Alternative Risk Transfer, The Convergence of the Insurance and

... financial system, thereby reducing the cost of reinsurance. This ultimately benefits individuals and institutions seeking insurance protection. Capital market participants benefit from a diversity of risks and returns that are not dependent on the same factors affecting traditional financial markets ...

... financial system, thereby reducing the cost of reinsurance. This ultimately benefits individuals and institutions seeking insurance protection. Capital market participants benefit from a diversity of risks and returns that are not dependent on the same factors affecting traditional financial markets ...

Chapter 1 PowerPoint

... Allocational Efficiency: highest/best use of funds DSUs try to fund projects with best cost/benefit ratios SSUs try to invest for best possible return for given maturity and risk Informational Efficiency: prices reflect relevant information Informationally efficient markets reprice quickly on new in ...

... Allocational Efficiency: highest/best use of funds DSUs try to fund projects with best cost/benefit ratios SSUs try to invest for best possible return for given maturity and risk Informational Efficiency: prices reflect relevant information Informationally efficient markets reprice quickly on new in ...

Slides

... Yes, the a & b represent the same thing in each and have the same constant values • The constant a can treated as the rate of return from the business initiation expense that created the core offering for the target market • The constant b can treated the amount lost in the average rate of the ret ...

... Yes, the a & b represent the same thing in each and have the same constant values • The constant a can treated as the rate of return from the business initiation expense that created the core offering for the target market • The constant b can treated the amount lost in the average rate of the ret ...

Economic Value Added (EVA), Agency Costs and Firm Performance

... As per traditional firm performance measures alone, an investor has to make the future investment decisions in the present based on the past information (Combs et al. 2005; Richard et al. 2009). At the most, the derived accounting indicators, such as certain financial ratios (e.g. ROA, ROE, debt-equ ...

... As per traditional firm performance measures alone, an investor has to make the future investment decisions in the present based on the past information (Combs et al. 2005; Richard et al. 2009). At the most, the derived accounting indicators, such as certain financial ratios (e.g. ROA, ROE, debt-equ ...

PDF

... enforcing property rights and in delivering infrastructure: poor rural areas face inherent market failures in economic coordination. In the immediate post- independence period SSA governments needed to act, and to be seen to act, to promote agricultural and rural development. The private sector was ...

... enforcing property rights and in delivering infrastructure: poor rural areas face inherent market failures in economic coordination. In the immediate post- independence period SSA governments needed to act, and to be seen to act, to promote agricultural and rural development. The private sector was ...

Solutions to Chapter 1

... Rather, a bank loan is a claim on cash flows generated by other activities, which makes it a financial asset. 11. Investment in research and development creates ‘know-how.’ This knowledge is then used to produce goods and services, which makes it a real asset. 12. The responsibilities of the treasur ...

... Rather, a bank loan is a claim on cash flows generated by other activities, which makes it a financial asset. 11. Investment in research and development creates ‘know-how.’ This knowledge is then used to produce goods and services, which makes it a real asset. 12. The responsibilities of the treasur ...

significance and differences of marketing and sales controlling

... Small- and medium-sized companies usually perceive controlling in connection with financial management. However, this is a serious mistake, which may have very unpleasant consequences for businesses. Such consequences are usually connected with a failure to achieve operational and strategic aims in ...

... Small- and medium-sized companies usually perceive controlling in connection with financial management. However, this is a serious mistake, which may have very unpleasant consequences for businesses. Such consequences are usually connected with a failure to achieve operational and strategic aims in ...

This PDF is a selection from an out-of-print volume from... of Economic Research

... savings. This nonoptimality manifests itself in two ways. First, investors, especially the young, may be forced to bear more risk in their portfolios than they would choose in the absence of this market failure. Second, for any given level of risk, the portfolios held by investors will be inefficien ...

... savings. This nonoptimality manifests itself in two ways. First, investors, especially the young, may be forced to bear more risk in their portfolios than they would choose in the absence of this market failure. Second, for any given level of risk, the portfolios held by investors will be inefficien ...

