Investing in Strong Brands Doubles Returns over

... It has long been acknowledged that powerful brands drive stakeholder preference, improving business performance and ultimately increasing shareholder value. However, for the first time the extent of this effect has been quantified. Valuation and strategy agency Brand Finance has been tracking the br ...

... It has long been acknowledged that powerful brands drive stakeholder preference, improving business performance and ultimately increasing shareholder value. However, for the first time the extent of this effect has been quantified. Valuation and strategy agency Brand Finance has been tracking the br ...

This presentation is for discussion purposes only and is not an

... as well as income received from licensed production, merchandise, cast album and stock and amateur licensing. Rebecca Broadway LP’s returns will be equal to 50% of Adjusted Net Profits, pro-rata based on the amount invested against total Rebecca Broadway Limited Partnership capitalization. The follo ...

... as well as income received from licensed production, merchandise, cast album and stock and amateur licensing. Rebecca Broadway LP’s returns will be equal to 50% of Adjusted Net Profits, pro-rata based on the amount invested against total Rebecca Broadway Limited Partnership capitalization. The follo ...

Policies and Procedures

... State Small Business Credit Initiative (SSBCI). The 49SAF is intended to help high-growth, early-stage businesses with the potential to produce significant economic impact, including jobs, find funding. Because banks usually loan based on assets, a startup business’s initial capital is often produce ...

... State Small Business Credit Initiative (SSBCI). The 49SAF is intended to help high-growth, early-stage businesses with the potential to produce significant economic impact, including jobs, find funding. Because banks usually loan based on assets, a startup business’s initial capital is often produce ...

Title in Arial bold Subhead in Arial

... – premium based upon creditworthiness and outstanding WC liabilities – SF arranges security on a portfolio basis on behalf of all eligible companies – all eligible companies (based on minimum credit rating) must participate ...

... – premium based upon creditworthiness and outstanding WC liabilities – SF arranges security on a portfolio basis on behalf of all eligible companies – all eligible companies (based on minimum credit rating) must participate ...

Gravitational waves

... the ‘institutionalisation’ of the hedge fund industry by focusing on attracting talent and diversifying its portfolio management process; both in terms of people and systems. “We are a discretionary macro fund but we are very focused on quantitative models to help us in our investment process so tha ...

... the ‘institutionalisation’ of the hedge fund industry by focusing on attracting talent and diversifying its portfolio management process; both in terms of people and systems. “We are a discretionary macro fund but we are very focused on quantitative models to help us in our investment process so tha ...

The Role of Investment Banking for the German Economy

... analyse both the economic benefits and the costs stemming from investment banking. The study focuses on investment banks as this part of banking is particularly relevant for financing companies as well as the development and use of specif‐ ic products to support the needs of priv ...

... analyse both the economic benefits and the costs stemming from investment banking. The study focuses on investment banks as this part of banking is particularly relevant for financing companies as well as the development and use of specif‐ ic products to support the needs of priv ...

The Best Solution for Protecting Retirement Portfolios: Put and Call

... chart. Mutual fund and ETF investments include expense charges for active management that would need to be factored into financial projections. Another strategy for downside protection involves purchasing structured notes, where investment banks use options and derivatives to provide principal prote ...

... chart. Mutual fund and ETF investments include expense charges for active management that would need to be factored into financial projections. Another strategy for downside protection involves purchasing structured notes, where investment banks use options and derivatives to provide principal prote ...

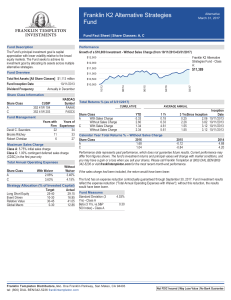

Franklin K2 Alternative Strategies Fund Fact Sheet

... involve greater credit risk, including the possibility of default or bankruptcy. Currency management strategies could result in losses to the Fund if currencies do not perform as the investment manager or sub-advisor expects. The Fund may make short sales of securities, which involves the risk that ...

... involve greater credit risk, including the possibility of default or bankruptcy. Currency management strategies could result in losses to the Fund if currencies do not perform as the investment manager or sub-advisor expects. The Fund may make short sales of securities, which involves the risk that ...

