Property–Casualty Insurance Basics

... personal and commercial auto insurance, commercial property and liability coverage for businesses, workers’ compensation, homeowners’ insurance, medical malpractice coverage, and product liability insurance. As an industry, property-casualty insurers account for nearly 3% of our country’s GDP and pr ...

... personal and commercial auto insurance, commercial property and liability coverage for businesses, workers’ compensation, homeowners’ insurance, medical malpractice coverage, and product liability insurance. As an industry, property-casualty insurers account for nearly 3% of our country’s GDP and pr ...

Introduction to Minsky`s Stabilizing an Unstable Economy

... that it can generate? Again, however, that is too simplistic because it ignores the financing arrangements. Minsky argued that the amount one is willing to pay depends on the amount of external finance required—greater borrowing exposes the buyer to higher risk of insolvency. This is why “borrower’s ...

... that it can generate? Again, however, that is too simplistic because it ignores the financing arrangements. Minsky argued that the amount one is willing to pay depends on the amount of external finance required—greater borrowing exposes the buyer to higher risk of insolvency. This is why “borrower’s ...

Impairment Of Debt and Write Off Policy – 2016/2017

... Dr JS Moroka cheque against the debt impairment provision votes in the income and expenditure ledger and process it against the relevant debtors account. 6.8 The Accountant: Credit Control and Debt Collection must annually prepare a reconciliation of debt impairment accounts/votes with supporting do ...

... Dr JS Moroka cheque against the debt impairment provision votes in the income and expenditure ledger and process it against the relevant debtors account. 6.8 The Accountant: Credit Control and Debt Collection must annually prepare a reconciliation of debt impairment accounts/votes with supporting do ...

Exit Strategies: Know Your Options

... Products are subject to underwriting guidelines, review and approval. Products may not be available in all jurisdictions. This presentation does not constitute an offer to sell any of the insurance coverages or other financial products described herein. The purpose of this presentation is to provide ...

... Products are subject to underwriting guidelines, review and approval. Products may not be available in all jurisdictions. This presentation does not constitute an offer to sell any of the insurance coverages or other financial products described herein. The purpose of this presentation is to provide ...

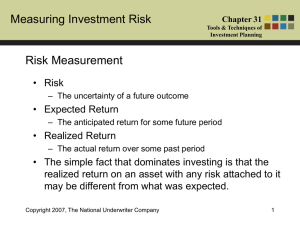

Chapter 31 Tools & Techniques of Investment Planning

... – The anticipated return for some future period ...

... – The anticipated return for some future period ...

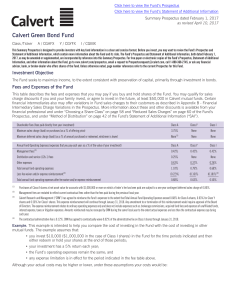

Calvert Green Bond Fund

... Fixed income markets have recently experienced a period of relatively high volatility due to rising U.S. treasury yields which, in part, reflect the market’s expectations for higher U.S. economic growth and inflation. As a result of the Federal Reserve’s recent decision to raise the target fed funds ...

... Fixed income markets have recently experienced a period of relatively high volatility due to rising U.S. treasury yields which, in part, reflect the market’s expectations for higher U.S. economic growth and inflation. As a result of the Federal Reserve’s recent decision to raise the target fed funds ...

De Grauwe , Paul, Ji , Yuemei Steinbach , Armin. 'The EU debt crisis: Testing and revisiting conventional legal doctrine' LEQS Paper No. 108, April 2016

... The EU debt crisis: Testing and revisiting conventional legal doctrine later, the European Stability Mechanism (ESM) was added; the European Central Bank’s Securities Markets Programme (SMP) covering bond purchases since May 2010 and finally the announcement by the ECB that it would purchase an unl ...

... The EU debt crisis: Testing and revisiting conventional legal doctrine later, the European Stability Mechanism (ESM) was added; the European Central Bank’s Securities Markets Programme (SMP) covering bond purchases since May 2010 and finally the announcement by the ECB that it would purchase an unl ...

ROLE PLAYED BY SACCOS IN FINANCIAL INTERMEDIATION IN

... accurately gauge the risk of various investments and to price them accordingly. This can be seen in the pricing of loans, investment products and other financial products offered by the intermediaries. According to King and Levine (1993), financial development is a good predictor of future growth; f ...

... accurately gauge the risk of various investments and to price them accordingly. This can be seen in the pricing of loans, investment products and other financial products offered by the intermediaries. According to King and Levine (1993), financial development is a good predictor of future growth; f ...

econstor

... only a small fraction of the gain in the levered firm value. If managers want to determine their firm’s optimal leverage ratios, they need to precisely assess the present state of the economy and the expected growth rate of EBIT. If they fail to identify the present conditions, they come to a non-op ...

