- TestbankU

... completed, companies debit the cost to Finished Goods Inventory and credit it to Work in Process Inventory. When a job is sold the entries are: (a) Debit Cash or Accounts Receivable and credit Sales Revenue for the selling price, and (b) Debit Cost of Goods Sold and credit Finished Goods Inventory f ...

... completed, companies debit the cost to Finished Goods Inventory and credit it to Work in Process Inventory. When a job is sold the entries are: (a) Debit Cash or Accounts Receivable and credit Sales Revenue for the selling price, and (b) Debit Cost of Goods Sold and credit Finished Goods Inventory f ...

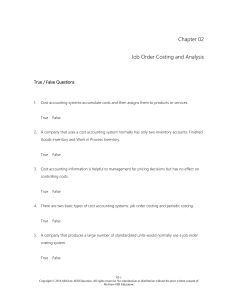

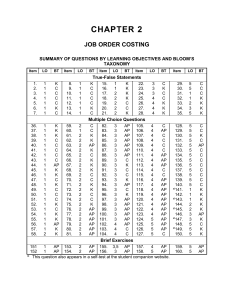

Chapter 02 Job Order Costing and Analysis

... 76. The Work in Process Inventory account of a manufacturing company that uses an overhead rate based on direct labor cost has a $4,400 debit balance after all posting is completed. The cost sheet of the one job still in process shows direct material cost of $2,000 and direct labor cost of $800. The ...

... 76. The Work in Process Inventory account of a manufacturing company that uses an overhead rate based on direct labor cost has a $4,400 debit balance after all posting is completed. The cost sheet of the one job still in process shows direct material cost of $2,000 and direct labor cost of $800. The ...

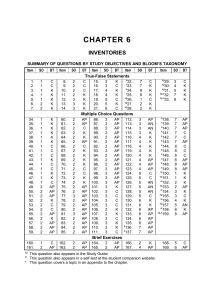

chapter 6

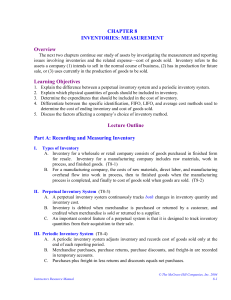

... 2. Explain the accounting for inventories, and apply the inventory cost flow methods. The primary basis of accounting for inventories is cost. Cost includes all expenditures necessary to acquire goods and place them in condition ready for sale. Cost of goods available for sale includes (a) cost of b ...

... 2. Explain the accounting for inventories, and apply the inventory cost flow methods. The primary basis of accounting for inventories is cost. Cost includes all expenditures necessary to acquire goods and place them in condition ready for sale. Cost of goods available for sale includes (a) cost of b ...

Managerial Accounting

... • The term Managerial accounting refers to accounting for the management, i.e., accounting which provides necessary information to the management for discharging its functions. The functions of the management are planning, organizing, directing and controlling. • Thus, Managerial accounting provides ...

... • The term Managerial accounting refers to accounting for the management, i.e., accounting which provides necessary information to the management for discharging its functions. The functions of the management are planning, organizing, directing and controlling. • Thus, Managerial accounting provides ...

66862 c07 296-365

... To this point, we have concentrated on the accounting for businesses that sell services. Banks, hotels, airlines, health clubs, real estate offices, law firms, and accounting firms are all examples of service companies. In this chapter we turn to accounting by companies that sell products, or what a ...

... To this point, we have concentrated on the accounting for businesses that sell services. Banks, hotels, airlines, health clubs, real estate offices, law firms, and accounting firms are all examples of service companies. In this chapter we turn to accounting by companies that sell products, or what a ...

2-ERP - Ruby Buccat, wikispaces

... EX: EZ-FLO International, Inc improve its inventory management processes and has eliminated its annual inventory count ...

... EX: EZ-FLO International, Inc improve its inventory management processes and has eliminated its annual inventory count ...

download

... revenue is reported as sales, and its cost is recognized as an expense called cost of merchandise sold. ...

... revenue is reported as sales, and its cost is recognized as an expense called cost of merchandise sold. ...

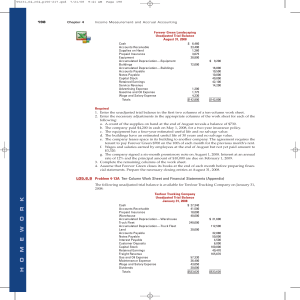

HOMEWORK

... illing itself as one of the world’s largest specialty retailers, Gap Inc. had its humble beginning when Doris and Don Fisher opened their first store in San Francisco in 1969. From that single store, the company has grown to operate more than 3,100 stores and to generate revenue that exceeded $15.9 ...