Graystone Consulting Contact List

... members on the 403(b) Retirement Plan here at St. Norbert College. Some of the services are: o Investment Fund Monitoring o Benchmark Plan Fees & Costs o On-Site Group Employee Meetings o One-on-One Employee Meetings (in-person or on phone) Graystone Consulting is a business of Morgan Stanley Gr ...

... members on the 403(b) Retirement Plan here at St. Norbert College. Some of the services are: o Investment Fund Monitoring o Benchmark Plan Fees & Costs o On-Site Group Employee Meetings o One-on-One Employee Meetings (in-person or on phone) Graystone Consulting is a business of Morgan Stanley Gr ...

Hedge Fund Directive clashes with Irish regulations If the European

... Directive proposes, therefore, to affect the operations of managers of all nonUCITS funds, irrespective of the legal structure of the fund, its investment strategy, whether it is domiciled inside or outside of the EU or whether it is an open or closed-ended fund. The Explanatory Memorandum concedes ...

... Directive proposes, therefore, to affect the operations of managers of all nonUCITS funds, irrespective of the legal structure of the fund, its investment strategy, whether it is domiciled inside or outside of the EU or whether it is an open or closed-ended fund. The Explanatory Memorandum concedes ...

Market Penetration and Investment Pattern: A Study

... March 2015, more than 2000 different mutual fund schemes were on offer across AMCs (SEBI Annual Report 2014-15). Investors can choose the schemes according to the structure: Open-ended Funds or Close-ended Funds or by the objective of their investment: Growth Funds, Income Funds, Balanced Funds or M ...

... March 2015, more than 2000 different mutual fund schemes were on offer across AMCs (SEBI Annual Report 2014-15). Investors can choose the schemes according to the structure: Open-ended Funds or Close-ended Funds or by the objective of their investment: Growth Funds, Income Funds, Balanced Funds or M ...

L’avenir de l’Afrique et le soutien de la Banque mondiale

... companies’ performance vis-à-vis the stated agreements and ensuring that those agreements are in fact beneficial to Gabon; and Procuring World Bank Group advice and technical assistance to strengthen areas such as public financial management, debt management, and taxation systems as well as the pe ...

... companies’ performance vis-à-vis the stated agreements and ensuring that those agreements are in fact beneficial to Gabon; and Procuring World Bank Group advice and technical assistance to strengthen areas such as public financial management, debt management, and taxation systems as well as the pe ...

LEARNING HOW RAYMOND JAMES PROTECTS YOUR ACCOUNT

... annually by an independent public accounting firm. Raymond James Bank, N.A. is a national bank chartered by the Office of the Comptroller of the Currency (OCC) and subject to the rules of the Federal Financial Institutions Examination Council (FFIEC), which includes the Board of Governors of the Fed ...

... annually by an independent public accounting firm. Raymond James Bank, N.A. is a national bank chartered by the Office of the Comptroller of the Currency (OCC) and subject to the rules of the Federal Financial Institutions Examination Council (FFIEC), which includes the Board of Governors of the Fed ...

FACTORS AFFECTING PORTFOLIO INVESTMENT IN PAKISTAN

... of interest as well as the positive reception of the value of the instruments. Most of the studies emphasized on the positive aspects of foreign capital on economic growth. Foreign capital improves the process of economic growth by filling the gap between savings and investment. Foreign capital flow ...

... of interest as well as the positive reception of the value of the instruments. Most of the studies emphasized on the positive aspects of foreign capital on economic growth. Foreign capital improves the process of economic growth by filling the gap between savings and investment. Foreign capital flow ...

Foreign Direct Investment and Transnational Corporations in the

... agency seated in the capital city of Bratislava. In following years SARIO provided significant institutional support for foreign investors. Under the care of SARIO there were many investment projects in automotive sector, in electronics, in chemistry, rubber and plastics and in machinery implemented ...

... agency seated in the capital city of Bratislava. In following years SARIO provided significant institutional support for foreign investors. Under the care of SARIO there were many investment projects in automotive sector, in electronics, in chemistry, rubber and plastics and in machinery implemented ...

T. Rowe Price Target Date Conversion Strategy

... guaranteed at any time, including at or after the target date, which is the approximate date when investors turn age 65. The target date strategies invest in a broad range of underlying portfolios that include stocks, bonds, and short-term investments and are subject to the risks of different areas ...

