Pricing Insurance Policies: The Internal Rate of Return Model

... Financial pricing models calculate a return on the capital used by a firm to furnish goods or services. The insurance contract is a promise, a commitment to compensate policyholders if certain contingent events occur. Surplus backs this promise, without the financial support, an insurer could not fu ...

... Financial pricing models calculate a return on the capital used by a firm to furnish goods or services. The insurance contract is a promise, a commitment to compensate policyholders if certain contingent events occur. Surplus backs this promise, without the financial support, an insurer could not fu ...

Accounting Notes

... Depreciation of Plant Assets - the allocation of a plant asset's cost to an expense account as it is used over its useful life. Debit an expense account and credit a contra-asset account. Why use Accumulated Depreciation instead of just crediting the original asset account? (1) If the original asset ...

... Depreciation of Plant Assets - the allocation of a plant asset's cost to an expense account as it is used over its useful life. Debit an expense account and credit a contra-asset account. Why use Accumulated Depreciation instead of just crediting the original asset account? (1) If the original asset ...

Foreign Institutional Investors and Corporate Governance in

... launched to encourage and convince institutional investors to play a more active role. However, not enough is known about how institutional investors utilize CG in their investment decisions, in particular in emerging markets, where funding needs are high and investor protection standards often stil ...

... launched to encourage and convince institutional investors to play a more active role. However, not enough is known about how institutional investors utilize CG in their investment decisions, in particular in emerging markets, where funding needs are high and investor protection standards often stil ...

Fact sheet Comparing listed and unlisted assets

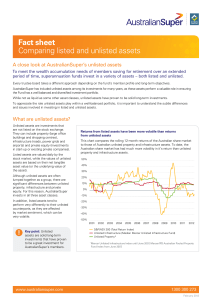

... of listed assets reflects not only the value of the underlying asset but also market sentiment (the general attitude of investors towards the prospects for good returns from the markets), which has been up and down over the last 12 months. The prices of listed investments (particularly Australian re ...

... of listed assets reflects not only the value of the underlying asset but also market sentiment (the general attitude of investors towards the prospects for good returns from the markets), which has been up and down over the last 12 months. The prices of listed investments (particularly Australian re ...

3.1 - United Nations Statistics Division

... • Therefore, they should be recognized as households’ assets, irrespective of the fact that segregated schemes’ assets exist or not, and of the fact that the employer may have recorded an associated liability entry in his balance sheet or not • Consequently recommends recording of the liabilities of ...

... • Therefore, they should be recognized as households’ assets, irrespective of the fact that segregated schemes’ assets exist or not, and of the fact that the employer may have recorded an associated liability entry in his balance sheet or not • Consequently recommends recording of the liabilities of ...

Financial Innovations and Macroeconomic Volatility

... Might proxy for un-modeled financial frictions (CKM, 2006) ...

... Might proxy for un-modeled financial frictions (CKM, 2006) ...

June - sibstc

... profits and cash flows. In exchange for the high risk that venture capitalists assume by investing in smaller and less mature companies, usually, they get significant control over company decisions, in addition to a significant portion of the company's ownership (and consequently value). VC is an i ...

... profits and cash flows. In exchange for the high risk that venture capitalists assume by investing in smaller and less mature companies, usually, they get significant control over company decisions, in addition to a significant portion of the company's ownership (and consequently value). VC is an i ...

Investing in Stocks Chapter Sixteen

... • Follow the value of the stock. Do you have a certain price at which you will sell? • Watch the company’s financials - are profits going up or down? If their profits are well below the industry average it may be time to sell. • Track the firm’s product line. Are they state-of-the-art or becoming ob ...

... • Follow the value of the stock. Do you have a certain price at which you will sell? • Watch the company’s financials - are profits going up or down? If their profits are well below the industry average it may be time to sell. • Track the firm’s product line. Are they state-of-the-art or becoming ob ...

Evolution of the Traditional Credit Management Function

... which requires interdependencies between credit, customer service, collections, accounts receivable and logistics, the benefit of the “team” approach becomes apparent. You need to embrace and not fight this idea, as it offers impressive promotional and learning opportunities. Outsourcing as an Alter ...