... illing itself as one of the world’s largest specialty retailers, Gap Inc. had its humble beginning when Doris and Don Fisher opened their first store in San Francisco in 1969. From that single store, the company has grown to operate more than 3,100 stores and to generate revenue that exceeded $15.9 ...

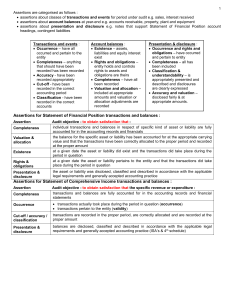

Aue2602 Summary

... and person writing up the records and reconciling the bank account. Should also be someone independent of all these who handles the debtor’s queries. Person who maintains debtor’s records should be independent of person who authorises adjustments to debtors accounts (e.g. credit notes) isolation o ...

... and person writing up the records and reconciling the bank account. Should also be someone independent of all these who handles the debtor’s queries. Person who maintains debtor’s records should be independent of person who authorises adjustments to debtors accounts (e.g. credit notes) isolation o ...

Sales and Consumer Inventory

... To test the predictions of the model, we use store-level and household-level were collected using scanning devices in nine supermarkets, belonging to five different chains, in two submarkets of a largeMidwestern city. The store-level data include weekly prices, quantities, dataset follows the purcha ...

... To test the predictions of the model, we use store-level and household-level were collected using scanning devices in nine supermarkets, belonging to five different chains, in two submarkets of a largeMidwestern city. The store-level data include weekly prices, quantities, dataset follows the purcha ...

FAP Chapter 19 SM - Test Bank wizard

... 10. This production run should be accounted for as a job lot (batch). Although individual iPhones could be viewed as individual jobs, the costs of tracking this detailed information would outweigh the benefits. Determining the cost of the batch should provide management and employees with sufficient ...

... 10. This production run should be accounted for as a job lot (batch). Although individual iPhones could be viewed as individual jobs, the costs of tracking this detailed information would outweigh the benefits. Determining the cost of the batch should provide management and employees with sufficient ...

Merchandising Business

... Gives a continual record of the amount of inventory on hand. When an item is sold it is recorded in the Cost of Goods Sold account. Because of advances in computer Periodic Methodmethod technology, the perpetual Requires updating the inventory only is widely used inaccount practice andat the end ...

... Gives a continual record of the amount of inventory on hand. When an item is sold it is recorded in the Cost of Goods Sold account. Because of advances in computer Periodic Methodmethod technology, the perpetual Requires updating the inventory only is widely used inaccount practice andat the end ...

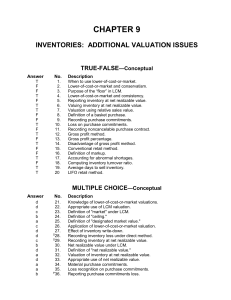

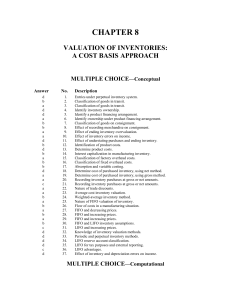

Answer No. Description - accountingreviewmaterials

... Calculate cost of goods sold given a markup on cost. Calculate merchandise purchases given a markup on cost. Calculate total sales from cost information. Markup on cost equivalent to a markup on selling price. Estimate ending inventory using gross profit method. Calculate ending inventory using gros ...

... Calculate cost of goods sold given a markup on cost. Calculate merchandise purchases given a markup on cost. Calculate total sales from cost information. Markup on cost equivalent to a markup on selling price. Estimate ending inventory using gross profit method. Calculate ending inventory using gros ...

Enterprise applications center of excellence

... Prepare the company for transformational change (all the time) Continuous business improvement ...

... Prepare the company for transformational change (all the time) Continuous business improvement ...

Respect for people

... Small lots mean less average inventory and shorten manufacturing lead time Small lots with shorter setup times increase flexibility to respond to demand changes Strive for single digit setups- < 10 minutes Setup reduction process is well-documented ...

... Small lots mean less average inventory and shorten manufacturing lead time Small lots with shorter setup times increase flexibility to respond to demand changes Strive for single digit setups- < 10 minutes Setup reduction process is well-documented ...

