Changes in Ownership Structure

... Mutual insurers have no publicly traded ownership rights. As such, mutual insurers have obtained additional capital in two primary ways other than demutualization: (1) establishing a publicly owned subsidiary (e.g., Metropolitan Life), and (2) issuing surplus notes (e.g., John Hancock). In a survey ...

... Mutual insurers have no publicly traded ownership rights. As such, mutual insurers have obtained additional capital in two primary ways other than demutualization: (1) establishing a publicly owned subsidiary (e.g., Metropolitan Life), and (2) issuing surplus notes (e.g., John Hancock). In a survey ...

The Development of a European Capital Market

... for Invisible Transactions has for instance been invited to make a "Study on the Improvement of Capital Markets", the results of which are to be published shortly. In addition, the underlying purpose of the Group's work differs from what was aimed at in most of these other studies, which set out to ...

... for Invisible Transactions has for instance been invited to make a "Study on the Improvement of Capital Markets", the results of which are to be published shortly. In addition, the underlying purpose of the Group's work differs from what was aimed at in most of these other studies, which set out to ...

International Financial Stability - International Center for Monetary

... CEPR is a registered educational charity. Institutional (core) finance for the Centre is provided by the European Central Bank, the Bank of England, 33 other national central banks, 36 companies and the European Commission. None of these organizations gives prior review to the Centre’s publications, ...

... CEPR is a registered educational charity. Institutional (core) finance for the Centre is provided by the European Central Bank, the Bank of England, 33 other national central banks, 36 companies and the European Commission. None of these organizations gives prior review to the Centre’s publications, ...

2006 Annual Report - Media Corporate IR Net

... This strong financial performance has enabled us to continue our record of returning capital to shareholders. 2006 was our 29th consecutive year of raising our quarterly dividend, which increased by 12 percent to $0.56. Over that time, our dividend has increased at a compound annual growth rate of 1 ...

... This strong financial performance has enabled us to continue our record of returning capital to shareholders. 2006 was our 29th consecutive year of raising our quarterly dividend, which increased by 12 percent to $0.56. Over that time, our dividend has increased at a compound annual growth rate of 1 ...

Introduction to Credit Risk Modeling, An

... be that the analyst should reject the deal based on the information she or he has about the company and the current market situation. An alternative would be to grant the loan to the customer but to insure the loss potentially arising from the engagement by means of some credit risk management instr ...

... be that the analyst should reject the deal based on the information she or he has about the company and the current market situation. An alternative would be to grant the loan to the customer but to insure the loss potentially arising from the engagement by means of some credit risk management instr ...

CONFIDENTIAL PRIVATE PLACEMENT MEMORANDUM

... Corporation (hereinafter referred to as the “COMPANY”), is offering by means of this Confidential Private Placement Memorandum a minimum of F o u r (4) and a maximum of Two Hundred (200) Unsecured Promissory Notes (“Notes”) at an offering price of Five Hundred Thousand ($500,000) Dollars per Note, f ...

... Corporation (hereinafter referred to as the “COMPANY”), is offering by means of this Confidential Private Placement Memorandum a minimum of F o u r (4) and a maximum of Two Hundred (200) Unsecured Promissory Notes (“Notes”) at an offering price of Five Hundred Thousand ($500,000) Dollars per Note, f ...

Risk Management, Governance, Culture, and Risk Taking in

... activities so that it would have to give up projects. A lower rating than A might make it impossible for the bank to keep engaging in value-creating activities. This might be the case, for instance, if potential counterparties are not willing to transact with it if it has such a rating. A bank with ...

... activities so that it would have to give up projects. A lower rating than A might make it impossible for the bank to keep engaging in value-creating activities. This might be the case, for instance, if potential counterparties are not willing to transact with it if it has such a rating. A bank with ...

Timing the Treasury Bond Market

... Since the model uses indicators to decide in which security to invest, it uses patterns from historic data. Hence, the model performs a technical analysis to time the market. As opposed to fundamental analysis, which involves analyzing the intrinsic value of a company, technical analysis is the stud ...

... Since the model uses indicators to decide in which security to invest, it uses patterns from historic data. Hence, the model performs a technical analysis to time the market. As opposed to fundamental analysis, which involves analyzing the intrinsic value of a company, technical analysis is the stud ...

