FIT FOR THE FUTURE - N Brown Group plc

... our credit book. We have been very careful to maintain these strengths. Secondly, however, we had a number of weaknesses, namely: merchandising, the value for money of some of our products, our digital marketing capability, low brand awareness and an under-invested systems infrastructure. We have ma ...

... our credit book. We have been very careful to maintain these strengths. Secondly, however, we had a number of weaknesses, namely: merchandising, the value for money of some of our products, our digital marketing capability, low brand awareness and an under-invested systems infrastructure. We have ma ...

Expected and unexpected bond excess returns

... spanned by order flow, forward rates and macroeconomic variables. These variables explain between 50% and 70% of expected excess returns. Thus, the predictability of bond excess returns stems from the strong linkage of expected excess returns to available economic information and order flow. The ana ...

... spanned by order flow, forward rates and macroeconomic variables. These variables explain between 50% and 70% of expected excess returns. Thus, the predictability of bond excess returns stems from the strong linkage of expected excess returns to available economic information and order flow. The ana ...

Superannuation funds and alternative asset investment

... Perhaps the most frequently discussed contributor to implementation risk is the risk that, in seeking to invest in alternative assets, superannuation fund trustees may pay excessively high prices for these assets. While it is difficult to assess the prevalence of this issue across the spectrum of su ...

... Perhaps the most frequently discussed contributor to implementation risk is the risk that, in seeking to invest in alternative assets, superannuation fund trustees may pay excessively high prices for these assets. While it is difficult to assess the prevalence of this issue across the spectrum of su ...

household debt and unemployment

... Motivation and research question. The worst employment slumps tend to follow the largest expansions of household debt. For example, in the US, household debt as a percentage of GDP climbed from below fifty percent in 1980 to almost one hundred percent by 2006, and the Great Recession that accompanie ...

... Motivation and research question. The worst employment slumps tend to follow the largest expansions of household debt. For example, in the US, household debt as a percentage of GDP climbed from below fifty percent in 1980 to almost one hundred percent by 2006, and the Great Recession that accompanie ...

household debt and unemployment

... Motivation and research question. The worst employment slumps tend to follow the largest expansions of household debt. For example, in the US, household debt as a percentage of GDP climbed from below fifty percent in 1980 to almost one hundred percent by 2006, and the Great Recession that accompanie ...

... Motivation and research question. The worst employment slumps tend to follow the largest expansions of household debt. For example, in the US, household debt as a percentage of GDP climbed from below fifty percent in 1980 to almost one hundred percent by 2006, and the Great Recession that accompanie ...

Information Risk and Credit Default Swap Markets

... and CDS indices (Fabozzi et al., 2007), single-name CDS are the most commonly used credit derivative instrument accounting for nearly half of the credit derivative market’s share (Blanco et al., 2005). A CDS as a derivative instrument offers advantages over corporate bonds and secondary loan markets ...

... and CDS indices (Fabozzi et al., 2007), single-name CDS are the most commonly used credit derivative instrument accounting for nearly half of the credit derivative market’s share (Blanco et al., 2005). A CDS as a derivative instrument offers advantages over corporate bonds and secondary loan markets ...

SAST - SA Legg Mason BW Large Cap Value

... circumstances, investing at least 80% of its net assets in equity securities of large capitalization companies. Large capitalization companies are those with market capitalizations similar to companies in the Russell 1000® Value Index (the “Index”). As of March 31, 2017, the median market capitaliza ...

... circumstances, investing at least 80% of its net assets in equity securities of large capitalization companies. Large capitalization companies are those with market capitalizations similar to companies in the Russell 1000® Value Index (the “Index”). As of March 31, 2017, the median market capitaliza ...

Report of the High-level Expert Group on reforming the structure of

... trading book by the Basel Committee to improve the control of market risk within the banking system. The Group sees the Commission's proposed Bank Recovery and Resolution Directive (BRR) as an essential part of the future regulatory structure. This proposal is a significant step forward in ensuring ...

... trading book by the Basel Committee to improve the control of market risk within the banking system. The Group sees the Commission's proposed Bank Recovery and Resolution Directive (BRR) as an essential part of the future regulatory structure. This proposal is a significant step forward in ensuring ...

Credit Risk Credit Risk Management System Management System

... Inspectors will verify and inspect the credit risk management systems of financial institutions using the Risk Management Systems Checklists (Common Items) and this checklist. They will also inspect the self-assessments on asset quality, write offs and reserves, and capital adequacy ratios etc. of t ...

