Guidelines on Risk Based Capital Adequacy

... the banking sector’s ability to absorb shocks arising from financial and economic stress, whatever the source, thus reducing the risk of spillover from the financial sector to the real economy. “Basel III: A global regulatory framework for more resilient banks and banking systems” (known as Basel II ...

... the banking sector’s ability to absorb shocks arising from financial and economic stress, whatever the source, thus reducing the risk of spillover from the financial sector to the real economy. “Basel III: A global regulatory framework for more resilient banks and banking systems” (known as Basel II ...

Ending "Too Big To Fail"

... “Too big to fail” is far from a new issue, as discussed in detail by Stern and Feldman (2004)―in the modern American context, it dates from at least the conservatorship of Continental Illinois in the 1980s. Concerns about this issue have become more intense since fall 2008. The status of “too big to ...

... “Too big to fail” is far from a new issue, as discussed in detail by Stern and Feldman (2004)―in the modern American context, it dates from at least the conservatorship of Continental Illinois in the 1980s. Concerns about this issue have become more intense since fall 2008. The status of “too big to ...

Relative Wealth Concerns and Financial Bubbles

... deviate such that the aggregate response leads to an amplification of the original deviation. As a result, optimal risk sharing will not be stable, and asset price distortions will emerge in all stable equilibria. While the standard assumption in economic models is that utility is derived from the a ...

... deviate such that the aggregate response leads to an amplification of the original deviation. As a result, optimal risk sharing will not be stable, and asset price distortions will emerge in all stable equilibria. While the standard assumption in economic models is that utility is derived from the a ...

The Use of Debt Covenants in Public Debt: The Role of

... flexibility to take firm value increasing actions. These Type II error costs are likely to be greater for growth firms with greater uncertainty about their future prospects, than for firms that already have the majority of their assets in place.11 Private debt may be less subject to these costs bec ...

... flexibility to take firm value increasing actions. These Type II error costs are likely to be greater for growth firms with greater uncertainty about their future prospects, than for firms that already have the majority of their assets in place.11 Private debt may be less subject to these costs bec ...

Cross-sectional volatility and return dispersion

... and 5th percentile managers for the nine years from 1990 through 1998 was 16-34 pps, but for the four quarters ending in June 2000, the range grew to 3097 pps. Being a good (or lucky) active manager in 2000 paid off handsomely; being bad (or unlucky) really hurt. The source of much of this rising di ...

... and 5th percentile managers for the nine years from 1990 through 1998 was 16-34 pps, but for the four quarters ending in June 2000, the range grew to 3097 pps. Being a good (or lucky) active manager in 2000 paid off handsomely; being bad (or unlucky) really hurt. The source of much of this rising di ...

Financial Innovation: The Bright and the Dark Sides

... with smaller market shares, lower loan-asset ratios and higher growth rates. This suggests that smaller banks, banks that diversify away from traditional intermediation and faster growing banks are relatively more fragile in countries with higher levels of financial innovation. The relationship betw ...

... with smaller market shares, lower loan-asset ratios and higher growth rates. This suggests that smaller banks, banks that diversify away from traditional intermediation and faster growing banks are relatively more fragile in countries with higher levels of financial innovation. The relationship betw ...

OTC Derivatives Presentation

... • Definition of a Derivative – a financial instrument (swap, put, call, cap, floor, collar, or similar option) for the purchase or sale of, or whose value is based on, one or more interest or other rates, currencies, commodities, securities, instruments of indebtedness, indices, quantitative measure ...

... • Definition of a Derivative – a financial instrument (swap, put, call, cap, floor, collar, or similar option) for the purchase or sale of, or whose value is based on, one or more interest or other rates, currencies, commodities, securities, instruments of indebtedness, indices, quantitative measure ...

SunAmerica Dynamic Allocation Portfolio Summary

... and short-term investments (the “Overlay Component”). The Fund-of-Funds Component will allocate approximately 50% to 80% of its assets to Underlying Portfolios investing primarily in equity securities and 20% to 50% of its assets to Underlying Portfolios investing primarily in fixed income securitie ...