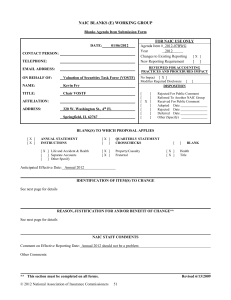

naic blanks (e) working group - National Association of Insurance

... Bonds are to be grouped as listed below and each category arranged alphabetically (securities included in U.S. States, Territories and Possessions; U.S. Political Subdivisions of States, Territories and Possessions; and U.S. Special Revenue and Special Assessment Obligations and all Non-Guaranteed O ...

... Bonds are to be grouped as listed below and each category arranged alphabetically (securities included in U.S. States, Territories and Possessions; U.S. Political Subdivisions of States, Territories and Possessions; and U.S. Special Revenue and Special Assessment Obligations and all Non-Guaranteed O ...

Total Produ let`s grow to

... The Annual General Meeting of the Company will take place at the Radisson SAS Royal Hotel, Golden Lane, Dublin 8 on Thursday 20 May 2010 at 10.30 a.m. Notice of the meeting is set out on pages 104 to 106 and a personalised proxy form is included in the mailing to shareholders of this annual report. ...

... The Annual General Meeting of the Company will take place at the Radisson SAS Royal Hotel, Golden Lane, Dublin 8 on Thursday 20 May 2010 at 10.30 a.m. Notice of the meeting is set out on pages 104 to 106 and a personalised proxy form is included in the mailing to shareholders of this annual report. ...

Corporate Governance Reforms around the World

... their self-appointed agents. The corporate governance literature has identified two general ways in which professional managers can exploit the confidence bestowed on them (Gedajlovic & Shapiro, 1998). The first of these is generally known as on-the-job consumption (Williamson, 1964), and involves m ...

... their self-appointed agents. The corporate governance literature has identified two general ways in which professional managers can exploit the confidence bestowed on them (Gedajlovic & Shapiro, 1998). The first of these is generally known as on-the-job consumption (Williamson, 1964), and involves m ...

SSQ GUARANTEED INVESTMENT FUND GUARANTEES

... upon death on all investments in SSQ GIFs. If you wish, for an additional fee, you may increase your guarantee option and insure 100% of your capital upon maturity or 100% upon death. In addition, segregated funds may protect your assets in the event of personal bankruptcy. Contracts issued by insur ...

... upon death on all investments in SSQ GIFs. If you wish, for an additional fee, you may increase your guarantee option and insure 100% of your capital upon maturity or 100% upon death. In addition, segregated funds may protect your assets in the event of personal bankruptcy. Contracts issued by insur ...

Accruals, Financial Distress, and Debt Covenants Troy D. Janes

... extreme accruals are more likely to become distressed than firms with moderate accruals. This paper also examines one possible use of the information in accruals by commercial lenders. Results indicate that lenders do not fully consider the relation between accruals and financial distress when setti ...

... extreme accruals are more likely to become distressed than firms with moderate accruals. This paper also examines one possible use of the information in accruals by commercial lenders. Results indicate that lenders do not fully consider the relation between accruals and financial distress when setti ...

Chapter 1 - We can offer most test bank and solution manual you

... 8. Risk in terms of financial returns reflects an investor’s uncertainty about economic gains or losses that will result from a particular investment. ANS: T PTS: 1 DIF: Easy OBJ: Knowledge NOT: AACSB: Business Knowledge & Analytical Skills | Management: Strategy | Dierdorff & Rubin: Foundational sk ...

... 8. Risk in terms of financial returns reflects an investor’s uncertainty about economic gains or losses that will result from a particular investment. ANS: T PTS: 1 DIF: Easy OBJ: Knowledge NOT: AACSB: Business Knowledge & Analytical Skills | Management: Strategy | Dierdorff & Rubin: Foundational sk ...

The Impact of Market Sentiment Index on Stock

... shown that Malaysian investor sentiment index could be measured by an equation of seven market variables. Using regression analysis and controlling for firm size, market-tobook ratio, financial leverage and growth opportunity, this index is shown to be able to predict Kuala Lumpur Composite Index (K ...

... shown that Malaysian investor sentiment index could be measured by an equation of seven market variables. Using regression analysis and controlling for firm size, market-tobook ratio, financial leverage and growth opportunity, this index is shown to be able to predict Kuala Lumpur Composite Index (K ...

