Overview Main Issues in Debt Management in African

... Other components of the debt stock • Quasi-government debt is a feature of many African countries • Some central banks issue their own bills to manage liquidity or implement monetary policy • This may be a consequence of an absence of a sufficient supply government securities • Does the existence of ...

... Other components of the debt stock • Quasi-government debt is a feature of many African countries • Some central banks issue their own bills to manage liquidity or implement monetary policy • This may be a consequence of an absence of a sufficient supply government securities • Does the existence of ...

NRCS Pastureland Ecology - Agricultural and Resource Economics

... 2. Futures markets have proved to be the most reliable guide to future prices 3. However, futures markets are not infallible and cannot foresee unexpected events that affect dairy markets like abnormal weather, financial crises and political turmoil 4.The tool uses historic data on futures prices an ...

... 2. Futures markets have proved to be the most reliable guide to future prices 3. However, futures markets are not infallible and cannot foresee unexpected events that affect dairy markets like abnormal weather, financial crises and political turmoil 4.The tool uses historic data on futures prices an ...

Corporate Financial Distress and Bankruptcy

... Equity is measured by the combined market value of all shares of stock, preferred and common, while liabilities include both current and long-term. This ratio shows how much the firms’ assets can decline in value before the liabilities exceed the assets and the firm becomes insolvent. For example, a ...

... Equity is measured by the combined market value of all shares of stock, preferred and common, while liabilities include both current and long-term. This ratio shows how much the firms’ assets can decline in value before the liabilities exceed the assets and the firm becomes insolvent. For example, a ...

HOW THE FLAWS OF BASEL II LED TO THE COLLAPSE OF BEAR

... business similar to any other commercial enterprise.15 As a result, the advocates of this position assert that investment banks should be subject to the same regulatory oversight as any other business.16 Such oversight is often relaxed or entirely nonexistent. Nonetheless, every nation in the world ...

... business similar to any other commercial enterprise.15 As a result, the advocates of this position assert that investment banks should be subject to the same regulatory oversight as any other business.16 Such oversight is often relaxed or entirely nonexistent. Nonetheless, every nation in the world ...

Insurance Models and risk-function premium principle (Warwick)

... To ensure that the insurance company does not go bankrupt, we need to have a efficient model which is amenable to analysis. Insurance deals with situations which are highly complex. For example insurance against weather fluctuations, which the field of Catastrophe modelling deals with. Predicting we ...

... To ensure that the insurance company does not go bankrupt, we need to have a efficient model which is amenable to analysis. Insurance deals with situations which are highly complex. For example insurance against weather fluctuations, which the field of Catastrophe modelling deals with. Predicting we ...

Monetary Policy, Financial Conditions, and Financial Stability

... As discussed in detail in this paper, when financial intermediation is added to these models, interest rate changes can also affect loan supply through credit market frictions, such as asymmetric information between borrowers and lenders that gives rise to an external finance premium. The size of t ...

... As discussed in detail in this paper, when financial intermediation is added to these models, interest rate changes can also affect loan supply through credit market frictions, such as asymmetric information between borrowers and lenders that gives rise to an external finance premium. The size of t ...

Audit Planning and Analytical Procedures

... The Planning entails the development of: A general strategy (the overall audit plan); and A detailed approach for the nature, timing and extent of the audit procedures (the audit ...

... The Planning entails the development of: A general strategy (the overall audit plan); and A detailed approach for the nature, timing and extent of the audit procedures (the audit ...

ICICI-Prudential-Fixed-Maturity-Plan-Series 73

... Reverse Repo and Repo in Government Securities/Government Securities/T-bills) and derivatives. 5. Post New Fund Offer period and towards the maturity of the Scheme, there may be higher allocation to cash and cash equivalent. 6. In the event of any deviations from floor and ceiling of credit ratings ...

... Reverse Repo and Repo in Government Securities/Government Securities/T-bills) and derivatives. 5. Post New Fund Offer period and towards the maturity of the Scheme, there may be higher allocation to cash and cash equivalent. 6. In the event of any deviations from floor and ceiling of credit ratings ...

Financial News

... “estimate”, “forecast”, “target”, “objective” and other similar expressions or future or conditional verbs such as “will”, “should”, “would” and “could”. By their nature, these statements require us to make assumptions, including the economic assumptions set out in the “Financial performance overvie ...

... “estimate”, “forecast”, “target”, “objective” and other similar expressions or future or conditional verbs such as “will”, “should”, “would” and “could”. By their nature, these statements require us to make assumptions, including the economic assumptions set out in the “Financial performance overvie ...