... guaranteed at any time, including at or after the target date, which is the approximate date when investors turn age 65. The target date strategies invest in a broad range of underlying portfolios that include stocks, bonds, and short-term investments and are subject to the risks of different areas ...

Merk Investments

... cases, limited geographic focus, political and economic instability, and relatively illiquid markets. The Fund is subject to interest rate risk which is the risk that debt securities in the Fund's portfolio will decline in value because of increases in market interest rates. As a non-diversified fun ...

... cases, limited geographic focus, political and economic instability, and relatively illiquid markets. The Fund is subject to interest rate risk which is the risk that debt securities in the Fund's portfolio will decline in value because of increases in market interest rates. As a non-diversified fun ...

IOSR Journal of Economics and Finance (IOSR-JEF)

... developing countries firms rely mostly on internal sources and informal credit markets for funds because their money and capital markets are not well developed (Osei, 2002). As a result of this, long term investments are discouraged. The role of capital in the growth of an economy cannot be over emp ...

... developing countries firms rely mostly on internal sources and informal credit markets for funds because their money and capital markets are not well developed (Osei, 2002). As a result of this, long term investments are discouraged. The role of capital in the growth of an economy cannot be over emp ...

Some Lessons from Capital Market History

... Average Returns: The First Lesson The Variability of Returns: The Second ...

... Average Returns: The First Lesson The Variability of Returns: The Second ...

Chapter 2: Investment and Physical Capital

... Transition is typically thought of as re-writing the rules, and progress in transition is measured by what is still missing among the rules — and now institutions as well. But the big problem for Russia is not what is missing, but rather what is there — as a result of 70 years of misallocation. The ...

... Transition is typically thought of as re-writing the rules, and progress in transition is measured by what is still missing among the rules — and now institutions as well. But the big problem for Russia is not what is missing, but rather what is there — as a result of 70 years of misallocation. The ...

POULTRY INVESTMENT PROPOSAL

... The global broiler production has increased by 37% between 2002 to 2011. Consumption of chicken and other chicken products also continues to grow. Currently nearly 42 kilograms of chicken is produced per person worldwide, but chicken consumption varies greatly by region and socioeconomic status. In ...

... The global broiler production has increased by 37% between 2002 to 2011. Consumption of chicken and other chicken products also continues to grow. Currently nearly 42 kilograms of chicken is produced per person worldwide, but chicken consumption varies greatly by region and socioeconomic status. In ...

SSF - oneam

... The index rebounded after the rebounded and rose to the highest level of at year at 1,600 after the coup by NCPO combined with curfew uplifted in some area, improved industry confidence to the highest level in 7 months, and the introduction of temporary constitution brought back overall investors’ c ...

... The index rebounded after the rebounded and rose to the highest level of at year at 1,600 after the coup by NCPO combined with curfew uplifted in some area, improved industry confidence to the highest level in 7 months, and the introduction of temporary constitution brought back overall investors’ c ...

Resolution of the Government of the Russian Federation from

... proposals and comments from the business community and organizations on the content of the draft plan. 17. A public discussion shall be held during 10 calendar days from the date of posting information about its holding. 18. Within 7 calendar days after the public discussion, the Ministry can intro ...

... proposals and comments from the business community and organizations on the content of the draft plan. 17. A public discussion shall be held during 10 calendar days from the date of posting information about its holding. 18. Within 7 calendar days after the public discussion, the Ministry can intro ...

Pilot Provisions on the Formation of Subsidiary Companies by

... 1. for the latest 12 months, all its risk control indicators have reached the prescribed standards and its net capital has been 120 million yuan or more; 2. it has a relatively strong operation and management capability, and, if it has set up a subsidiary company to operate securities brokerage, sec ...

... 1. for the latest 12 months, all its risk control indicators have reached the prescribed standards and its net capital has been 120 million yuan or more; 2. it has a relatively strong operation and management capability, and, if it has set up a subsidiary company to operate securities brokerage, sec ...

Downgrade risk of South Africa`s sovereign debt

... Gordhan’s imminent arrest, related to allegations of his involvement with setting up a previous covert investigation unit within the South African Revenue Service, have introduced worries that these institutions are no longer deemed untouchable by ...

... Gordhan’s imminent arrest, related to allegations of his involvement with setting up a previous covert investigation unit within the South African Revenue Service, have introduced worries that these institutions are no longer deemed untouchable by ...