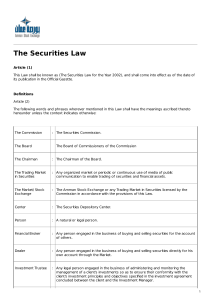

The Securities Law

... of the provisions of this Law or the regulations, instructions and decisions issued pursuant thereto. B. The Commission may investigate, through the competent entity therein, any information, circumstances or practices it deems necessary and appropriate for the implementation of the provisions of th ...

... of the provisions of this Law or the regulations, instructions and decisions issued pursuant thereto. B. The Commission may investigate, through the competent entity therein, any information, circumstances or practices it deems necessary and appropriate for the implementation of the provisions of th ...

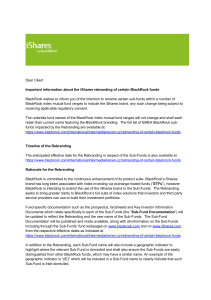

BlackRock funds rebranding to iShares

... highlight where the relevant Sub-Fund is domiciled and shall also ensure the Sub-Funds are easily distinguished from other BlackRock funds, which may have a similar name. An example of the geographic indicator is “(IE)” which will be included in a Sub-Fund name to clearly indicate that such Sub-Fund ...

... highlight where the relevant Sub-Fund is domiciled and shall also ensure the Sub-Funds are easily distinguished from other BlackRock funds, which may have a similar name. An example of the geographic indicator is “(IE)” which will be included in a Sub-Fund name to clearly indicate that such Sub-Fund ...

LESSON 13: FACTORING – THEORETICAL FRAMEWORK

... the Unification of Private Law (UNIDROIT), Rome during 1988 recommended, in simple words, the definition of factoring as under: “Factoring means an arrangement between a factor and his client which includes at least two of the following services to be provided by the factor: ...

... the Unification of Private Law (UNIDROIT), Rome during 1988 recommended, in simple words, the definition of factoring as under: “Factoring means an arrangement between a factor and his client which includes at least two of the following services to be provided by the factor: ...

capital - International Actuarial Association

... measurement method and targets are selected, the calculations can never be as precise as implied by the final number determined as an x% or y% confidence level. For this reason, an important consideration is whether the measure used is able to correctly identify companies who are at an unacceptably ...

... measurement method and targets are selected, the calculations can never be as precise as implied by the final number determined as an x% or y% confidence level. For this reason, an important consideration is whether the measure used is able to correctly identify companies who are at an unacceptably ...

united states securities and exchange commission - corporate

... to have higher standards and better quality products. Six Sigma embodies the principles of total quality management that focus on measuring results and reducing product or service failure rates to 3.4 per million. All aspects of a Six Sigma company’s infrastructure must be analyzed, and if necessary ...

... to have higher standards and better quality products. Six Sigma embodies the principles of total quality management that focus on measuring results and reducing product or service failure rates to 3.4 per million. All aspects of a Six Sigma company’s infrastructure must be analyzed, and if necessary ...

Reinsurance Market Report

... approximately a 2.6 percentage point impact after tax on the aggregate annualised RoE (FY 2015: 0.9 percentage points). ...

... approximately a 2.6 percentage point impact after tax on the aggregate annualised RoE (FY 2015: 0.9 percentage points). ...

Document

... fit theory suggests that individuals holding protean career orientation will be more satisfied in protean and boundaryless environments whereas individuals holding traditional hierarchical attitudes will be more satisfied in traditional hierarchical environments. Exploring the prospect relationship ...

... fit theory suggests that individuals holding protean career orientation will be more satisfied in protean and boundaryless environments whereas individuals holding traditional hierarchical attitudes will be more satisfied in traditional hierarchical environments. Exploring the prospect relationship ...

Cost Accounting, 13e (Horngren et al

... 11) An Enterprise Resource Planning (ERP) System is a single database that collects data and feeds into applications that support each of the company's business activities, such as purchases, production, distribution, and sales. Answer: TRUE Diff: 1 Terms: management accounting Objective: 1 AACSB: U ...

... 11) An Enterprise Resource Planning (ERP) System is a single database that collects data and feeds into applications that support each of the company's business activities, such as purchases, production, distribution, and sales. Answer: TRUE Diff: 1 Terms: management accounting Objective: 1 AACSB: U ...