Effects of Financial Globalization on Developing Countries

... (iii) What factors can help to harness the benefits of financial globalization? Developing economies’ financial linkages with the global economy have risen significantly in recent decades. However, a relatively small group of these countries has garnered a lion’s share of private capital flows from ...

... (iii) What factors can help to harness the benefits of financial globalization? Developing economies’ financial linkages with the global economy have risen significantly in recent decades. However, a relatively small group of these countries has garnered a lion’s share of private capital flows from ...

Implied Volatility Sentiment: A Tale of Two Tails

... attitude towards risk. Investors feared another crash and became more willing to give up upside potential in equities to hedge against the risk of drawdowns via put options. Bates (2003) suggest that even models adjusted for stochastic volatility, stochastic interest rates, and random jumps do not f ...

... attitude towards risk. Investors feared another crash and became more willing to give up upside potential in equities to hedge against the risk of drawdowns via put options. Bates (2003) suggest that even models adjusted for stochastic volatility, stochastic interest rates, and random jumps do not f ...

1305080572_490665

... Develop a list of questions that you would want to ask management so that you could gain enough information to make those assessments Identify any specific transaction areas are you willing to assess control risk less than high (100%) Module III: Control testing the sales processing subset of the re ...

... Develop a list of questions that you would want to ask management so that you could gain enough information to make those assessments Identify any specific transaction areas are you willing to assess control risk less than high (100%) Module III: Control testing the sales processing subset of the re ...

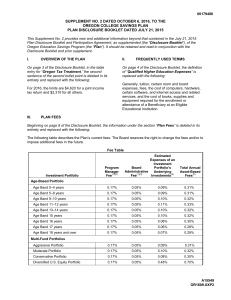

Disclosure Booklet - Oregon College Savings Plan

... share of the Plan Manager Fee and the Board Administrative Fee as these fees reduce the Investment Portfolio’s return. (2) Each Investment Portfolio (with the exception of the Principal Plus Interest Portfolio) pays the Plan Manager a fee at an annual rate of 0.17% of the average daily net assets of ...

... share of the Plan Manager Fee and the Board Administrative Fee as these fees reduce the Investment Portfolio’s return. (2) Each Investment Portfolio (with the exception of the Principal Plus Interest Portfolio) pays the Plan Manager a fee at an annual rate of 0.17% of the average daily net assets of ...

Alfjaneirtnjanjgahjktnm,brazjklhhjkznm

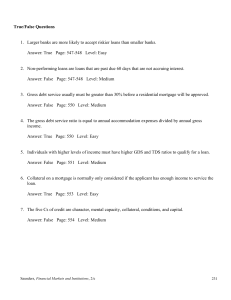

... D) none of the above Answer: B Page: 563 Level: Difficult 33. From the data given it appears that Big Valley I. Has greater short term insolvency risk than the industry average II. Has less long term insolvency risk than the industry average III. Generates fewer sales per dollar invested in fixed as ...

... D) none of the above Answer: B Page: 563 Level: Difficult 33. From the data given it appears that Big Valley I. Has greater short term insolvency risk than the industry average II. Has less long term insolvency risk than the industry average III. Generates fewer sales per dollar invested in fixed as ...

Equity Diversification:

... second well-chosen stock would create some diversity, adding a third would diversify the portfolio further, and so on. In a broadly diversified portfolio, some individual stock prices would be up when others were down, thus netting less overall portfolio volatility. It’s possible that the reduction ...

... second well-chosen stock would create some diversity, adding a third would diversify the portfolio further, and so on. In a broadly diversified portfolio, some individual stock prices would be up when others were down, thus netting less overall portfolio volatility. It’s possible that the reduction ...

English - Oman Air

... Our branding strategy is fuelled by our total commitment to offering passengers the very best in 21st Century air travel. Having previously unveiled our much-praised Airbus A330 fleet on our long haul routes, in 2011 we took delivery of the first of our Embraer E175 regional jets. These superb aircr ...

... Our branding strategy is fuelled by our total commitment to offering passengers the very best in 21st Century air travel. Having previously unveiled our much-praised Airbus A330 fleet on our long haul routes, in 2011 we took delivery of the first of our Embraer E175 regional jets. These superb aircr ...

