Grade 9 Investment for households

... make. It provides a home to the family, while contributing to their wealth creation. House prices increase, so when you buy a house today you should be able to sell it in a few years’ time at a profit. You can also buy property to rent out so that it provides you with a monthly income. This is ...

... make. It provides a home to the family, while contributing to their wealth creation. House prices increase, so when you buy a house today you should be able to sell it in a few years’ time at a profit. You can also buy property to rent out so that it provides you with a monthly income. This is ...

SVB FInancial Group Announces Selected

... that are not normally excluded or included in the most directly comparable measure calculated and presented in accordance with GAAP. The company believes that this non-GAAP financial measure, when taken together with the corresponding GAAP financial measures, provide meaningful supplemental informat ...

... that are not normally excluded or included in the most directly comparable measure calculated and presented in accordance with GAAP. The company believes that this non-GAAP financial measure, when taken together with the corresponding GAAP financial measures, provide meaningful supplemental informat ...

Does portfolio manager ownership affect fund performance? Finnish

... ownership actually leads to inferior, not superior performance. More precisely, for every additional percent the manager’s personal investment comprises of his taxable net wealth, the fund’s objective-adjusted return decreases by 9-14 basis points and objective-adjusted Sharpe by 1-2 basis points, d ...

... ownership actually leads to inferior, not superior performance. More precisely, for every additional percent the manager’s personal investment comprises of his taxable net wealth, the fund’s objective-adjusted return decreases by 9-14 basis points and objective-adjusted Sharpe by 1-2 basis points, d ...

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

... holder of China Yuchai International CYI with approximately 6.23% of the outstanding shares. As a long-term shareholder, Shah Capital has seen CYIs main operating subsidiary, Guangxi Yuchai Machinery Company Limited GYMCL, continue to innovate and lead multiple markets for engines across Asia. Toget ...

... holder of China Yuchai International CYI with approximately 6.23% of the outstanding shares. As a long-term shareholder, Shah Capital has seen CYIs main operating subsidiary, Guangxi Yuchai Machinery Company Limited GYMCL, continue to innovate and lead multiple markets for engines across Asia. Toget ...

Correlation of Risks, Integrating Risk Measurement – Risk

... interest rate risk management practices at individual thrifts Identify outlier thrifts that need more supervisory attention Identify systemic interest rate risk trends within the thrift industry Designed to spot storm clouds on the horizon Fair valuation of all balance sheet items in disaggreg ...

... interest rate risk management practices at individual thrifts Identify outlier thrifts that need more supervisory attention Identify systemic interest rate risk trends within the thrift industry Designed to spot storm clouds on the horizon Fair valuation of all balance sheet items in disaggreg ...

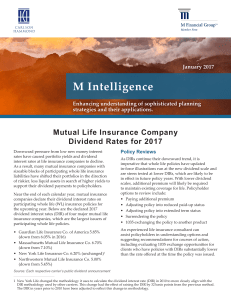

Mutual Life Dividend Rates – March 2017

... times the industry average. Mass Mutual and Northwestern Mutual have significantly lower allocations to bonds but appear to make up for the difference with larger allocations to mortgages (primarily commercial). In each case, the mutual companies are allocating higher percentages of their general ac ...

... times the industry average. Mass Mutual and Northwestern Mutual have significantly lower allocations to bonds but appear to make up for the difference with larger allocations to mortgages (primarily commercial). In each case, the mutual companies are allocating higher percentages of their general ac ...

November 7 Houston - Mad Hedge Fund Trader

... *Bonds- buy dips over a 1.80% yield *Commodities- trading sell setting up in oil, copper *Currencies- Euro stand aside, too early to sell, sell yen OTM Calls sell short Aussie *Precious Metals – buy the dips, the fall rally has begun ...

... *Bonds- buy dips over a 1.80% yield *Commodities- trading sell setting up in oil, copper *Currencies- Euro stand aside, too early to sell, sell yen OTM Calls sell short Aussie *Precious Metals – buy the dips, the fall rally has begun ...

High-performing credit specialist pVe keeps a wary eye on

... lenty of European-based credit and structured credit managers racked up very impressive performance in last year’s generally buoyant market conditions, with more than a few making returns of 50% or more in a banner year for the credit asset class as a whole. But not many of them also managed to post ...

... lenty of European-based credit and structured credit managers racked up very impressive performance in last year’s generally buoyant market conditions, with more than a few making returns of 50% or more in a banner year for the credit asset class as a whole. But not many of them also managed to post ...

Measuring Portfolio Diversification

... The effect of adding the new loan is to reduce the concentration ratio from 50% to 33%. The change in diversification is apparent in the increase of the diversification quotient from two to three. The portfolio now has the same diversification as a portfolio of three loans of equal size. For this sm ...

... The effect of adding the new loan is to reduce the concentration ratio from 50% to 33%. The change in diversification is apparent in the increase of the diversification quotient from two to three. The portfolio now has the same diversification as a portfolio of three loans of equal size. For this sm ...

here - Educators Financial Group

... which provides its services in all provinces of Canada except Prince Edward Island, and also provides its services in the Northwest Territories. Investments in emerging markets are by their nature higher risk and potentially more volatile than those inherent in established markets. Economies in emer ...

... which provides its services in all provinces of Canada except Prince Edward Island, and also provides its services in the Northwest Territories. Investments in emerging markets are by their nature higher risk and potentially more volatile than those inherent in established markets. Economies in emer ...

