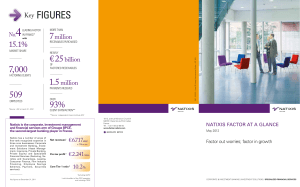

Key FIGURES - Natixis Factor

... Financing, Employee Savings Schemes, Payment, Securities services). ...

... Financing, Employee Savings Schemes, Payment, Securities services). ...

Document

... • THE SEPARATION THEOREM – to be somewhere on the CML, the investor initially • decides to invest and • based on risk preferences makes a separate financing decision either – to borrow or – to lend ...

... • THE SEPARATION THEOREM – to be somewhere on the CML, the investor initially • decides to invest and • based on risk preferences makes a separate financing decision either – to borrow or – to lend ...

10-CAPM

... • THE SEPARATION THEOREM – to be somewhere on the CML, the investor initially • decides to invest and • based on risk preferences makes a separate financing decision either – to borrow or – to lend ...

... • THE SEPARATION THEOREM – to be somewhere on the CML, the investor initially • decides to invest and • based on risk preferences makes a separate financing decision either – to borrow or – to lend ...

McGovern Financial Advisors, LLC Privacy Notice This Client

... “us,” or “firm”), a registered investment advisor firm in the business of providing financial planning and investment advisory services to clients. We are committed to safeguarding the confidential information of our clients. We hold all personal information provided to our firm in strictest confide ...

... “us,” or “firm”), a registered investment advisor firm in the business of providing financial planning and investment advisory services to clients. We are committed to safeguarding the confidential information of our clients. We hold all personal information provided to our firm in strictest confide ...

Chapter12Review

... d. The price-earnings ratio for one firm may be compared to the priceearnings ratio for all firms. e. A low price-earnings ratio indicates that a stock may be a good investment and a high price-earnings ratio may indicate that it is a poor investment. 4. Which of the following statement is not true? ...

... d. The price-earnings ratio for one firm may be compared to the priceearnings ratio for all firms. e. A low price-earnings ratio indicates that a stock may be a good investment and a high price-earnings ratio may indicate that it is a poor investment. 4. Which of the following statement is not true? ...

Personal Finance IQ

... 18. Corporations are required by law to pay a specified dollar amount per share to their common stock shareholders each year. 19. The administrative costs of managed equity mutual funds will generally be lower than for indexed equity funds because managed funds typically spend less on research and s ...

... 18. Corporations are required by law to pay a specified dollar amount per share to their common stock shareholders each year. 19. The administrative costs of managed equity mutual funds will generally be lower than for indexed equity funds because managed funds typically spend less on research and s ...

Great Panther shares higher, resumes mining at Topia, Mexico

... You understand that the Site may contain opinions from time to time with regard to securities mentioned in other products, including company related products, and that those opinions may be different from those obtained by using another product related to the Company. You understand and agree that ...

... You understand that the Site may contain opinions from time to time with regard to securities mentioned in other products, including company related products, and that those opinions may be different from those obtained by using another product related to the Company. You understand and agree that ...

1st Quarter 2015 Market Commentary

... portfolio provide a roadmap to follow in times of duress. Steps may need to be taken to ensure capital preservation, but must be weighed against their potential impact on long-term performance. Implementing a disciplined, strategic approach with portfolio allocation across varying asset classes is a ...

... portfolio provide a roadmap to follow in times of duress. Steps may need to be taken to ensure capital preservation, but must be weighed against their potential impact on long-term performance. Implementing a disciplined, strategic approach with portfolio allocation across varying asset classes is a ...

Graystone Consulting Contact List

... members on the 403(b) Retirement Plan here at St. Norbert College. Some of the services are: o Investment Fund Monitoring o Benchmark Plan Fees & Costs o On-Site Group Employee Meetings o One-on-One Employee Meetings (in-person or on phone) Graystone Consulting is a business of Morgan Stanley Gr ...

... members on the 403(b) Retirement Plan here at St. Norbert College. Some of the services are: o Investment Fund Monitoring o Benchmark Plan Fees & Costs o On-Site Group Employee Meetings o One-on-One Employee Meetings (in-person or on phone) Graystone Consulting is a business of Morgan Stanley Gr ...

Document

... products, systems, and management services, and the franchisee provides market knowledge, capital, and personal involvement in management ...

... products, systems, and management services, and the franchisee provides market knowledge, capital, and personal involvement in management ...

Armajaro presentation template - Globalserve International Network

... its clients to gain exposure to equity, foreign exchange, commodity and fixed income markets, with various degrees of capital risk. Armajaro Securities has established trading relationships with derivative market makers and note issuers in the City of London and across Europe, enabling us to offer o ...