FREE Sample Here

... Chapter Competency 16 - Prepare a schedule of cost of goods manufactured, including the computation of the cost of direct materials used. Product cost flows To create a schedule of cost of goods manufactured as well as a balance sheet and income statement, it is important to understand the flow of p ...

... Chapter Competency 16 - Prepare a schedule of cost of goods manufactured, including the computation of the cost of direct materials used. Product cost flows To create a schedule of cost of goods manufactured as well as a balance sheet and income statement, it is important to understand the flow of p ...

Moderate

... deceptive when used in a period of rising prices because the reported income is not fully available since a part of it must be used to replace inventory at higher cost. The results achieved by the weighted average method resemble those of the specific identification method where items are chosen at ...

... deceptive when used in a period of rising prices because the reported income is not fully available since a part of it must be used to replace inventory at higher cost. The results achieved by the weighted average method resemble those of the specific identification method where items are chosen at ...

FREE Sample Here

... Chapter Competency 16 - Prepare a schedule of cost of goods manufactured, including the computation of the cost of direct materials used. Product cost flows To create a schedule of cost of goods manufactured as well as a balance sheet and income statement, it is important to understand the flow of p ...

... Chapter Competency 16 - Prepare a schedule of cost of goods manufactured, including the computation of the cost of direct materials used. Product cost flows To create a schedule of cost of goods manufactured as well as a balance sheet and income statement, it is important to understand the flow of p ...

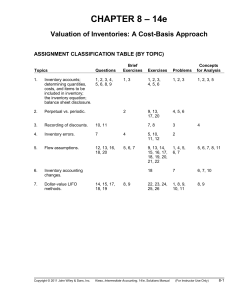

chapter 8 - Csulb.edu

... back) in inventories when FIFO is used during a period of rising prices. b. LIFO tends to smooth out the net income pattern by matching current cost of goods sold with current revenue, when inventories remain at constant quantities. c. When a firm using the LIFO method fails to maintain its usual in ...

... back) in inventories when FIFO is used during a period of rising prices. b. LIFO tends to smooth out the net income pattern by matching current cost of goods sold with current revenue, when inventories remain at constant quantities. c. When a firm using the LIFO method fails to maintain its usual in ...

Manufacturing Costs

... Enterprise ReLOurce Planning (ERP) – LOftware programs designed to manage all major business processes. Computer-Integrated Manufacturing (CIM) – manufacturing products with increased automation. Just-In-Time (JIT) Inventory Methods Inventory system in which goods are manufactured or purchased just ...

... Enterprise ReLOurce Planning (ERP) – LOftware programs designed to manage all major business processes. Computer-Integrated Manufacturing (CIM) – manufacturing products with increased automation. Just-In-Time (JIT) Inventory Methods Inventory system in which goods are manufactured or purchased just ...

TRUE/FALSE. Write `T` if the statement is true and `F` if the statement

... 80) A company that uses the perpetual inventory method purchases inventory of $1,000 on account with terms of 2/10 net/30. Which of the following entries would be made to record the payment for the inventory if the payment is made 20 days later? A) The accounting entry would be a $20 debit to Invent ...

... 80) A company that uses the perpetual inventory method purchases inventory of $1,000 on account with terms of 2/10 net/30. Which of the following entries would be made to record the payment for the inventory if the payment is made 20 days later? A) The accounting entry would be a $20 debit to Invent ...

Chapter 20

... typically use job order costing. – A job order costing system traces the costs of direct materials, direct labor, and overhead to a specific batch of products or a specific job order. (cont.) • A job order cost card is the document on which all costs incurred in the production of a particular job or ...

... typically use job order costing. – A job order costing system traces the costs of direct materials, direct labor, and overhead to a specific batch of products or a specific job order. (cont.) • A job order cost card is the document on which all costs incurred in the production of a particular job or ...

inventory cost flow for a - McGraw

... A. Regardless of the system used, it's necessary to assign dollar amounts to physical quantities of goods sold and goods remaining in ending inventory. (T8-9) 1. The specific identification method matches each unit sold or each unit on hand at the end of the period with its actual cost. The method i ...

... A. Regardless of the system used, it's necessary to assign dollar amounts to physical quantities of goods sold and goods remaining in ending inventory. (T8-9) 1. The specific identification method matches each unit sold or each unit on hand at the end of the period with its actual cost. The method i ...