Temperature, Aggregate Risk, and Expected Returns

... Standard & Poor’s (S&P) equity index and the Morgan Stanley Capital International (MSCI) equity index, both expressed in U.S. dollars. We also consider the MSCI All Country World Index which measures equity returns across developed and emerging markets, 45 countries in total, to compute the world ma ...

... Standard & Poor’s (S&P) equity index and the Morgan Stanley Capital International (MSCI) equity index, both expressed in U.S. dollars. We also consider the MSCI All Country World Index which measures equity returns across developed and emerging markets, 45 countries in total, to compute the world ma ...

What is the information content of dividend changes

... Recent theoretical research shows that firm-specific information risk is priced, and cannot be diversified away (Easely and O’Hara, 2001, O’Hara, 2003, Leuz and Verrechia, 2004). These models imply that the precision of information reduces the risk premium demanded by uninformed traders in a multi- ...

... Recent theoretical research shows that firm-specific information risk is priced, and cannot be diversified away (Easely and O’Hara, 2001, O’Hara, 2003, Leuz and Verrechia, 2004). These models imply that the precision of information reduces the risk premium demanded by uninformed traders in a multi- ...

securities and futures act - Monetary Authority of Singapore

... (b) in the case of a scheme where the offer of units is an offer for which a prospectus is required, the units in the scheme are listed for quotation on a securities exchange within 30 days after the prospectus in respect of the offer is registered by the Authority; (c) the advertising and marketing ...

... (b) in the case of a scheme where the offer of units is an offer for which a prospectus is required, the units in the scheme are listed for quotation on a securities exchange within 30 days after the prospectus in respect of the offer is registered by the Authority; (c) the advertising and marketing ...

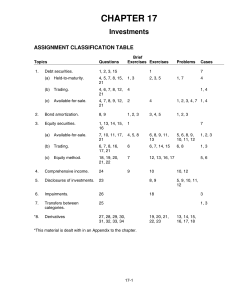

- Backpack

... – There is a fear that managers may waste corporate resources by over-investing in low or poor NPV projects. – Gordon Donaldson argued this is the reason for the pecking order managements tend to use when raising capital • Shareholders would prefer to receive a dividend and then have management file ...

... – There is a fear that managers may waste corporate resources by over-investing in low or poor NPV projects. – Gordon Donaldson argued this is the reason for the pecking order managements tend to use when raising capital • Shareholders would prefer to receive a dividend and then have management file ...

3.1 Earnings management - Erasmus University Thesis Repository

... states from 1 January 2005 will be discussed. In Chapter 3, a broad literature review will be given. This review considers two main branches of literature. First, earnings management will be considered. I will define earnings management, look into the incentives for earnings management, and consider ...

... states from 1 January 2005 will be discussed. In Chapter 3, a broad literature review will be given. This review considers two main branches of literature. First, earnings management will be considered. I will define earnings management, look into the incentives for earnings management, and consider ...

supply chains and the oecd guidelines for multinational

... Trader: Traders typically make markets for goods and services by purchasing and reselling them, often across geographical boundaries. They typically are not involved in product development, manufacturing, or marketing to consumers. ...

... Trader: Traders typically make markets for goods and services by purchasing and reselling them, often across geographical boundaries. They typically are not involved in product development, manufacturing, or marketing to consumers. ...

Volatility and Fixed Income Asset Class Comparison

... to pay for an implied volatility level in excess of the expected realized volatility.2 In a general sense, the risk premium in the case of fixed income can be thought of as compensation for the uncertainty in the rate of inflation and for interest rate and duration-driven volatility. In the same way ...

... to pay for an implied volatility level in excess of the expected realized volatility.2 In a general sense, the risk premium in the case of fixed income can be thought of as compensation for the uncertainty in the rate of inflation and for interest rate and duration-driven volatility. In the same way ...

Overview of Investment Management Fees

... LACERS’ Fiduciary Duty with Respect to Fees • Fiduciaries are subject to strict standards of conduct because they must act on behalf of the participants and beneficiaries of a retirement plan. One of the tenets of fiduciary responsibility is to pay only for “reasonable” plan expenses. ...

... LACERS’ Fiduciary Duty with Respect to Fees • Fiduciaries are subject to strict standards of conduct because they must act on behalf of the participants and beneficiaries of a retirement plan. One of the tenets of fiduciary responsibility is to pay only for “reasonable” plan expenses. ...

Transfers and Servicing (Topic 860)

... because substantially all the risks and rewards under IFRS are typically considered to be retained by the transferor, resulting in a requirement for secured borrowing accounting. However, the derecognition model in IFRS is expected to result in secured borrowing accounting for a broader spectrum of ...

... because substantially all the risks and rewards under IFRS are typically considered to be retained by the transferor, resulting in a requirement for secured borrowing accounting. However, the derecognition model in IFRS is expected to result in secured borrowing accounting for a broader spectrum of ...

DRAFT Not for Citation or Distribution

... individual firm. We test the hypothesis that firms decide to locate in the formal or informal sector based on a costbenefit analysis, which is in turn dependent on several aspects of the investment climate. And for the first time, a unique cross-country dataset from sub-Saharan Africa enables us to ...

... individual firm. We test the hypothesis that firms decide to locate in the formal or informal sector based on a costbenefit analysis, which is in turn dependent on several aspects of the investment climate. And for the first time, a unique cross-country dataset from sub-Saharan Africa enables us to ...