... Inspectors will verify and inspect the credit risk management systems of financial institutions using the Risk Management Systems Checklists (Common Items) and this checklist. They will also inspect the self-assessments on asset quality, write offs and reserves, and capital adequacy ratios etc. of t ...

simpler, smoother, smarter business

... Enfo developed its organisation and methods of operation in order to better respond to the changing market situation. Account responsibilities were centralised so that customers have a single contact person. The sales process ...

... Enfo developed its organisation and methods of operation in order to better respond to the changing market situation. Account responsibilities were centralised so that customers have a single contact person. The sales process ...

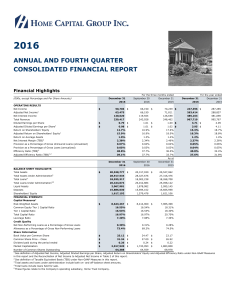

2016 Q4 Report - Home Capital Group

... Annual Report. Forward-looking statements are typically identified by words such as “will,” “believe,” “expect,” “anticipate,” “intend,” “should,” “estimate,” “plan,” “forecast,” “may,” and “could” or other similar expressions. By their very nature, these statements require the Company to make assum ...

... Annual Report. Forward-looking statements are typically identified by words such as “will,” “believe,” “expect,” “anticipate,” “intend,” “should,” “estimate,” “plan,” “forecast,” “may,” and “could” or other similar expressions. By their very nature, these statements require the Company to make assum ...

BIS 85th Annual Report - June 2015

... Interaction of domestic monetary regimes . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Box V.A: Mapping the dollar and euro zones . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Box V.B: Global liquidity as global credit aggregates . . . . . . . . . ...

... Interaction of domestic monetary regimes . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Box V.A: Mapping the dollar and euro zones . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Box V.B: Global liquidity as global credit aggregates . . . . . . . . . ...

call-for-input on the crowdfunding rules

... companies (which allow investors to acquire ownership of a property-asset via the purchasing of shares of a single property or a number of properties) as opposed to commercial businesses. This suggests a trend towards using both loan and investment-based crowdfunding platforms for more fund-like inv ...

... companies (which allow investors to acquire ownership of a property-asset via the purchasing of shares of a single property or a number of properties) as opposed to commercial businesses. This suggests a trend towards using both loan and investment-based crowdfunding platforms for more fund-like inv ...

Accruals, Net Stock Issues and Value-Glamour Anomalies

... strong positive relation with past sales growth. Note that according to Lakonishok et al. (1994), naïve investors form their expectations on the basis of past sales growth. As such, one can expect a potential relation between the value/growth anomaly and the external financing anomaly, driven from ...

... strong positive relation with past sales growth. Note that according to Lakonishok et al. (1994), naïve investors form their expectations on the basis of past sales growth. As such, one can expect a potential relation between the value/growth anomaly and the external financing anomaly, driven from ...

Pairs Trading in the UK Equity Market Risk and Return

... Given the majority of hedge fund activity and academic research focuses on the US, what are the returns from following such strategies in the UK? Is there a difference in performance and if so, can it be explained by the different characteristics of the two markets? In this paper we attempt to addr ...

... Given the majority of hedge fund activity and academic research focuses on the US, what are the returns from following such strategies in the UK? Is there a difference in performance and if so, can it be explained by the different characteristics of the two markets? In this paper we attempt to addr ...

Report of the management board for the period from 1

... contribution to increase the competitiveness of independent retailers in Poland. It was a year of record cash flow generated from operating activities and also a year of successful integration of companies, which we acquired in 2014 – Kolporter FMCG and Inmedio. The merger of Kolporter part responsi ...

... contribution to increase the competitiveness of independent retailers in Poland. It was a year of record cash flow generated from operating activities and also a year of successful integration of companies, which we acquired in 2014 – Kolporter FMCG and Inmedio. The merger of Kolporter part responsi ...

EIB - EESC European Economic and Social Committee

... EUR 60 000 million and will last “at least” until September 2016, will be implemented through the acquisition of financial assets. • So, “at least” it will reach 1,14 trillion EUR (As a reference: more than 50 times the EC Investment Plan for Europe or Juncker Plan). ...

... EUR 60 000 million and will last “at least” until September 2016, will be implemented through the acquisition of financial assets. • So, “at least” it will reach 1,14 trillion EUR (As a reference: more than 50 times the EC Investment Plan for Europe or Juncker Plan). ...