Risk And Return - Thunderbird Trust

... Risk And Return Always a Tradeoff!! Higher Risk High Potential Return ...

... Risk And Return Always a Tradeoff!! Higher Risk High Potential Return ...

Econometrics of Financial Markets

... other than stock returns. f) Chapter 8. Dynamic equilibrium models which can generate persistent time-variation in expected returns. g) Chapters 10 and 11. Same approach is used to separate a basic treatment of fixed-income securities in Ch.10 from a discussion of equilibrium term-structure models i ...

... other than stock returns. f) Chapter 8. Dynamic equilibrium models which can generate persistent time-variation in expected returns. g) Chapters 10 and 11. Same approach is used to separate a basic treatment of fixed-income securities in Ch.10 from a discussion of equilibrium term-structure models i ...

position description - the Bay of Plenty District Health Board

... Establishes and maintains effective internal and external relationships. Is dedicated to listening to understanding and recognising the needs of others. ...

... Establishes and maintains effective internal and external relationships. Is dedicated to listening to understanding and recognising the needs of others. ...

opn tax free investment account

... to the correctness, accuracy or completeness of the information and opinions. We do not undertake to update, modify or amend the information on a frequent basis or to advise any person if such information subsequently becomes inaccurate. In the event that specific collective investment schemes in se ...

... to the correctness, accuracy or completeness of the information and opinions. We do not undertake to update, modify or amend the information on a frequent basis or to advise any person if such information subsequently becomes inaccurate. In the event that specific collective investment schemes in se ...

Now - CT Corporation

... estate’s new status as a standalone investment class. This includes renewed investor attention as well as newer sources of capital, such as small and mid-cap equity funds, new mutual funds, ETFs and institutional investors that have yet to invest in listed real estate. New tax incentives for U.S. RE ...

... estate’s new status as a standalone investment class. This includes renewed investor attention as well as newer sources of capital, such as small and mid-cap equity funds, new mutual funds, ETFs and institutional investors that have yet to invest in listed real estate. New tax incentives for U.S. RE ...

Vanguard High Growth Index Fund

... (No minimums apply for platforms) For platform availability visit vanguard.com.au/mastertrust ...

... (No minimums apply for platforms) For platform availability visit vanguard.com.au/mastertrust ...

Lecture # 29

... they want. Rule makers adopt one type of vision, rule takers adopt another and rule breakers, yet another. Rule makers will adopt a vision in which they dominate and set the rules in a given market. Rule takers will adapt a vision in which they are industry leaders but perennially less than first-pl ...

... they want. Rule makers adopt one type of vision, rule takers adopt another and rule breakers, yet another. Rule makers will adopt a vision in which they dominate and set the rules in a given market. Rule takers will adapt a vision in which they are industry leaders but perennially less than first-pl ...

The Weekly Brief 03-13-17 - Paramount Wealth Management

... “Making good decisions involves hard work. Important decisions are made in the face of great uncertainty, and often under time pressure. The world is a complex place: People and organizations respond to any decision, working together or against one another, in ways that defy comprehension. There are ...

... “Making good decisions involves hard work. Important decisions are made in the face of great uncertainty, and often under time pressure. The world is a complex place: People and organizations respond to any decision, working together or against one another, in ways that defy comprehension. There are ...

Private Placements

... Corporation (“DTCC”) since 2001. Today, we provide custody and brokerage services for billions of dollars of investor assets and provide services to thousands of financial professionals and institutions worldwide on both a full service and a technology licensed basis. With access to proven highly sc ...

... Corporation (“DTCC”) since 2001. Today, we provide custody and brokerage services for billions of dollars of investor assets and provide services to thousands of financial professionals and institutions worldwide on both a full service and a technology licensed basis. With access to proven highly sc ...

Markets look abroad for opportunities.

... This material is not a recommendation to buy, sell, hold or roll over any asset, adopt an investment strategy, retain a specific investment manager or use a particular account type. It does not take into account the specific investment objectives, tax and financial condition or particular needs of a ...

... This material is not a recommendation to buy, sell, hold or roll over any asset, adopt an investment strategy, retain a specific investment manager or use a particular account type. It does not take into account the specific investment objectives, tax and financial condition or particular needs of a ...

Asset Enhancement CPF INVESTMENT GUIDELINES (CPFIG

... Paras 4.1 and 4.2 do not apply to unrated debt securities issued by Singapore-incorporated issuers8 and Singapore statutory boards. FMCs may invest in all such debt securities until such time as is stated otherwise. Nevertheless, the single entity limit for these unrated corporate debt securities is ...

... Paras 4.1 and 4.2 do not apply to unrated debt securities issued by Singapore-incorporated issuers8 and Singapore statutory boards. FMCs may invest in all such debt securities until such time as is stated otherwise. Nevertheless, the single entity limit for these unrated corporate debt securities is ...

Investments Lecture Notes

... that the investor can exert a controlling influence over the investee. An investor who owns more than 50% of a company's voting stock has control over the investee. This investor can dominate all other shareholders in electing the corporation's board of directors and has control over the investee's ...

... that the investor can exert a controlling influence over the investee. An investor who owns more than 50% of a company's voting stock has control over the investee. This investor can dominate all other shareholders in electing the corporation's board of directors and has control over the investee's ...

How do internal controls and self

... efficient. Since we started to work on this system, a number of ...

... efficient. Since we started to work on this system, a number of ...

xxxxxxxx File Notes

... both principal and interest as a result of the LIBOR rigging, which involved the largest and oldest banks in the world. 1.8. Lehman Brothers sought Bankruptcy protection in 2008. It is being rapped up now with hundreds of unanswered questions. But one thing that is certain is that Lehman was most pr ...