... and short-term investments (the “Overlay Component”). The Fund-of-Funds Component will allocate approximately 50% to 80% of its assets to Underlying Portfolios investing primarily in equity securities and 20% to 50% of its assets to Underlying Portfolios investing primarily in fixed income securitie ...

An Evaluation of Money Market Fund Reform Proposals

... provision whereby investors cannot immediately redeem all of their shares (Alternative 2); or requiring MMFs to have a 3% subordinated capital buffer (Alternative 3). In June 2013, the Securities and Exchange Commission (SEC) asked for more specific feedback on the floating NAV proposal, and the pos ...

... provision whereby investors cannot immediately redeem all of their shares (Alternative 2); or requiring MMFs to have a 3% subordinated capital buffer (Alternative 3). In June 2013, the Securities and Exchange Commission (SEC) asked for more specific feedback on the floating NAV proposal, and the pos ...

Financial Market Infrastructure Ordinance

... 1. contractually entering into securities transactions or other contracts involving financial instruments between two participants or between one participant and another central counterparty, 2. the establishment of mechanisms relating to the planning for and protection against outages of participan ...

... 1. contractually entering into securities transactions or other contracts involving financial instruments between two participants or between one participant and another central counterparty, 2. the establishment of mechanisms relating to the planning for and protection against outages of participan ...

Liquidity Policies and Systemic Risk

... equilibrium settings (e.g. Diamond and Dybvig [1983] and Kahn and Santos [2005]), there are only few, recent examples of dynamic general equilibrium models that incorporate systemic liquidity crisis (e.g. Angeloni and Faia [2013], Gertler and Kiyotaki [2012], and Martin, Skeie, and Von Thadden [2013 ...

... equilibrium settings (e.g. Diamond and Dybvig [1983] and Kahn and Santos [2005]), there are only few, recent examples of dynamic general equilibrium models that incorporate systemic liquidity crisis (e.g. Angeloni and Faia [2013], Gertler and Kiyotaki [2012], and Martin, Skeie, and Von Thadden [2013 ...

Methods of Loan Guarantee Valuation and Accounting

... upper limit on the total value of guarantees. Guarantees are counted against this upper limit in various ways, including, in extreme cases, at the full face value of the underlying loans guaranteed plus interest payments due, even though the expected probability of default is significantly less than ...

... upper limit on the total value of guarantees. Guarantees are counted against this upper limit in various ways, including, in extreme cases, at the full face value of the underlying loans guaranteed plus interest payments due, even though the expected probability of default is significantly less than ...

Public Debt sustainability

... complete markets, the willingness to pay for consumption in different states of the world will differ across individuals, as will the measure of risk. While this form of heterogeneity makes the evaluation of sustainability more subtle, it may be important to improve the performance of the CCAPM. Ind ...

... complete markets, the willingness to pay for consumption in different states of the world will differ across individuals, as will the measure of risk. While this form of heterogeneity makes the evaluation of sustainability more subtle, it may be important to improve the performance of the CCAPM. Ind ...

PDF - Deutsche Bank

... Figures may not add up due to rounding differences Incl. policyholder benefits and claims, restructuring costs, impairment of goodwill and other intangible assets where applicable Includes CtA related to Postbank and OpEx Figures differ to previously reported numbers due to methodology change in 1Q2 ...

... Figures may not add up due to rounding differences Incl. policyholder benefits and claims, restructuring costs, impairment of goodwill and other intangible assets where applicable Includes CtA related to Postbank and OpEx Figures differ to previously reported numbers due to methodology change in 1Q2 ...

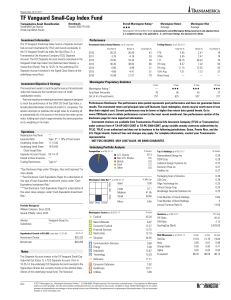

TF Vanguard Small-Cap Index Fund

... and/or its content providers; (2) may not be copied or distributed and (3) is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of information. Past performance is no guarantee of future perf ...

... and/or its content providers; (2) may not be copied or distributed and (3) is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of information. Past performance is no guarantee of future perf ...