NBER WORKING PAPER SERIES AN ASSESSMENT OF THE NEW MERCHANTILISM

... endogenous Sudden Stops. To this end, we introduce a collateral constraint that limits debt not to exceed a fraction of the value of total income in units of tradable goods. As Mendoza (2006a) explains, this credit-market imperfection causes endogenous Sudden Stops because of the strong amplificatio ...

... endogenous Sudden Stops. To this end, we introduce a collateral constraint that limits debt not to exceed a fraction of the value of total income in units of tradable goods. As Mendoza (2006a) explains, this credit-market imperfection causes endogenous Sudden Stops because of the strong amplificatio ...

FORM 10-Q - corporate

... America (U.S. GAAP) and pursuant to the rules and regulations of the Securities and Exchange Commission (SEC), requires management to make estimates and assumptions that affect reported amounts. The most significant estimates include those related to the residual values for leased assets, our allowa ...

... America (U.S. GAAP) and pursuant to the rules and regulations of the Securities and Exchange Commission (SEC), requires management to make estimates and assumptions that affect reported amounts. The most significant estimates include those related to the residual values for leased assets, our allowa ...

Financial distress, reorganization and corporate performance

... forgiveness will free up assets. However, as the level of debt in the company's capital structure increases it would become harder for coalitions to successfully implement these strategies to secure reorganisation. As leverage increases, equity's claim over the company's assets will diminish, thereb ...

... forgiveness will free up assets. However, as the level of debt in the company's capital structure increases it would become harder for coalitions to successfully implement these strategies to secure reorganisation. As leverage increases, equity's claim over the company's assets will diminish, thereb ...

The Decentering of the Global Firm Working Paper

... national identity no longer guaranteed that it would advance the economic interests of a particular country. For example, a foreign firm with substantial investments in the United States may well be better for America than an American firm with most of its operations abroad. Reich’s question provoke ...

... national identity no longer guaranteed that it would advance the economic interests of a particular country. For example, a foreign firm with substantial investments in the United States may well be better for America than an American firm with most of its operations abroad. Reich’s question provoke ...

Finding Your Way Around the Book`s Web Site

... the stock market boom in January, 2000 (when the Dow Index stood at 11,600 and the NASDAQ was over 5000), whether the boom would be remembered as “one of the many euphoric speculative bubbles that have dotted human history.” In 1999 he said, “History tells us that sharp reversals in confidence happe ...

... the stock market boom in January, 2000 (when the Dow Index stood at 11,600 and the NASDAQ was over 5000), whether the boom would be remembered as “one of the many euphoric speculative bubbles that have dotted human history.” In 1999 he said, “History tells us that sharp reversals in confidence happe ...

Inefficient Markets, Efficient Investment?

... How might mispricing facilitate efficient investment? Faced with the reality of overpriced equity, a long-run value-maximizing manager will issue equity and invest the proceeds in cash, effectively transferring value from new shareholders to existing shareholders. To the extent that market ineffici ...

... How might mispricing facilitate efficient investment? Faced with the reality of overpriced equity, a long-run value-maximizing manager will issue equity and invest the proceeds in cash, effectively transferring value from new shareholders to existing shareholders. To the extent that market ineffici ...

Mackenzie Maximum Diversification Developed Europe Index ETF

... TOBAM is a registered trademark and service mark of TOBAM S.A.S. or its affiliates (“TOBAM”) and is used under license for certain purposes by Mackenzie Financial Corporation. Reproduction of the TOBAM data and information in any form is prohibited except with the prior written permission of TOBAM S ...

... TOBAM is a registered trademark and service mark of TOBAM S.A.S. or its affiliates (“TOBAM”) and is used under license for certain purposes by Mackenzie Financial Corporation. Reproduction of the TOBAM data and information in any form is prohibited except with the prior written permission of TOBAM S ...

FINANCIAL PLANNING RESEARCH JOURNAL

... In the case of financial planning/financial services perhaps the above quote should be extended to “death, taxes and uncertainty”. The last few months have certainly seen a lot of uncertainty with market volatility, consumer/investor/business confidence hit, regulatory uncertainty over superannuatio ...

... In the case of financial planning/financial services perhaps the above quote should be extended to “death, taxes and uncertainty”. The last few months have certainly seen a lot of uncertainty with market volatility, consumer/investor/business confidence hit, regulatory uncertainty over superannuatio ...