Lesson Module 1: The Fundamentals of Net Worth

... Net Worth is a rough representation of your financial position at one point in time. The formula to calculate your net worth is: Net Worth = Assets – Liabilities An asset is something that you own that has positive economic value. It can be a liquid asset, meaning it can be easily turned into cash. ...

... Net Worth is a rough representation of your financial position at one point in time. The formula to calculate your net worth is: Net Worth = Assets – Liabilities An asset is something that you own that has positive economic value. It can be a liquid asset, meaning it can be easily turned into cash. ...

Lesson 4 - uwcentre

... 2009 led some economists to predict that inflation would rise and make long-term bonds a poor investment. Question: How do investors take into account expected inflation and other factors when making investment decisions? ...

... 2009 led some economists to predict that inflation would rise and make long-term bonds a poor investment. Question: How do investors take into account expected inflation and other factors when making investment decisions? ...

Determining Interest Rates

... 2009 led some economists to predict that inflation would rise and make long-term bonds a poor investment. Question: How do investors take into account expected inflation and other factors when making investment decisions? ...

... 2009 led some economists to predict that inflation would rise and make long-term bonds a poor investment. Question: How do investors take into account expected inflation and other factors when making investment decisions? ...

Cross-Industry Product Diversification

... risk-adjusted profits. The overall conclusion is that product diversification into non-interest income activities need not be stabilizing. As a way of explanation, Stiroh (2004) points out that convergence across financial institutions has led to higher correlations among product lines, reducing div ...

... risk-adjusted profits. The overall conclusion is that product diversification into non-interest income activities need not be stabilizing. As a way of explanation, Stiroh (2004) points out that convergence across financial institutions has led to higher correlations among product lines, reducing div ...

STRATEGIC INTENT - The University of New Mexico

... arranged over several months to test how random selection performed against leading stock traders. Luckily for the financial analysts, the latter managed to at least beat the darts on average, but the victory was not deemed sufficiently convincing enough to justify the hefty brokerage fees charged b ...

... arranged over several months to test how random selection performed against leading stock traders. Luckily for the financial analysts, the latter managed to at least beat the darts on average, but the victory was not deemed sufficiently convincing enough to justify the hefty brokerage fees charged b ...

dollar deposed stress test scenario

... Model of Oxford Economics. This yields ‘GDP@Risk’ which estimates the loss to the global gross domestic product over 5 years, i.e., the cumulative effect of this scenario on the global economy. GPD@Risk, expressed in real terms in US dollars, ranges from $1.9 trillion for S1, a loss, to a global gai ...

... Model of Oxford Economics. This yields ‘GDP@Risk’ which estimates the loss to the global gross domestic product over 5 years, i.e., the cumulative effect of this scenario on the global economy. GPD@Risk, expressed in real terms in US dollars, ranges from $1.9 trillion for S1, a loss, to a global gai ...

Building a better retirement income solution

... that their organization already has solved the retirement income dilemma. As baby boomers begin to retire in increasing numbers and firms face continued pressure for organic growth, it is necessary for an introspective look at the firm’s end-to-end retirement income offering, inclusive of planning a ...

... that their organization already has solved the retirement income dilemma. As baby boomers begin to retire in increasing numbers and firms face continued pressure for organic growth, it is necessary for an introspective look at the firm’s end-to-end retirement income offering, inclusive of planning a ...

Engineering Economics - Inside Mines

... project in terms of its annual value or cost. For example it may be easier to evaluate specific components of an investment or individual pieces of equipment based upon their annual costs as the data may be more readily available for analysis. ...

... project in terms of its annual value or cost. For example it may be easier to evaluate specific components of an investment or individual pieces of equipment based upon their annual costs as the data may be more readily available for analysis. ...

Towards a framework for calibrating macroprudential leverage limits

... restrictions on new lending that generate a credit crunch. Market participants can contribute to the build-up of excessive leverage when they do not internalise costs that their actions impose on the financial system. Pressure of short-term competition, optimism about future asset prices and the fav ...

... restrictions on new lending that generate a credit crunch. Market participants can contribute to the build-up of excessive leverage when they do not internalise costs that their actions impose on the financial system. Pressure of short-term competition, optimism about future asset prices and the fav ...

NBER WORKING PAPER SERIES FINANCIAL INNOVATION, MARKET PARTICIPATION AND ASSET PRICES Laurent Calvet

... that excludes the optioned stock as well as for the market index. Similar empirical evidence is available for other countries and derivative markets (e.g. Jochum and Kodres, 1998). A rich theoretical literature has also explored the impact of innovation, and three results are most directly related t ...

... that excludes the optioned stock as well as for the market index. Similar empirical evidence is available for other countries and derivative markets (e.g. Jochum and Kodres, 1998). A rich theoretical literature has also explored the impact of innovation, and three results are most directly related t ...

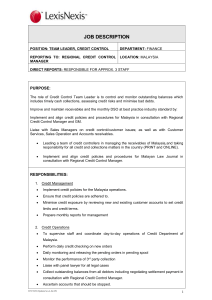

Job Description

... Minimising number of on hold customers Improve in debts recovery from doubtful customers Working very closely with Customer Service team for timely resolution of customer inquiries Reduction in debtor days and stopped accounts as well as increased cash collections and calls made as identified in per ...

... Minimising number of on hold customers Improve in debts recovery from doubtful customers Working very closely with Customer Service team for timely resolution of customer inquiries Reduction in debtor days and stopped accounts as well as increased cash collections and calls made as identified in per ...

Wealth Growth Planning Brochure

... kids a sound education, or retiring when you want to. While you build the resources to fulfill your life’s goals, you also want to ensure that your money continues to work hard for you even in varying economic situations. ...