... both principal and interest as a result of the LIBOR rigging, which involved the largest and oldest banks in the world. 1.8. Lehman Brothers sought Bankruptcy protection in 2008. It is being rapped up now with hundreds of unanswered questions. But one thing that is certain is that Lehman was most pr ...

Investment Properties

... under a finance lease) to earn rentals or for capital appreciation or both rather than for: Use in the production or supply of goods or services or for administrative purposes; or Sale in the ordinary course of business ...

... under a finance lease) to earn rentals or for capital appreciation or both rather than for: Use in the production or supply of goods or services or for administrative purposes; or Sale in the ordinary course of business ...

85 Weighted average assumptions used to determine net periodic

... corresponding to the Company’s benefit obligations and is subject to change each year. For non-U.S. plans, rates appropriate for each plan are determined based on investment-grade instruments with maturities approximately equal to the average expected benefit payout under the plan. During 2016, the ...

... corresponding to the Company’s benefit obligations and is subject to change each year. For non-U.S. plans, rates appropriate for each plan are determined based on investment-grade instruments with maturities approximately equal to the average expected benefit payout under the plan. During 2016, the ...

postfile_68952.doc

... management from an Asia Pacific perspective, aiming to gain new insights on different fields of management such as accounting, finance, organizational behavior, human resources, marketing, information management, e-commerce, productions and operations management, and corporate strategy. Research pap ...

... management from an Asia Pacific perspective, aiming to gain new insights on different fields of management such as accounting, finance, organizational behavior, human resources, marketing, information management, e-commerce, productions and operations management, and corporate strategy. Research pap ...

Today at Merrill Lynch, I began by reorganizing some old client files

... paying out a large portion of their earnings, their growth potential may be low. Stocks that do not pay out such high dividends can be classified as growth stocks. These companies have had steady increases in earnings over the years and provide a high return on equity. Lastly, value stocks are a pop ...

... paying out a large portion of their earnings, their growth potential may be low. Stocks that do not pay out such high dividends can be classified as growth stocks. These companies have had steady increases in earnings over the years and provide a high return on equity. Lastly, value stocks are a pop ...

Economist Insights GDP: Growth dependent payments

... The views expressed are as of February 2015 and are a general guide to the views of UBS Global Asset Management. This document does not replace portfolio and fund-specific materials. Commentary is at a macro or strategy level and is not with reference to any registered or other mutual fund. This doc ...

... The views expressed are as of February 2015 and are a general guide to the views of UBS Global Asset Management. This document does not replace portfolio and fund-specific materials. Commentary is at a macro or strategy level and is not with reference to any registered or other mutual fund. This doc ...

74 KB - Financial System Inquiry

... plain in the light of recent history, and were, to some extent, explored in Bird et al. (2010). Members of the Review would be well aware how research can be influenced by prior beliefs. The way in which the analysis is set up can heavily influence, or in extreme cases completely pre-determine, part ...

... plain in the light of recent history, and were, to some extent, explored in Bird et al. (2010). Members of the Review would be well aware how research can be influenced by prior beliefs. The way in which the analysis is set up can heavily influence, or in extreme cases completely pre-determine, part ...

Best-Practices-of-Asset-Management-Neighborworks-Part

... Top ten indicators valued by asset managers Most common problems in affordable housing Most valued partnerships and why How to get the most from your property ...

... Top ten indicators valued by asset managers Most common problems in affordable housing Most valued partnerships and why How to get the most from your property ...

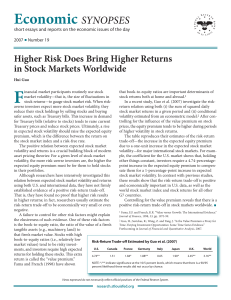

Higher Risk Does Bring Higher Returns in Stock Markets Worldwide

... prices, the equity premium tends to be higher during periods Treasury prices and reduce stock prices. Ultimately, a rise of higher volatility in stock returns. in expected stock volatility should raise the expected equity The table reproduces their estimates of the risk-return premium, which is the ...

... prices, the equity premium tends to be higher during periods Treasury prices and reduce stock prices. Ultimately, a rise of higher volatility in stock returns. in expected stock volatility should raise the expected equity The table reproduces their estimates of the risk-return premium, which is the ...

Q4 Carnegie Counselor - Carnegie Investment Counsel

... likely go to jail, trying to earn outsized arise. Every quarter different only public data for brings our research to very profits for his clients. While we are obstacles that force Carnegie to weigh avoid a similar fate.we’ll be pursuing committed to you, the anddata potential on to onlyrisks publi ...

... likely go to jail, trying to earn outsized arise. Every quarter different only public data for brings our research to very profits for his clients. While we are obstacles that force Carnegie to weigh avoid a similar fate.we’ll be pursuing committed to you, the anddata potential on to onlyrisks publi ...

offering supplement - Active Return Capital

... Form found as an Appendix to the Offering Supplement stating that they qualify as “Qualifying Investors” and that they have read and understood the risk warnings in the Offering Memorandum and in this Offering Supplement. In the case of joint holders, all holders should individually qualify as “Qual ...

... Form found as an Appendix to the Offering Supplement stating that they qualify as “Qualifying Investors” and that they have read and understood the risk warnings in the Offering Memorandum and in this Offering Supplement. In the case of joint holders, all holders should individually qualify as “Qual ...