The Role of Interest Rate Swaps in Corporate

... n interest rate swap is a contractual agreement between two parties to exchange a series of interest rate payments without exchanging the underlying debt. The interest rate swap represents one example of a general category of financial instruments known as derivative instruments. In the most general ...

... n interest rate swap is a contractual agreement between two parties to exchange a series of interest rate payments without exchanging the underlying debt. The interest rate swap represents one example of a general category of financial instruments known as derivative instruments. In the most general ...

International Financial Reporting Standard 13 Fair Value

... Because different entities (and businesses within those entities) with different activities may have access to different markets, the principal (or most advantageous) market for the same asset or liability might be different for different entities (and businesses within those entities). Therefore, t ...

... Because different entities (and businesses within those entities) with different activities may have access to different markets, the principal (or most advantageous) market for the same asset or liability might be different for different entities (and businesses within those entities). Therefore, t ...

Euromoney Institutional Investor PLC acquires Total Derivatives

... business, announced today that it has signed an agreement to acquire Total Derivatives Limited (“Total Derivatives”), a leading provider of real-time news and analysis about the global fixed income derivatives markets. ...

... business, announced today that it has signed an agreement to acquire Total Derivatives Limited (“Total Derivatives”), a leading provider of real-time news and analysis about the global fixed income derivatives markets. ...

This PDF is a selection from a published volume from... National Bureau of Economic Research

... are secured by some sort of collateral that can be confiscated by the lender in case of default. A house is a prime example of collateral. For example, a home owner may use a $100,000 house to collateralize borrowing $80,000. In this case, we say that the margin requirement (or down payment, or hair ...

... are secured by some sort of collateral that can be confiscated by the lender in case of default. A house is a prime example of collateral. For example, a home owner may use a $100,000 house to collateralize borrowing $80,000. In this case, we say that the margin requirement (or down payment, or hair ...

USING THE BALANCE SHEET APPROACH IN FINANCIAL

... sheets, and could lead to a crisis: 1) liquidity and interest-rate risks – where a mismatch in maturity and times of interest-rate changes of assets and liabilities could create exposure to changes in demand for liquidity or in interest rate; 2) foreign currency risk – where the gap between assets a ...

... sheets, and could lead to a crisis: 1) liquidity and interest-rate risks – where a mismatch in maturity and times of interest-rate changes of assets and liabilities could create exposure to changes in demand for liquidity or in interest rate; 2) foreign currency risk – where the gap between assets a ...

Document

... Unlike other ratios, return on capital has a theoretical benchmark, the cost of capital also called the required return on capital. For example, the return on equity, ROE, could be compared with the required return on equity, kE, as estimated, for example, by the capital asset pricing model. If ROE ...

... Unlike other ratios, return on capital has a theoretical benchmark, the cost of capital also called the required return on capital. For example, the return on equity, ROE, could be compared with the required return on equity, kE, as estimated, for example, by the capital asset pricing model. If ROE ...

LEVERAGE, HEDGE FUNDS AND RISK

... great deal of conviction in his positions. Investor skill and experience are required in order to distinguish between these two scenarios. The level of leverage used by a hedge fund cannot be observed in isolation as an indicator of the riskiness of that fund or its underlying strategies. Understand ...

... great deal of conviction in his positions. Investor skill and experience are required in order to distinguish between these two scenarios. The level of leverage used by a hedge fund cannot be observed in isolation as an indicator of the riskiness of that fund or its underlying strategies. Understand ...

Adverse Selection in Reinsurance Markets

... c. Other non-US (unaffiliated) insurers (e.g., Lloyds syndicates) - codes 08000010899998 2. Unauthorized reinsurance a. Other US unaffiliated insurers - codes 1400001-1499998 b. Voluntary pools - codes 1600001-1699998 c. Other non-US (unaffiliated) insurers - codes 1700001-1799998 While theory does ...

... c. Other non-US (unaffiliated) insurers (e.g., Lloyds syndicates) - codes 08000010899998 2. Unauthorized reinsurance a. Other US unaffiliated insurers - codes 1400001-1499998 b. Voluntary pools - codes 1600001-1699998 c. Other non-US (unaffiliated) insurers - codes 1700001-1799998 While theory does ...