... only a small fraction of the gain in the levered firm value. If managers want to determine their firm’s optimal leverage ratios, they need to precisely assess the present state of the economy and the expected growth rate of EBIT. If they fail to identify the present conditions, they come to a non-op ...

Creation of financial assets

... 1) bank deposits/loans, in Eurodollars/Yen etc. - OTC(non- marketable) 2) Commercial Bills, Certificates of Deposit CDs, - (also sold in secondary market) 3) Have a known return (=yield/interest rate), if held to maturity ...

... 1) bank deposits/loans, in Eurodollars/Yen etc. - OTC(non- marketable) 2) Commercial Bills, Certificates of Deposit CDs, - (also sold in secondary market) 3) Have a known return (=yield/interest rate), if held to maturity ...

Asset allocation in a low-yield and volatile environment

... from the historical patterns captured in the VCMM. More important, the VCMM may be underestimating extreme negative scenarios unobserved in the historical period on which the model estimation is based. All investing is subject to risk. Past performance is no guarantee of future returns. Investments ...

... from the historical patterns captured in the VCMM. More important, the VCMM may be underestimating extreme negative scenarios unobserved in the historical period on which the model estimation is based. All investing is subject to risk. Past performance is no guarantee of future returns. Investments ...

Financial-Reform-and-Rural-Development

... Latin American countries due to financial liberalisation being pursued in a poor regulatory framework. ...

... Latin American countries due to financial liberalisation being pursued in a poor regulatory framework. ...

Dr. Krzysztof Ostaszewski, FSA, CFA, MAAA Actuarial Program

... There is also a third group of financial assets: derivative securities. A derivative security has its cash flows derived from cash flows of other securities. It does not relate directly to income produced in economic activity, but rather, it relates to it indirectly, through other securities. Assets ...

... There is also a third group of financial assets: derivative securities. A derivative security has its cash flows derived from cash flows of other securities. It does not relate directly to income produced in economic activity, but rather, it relates to it indirectly, through other securities. Assets ...

The financial stability implications of increased capital flows for

... Definitions and data Most of the literature on capital flows to emerging market countries analyses net flows, which indicate how large the balance of external funds that enter or leave an economy is. While the composition of net capital flows matters for financial stability, net flows per se are pri ...

... Definitions and data Most of the literature on capital flows to emerging market countries analyses net flows, which indicate how large the balance of external funds that enter or leave an economy is. While the composition of net capital flows matters for financial stability, net flows per se are pri ...

The Gain-Loss Spread: A New and Intuitive

... expected outcome over a chosen time horizon at a chosen level of confidence; and “downside beta,” which measures whether an asset magnifies or mitigates the market’s downside fluctuations.8 Other risk measures relevant for optimal portfolio selection include the mean absolute deviation, the stable d ...

... expected outcome over a chosen time horizon at a chosen level of confidence; and “downside beta,” which measures whether an asset magnifies or mitigates the market’s downside fluctuations.8 Other risk measures relevant for optimal portfolio selection include the mean absolute deviation, the stable d ...

Joint Dynamics of Bond and Stock Returns - Wisconsin-School

... comovement, or a “common factor” in returns on assets with independent cash flows in general equilibrium. Martin (2012) generalized this setup to multiple “trees”. My paper differs from these by endogenizing the size of “trees” and modeling technologies with different amounts of cash-flow risk. The ...

... comovement, or a “common factor” in returns on assets with independent cash flows in general equilibrium. Martin (2012) generalized this setup to multiple “trees”. My paper differs from these by endogenizing the size of “trees” and modeling technologies with different amounts of cash-flow risk. The ...

instructions for preparing and publishing the annual

... capital assets not held for resale. Such donations are, however, a transaction that must be reported in an accrual-based government-wide statement of activities. Restate sales of capital assets on an accrual basis. Governmental funds report the full amount of the proceeds from a capital asset sale a ...

... capital assets not held for resale. Such donations are, however, a transaction that must be reported in an accrual-based government-wide statement of activities. Restate sales of capital assets on an accrual basis. Governmental funds report the full amount of the proceeds from a capital asset sale a ...

Auditing complex financial instruments

... considerations in relation to valuations and to financial statement disclosures about risks and uncertainties pertaining to complex financial instruments. The consultation draft includes guidance that draws on the IAASB Staff Audit Practice Alert on “Challenges in Auditing Fair Value Accounting Esti ...

... considerations in relation to valuations and to financial statement disclosures about risks and uncertainties pertaining to complex financial instruments. The consultation draft includes guidance that draws on the IAASB Staff Audit Practice Alert on “Challenges in Auditing Fair Value Accounting Esti ...