... which requires interdependencies between credit, customer service, collections, accounts receivable and logistics, the benefit of the “team” approach becomes apparent. You need to embrace and not fight this idea, as it offers impressive promotional and learning opportunities. Outsourcing as an Alter ...

130510496X_441953

... Business risk vs. financial risk Derivatives A derivative is a financial contract whose returns are derived from those of an underlying factor. Size of the derivatives market at year-end 2013 $710 trillion notional principal U.S. Fourth Quarter GDP was only $17 trillion See Figure 1.1 for OT ...

... Business risk vs. financial risk Derivatives A derivative is a financial contract whose returns are derived from those of an underlying factor. Size of the derivatives market at year-end 2013 $710 trillion notional principal U.S. Fourth Quarter GDP was only $17 trillion See Figure 1.1 for OT ...

Position: Marketing and Events Assistant

... The full time equivalent hours for the post are 37.5 hours a week; however flexibility is required. The post holder will be required to work any additional hours necessary to satisfactorily fulfil the responsibilities of the post. Notice Period The notice period required from the post holder is a mi ...

... The full time equivalent hours for the post are 37.5 hours a week; however flexibility is required. The post holder will be required to work any additional hours necessary to satisfactorily fulfil the responsibilities of the post. Notice Period The notice period required from the post holder is a mi ...

The Fossil Fuel Transition

... to the company development portfolio and puts shareholder value at greater risk. We believe that the fossil fuel industry has a history of failing to assess risks (e.g. price, cost, delivery date, tax) correctly. There are many examples in the past decade of investment decisions by fossil fuel compa ...

... to the company development portfolio and puts shareholder value at greater risk. We believe that the fossil fuel industry has a history of failing to assess risks (e.g. price, cost, delivery date, tax) correctly. There are many examples in the past decade of investment decisions by fossil fuel compa ...

Analysis of IDC EMEA Top 10 announcement (prelim)

... Costs (power over suppliers, business model, OPEX control) Pricing (power over customers) Asset Utilization Access and Cost of Capital Growth (branding, distribution channels, marcom) Risk Management (hedging, diversification, leverage) ...

... Costs (power over suppliers, business model, OPEX control) Pricing (power over customers) Asset Utilization Access and Cost of Capital Growth (branding, distribution channels, marcom) Risk Management (hedging, diversification, leverage) ...

THE PROS + CONS - Spring Financial Group

... at no cost. Our books and seminars seek to inform people of not only the benefits but also the potential risks and pitfalls of various strategies and investments. With this aim in mind, we are delighted to provide you with a free copy of this eBook. We live in interesting (and somewhat difficult) ti ...

... at no cost. Our books and seminars seek to inform people of not only the benefits but also the potential risks and pitfalls of various strategies and investments. With this aim in mind, we are delighted to provide you with a free copy of this eBook. We live in interesting (and somewhat difficult) ti ...

Does pension funds` fiduciary duty prohibit the integration of

... environmental, social or governance (ESG) criteria, but critics claim that the integration of any of these non-financial criteria into pension fund investment processes conflicts with fiduciary duties. On this matter, the 2005 Freshfields report concluded that pension funds’ fiduciary duties (e.g. p ...

... environmental, social or governance (ESG) criteria, but critics claim that the integration of any of these non-financial criteria into pension fund investment processes conflicts with fiduciary duties. On this matter, the 2005 Freshfields report concluded that pension funds’ fiduciary duties (e.g. p ...

A Wealth-Dependent Investment Opportunity Set

... It is important to understand investors’ behavior in the analysis of financial market. Studies on consumption and investment problem of an economic agent usually assume that her available investment opportunity set is fixed throughout. However, it is not the case in practice that an investor has the ...

... It is important to understand investors’ behavior in the analysis of financial market. Studies on consumption and investment problem of an economic agent usually assume that her available investment opportunity set is fixed throughout. However, it is not the case in practice that an investor has the ...

