1 DIVIDEND DECISIONS OF UK FIRMS AND EFFECTS OF THE

... substitute. Rather dividends might be interpreted as protection against takeovers, especially in the UK where forms of poison pills are illegal; take-over of a peer has been shown to be a trigger for higher payout (Servaes and Tamayo 2014). 2.4 Mis-pricing and catering to investors. Managers with in ...

... substitute. Rather dividends might be interpreted as protection against takeovers, especially in the UK where forms of poison pills are illegal; take-over of a peer has been shown to be a trigger for higher payout (Servaes and Tamayo 2014). 2.4 Mis-pricing and catering to investors. Managers with in ...

Statutory Issue Paper No. 94 Allocation of Expenses

... Many entities operate within a group where personnel and facilities are shared. Shared expenses, including expenses under the terms of a management contract, shall be apportioned to the entities incurring the expense as if the expense had been paid solely by the incurring entity. The apportionment s ...

... Many entities operate within a group where personnel and facilities are shared. Shared expenses, including expenses under the terms of a management contract, shall be apportioned to the entities incurring the expense as if the expense had been paid solely by the incurring entity. The apportionment s ...

2015 Annual Report

... In 2015, the Internet further penetrated everyday life, providing users with new value and additional convenience. Messaging and social networking continued to rank as the highest time spent and widest penetration activities on smart phones, and evolved into increasingly relevant content discovery m ...

... In 2015, the Internet further penetrated everyday life, providing users with new value and additional convenience. Messaging and social networking continued to rank as the highest time spent and widest penetration activities on smart phones, and evolved into increasingly relevant content discovery m ...

Word Document - Berkeley-Haas

... relative to the capital ratios of mutual thrifts that did not convert than they had been in the 1980s. Thus, the low-capital-ratio motive for thrift conversion was presumably less common and less pressing during the 1990s than it had been earlier. Two prominent studies investigated thrift conversion ...

... relative to the capital ratios of mutual thrifts that did not convert than they had been in the 1980s. Thus, the low-capital-ratio motive for thrift conversion was presumably less common and less pressing during the 1990s than it had been earlier. Two prominent studies investigated thrift conversion ...

161128 APS 210 FINAL clean

... complexity of the ADI. In formulating this strategy, the ADI must consider its legal structure, key business lines, the breadth and diversity of markets, products and jurisdictions in which it operates and home and host regulatory requirements. ...

... complexity of the ADI. In formulating this strategy, the ADI must consider its legal structure, key business lines, the breadth and diversity of markets, products and jurisdictions in which it operates and home and host regulatory requirements. ...

Group Consolidated Financial Statements 2016 (IFRS)

... Other comprehensive income Items that may not be reclassified to profit or loss Remeasurement of net liability of defined pension plans Deferred taxes relating to items that may not be reclassified Total ...

... Other comprehensive income Items that may not be reclassified to profit or loss Remeasurement of net liability of defined pension plans Deferred taxes relating to items that may not be reclassified Total ...

Measuring Securities Litigation Risk

... Lo (2005), and Rogers and Stocken (2005), although a number of these variables are new and increase the predictive ability of the models significantly. Finally, we find that a variable that captures whether a firm has been subject to securities litigation in the prior three years is strongly negativ ...

... Lo (2005), and Rogers and Stocken (2005), although a number of these variables are new and increase the predictive ability of the models significantly. Finally, we find that a variable that captures whether a firm has been subject to securities litigation in the prior three years is strongly negativ ...

Intangibles

... Intangible assets, which generally result from legal or contractual rights, do not have a physical substance. Like tangible noncurrent assets, intangible assets are held for use rather than investment; have an expected life of more than one year; are valuable because of their ability to generate rev ...

... Intangible assets, which generally result from legal or contractual rights, do not have a physical substance. Like tangible noncurrent assets, intangible assets are held for use rather than investment; have an expected life of more than one year; are valuable because of their ability to generate rev ...

ABSTRACT Title of Document:

... non-housing consumption and the supply effect due to the working capital constraint. Quantitatively, the direct `mortgage rate' effect is the most important channel. When the housing asset acts as collateral to reduce household's financing costs, it provides an empirically important mechanism to amp ...

... non-housing consumption and the supply effect due to the working capital constraint. Quantitatively, the direct `mortgage rate' effect is the most important channel. When the housing asset acts as collateral to reduce household's financing costs, it provides an empirically important mechanism to amp ...

Appendix 6(ii) Investor`s Statement (legal person) First name and

... performing portfolio management activities, where the portfolios consist of one or more financial instruments. Where in each case, the persons concerned are natural persons who ultimately, directly or through other entities, finance and control the Investor’s activities (in particular in the case of ...

... performing portfolio management activities, where the portfolios consist of one or more financial instruments. Where in each case, the persons concerned are natural persons who ultimately, directly or through other entities, finance and control the Investor’s activities (in particular in the case of ...

form 10-k old national bancorp

... On January 1, 2011, unaudited financial statements of Monroe Bancorp showed assets of $808.1 million, which included $509.6 million of loans, $166.4 million of securities and $711.5 million of deposits. The acquisition strengthened our deposit market share in the Bloomington, Indiana market and impr ...

