...

How Ownership Structure Affects Capital Structure and Firm

... Bajaj et al. (1998) argued that ownership5 is positively correlated with indices of firm performance and also with various measures of the debt-equity ratio6; ownership is however negatively correlated with perquisite consumption per unit of investment.7 The latter is labelled as a measure for the d ...

... Bajaj et al. (1998) argued that ownership5 is positively correlated with indices of firm performance and also with various measures of the debt-equity ratio6; ownership is however negatively correlated with perquisite consumption per unit of investment.7 The latter is labelled as a measure for the d ...

Download attachment

... come under attack as not only unaffordable but as also constraints or distortions on the ‘‘new’’ global economy. Not only is the assessment neoliberal, because it accepts and prefers a reality of marketisation within the economy at large to which one must simply conform and within which labour and i ...

... come under attack as not only unaffordable but as also constraints or distortions on the ‘‘new’’ global economy. Not only is the assessment neoliberal, because it accepts and prefers a reality of marketisation within the economy at large to which one must simply conform and within which labour and i ...

Zephyr Analytics API - Informa Investment Solutions

... Rolling, expanding, and simple date range windows are available for all statistics ...

... Rolling, expanding, and simple date range windows are available for all statistics ...

FSB Securities Lending and Repos: Market Overview and Financial

... on the total amount of non-cash collateral available to them. “Collateral mining” refers to the practice whereby banks and broker-dealers obtain and exchange securities in order to collateralise their other activities. 17 Increasingly, banks and broker-dealers are seeking to centralise collateral ma ...

... on the total amount of non-cash collateral available to them. “Collateral mining” refers to the practice whereby banks and broker-dealers obtain and exchange securities in order to collateralise their other activities. 17 Increasingly, banks and broker-dealers are seeking to centralise collateral ma ...

Accounting for Financial Instruments: Difficulties with Fair Value

... financial institutions had to account for large losses during that time and claimed that FASB’s standards amplified their financial troubles (Nelson). Although it was hardly FASB’s fault for the financial crisis, the Board recognized that there were gaps and inconsistencies in the standards, such as ...

... financial institutions had to account for large losses during that time and claimed that FASB’s standards amplified their financial troubles (Nelson). Although it was hardly FASB’s fault for the financial crisis, the Board recognized that there were gaps and inconsistencies in the standards, such as ...

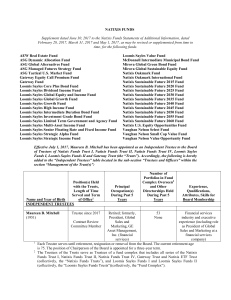

LOOMIS SAYLES VALUE FUND Supplement dated April 19, 2017 to

... Funds I or Loomis Sayles Funds II listed above (each, a “Trust” and together, the “Trusts,” with each series being known as a “Fund”). This Statement is not a prospectus and is authorized for distribution only when accompanied or preceded by each Fund’s Summary or Statutory Prospectus, each dated Ma ...

... Funds I or Loomis Sayles Funds II listed above (each, a “Trust” and together, the “Trusts,” with each series being known as a “Fund”). This Statement is not a prospectus and is authorized for distribution only when accompanied or preceded by each Fund’s Summary or Statutory Prospectus, each dated Ma ...

Dividend Policy, Strategy and Analysis

... to shareholders rather than being routinely reinvested to expand old businesses or diversify into new. Economists tell us that a company’s dividend policy will have no effect on its stock price. How can that be? If it is a mature company, shareholders rightly expect it to pay out a high percentage o ...

... to shareholders rather than being routinely reinvested to expand old businesses or diversify into new. Economists tell us that a company’s dividend policy will have no effect on its stock price. How can that be? If it is a mature company, shareholders rightly expect it to pay out a high percentage o ...

electronic reporting specification * qtfn and abn pc spreadsheet

... The QTFN report is an approved form under section 388-50 of Schedule 1 to the TAA 1953. Consequently, investment bodies that fail to lodge their QTFN report by the due date may be subjected to either administrative penalties or prosecution. An administrative penalty for the late lodgment of an appro ...

... The QTFN report is an approved form under section 388-50 of Schedule 1 to the TAA 1953. Consequently, investment bodies that fail to lodge their QTFN report by the due date may be subjected to either administrative penalties or prosecution. An administrative penalty for the late lodgment of an appro ...

the impact of foreign direct investment on economic

... Interestingly there are some arguments about whether FDI is really beneficial and how significant this benefit is to economic growth some critical proponents have said that in the cost of benefit analysis context, the less accuring to the host countries as a result of FDI outweighs the guaranteed be ...

... Interestingly there are some arguments about whether FDI is really beneficial and how significant this benefit is to economic growth some critical proponents have said that in the cost of benefit analysis context, the less accuring to the host countries as a result of FDI outweighs the guaranteed be ...

Annual report 2015/16

... personal medical conditions. Coloplast works closely with users to develop solutions that consider their special needs. Coloplast calls this intimate healthcare. Coloplast markets and sells its products and services globally, and in most markets the products are eligible for reimbursement from local ...

... personal medical conditions. Coloplast works closely with users to develop solutions that consider their special needs. Coloplast calls this intimate healthcare. Coloplast markets and sells its products and services globally, and in most markets the products are eligible for reimbursement from local ...

Gift Acceptance Policy - West Central Initiative

... The relationship between a client donor and WCI shall be consistent with those outlined in the WCI Operational Guidelines (see TAB 2, Resolution of the Board of Directors of West Central Initiative). In all cases, individual donor gift information will be kept confidential, and donors are always enc ...

... The relationship between a client donor and WCI shall be consistent with those outlined in the WCI Operational Guidelines (see TAB 2, Resolution of the Board of Directors of West Central Initiative). In all cases, individual donor gift information will be kept confidential, and donors are always enc ...

DOCX file of IMPACT-Australia: Investment for social and

... are told here. We are also inspired by growth and development overseas, particularly in the US and the UK. Australia needs new and innovative ways to finance efficient and effective social remedies. Government and philanthropy, the traditional funders, can only achieve so much on their own. Lack of ...

... are told here. We are also inspired by growth and development overseas, particularly in the US and the UK. Australia needs new and innovative ways to finance efficient and effective social remedies. Government and philanthropy, the traditional funders, can only achieve so much on their own. Lack of ...