Conventional Direction to Unconventional Measures: Using

... fiscal capacity (High level Group on Own Resources, 2014). The Juncker Plan could be the link between those countries that need more solidarity and public investments in order to ensure employment-friendly growth and other member states whose priority is fiscal discipline. In this paper we try to de ...

... fiscal capacity (High level Group on Own Resources, 2014). The Juncker Plan could be the link between those countries that need more solidarity and public investments in order to ensure employment-friendly growth and other member states whose priority is fiscal discipline. In this paper we try to de ...

Appendix 9 - Managed Investments Act

... involves custodians holding financial assets in a way that does not separate scheme property for one managed investment scheme from the scheme property of other managed investment schemes (2 instruments). (ix) ...

... involves custodians holding financial assets in a way that does not separate scheme property for one managed investment scheme from the scheme property of other managed investment schemes (2 instruments). (ix) ...

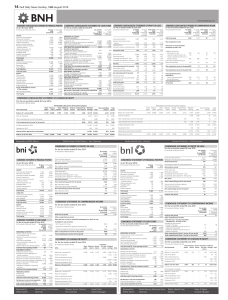

14 Gulf Daily News Sunday, 14th August 2016

... Non-controlling interest Total comprehensive income for the period ...

... Non-controlling interest Total comprehensive income for the period ...

Technology Industry on Financial Ratios and Stock Returns

... the predictive power to future stock returns and future earnings performance so ROE could be explained by the higher profitability of these firms for the period 1993 to 2001 in Tunisia same as Omran and Ragab (2004) studied the relationships between common financial ratios and stock returns in Egypt ...

... the predictive power to future stock returns and future earnings performance so ROE could be explained by the higher profitability of these firms for the period 1993 to 2001 in Tunisia same as Omran and Ragab (2004) studied the relationships between common financial ratios and stock returns in Egypt ...

Close Strategic Alpha Prospectus - Close Brothers Asset Management

... Prospectus and accepts responsibility accordingly. It has taken all reasonable care to ensure that, to the best of its knowledge and belief, the information in this document does not contain any untrue or misleading statement or omit any matters required by the COLL Sourcebook to be included in it. ...

... Prospectus and accepts responsibility accordingly. It has taken all reasonable care to ensure that, to the best of its knowledge and belief, the information in this document does not contain any untrue or misleading statement or omit any matters required by the COLL Sourcebook to be included in it. ...

Recapitalization and Banks` Performance: A Case Study of Nigerian

... Recapitalization entails increasing the debt stock of the company or issuing additional shares through existing shareholders or new shareholders or a combination of the two. It could even take the form of merger and acquisition or foreign direct investment. Whichever form it takes the end result is ...

... Recapitalization entails increasing the debt stock of the company or issuing additional shares through existing shareholders or new shareholders or a combination of the two. It could even take the form of merger and acquisition or foreign direct investment. Whichever form it takes the end result is ...

Is buy and hold dead - Richard Bernstein Advisors

... Each index reflects an unmanaged universe of securities without any deduction for advisory fees or other expenses that would reduce actual returns, as well as the reinvestment of all income and dividends. An actual investment in the securities included in the index would require an investor to incur ...

... Each index reflects an unmanaged universe of securities without any deduction for advisory fees or other expenses that would reduce actual returns, as well as the reinvestment of all income and dividends. An actual investment in the securities included in the index would require an investor to incur ...

SM_Ch06

... auditee’s business. This includes ‘company-level’ or ‘management controls’ as well as control over business processes, information systems and financial statements . There are various frameworks an auditor can choose from, and usually an audit firm will develop a version for use by its audit teams. ...

... auditee’s business. This includes ‘company-level’ or ‘management controls’ as well as control over business processes, information systems and financial statements . There are various frameworks an auditor can choose from, and usually an audit firm will develop a version for use by its audit teams. ...

EANGUS MEMORIAL BUILDING FUND CONTRIBUTION

... the New Patriot and Conference book as a Corporate Bronze Contributor. ...

