Corporate Finance

... finances of a business is a corporate finance decision. Defined broadly, everything that a business does fits ...

... finances of a business is a corporate finance decision. Defined broadly, everything that a business does fits ...

Is it Still Worth Investing in Bonds

... investment portfolio for the purpose of generating high returns (though they have in fact done this over the last 30 years). Rather, the role of bonds is to increase diversification, as bonds tend to perform well when shares are doing badly and vice versa. So bonds help insulate against the worst ki ...

... investment portfolio for the purpose of generating high returns (though they have in fact done this over the last 30 years). Rather, the role of bonds is to increase diversification, as bonds tend to perform well when shares are doing badly and vice versa. So bonds help insulate against the worst ki ...

w/guild dbn circuit 712 - Methodist Youth Unit:Home

... based-donations or assessments, but – wealth through generous giving and entrepreneurship(upwardly mobile), thus promoting Youth Economic Empowerment. ...

... based-donations or assessments, but – wealth through generous giving and entrepreneurship(upwardly mobile), thus promoting Youth Economic Empowerment. ...

User Classes and Characteristics

... The managers also need much vital/ business critical information before processing any associates requests either for approval or rejections (as these decisions are based on various parameters), which eat up so much of their time and the associates need to wait for the request status for a long time ...

... The managers also need much vital/ business critical information before processing any associates requests either for approval or rejections (as these decisions are based on various parameters), which eat up so much of their time and the associates need to wait for the request status for a long time ...

Economic Update - IMA Michigan Council

... construed as (i) an offer to sell or solicitation of an offer to buy any security or (ii) a recommendation as to the advisability of investing in, purchasing or selling any security. Any opinions expressed herein reflect our judgment and are subject to change. Certain of the statements contained her ...

... construed as (i) an offer to sell or solicitation of an offer to buy any security or (ii) a recommendation as to the advisability of investing in, purchasing or selling any security. Any opinions expressed herein reflect our judgment and are subject to change. Certain of the statements contained her ...

Chapter 27 The Theory of Active Portfolio Management

... E. only clients with whom she has established long-term relationships, because she knows their personal preferences. The optimal portfolio will be the one with the highest reward-to-variability ratio. Investors can choose for themselves how they want to combine this portfolio with the risk-free asse ...

... E. only clients with whom she has established long-term relationships, because she knows their personal preferences. The optimal portfolio will be the one with the highest reward-to-variability ratio. Investors can choose for themselves how they want to combine this portfolio with the risk-free asse ...

how the p/e ratio can really help you

... Apart from the measurable quantitative factors, mentioned above, there are also non-measurable qualitative factors, such as management’s integrity, general capability, entrepreneurial flair and core values, the nature of the company’s business and future growth prospects. These are much more importa ...

... Apart from the measurable quantitative factors, mentioned above, there are also non-measurable qualitative factors, such as management’s integrity, general capability, entrepreneurial flair and core values, the nature of the company’s business and future growth prospects. These are much more importa ...

Industrial Metals as Investment - SummerHaven

... the Dollar index suggests that metals retain their positive return characteristics during periods of US Dollar decline. Finally, metals have a moderately positive correlation with unexpected inflation (22%) and inflation (13%). Thus, as previously shown for a broadly-diversified commodity portfolio, ...

... the Dollar index suggests that metals retain their positive return characteristics during periods of US Dollar decline. Finally, metals have a moderately positive correlation with unexpected inflation (22%) and inflation (13%). Thus, as previously shown for a broadly-diversified commodity portfolio, ...

New Investment Portfolios

... which seeks to provide long-term capital appreciation. The fund invests mainly in stocks of small companies. These companies tend to be unseasoned but are considered by the fund’s advisors to have superior growth potential. Dodge & Cox International Stock 529 Portfolio – Invests exclusively in the D ...

... which seeks to provide long-term capital appreciation. The fund invests mainly in stocks of small companies. These companies tend to be unseasoned but are considered by the fund’s advisors to have superior growth potential. Dodge & Cox International Stock 529 Portfolio – Invests exclusively in the D ...

Understanding Financial Statements

... 1. Profitability -its ability to earn income and sustain growth in both the short-term and long-term. A company's degree of profitability is usually based on the Statement of Financial Performance which reports on the company's results of operations; 2. Solvency and Liquidity - its ability to pay it ...

... 1. Profitability -its ability to earn income and sustain growth in both the short-term and long-term. A company's degree of profitability is usually based on the Statement of Financial Performance which reports on the company's results of operations; 2. Solvency and Liquidity - its ability to pay it ...

vinergy resources ltd. - Canadian Securities Exchange

... such as "could", "should", "expect", "believe", "will" and similar expressions and statements relating to matters that are not historical facts but are forward-looking statements. Such forward-looking statements are subject to both known and unknown risks and uncertainties which may cause the actual ...

... such as "could", "should", "expect", "believe", "will" and similar expressions and statements relating to matters that are not historical facts but are forward-looking statements. Such forward-looking statements are subject to both known and unknown risks and uncertainties which may cause the actual ...

Accounts Asst II

... short statement linking the position to the mission and goals of the organization and specifying the outputs of the positions. Duties should be presented in decreasing order of percentage of time spent on them, or in order of relative importance): Purpose: The purpose of the work is to facilitate ju ...

