Interest Rate

... Banks borrow less from fed more from other banks (increase demand for reserves); banks beef up their reserves (instead of using expensive fed loans for emergencies) (decrease in supply): decrease loans, deposits and money supply. Banks borrow more from fed less from other banks (decrease demand for ...

... Banks borrow less from fed more from other banks (increase demand for reserves); banks beef up their reserves (instead of using expensive fed loans for emergencies) (decrease in supply): decrease loans, deposits and money supply. Banks borrow more from fed less from other banks (decrease demand for ...

Define and Discuss on Monetary Policy

... Monetary policy is conducted by a nation's central bank. In the U.S., monetary policy is carried out by the Fed. The Fed has three main instruments that it uses to conduct monetary policy: open market operations, changes in reserve requirements, and changes in the discount rate. Recall from the ear ...

... Monetary policy is conducted by a nation's central bank. In the U.S., monetary policy is carried out by the Fed. The Fed has three main instruments that it uses to conduct monetary policy: open market operations, changes in reserve requirements, and changes in the discount rate. Recall from the ear ...

1-Introduction-FS - National Skills Academy for Financial Services

... The Financial Services industry is divided into two distinct areas. The first is: The professional sector (also known as the wholesale, or institutional sector) • Business to business ...

... The Financial Services industry is divided into two distinct areas. The first is: The professional sector (also known as the wholesale, or institutional sector) • Business to business ...

CH 4 PPT - Allen ISD

... for goods and services push money through banks. The economy at large plays a far greater role in determining how money is moving than does the government. Slide 20 ...

... for goods and services push money through banks. The economy at large plays a far greater role in determining how money is moving than does the government. Slide 20 ...

MERCANTILISM - WikiEducator

... form of Bank of England liabilities, both notes and deposits, though at these time notes seem to have dominated. It is, therefore, possible to speak of a single British monetary system, centered on the Bank of England, which in turn held its own reserves mainly in the form of gold bullion. Ireland, ...

... form of Bank of England liabilities, both notes and deposits, though at these time notes seem to have dominated. It is, therefore, possible to speak of a single British monetary system, centered on the Bank of England, which in turn held its own reserves mainly in the form of gold bullion. Ireland, ...

Comparison of efficiency and costs of payments: Some new

... • Employment share of payment related workforce 0.12 - 0.20 per cent • Unit costs of cash and cards are not terribly different 0.30 vs 0.26 € • Altogether costs seem to be much smaller than e.g. in the Netherlands and Belgium (but close to recent Swedish estimates 0.36 – 0.40 %) ...

... • Employment share of payment related workforce 0.12 - 0.20 per cent • Unit costs of cash and cards are not terribly different 0.30 vs 0.26 € • Altogether costs seem to be much smaller than e.g. in the Netherlands and Belgium (but close to recent Swedish estimates 0.36 – 0.40 %) ...

QUIZ 1 - Solutions 14.02 Principles of Macroeconomics March 3, 2005

... 3. In equilibrium in the …nancial market with the presence of banks, the supply of money is a fraction (< 1) of the supply of high powered money. False. The supply of high powered money is a fraction of the supply of money, since the former includes currency and reserves, and the latter currency and ...

... 3. In equilibrium in the …nancial market with the presence of banks, the supply of money is a fraction (< 1) of the supply of high powered money. False. The supply of high powered money is a fraction of the supply of money, since the former includes currency and reserves, and the latter currency and ...

New Theories of Optimal Currency Areas and their application to

... market, risk sharing through risk trading, that is, through financial portfolio diversification becomes an option for capital income. Most of national GDP is, of course, national labour income, which is not perfectly correlated with national capital income and is unlikely to be spanned by the capita ...

... market, risk sharing through risk trading, that is, through financial portfolio diversification becomes an option for capital income. Most of national GDP is, of course, national labour income, which is not perfectly correlated with national capital income and is unlikely to be spanned by the capita ...

·The Federal Reserve System controls the supply of money in th

... money supply, is made up of Federal Reserve notes-fiat paper money issued by Federal Reserve banks and printed at the Bureau of Engraving and Printing. This currency, issued in amounts of $1, $2, $5, $10, $20, $50, and $100, is distributed to the Fed district banks for storage. The Bureau of the Min ...

... money supply, is made up of Federal Reserve notes-fiat paper money issued by Federal Reserve banks and printed at the Bureau of Engraving and Printing. This currency, issued in amounts of $1, $2, $5, $10, $20, $50, and $100, is distributed to the Fed district banks for storage. The Bureau of the Min ...

Ch#18 Bank Management

... 3. Growth strategies such as acquisitions 4. Policies for capital structuring including decisions to raise capital or to repurchase stocks 5. To assess the bank’s performance and to ensure that correct action is taken in case of poor management. ...

... 3. Growth strategies such as acquisitions 4. Policies for capital structuring including decisions to raise capital or to repurchase stocks 5. To assess the bank’s performance and to ensure that correct action is taken in case of poor management. ...

The lender of last resort and modern central banking

... wealth with their bank; they have a debt claim, and so banks are levered. Second, this private money is credit money: bank deposits are “backed” by claims on firms and households. Indeed, deposit money is created by such loans, which are typically risky and illiquid. A bank holds only a fraction of ...

... wealth with their bank; they have a debt claim, and so banks are levered. Second, this private money is credit money: bank deposits are “backed” by claims on firms and households. Indeed, deposit money is created by such loans, which are typically risky and illiquid. A bank holds only a fraction of ...

Foreign Bank - Gulf Writing

... In numerous nations, the passage of remote banks has been expanded on a high scale amid the 1990s particularly in the nations which are less created. Because of monetary linearization approaches, the passage of outside banks operations expanded amid the mid 1990s which thus permitted remote banks to ...