... the New Patriot and Conference book as a Corporate Bronze Contributor. ...

Trading Away Democracy

... (CETA). The agreement included an investor-state dispute settlement (ISDS) mechanism, later tweaked and re-branded as ICS (Investment Court System) in February 2016, which could unleash a corporate litigation boom against Canada, the EU and individual EU member states, and could dangerously thwart g ...

... (CETA). The agreement included an investor-state dispute settlement (ISDS) mechanism, later tweaked and re-branded as ICS (Investment Court System) in February 2016, which could unleash a corporate litigation boom against Canada, the EU and individual EU member states, and could dangerously thwart g ...

Chapter 8 - McGraw Hill Higher Education

... varying degrees from the risk-free rate, depending on such factors as inflation, the term (maturity) of a loan, the risk of borrower default, the risk of prepayment, and the marketability, liquidity, convertibility, and tax status of the securities to which those rates ...

... varying degrees from the risk-free rate, depending on such factors as inflation, the term (maturity) of a loan, the risk of borrower default, the risk of prepayment, and the marketability, liquidity, convertibility, and tax status of the securities to which those rates ...

vornado realty lp - Vornado Realty Trust

... FFO adjusted for comparability was $689.5 million in 2005 compared to $639.1 million in 2004, an increase of $50.4 million. However, on a per share basis adjusted FFO declined $.05 per share from $4.80 in 2004 to $4.75 in 2005. The per share decline is almost entirely caused by dilution from the wei ...

... FFO adjusted for comparability was $689.5 million in 2005 compared to $639.1 million in 2004, an increase of $50.4 million. However, on a per share basis adjusted FFO declined $.05 per share from $4.80 in 2004 to $4.75 in 2005. The per share decline is almost entirely caused by dilution from the wei ...

Depression Babies

... at age 36-45 that is more than twice as high. For the 1941-50 cohort, the rate dips again, consistent with the fact that this cohort reached age 36-45 just after the depression years of the 1970s. In this paper we test whether these cohort differences persist after controlling for a wide range of de ...

... at age 36-45 that is more than twice as high. For the 1941-50 cohort, the rate dips again, consistent with the fact that this cohort reached age 36-45 just after the depression years of the 1970s. In this paper we test whether these cohort differences persist after controlling for a wide range of de ...

Determinant of Return on Assets and Return on Equity and Its

... leverage and profitability. It was also tested in their research that highly leveraged businesses are riskier in terms of their return on equity and investment but results indicated that highly leveraged firms were less risky in both market-based and accounting-based measures. In Jordan, Taani K and ...

... leverage and profitability. It was also tested in their research that highly leveraged businesses are riskier in terms of their return on equity and investment but results indicated that highly leveraged firms were less risky in both market-based and accounting-based measures. In Jordan, Taani K and ...

Estimating Equity Risk Premiums Report

... Jacquier et al. [15,16] developed an unbiased estimate of the mean (U) from historical data by weighing the geometric (G) and arithmetic (A) means by the ratio of number of years in the projection (P) to the number of years in the sample (S): U = A*(1-P/S) + G*(P/S) As the projection time gets long ...

... Jacquier et al. [15,16] developed an unbiased estimate of the mean (U) from historical data by weighing the geometric (G) and arithmetic (A) means by the ratio of number of years in the projection (P) to the number of years in the sample (S): U = A*(1-P/S) + G*(P/S) As the projection time gets long ...

four reasons to consider an allocation to international small cap

... this offers some potential to exploit inefficiencies. The total assets under management (AUM) in the eVestment Alliance database for international small cap is approximately $98 billion (as of 12/31/2015), representing just 5% of the $1.9 trillion international small cap universe. Compare that to th ...

... this offers some potential to exploit inefficiencies. The total assets under management (AUM) in the eVestment Alliance database for international small cap is approximately $98 billion (as of 12/31/2015), representing just 5% of the $1.9 trillion international small cap universe. Compare that to th ...