... short statement linking the position to the mission and goals of the organization and specifying the outputs of the positions. Duties should be presented in decreasing order of percentage of time spent on them, or in order of relative importance): Purpose: The purpose of the work is to facilitate ju ...

Ethics of the Financial Professional

... 9.3.2. Dreier swindled $400 million from _________________________________________ by selling $700 million of _________________________________________________ . 9.3.3. Dreier’s story is told in the 2011 documentary, Unraveled. 10. Web Challenge #1: If financial professionals are compensated when th ...

... 9.3.2. Dreier swindled $400 million from _________________________________________ by selling $700 million of _________________________________________________ . 9.3.3. Dreier’s story is told in the 2011 documentary, Unraveled. 10. Web Challenge #1: If financial professionals are compensated when th ...

Read on… - Insured Investment Brokers

... So what does it mean for the investor? Extreme volatility in the Rand can translate into sizeable profits or losses over the short term and in turn increase the risk in your portfolio. Your asset manager should essentially be able to successfully tap into offshore investing opportunities for better ...

... So what does it mean for the investor? Extreme volatility in the Rand can translate into sizeable profits or losses over the short term and in turn increase the risk in your portfolio. Your asset manager should essentially be able to successfully tap into offshore investing opportunities for better ...

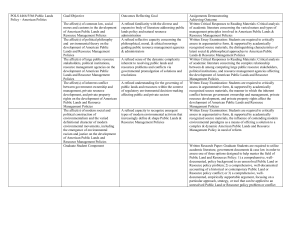

POLS 4466/5566 Public Lands Policy

... recognized source materials, the distinguishing characteristics of latent social & philosophical approaches to American Public Lands & Resource Management Policies Written Critical Responses to Reading Materials: Critical analysis of academic literature concerning the complex relationship between & ...

... recognized source materials, the distinguishing characteristics of latent social & philosophical approaches to American Public Lands & Resource Management Policies Written Critical Responses to Reading Materials: Critical analysis of academic literature concerning the complex relationship between & ...

chapter 17

... supermarkets charge more for chickens after they have been cut. The same considerations affect financial products, but: a. The proportionate costs to companies of repackaging the cash flow stream are generally small. b. Investors can also repackage cash flows cheaply for themselves. In fact, special ...

... supermarkets charge more for chickens after they have been cut. The same considerations affect financial products, but: a. The proportionate costs to companies of repackaging the cash flow stream are generally small. b. Investors can also repackage cash flows cheaply for themselves. In fact, special ...

OTE (Hellenic Telecoms)

... This report has been issued by EUROBANK Equities Investment Firm S.A, a member of the Athens Exchange, a member of the Cyprus Stock Exchange and a member of Eurobank Ergasias S.A. EUROBANK Equities Investment Firm S.A. is regulated by the Hellenic Capital Markets Commission (HCMC) with authorization ...

... This report has been issued by EUROBANK Equities Investment Firm S.A, a member of the Athens Exchange, a member of the Cyprus Stock Exchange and a member of Eurobank Ergasias S.A. EUROBANK Equities Investment Firm S.A. is regulated by the Hellenic Capital Markets Commission (HCMC) with authorization ...

Fixed Income in a Rising Rate Environment

... Sources: Morningstar Direct. Past performance does not guarantee future results. The chart is for illustrative purposes only and is not reflective of any Nuveen investment. Market indices do not include fees. You cannot invest directly in an index. ...

... Sources: Morningstar Direct. Past performance does not guarantee future results. The chart is for illustrative purposes only and is not reflective of any Nuveen investment. Market indices do not include fees. You cannot invest directly in an index. ...

Washington consensus

... enterprises; these should be privatised; i: also, reducing G takes pressure off Government financial borrowing requirement (PBR), enabling i-rts to fall and reducing ‘crowding out’ of private Investment (X- M): end import protection, thus enabling switch of resources exports. In some cases, deval ...

... enterprises; these should be privatised; i: also, reducing G takes pressure off Government financial borrowing requirement (PBR), enabling i-rts to fall and reducing ‘crowding out’ of private Investment (X- M): end import protection, thus enabling switch of resources exports. In some cases, deval ...

Chapter 11

... stock is called a share. Stocks are also called equities. • Stockowners can earn a profit in two ways: 1. Dividends, which are portions of a corporation’s profits, are paid out to stockholders of many corporations. The higher the corporate profit, the higher the dividend. 2. A capital gain is earned ...

... stock is called a share. Stocks are also called equities. • Stockowners can earn a profit in two ways: 1. Dividends, which are portions of a corporation’s profits, are paid out to stockholders of many corporations. The higher the corporate profit, the higher the dividend. 2. A capital gain is earned ...

No Slide Title

... How does one deal with Non-normality ? How does one deal with financial crises ? How does one deal with shifting parameter values ? What types of risks is it best applied to ? If normal just a multiple of Standard Deviation ! ...

... How does one deal with Non-normality ? How does one deal with financial crises ? How does one deal with shifting parameter values ? What types of risks is it best applied to ? If normal just a multiple of Standard Deviation ! ...