8. Overview of Main Changes in 2008 SNA (Financial)

... • Therefore, they should be recognized as households’ assets, irrespective of the fact that segregated schemes’ assets exist or not, and of the fact that the employer may have recorded an associated liability entry in his balance sheet or not • Consequently recommends recording of the liabilities of ...

... • Therefore, they should be recognized as households’ assets, irrespective of the fact that segregated schemes’ assets exist or not, and of the fact that the employer may have recorded an associated liability entry in his balance sheet or not • Consequently recommends recording of the liabilities of ...

NBER WORKING PAPER SERIES

... mortgage credit, but the core losses were exacerbated by four factors: high leverage (which amplifies the effect of price movements on balance sheets and can lead to margin calls that require unwinding positions pushing prices lower and making losses greater still), maturity mismatch (which leads to ...

... mortgage credit, but the core losses were exacerbated by four factors: high leverage (which amplifies the effect of price movements on balance sheets and can lead to margin calls that require unwinding positions pushing prices lower and making losses greater still), maturity mismatch (which leads to ...

Pindyck/Rubinfeld Microeconomics

... To make and sell these motors, a firm needs capital—namely, the factory that it built for $10 million. The firm’s $10 million capital stock allows it to earn a flow of profit of $80,000 per month. Was the $10 million investment in this factory a sound decision? If the factory will last 20 years, the ...

... To make and sell these motors, a firm needs capital—namely, the factory that it built for $10 million. The firm’s $10 million capital stock allows it to earn a flow of profit of $80,000 per month. Was the $10 million investment in this factory a sound decision? If the factory will last 20 years, the ...

A PUZZLE FOR BUSINESS?

... don’t tend to worry about it. The economic definition is straightforward: it just means the level of financial output per unit of input. In this case, we are talking about employee productivity, so the unit of input is labour. You may have some measures such as revenue per head or profit per full-ti ...

... don’t tend to worry about it. The economic definition is straightforward: it just means the level of financial output per unit of input. In this case, we are talking about employee productivity, so the unit of input is labour. You may have some measures such as revenue per head or profit per full-ti ...

2016-lecture-15

... of companies tend to need more financing at their disposal. Use financial statements and ratios Taxes – Firms in a higher tax bracket tends to utilize more debt to take advantage of the interest tax shield benefits. Profit level - Less profitable tends to use more financial leverage, because a les ...

... of companies tend to need more financing at their disposal. Use financial statements and ratios Taxes – Firms in a higher tax bracket tends to utilize more debt to take advantage of the interest tax shield benefits. Profit level - Less profitable tends to use more financial leverage, because a les ...

The Determinants of Forced Manager Turnovers in Major League

... MLS is a particularly interesting division to study because it is a relatively young league (founded in 1994) and has undergone rapid expansion in money, popularity and the actual number of teams that play in the league. Perhaps more importantly, the structure is also set up in a very different ...

... MLS is a particularly interesting division to study because it is a relatively young league (founded in 1994) and has undergone rapid expansion in money, popularity and the actual number of teams that play in the league. Perhaps more importantly, the structure is also set up in a very different ...

ExamView - Quiz # 6.tst

... a. both the equilibrium interest rate and the equilibrium quantity of loanable funds to fall. b. both the equilibrium interest rate and the equilibrium quantity of loanable funds to rise. c. the equilibrium interest rate to rise and the equilibrium quantity of loanable funds to fall. d. the equilibr ...

... a. both the equilibrium interest rate and the equilibrium quantity of loanable funds to fall. b. both the equilibrium interest rate and the equilibrium quantity of loanable funds to rise. c. the equilibrium interest rate to rise and the equilibrium quantity of loanable funds to fall. d. the equilibr ...

Pushing further in search of return: The new private equity model

... to match demand, buyers are paying premium prices to acquire target companies. This requires them to generate more value from the asset to meet their return objectives, which takes longer – holding periods have increased – and demands more investment in efficiency, channel effectiveness and other fo ...

... to match demand, buyers are paying premium prices to acquire target companies. This requires them to generate more value from the asset to meet their return objectives, which takes longer – holding periods have increased – and demands more investment in efficiency, channel effectiveness and other fo ...