... On January 1, 2011, unaudited financial statements of Monroe Bancorp showed assets of $808.1 million, which included $509.6 million of loans, $166.4 million of securities and $711.5 million of deposits. The acquisition strengthened our deposit market share in the Bloomington, Indiana market and impr ...

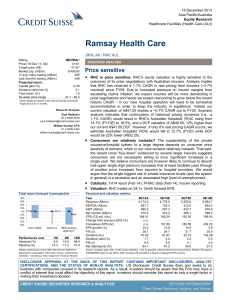

Ramsay Health Care 2013 12 18 - Price sensitive

... 1.1% CAGR) would result in RHC's Australian hospitals' ROIC rising from 14.7% (FY13E) to 18.5%, and a DCF valuation of A$46.50, 12% higher than our current A$41.50 DCF. However, if only 0% real pricing CAGR occurs, we estimate Australian hospitals' ROIC would fall to 12.7% (FY20) while DCF would be ...

... 1.1% CAGR) would result in RHC's Australian hospitals' ROIC rising from 14.7% (FY13E) to 18.5%, and a DCF valuation of A$46.50, 12% higher than our current A$41.50 DCF. However, if only 0% real pricing CAGR occurs, we estimate Australian hospitals' ROIC would fall to 12.7% (FY20) while DCF would be ...

On the Design of Collateralized Debt Obligation

... SLP of investors is fully exhausted by default losses. In contrast to a true sale transaction, the originator does not receive the issuance proceeds in a synthetic transaction. These need to be invested in AAA-securities or other almost default-free assets. In all transactions, the originator decide ...

... SLP of investors is fully exhausted by default losses. In contrast to a true sale transaction, the originator does not receive the issuance proceeds in a synthetic transaction. These need to be invested in AAA-securities or other almost default-free assets. In all transactions, the originator decide ...

Organizational Form and Firm Performance: Evidence

... To study the effect of organizational form on firm performance, I assembled a handcollected dataset using financial and production information filed before the Federal Power Commission by 291 operating firms in the industry; the dataset covers 2,754 firm-years from 1937 to 1960. To capture the effe ...

... To study the effect of organizational form on firm performance, I assembled a handcollected dataset using financial and production information filed before the Federal Power Commission by 291 operating firms in the industry; the dataset covers 2,754 firm-years from 1937 to 1960. To capture the effe ...

Market Signals Associated with Taiwan REIT IPOs

... without much attention paid before or after that day. Therefore, the decreasing number of news reports and dearth of information may be the main reason why interval (0, +1) has more significant abnormal returns than interval (-1, +1) for the listing date event. These patterns are consistent with the ...

... without much attention paid before or after that day. Therefore, the decreasing number of news reports and dearth of information may be the main reason why interval (0, +1) has more significant abnormal returns than interval (-1, +1) for the listing date event. These patterns are consistent with the ...

Essays on information asymmetry and the firm

... firms. The intuition is as follows. Given asymmetric information can lead to misvaluation, and recognizing that undervalued (but not overvalued) firms will conduct OMRs renders the empirical prediction that the shareholder wealth effect to OMR announcements should increase in the degree of a firm’s ...

... firms. The intuition is as follows. Given asymmetric information can lead to misvaluation, and recognizing that undervalued (but not overvalued) firms will conduct OMRs renders the empirical prediction that the shareholder wealth effect to OMR announcements should increase in the degree of a firm’s ...

EMERSON ELECTRIC CO (Form: 10-K, Received: 11/20

... modular software, not only to better control the process but also to collect and analyze valuable information about plant assets and processes. This capability gives customers the ability to detect or predict changes in equipment and process performance and the associated impact on plant operations. ...

... modular software, not only to better control the process but also to collect and analyze valuable information about plant assets and processes. This capability gives customers the ability to detect or predict changes in equipment and process performance and the associated impact on plant operations. ...

2009 Annual Report - Berkshire Hathaway Inc.

... Our metrics for evaluating our managerial performance are displayed on the facing page. From the start, Charlie and I have believed in having a rational and unbending standard for measuring what we have – or have not – accomplished. That keeps us from the temptation of seeing where the arrow of perf ...

... Our metrics for evaluating our managerial performance are displayed on the facing page. From the start, Charlie and I have believed in having a rational and unbending standard for measuring what we have – or have not – accomplished. That keeps us from the temptation of seeing where the arrow of perf ...

Bank of Nova Scotia: Proxy Circular

... of Directors, that the shareholders accept the approach to executive compensation disclosed in this management proxy circular delivered in advance of the 2017 annual meeting of shareholders of the Bank. This is an advisory vote, which means the results are not binding on the board. The human resourc ...

... of Directors, that the shareholders accept the approach to executive compensation disclosed in this management proxy circular delivered in advance of the 2017 annual meeting of shareholders of the Bank. This is an advisory vote, which means the results are not binding on the board. The human resourc ...