... In numerous nations, the passage of remote banks has been expanded on a high scale amid the 1990s particularly in the nations which are less created. Because of monetary linearization approaches, the passage of outside banks operations expanded amid the mid 1990s which thus permitted remote banks to ...

Document

... Suppose that the operating band is 4.5% to 5% and the Bank wishes to tighten policy by raising the band by 25 basis points In one of the eight fixed days for announcing changes to the band for ior, the Bank announces, at 9:00 a.m., that it is adjusting the band up from 4.5% to 5% to 4.75% to 5.25% F ...

... Suppose that the operating band is 4.5% to 5% and the Bank wishes to tighten policy by raising the band by 25 basis points In one of the eight fixed days for announcing changes to the band for ior, the Bank announces, at 9:00 a.m., that it is adjusting the band up from 4.5% to 5% to 4.75% to 5.25% F ...

Full PDF

... Other than those mentioned above the possible factors that may have effect on the time-deposit ratio are the greater awareness regarding portfolio adjustments brought about by financial deepening and diversification. As the economic reforms started in 1990‟s the financial liberalisation also proceed ...

... Other than those mentioned above the possible factors that may have effect on the time-deposit ratio are the greater awareness regarding portfolio adjustments brought about by financial deepening and diversification. As the economic reforms started in 1990‟s the financial liberalisation also proceed ...

Panel on Policy Reforms after the Crisis Chair: Barry Eichengreen geneRal DisCUssiOn

... can generate any level of reserves. It’s really hard to pin down even the optimal level of net foreign assets of a country. So, swap arrangements can be useful because they can provide contingent credit. Korea’s reserve levels may be too high. China’s reserves may be too high as well. But that may b ...

... can generate any level of reserves. It’s really hard to pin down even the optimal level of net foreign assets of a country. So, swap arrangements can be useful because they can provide contingent credit. Korea’s reserve levels may be too high. China’s reserves may be too high as well. But that may b ...

16 The impact of Basel I capital requirements on bank

... banks’ activities as originators of credit by encouraging them to boost their capital positions. However, as the risk asset ratio might be increased by altering either the numerator or the denominator in the ratio, banks could improve their position not only by securing larger amounts of capital, bu ...

... banks’ activities as originators of credit by encouraging them to boost their capital positions. However, as the risk asset ratio might be increased by altering either the numerator or the denominator in the ratio, banks could improve their position not only by securing larger amounts of capital, bu ...

The Quantity Theory of Money

... level of GDP assumed to be fixed), this will mean that there is MORE money in circulation chasing the same quantity of goods. This in turn bids up prices as the purchasing power of each dollar falls. The end result will be a proportional increase in the price level, i.e. 15% increase in P. ...

... level of GDP assumed to be fixed), this will mean that there is MORE money in circulation chasing the same quantity of goods. This in turn bids up prices as the purchasing power of each dollar falls. The end result will be a proportional increase in the price level, i.e. 15% increase in P. ...

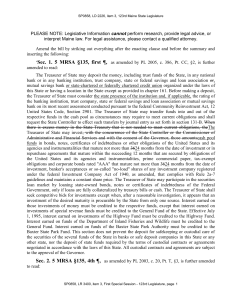

MS-Word, RTF - Maine Legislature

... The Treasurer of State may deposit the money, including trust funds of the State, in any national bank or in any banking institution, trust company, state or federal savings and loan association or, mutual savings bank or state-chartered or federally chartered credit union organized under the laws o ...

... The Treasurer of State may deposit the money, including trust funds of the State, in any national bank or in any banking institution, trust company, state or federal savings and loan association or, mutual savings bank or state-chartered or federally chartered credit union organized under the laws o ...

Securitisation rules in Singapore

... the applicable risk weights prescribed by the Authority. 9.3 However, investment grade securities from a securitisation transaction involving residential mortgages held in the banking book will be eligible for a 50 per cent risk-weight, where the following conditions are met: a. the loans underlying ...

... the applicable risk weights prescribed by the Authority. 9.3 However, investment grade securities from a securitisation transaction involving residential mortgages held in the banking book will be eligible for a 50 per cent risk-weight, where the following conditions are met: a. the loans underlying ...

Mark Gertler Bernanke Working

... However, agents must decide how to allocate their endowment before they learn their respective types. The options are storage and lending to the banking system. Individuals can store endowment if they wish, but they cannot directly invest in illiquid projects because evaluation and auditing of the p ...

... However, agents must decide how to allocate their endowment before they learn their respective types. The options are storage and lending to the banking system. Individuals can store endowment if they wish, but they cannot directly invest in illiquid projects because evaluation and auditing of the p ...

Problem Session-2

... c. Because BSB is cutting back on its loans, other banks will find themselves short of reserves and they may also cut back on their loans as well. d. BSB may find it difficult to cut back on its loans immediately, because it cannot force people to pay off loans. Instead, it can stop making new loans ...

... c. Because BSB is cutting back on its loans, other banks will find themselves short of reserves and they may also cut back on their loans as well. d. BSB may find it difficult to cut back on its loans immediately, because it cannot force people to pay off loans. Instead, it can stop making new loans ...

Economic Perspectives March 1997

... would not be in the country’s best interests in the long run. Many countries, including the U.S., have confronted this issue. While Poland has come a long way in reforming its banking system, in our view more progress needs to be made before Polish banks can operate efficiently. We believe the key p ...

... would not be in the country’s best interests in the long run. Many countries, including the U.S., have confronted this issue. While Poland has come a long way in reforming its banking system, in our view more progress needs to be made before Polish banks can operate efficiently. We believe the key p ...