... its clients to gain exposure to equity, foreign exchange, commodity and fixed income markets, with various degrees of capital risk. Armajaro Securities has established trading relationships with derivative market makers and note issuers in the City of London and across Europe, enabling us to offer o ...

Macro-economic environment - February 2015

... The impact of QE in the Eurozone is highly controversial. There is no guarantee that QE will work. Mario Draghi’s goal is to convince investors that he has a strategy big and bold enough to reinvigorate a depressed economy. Whether ECB purchases of government bonds will free up new lending space at ...

... The impact of QE in the Eurozone is highly controversial. There is no guarantee that QE will work. Mario Draghi’s goal is to convince investors that he has a strategy big and bold enough to reinvigorate a depressed economy. Whether ECB purchases of government bonds will free up new lending space at ...

As Interest Rates Rise, Muni Bonds` Unique Characteristics Matter

... Unique Characteristics Matter More This year, the Federal Reserve is likely to raise interest rates at least three times. The current rate hike cycle is the first in nearly a decade and after all those years of zero-bound rate policy, some investors may feel as though this is a step into uncharted t ...

... Unique Characteristics Matter More This year, the Federal Reserve is likely to raise interest rates at least three times. The current rate hike cycle is the first in nearly a decade and after all those years of zero-bound rate policy, some investors may feel as though this is a step into uncharted t ...

ENTERPRISE RISK MANAGEMENT

... Managed numbers can convey more, or less information Examples where signaling is important - Outside investors rely on accounting numbers to value the firm. Do “hedged” numbers convey more or less information - The profit or share price of a firm depends both on factors under the control of the ...

... Managed numbers can convey more, or less information Examples where signaling is important - Outside investors rely on accounting numbers to value the firm. Do “hedged” numbers convey more or less information - The profit or share price of a firm depends both on factors under the control of the ...

CHALLENGES OF IMPLEMENTING STRATEGIC CHANGE

... their strategies to gain competitive advantage and survive. Organizational change is a constant experience that is faced with a myriad of challenges. The main aim of this study was to determine the challenges of implementing strategic change at Green Forest Social Investment and establish measures p ...

... their strategies to gain competitive advantage and survive. Organizational change is a constant experience that is faced with a myriad of challenges. The main aim of this study was to determine the challenges of implementing strategic change at Green Forest Social Investment and establish measures p ...

Everything You Wanted to Know about Asset Management for

... reduce their projections of future earnings. At the same time, the fact that investors were taken by surprise would reduce their confidence and increase the discount rate. These two effects would reinforce each other and contribute to a sharp decline in the valuation of company shares. • Put simply, ...

... reduce their projections of future earnings. At the same time, the fact that investors were taken by surprise would reduce their confidence and increase the discount rate. These two effects would reinforce each other and contribute to a sharp decline in the valuation of company shares. • Put simply, ...

C01_Reilly1ce

... denominated in a currency different from that of the investor. – Changes in exchange rates affect the investors return when converting an investment back into the “home” currency. ...

... denominated in a currency different from that of the investor. – Changes in exchange rates affect the investors return when converting an investment back into the “home” currency. ...

US coastal conditions

... Conservation and Management Act, 1976 (MSA) - Claim rights over EEZ, 200 nautical mile limit - Establish 8 regional fisheries management councils - Used to promote long-term sustainable use of marine resource ...

... Conservation and Management Act, 1976 (MSA) - Claim rights over EEZ, 200 nautical mile limit - Establish 8 regional fisheries management councils - Used to promote long-term sustainable use of marine resource ...

water utilities management contracts – eca

... RFP 4.5.5. If the individual company or any of the Consortium partners constituting the Successful Bidder have submitted data, credentials, or any other information in their Technical Proposal Part VII (Information Forms of Annex E to this RFP) that are those of a parent company, the Company Managem ...

... RFP 4.5.5. If the individual company or any of the Consortium partners constituting the Successful Bidder have submitted data, credentials, or any other information in their Technical Proposal Part VII (Information Forms of Annex E to this RFP) that are those of a parent company, the Company Managem ...

pdf

... capture only a small fraction of the market return over time. For some reason, very few investors are prepared to put their money in equities, and with the fund managers they back, for the long haul. Why would that be? a) A large part of it is due to momentum investing. Many believe they ‘can ride ...

... capture only a small fraction of the market return over time. For some reason, very few investors are prepared to put their money in equities, and with the fund managers they back, for the long haul. Why would that be? a) A large part of it is due to momentum investing. Many believe they ‘can ride ...