Gambling with Other People`s Money

... the last three decades, when large financial institutions have gotten into trouble, the government has almost always rescued their bondholders and creditors. These policies have created incentives both to borrow and to lend recklessly. When large financial institutions get in trouble, equity holders ...

... the last three decades, when large financial institutions have gotten into trouble, the government has almost always rescued their bondholders and creditors. These policies have created incentives both to borrow and to lend recklessly. When large financial institutions get in trouble, equity holders ...

pdf · 209.2 KB

... On November 7, 2016, adidas AG announced the commencement of the third tranche of the share buyback programme with an aggregate acquisition cost of up to € 300 million (excluding incidental purchasing costs). Within the third tranche, which was completed on January 31, 2017, adidas AG bought back 2, ...

... On November 7, 2016, adidas AG announced the commencement of the third tranche of the share buyback programme with an aggregate acquisition cost of up to € 300 million (excluding incidental purchasing costs). Within the third tranche, which was completed on January 31, 2017, adidas AG bought back 2, ...

The Relationship Between The Use Of The C`S Of Credit And The

... to MSEs because the clients from this sector are largely poor, lacking in normal securities that can be used as collateral in conventional lending. Commercial banks have therefore for a long time perceived such businesses as highly risky and undeserving o f any credit, even though the business perso ...

... to MSEs because the clients from this sector are largely poor, lacking in normal securities that can be used as collateral in conventional lending. Commercial banks have therefore for a long time perceived such businesses as highly risky and undeserving o f any credit, even though the business perso ...

Pension plan funding, risk sharing and technology choice

... in the economy, linking it to the age distribution of the population and the empirical wealth distribution across generations. These models are notoriously di¢ cult to analyse but they are at the heart of research aimed at capturing the empirical interactions of life-cycle asset accumulation pattern ...

... in the economy, linking it to the age distribution of the population and the empirical wealth distribution across generations. These models are notoriously di¢ cult to analyse but they are at the heart of research aimed at capturing the empirical interactions of life-cycle asset accumulation pattern ...

Debt Refinancing and Equity Returns

... returns and leverage by explicitly elaborating on the role of a firm’s debt refinancing policies. Our main finding is that equity returns increase with leverage when accounting for firms’ refinancing risk. This finding suggests that previous evidence on how stock returns relate to leverage may have ...

... returns and leverage by explicitly elaborating on the role of a firm’s debt refinancing policies. Our main finding is that equity returns increase with leverage when accounting for firms’ refinancing risk. This finding suggests that previous evidence on how stock returns relate to leverage may have ...

International Accounting Standards and Value Relevance of Book

... that has trustees and the board. Board members are appointed by the trustees and exercise oversight and increase funds needed but the major responsibility of the board is to set the accounting standards. And this new structure has started its work from January 1, 2001 which is now known as IASB (Int ...

... that has trustees and the board. Board members are appointed by the trustees and exercise oversight and increase funds needed but the major responsibility of the board is to set the accounting standards. And this new structure has started its work from January 1, 2001 which is now known as IASB (Int ...

Understanding the New Financial Reform Legislation

... PROTECTION ACT For more information about the matters raised in this Legal Update, please contact your regular Mayer Brown contact or one of the following: Scott A. Anenberg ...

... PROTECTION ACT For more information about the matters raised in this Legal Update, please contact your regular Mayer Brown contact or one of the following: Scott A. Anenberg ...

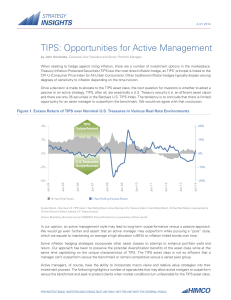

TIPS: Opportunities for Active Management

... When seeking to hedge against rising inflation, there are a number of investment options in the marketplace. Treasury Inflation-Protected Securities (TIPS) are the most direct inflation hedge, as TIPS’ principal is linked to the CPI-U (Consumer Price Index for All Urban Consumers). Other traditional ...

... When seeking to hedge against rising inflation, there are a number of investment options in the marketplace. Treasury Inflation-Protected Securities (TIPS) are the most direct inflation hedge, as TIPS’ principal is linked to the CPI-U (Consumer Price Index for All Urban Consumers). Other traditional ...