Macroeconomic Stability and Financial Regulation: Key Issues for

... has advised the Italian Treasury on the reform of security markets, and has been a member of the Treasury's privatisation committee, the European Parliament's advisory panel on financial services, and has served as Co-Director of the CEPR Financial Economics Programme. His research is in the fields ...

... has advised the Italian Treasury on the reform of security markets, and has been a member of the Treasury's privatisation committee, the European Parliament's advisory panel on financial services, and has served as Co-Director of the CEPR Financial Economics Programme. His research is in the fields ...

Corporate Governance

... with the Company will still be considered independent if they pass the remaining tests in clause 67 and the Board is satisfied of their independence. This allows non-executive directors to use their independence in the strategic decision-making process with sustainable outcomes for not only the shar ...

... with the Company will still be considered independent if they pass the remaining tests in clause 67 and the Board is satisfied of their independence. This allows non-executive directors to use their independence in the strategic decision-making process with sustainable outcomes for not only the shar ...

Rare events and investor risk aversion

... kernels to significant exogenous events by developing an event study approach allowing us to present graphical and statistical evidence. Our paper further differentiates itself from the literature in its focus on crude oil options, as the literature has focused mainly on equity and Forex markets (Co ...

... kernels to significant exogenous events by developing an event study approach allowing us to present graphical and statistical evidence. Our paper further differentiates itself from the literature in its focus on crude oil options, as the literature has focused mainly on equity and Forex markets (Co ...

USING A HYPOTHETICAL EFFICIENT FIRM TO BENCHMARK

... This type of regulation seeks to emulate competition in the markets where natural monopoly exists. To this end, it uses marginal cost criteria to set the prices, attempting to attain allocative efficiency.4 In addition, a self-financing constraint is imposed exogenously by the regulator since it wil ...

... This type of regulation seeks to emulate competition in the markets where natural monopoly exists. To this end, it uses marginal cost criteria to set the prices, attempting to attain allocative efficiency.4 In addition, a self-financing constraint is imposed exogenously by the regulator since it wil ...

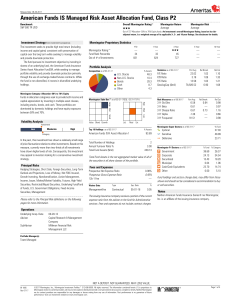

American Funds IS Managed Risk Asset Allocation Fund

... The Morningstar Return rates a fund's performance relative to other managed products in its Morningstar Category. It is an assessment of a product's excess return over a risk-free rate (the return of the 90-day Treasury Bill) in comparison with the products in its Morningstar category. In each Morni ...

... The Morningstar Return rates a fund's performance relative to other managed products in its Morningstar Category. It is an assessment of a product's excess return over a risk-free rate (the return of the 90-day Treasury Bill) in comparison with the products in its Morningstar category. In each Morni ...

Two Additional Market Vectors ETFs Offered to Qualified

... Fund shares are not individually redeemable and will be issued and redeemed at their NAV only through certain authorized broker-dealers in large, specified blocks of shares called “creation units” and otherwise can be bought and sold only through exchange trading. Creation units are issued and redee ...

... Fund shares are not individually redeemable and will be issued and redeemed at their NAV only through certain authorized broker-dealers in large, specified blocks of shares called “creation units” and otherwise can be bought and sold only through exchange trading. Creation units are issued and redee ...

1Q14 - Investors

... In connection with the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995, we provide the following cautionary remarks regarding important risks and uncertainties which, among others, could cause our actual results to differ materially from our expectations, including t ...

... In connection with the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995, we provide the following cautionary remarks regarding important risks and uncertainties which, among others, could cause our actual results to differ materially from our expectations, including t ...

Ecole thématique CNRS « Les méthodes de l`analyse

... • Interpersonal versus impersonal institutions • Relationship-based regulation systems: Subsistence institutions and the priority of individual risk diversification. The poor are rational. • Impersonal regulation systems: capitalist institutions and profit maximisation. ...

... • Interpersonal versus impersonal institutions • Relationship-based regulation systems: Subsistence institutions and the priority of individual risk diversification. The poor are rational. • Impersonal regulation systems: capitalist institutions and profit maximisation. ...

NBER WORKING PAPER SERIES FINANCIAL GLOBALIZATION, FINANCIAL CRISES, AND THE EXTERNAL

... even more, leaving them exposed to a greater risk of hitting the credit constraint. If this does happen, the classic Fisherian debt-de ation mechanism is set in motion and a full-blown nancial crisis follows. The crisis is characterized by a re-sale of equity and a sudden reversal in the debt pos ...

... even more, leaving them exposed to a greater risk of hitting the credit constraint. If this does happen, the classic Fisherian debt-de ation mechanism is set in motion and a full-blown nancial crisis follows. The crisis is characterized by a re-sale of equity and a sudden reversal in the debt pos ...