... kids a sound education, or retiring when you want to. While you build the resources to fulfill your life’s goals, you also want to ensure that your money continues to work hard for you even in varying economic situations. ...

Synovus to Acquire Entaire Global Companies, Inc.

... statements. Forward-looking statements are based on the information known to, and current beliefs and expectations of, Synovus’ management and are subject to significant risks and uncertainties. Actual results may differ materially from those contemplated by such forward-looking statements. A numbe ...

... statements. Forward-looking statements are based on the information known to, and current beliefs and expectations of, Synovus’ management and are subject to significant risks and uncertainties. Actual results may differ materially from those contemplated by such forward-looking statements. A numbe ...

disclosure quality on the polish alternative investment market

... ◆ raised capital in the new issues averaged 3.2 million PLN, but half of the emissions did not exceed 1.5 million PLN (median), ◆ Nominated Advisers (nomads) bought shares in about one third of all issues, ◆ in about 49% of companies, there were financial institutions under the shareholders, often t ...

... ◆ raised capital in the new issues averaged 3.2 million PLN, but half of the emissions did not exceed 1.5 million PLN (median), ◆ Nominated Advisers (nomads) bought shares in about one third of all issues, ◆ in about 49% of companies, there were financial institutions under the shareholders, often t ...

KASE Standard Presentation dated September 1, 2007

... KASE was established at November 17, 1993 under the name of Kazakh Interbank Currency Exchange, two days after the launching of tenge – new legal tender of Kazakhstan. Now, that day (November 15) is celebrated as the official annual holiday "The Day of Financiers". ...

... KASE was established at November 17, 1993 under the name of Kazakh Interbank Currency Exchange, two days after the launching of tenge – new legal tender of Kazakhstan. Now, that day (November 15) is celebrated as the official annual holiday "The Day of Financiers". ...

Dividend Yield vs. Dividend Growth

... The hypothetical backtested performance does not represent the results of actual trading using client assets nor decision-making during the period and does not and is not intended to indicate the past performance or future performance of any account or investment strategy managed by OSAM. If actual ...

... The hypothetical backtested performance does not represent the results of actual trading using client assets nor decision-making during the period and does not and is not intended to indicate the past performance or future performance of any account or investment strategy managed by OSAM. If actual ...

Financial Intermediary Leverage and Value-at-Risk

... that its equity doubles from its previous level, or it must sell half its assets, or some combination of both. ...

... that its equity doubles from its previous level, or it must sell half its assets, or some combination of both. ...

Competition - The Surveillance Studies Centre

... microeconomic theory. In line with microeconomic theory, and its treatment of competition, strategic management is concerned with how the firm position itself to compete in product markets (Rumelt, Schendel, & Teece 1994). In contrast, with economic theory that perceives firms as agents in an econom ...

... microeconomic theory. In line with microeconomic theory, and its treatment of competition, strategic management is concerned with how the firm position itself to compete in product markets (Rumelt, Schendel, & Teece 1994). In contrast, with economic theory that perceives firms as agents in an econom ...

Counterfactual Investing

... current positions, according to Strahilevitz et al. Investors tend to add less frequently to holdings whose price has gone up since being purchased (“winners”) and add more frequently to those whose price has dropped (“losers”). The counterfactual created for winners is, “I should have purchased mor ...

... current positions, according to Strahilevitz et al. Investors tend to add less frequently to holdings whose price has gone up since being purchased (“winners”) and add more frequently to those whose price has dropped (“losers”). The counterfactual created for winners is, “I should have purchased mor ...

Equilibrium Cross-Section of Returns

... ratio and firm size and stock returns, which appear to be inconsistent with the standard Capital Asset Pricing Model (CAPM). Despite their empirical success, these simple statistical relations have proved very hard to rationalize and their precise economic source remains a subject of debate.1 We cons ...

... ratio and firm size and stock returns, which appear to be inconsistent with the standard Capital Asset Pricing Model (CAPM). Despite their empirical success, these simple statistical relations have proved very hard to rationalize and their precise economic source remains a subject of debate.1 We cons ...

Foreign Investment in the Solomon Islands: A Legal Analysis By

... Costly and time consuming procedure. This procedure (outlined in 6.0 above) is prescribed in section 5 of the Investment Act (1990). As a prerequisite the law requires foreign investors to obtain a building plan, company registration income tax registration [and others] before applying for registrat ...

... Costly and time consuming procedure. This procedure (outlined in 6.0 above) is prescribed in section 5 of the Investment Act (1990). As a prerequisite the law requires foreign investors to obtain a building plan, company registration income tax registration [and others] before applying for registrat ...

note to staff - Towers Watson

... superannuation fund that provides benefits exclusively to employees of the Reserve Bank of Australia (RBA), Note Printing Australia Limited (NPA) and the Australian Prudential Regulation Authority. It had almost 2 650 members and $1.29 billion of assets as at 30 June 2016. The OSF is governed by a t ...

... superannuation fund that provides benefits exclusively to employees of the Reserve Bank of Australia (RBA), Note Printing Australia Limited (NPA) and the Australian Prudential Regulation Authority. It had almost 2 650 members and $1.29 billion of assets as at 30 June 2016. The OSF is governed by a t ...

EDHEC Working Paper Comparing Regulatory Measures Stock Market Volatility

... One of the main objectives of a regulator is to maintain stable financial markets. Major instruments for attaining such stability include fiscal and monetary policy measures, as well as direct restrictions on trading in financial markets. In this paper, we compare the effects of different regulatory ...

... One of the main objectives of a regulator is to maintain stable financial markets. Major instruments for attaining such stability include fiscal and monetary policy measures, as well as direct restrictions on trading in financial markets. In this paper, we compare the effects of different regulatory ...