2015 Annual Report China CITIC Bank Corporation Limited China

... which proposes to pay a cash dividend of RMB2.12 per 10 shares (before tax). No scheme for transfer of capital reserve to share capital will be applied for the current year. Risk reminder on for ward looking statements: Forward looking statements such as future plans and development strategies conta ...

... which proposes to pay a cash dividend of RMB2.12 per 10 shares (before tax). No scheme for transfer of capital reserve to share capital will be applied for the current year. Risk reminder on for ward looking statements: Forward looking statements such as future plans and development strategies conta ...

March 31, 2017 Form 10-Q

... Future policy benefits for life and accident and health insurance contracts Policyholder contract deposits (portion measured at fair value: 2017 - $3,097; 2016 - $3,058) Other policyholder funds (portion measured at fair value: 2017 - $5; 2016 - $5) Other liabilities (portion measured at fair value: ...

... Future policy benefits for life and accident and health insurance contracts Policyholder contract deposits (portion measured at fair value: 2017 - $3,097; 2016 - $3,058) Other policyholder funds (portion measured at fair value: 2017 - $5; 2016 - $5) Other liabilities (portion measured at fair value: ...

CONTENTS - National Bank of Pakistan

... over last year. In spite of soft interest rates, which continued for major part of 2004 causing spreads to decline, the bank enhanced its net interest income by Rs. 1,671 million (13%) through growth in the loan portfolio which increased by Rs. 60 billion (37%). The growth was across all sectors, in ...

... over last year. In spite of soft interest rates, which continued for major part of 2004 causing spreads to decline, the bank enhanced its net interest income by Rs. 1,671 million (13%) through growth in the loan portfolio which increased by Rs. 60 billion (37%). The growth was across all sectors, in ...

Bangladesh: Strengthening Finance for the 7th Five Year Plan and

... the budget. Once completely strengthened, this strategic process could allow the future analysis of other sources of finance that are also important to develop, but that are not necessarily under the direct control of the government. This strategic planning process could eventually lead to the devel ...

... the budget. Once completely strengthened, this strategic process could allow the future analysis of other sources of finance that are also important to develop, but that are not necessarily under the direct control of the government. This strategic planning process could eventually lead to the devel ...

Risk Aversion and Clientele Effects

... foundation of asset pricing theory and the definition of capital market integration – i.e. that a unit of risk exposure in one market commands the same compensation as a unit of risk exposure in another. While investor preferences are an important bridge that joins risk exposure and returns, only li ...

... foundation of asset pricing theory and the definition of capital market integration – i.e. that a unit of risk exposure in one market commands the same compensation as a unit of risk exposure in another. While investor preferences are an important bridge that joins risk exposure and returns, only li ...

dollar cost averaging - the role of cognitive error

... DCA buys at an average purchase cost which is below the average price is irrelevant because investors cannot subsequently sell at this average price (Thorley, 1994; Milevsky and Posner, 2003), but this misrepresents the case put forward for DCA. If investors could sell at the average price then DCA ...

... DCA buys at an average purchase cost which is below the average price is irrelevant because investors cannot subsequently sell at this average price (Thorley, 1994; Milevsky and Posner, 2003), but this misrepresents the case put forward for DCA. If investors could sell at the average price then DCA ...

International Risk‐Taking, Volatility, and Consumption Growth No. 06‐17

... some countries are net borrowers and some countries are net lenders, depending on their risk aversion, but long and short positions in the risk-free asset cancel out once we aggregate them. Investors with low risk aversion who want to invest more than 100 percent of their wealth in the global mutual ...

... some countries are net borrowers and some countries are net lenders, depending on their risk aversion, but long and short positions in the risk-free asset cancel out once we aggregate them. Investors with low risk aversion who want to invest more than 100 percent of their wealth in the global mutual ...

Backtesting Value-at-Risk based on Tail Losses Woon K. Wong

... for the market risk at 99% whereas for the credit and operational risks, VaR is calculated at 99.9% level. Moreover, due to diversification, VaR at the level of the whole bank is often found to be adequate for regulatory capital determination. As long as there is no single position that dominates t ...

... for the market risk at 99% whereas for the credit and operational risks, VaR is calculated at 99.9% level. Moreover, due to diversification, VaR at the level of the whole bank is often found to be adequate for regulatory capital determination. As long as there is no single position that dominates t ...

ARM Holdings plc - corporate

... Forward-looking statements are not guarantees of future performance and involve known and unknown risks, uncertainties and other important factors that could cause actual results, to differ materially ...

... Forward-looking statements are not guarantees of future performance and involve known and unknown risks, uncertainties and other important factors that could cause actual results, to differ materially ...

PDF

... then the European colonizers set up an institutional structure where the protection of property rights was weak. Our objective in this paper is to investigate the role of the different theoretical explanations for the lack of flows of capital from rich countries to poor countries in a systematic emp ...

... then the European colonizers set up an institutional structure where the protection of property rights was weak. Our objective in this paper is to investigate the role of the different theoretical explanations for the lack of flows of capital from rich countries to poor countries in a systematic emp ...

NBER WORKING PAPER SERIES AN EMPIRICAL INVESTIGATION

... then the European colonizers set up an institutional structure where the protection of property rights was weak. Our objective in this paper is to investigate the role of the different theoretical explanations for the lack of flows of capital from rich countries to poor countries in a systematic emp ...

... then the European colonizers set up an institutional structure where the protection of property rights was weak. Our objective in this paper is to investigate the role of the different theoretical explanations for the lack of flows of capital from rich countries to poor countries in a systematic emp ...