FINANCIAL KEYNESIANISM AND MARKET INSTABILITY

... Hence, the problem is the rise of what Minsky called money manager capitalism—the modern form of the previous stage of finance capitalism that self-destructed in the Great Depression of the 1930s. He characterized money manger capitalism as one dominated by highly leveraged funds seeking maximum re ...

... Hence, the problem is the rise of what Minsky called money manager capitalism—the modern form of the previous stage of finance capitalism that self-destructed in the Great Depression of the 1930s. He characterized money manger capitalism as one dominated by highly leveraged funds seeking maximum re ...

Northrop Grumman Financial Security and Savings - corporate

... International Equity Fund — The International Equity Fund consists of stocks of a diversified group of companies in developed countries outside of the U.S. The fund’s objectives are capital appreciation over the long term, along with current income (dividends). Small Cap Fund — The Small Cap Fund co ...

... International Equity Fund — The International Equity Fund consists of stocks of a diversified group of companies in developed countries outside of the U.S. The fund’s objectives are capital appreciation over the long term, along with current income (dividends). Small Cap Fund — The Small Cap Fund co ...

The Retail Bond market continues to present great opportunities for

... typically don’t want too much risk. They may have another part of their savings in riskier growth orientated products or they may have no other risk assets at all. Either way some investors would consider that a balanced investment portfolio will include a portion of investment into gilts or corpora ...

... typically don’t want too much risk. They may have another part of their savings in riskier growth orientated products or they may have no other risk assets at all. Either way some investors would consider that a balanced investment portfolio will include a portion of investment into gilts or corpora ...

Disruption in the Capital Markets: What Happened? Joseph P. Forte

... distrust the AAA rating of CDO structures now burdened by loans too risky to have been placed in a traditional RMBS structure which were similarly rated. It would be rational to assume that the subprime loan “melt down” (as the media coined it) would be self contained event –as risky overleveraged r ...

... distrust the AAA rating of CDO structures now burdened by loans too risky to have been placed in a traditional RMBS structure which were similarly rated. It would be rational to assume that the subprime loan “melt down” (as the media coined it) would be self contained event –as risky overleveraged r ...

Investment Recommendation in P2P Lending: A Portfolio

... choose items that similar users like” [12]. In investment, as the goal of investors is to get as many returns as possible with their unique risk preferences, most investors would like to get recommendations from experienced investors rather than the beginners even though these beginners are more sim ...

... choose items that similar users like” [12]. In investment, as the goal of investors is to get as many returns as possible with their unique risk preferences, most investors would like to get recommendations from experienced investors rather than the beginners even though these beginners are more sim ...

How critical the built up of estate is in participating fund and how

... Companies) Regulations, 2002 defines FFA as “The FFA shall represent all funds, the allocation of which, either to the policyholders or to the shareholders, has not been determined by the end of the financial year”. Estate can be defined as: “excess of par assets over those required to meet the re ...

... Companies) Regulations, 2002 defines FFA as “The FFA shall represent all funds, the allocation of which, either to the policyholders or to the shareholders, has not been determined by the end of the financial year”. Estate can be defined as: “excess of par assets over those required to meet the re ...

Energy Transition Law - 2 Degrees Investing Initiative

... and Governance (ESG) policies but also the practical consequences of these policies on the composition of portfolios. Special attention should be placed on the description of the integration of those criteria into strategic asset allocation and for illiquid assets. To maximize impact, investors shou ...

... and Governance (ESG) policies but also the practical consequences of these policies on the composition of portfolios. Special attention should be placed on the description of the integration of those criteria into strategic asset allocation and for illiquid assets. To maximize impact, investors shou ...

Pacer ETFs Crosses $1 Billion Threshold

... An investment in the Funds is subject to investment risk, including the possible loss of principal. Pacer ETF shares may be bought and sold on an exchange through a brokerage account. Brokerage commissions and ETF expenses will reduce investment returns. There can be no assurance that an active trad ...

... An investment in the Funds is subject to investment risk, including the possible loss of principal. Pacer ETF shares may be bought and sold on an exchange through a brokerage account. Brokerage commissions and ETF expenses will reduce investment returns. There can be no assurance that an active trad ...

The Offshore-Intensity Ratio

... financing of its domestic economy.’ On the one hand, such an approach might seem a bit simplistic, because it does not look into the jurisdictions to see if they specifically tried to attract foreign capital by lowering their standards in order to attract external capital. However, the simplicity of ...

... financing of its domestic economy.’ On the one hand, such an approach might seem a bit simplistic, because it does not look into the jurisdictions to see if they specifically tried to attract foreign capital by lowering their standards in order to attract external capital. However, the simplicity of ...

Angus Selby – Vice President Morgan Stanley

... optimality, plus competitive advantages in innovation, marketing and other core factors. Capital access generally much better ...

... optimality, plus competitive advantages in innovation, marketing and other core factors. Capital access generally much better ...

Are Your Midlevel and Branch Managers Maximizing Company

... Too often we manage by measuring SYMPTOMS or SECONDARY RESULTS ...

... Too often we manage by measuring SYMPTOMS or SECONDARY RESULTS ...

declaration of understanding and direction

... causes of action, suits, duties, debts, claims, demands, interest, penalties, liabilities, damages, costs, expenses, fees, covenants and contracts whatsoever which the Undersigned now has or hereafter can, shall or may have against the Trustee or the Investment Dealer by reason of or in any way aris ...

... causes of action, suits, duties, debts, claims, demands, interest, penalties, liabilities, damages, costs, expenses, fees, covenants and contracts whatsoever which the Undersigned now has or hereafter can, shall or may have against the Trustee or the Investment Dealer by reason of or in any way aris ...