Intermediate Accounting, Eighth Canadian Edition

... – Onerous contracts are contracts where unavoidable costs to complete the contract are higher than expected benefits Copyright © John Wiley & Sons Canada, Ltd. ...

... – Onerous contracts are contracts where unavoidable costs to complete the contract are higher than expected benefits Copyright © John Wiley & Sons Canada, Ltd. ...

Intermediate Accounting - McGraw Hill Higher Education

... insurance costs on goods in transit, material handling expenses, and import brokerage and excise fees These costs may be included in overhead, which may then be allocated to inventory General and administrative (G&A) expenses are normally treated as period expenses because they relate more dir ...

... insurance costs on goods in transit, material handling expenses, and import brokerage and excise fees These costs may be included in overhead, which may then be allocated to inventory General and administrative (G&A) expenses are normally treated as period expenses because they relate more dir ...

Sample Test for Management Accounting

... 11. The Inground Sprinkler Supply sells sprinkler systems suited for large or small yards. The company has decided to adopt an activity-based costing system. Last year the company incurred $1,000,000 in overhead costs related to the following activities: Activity Purchasing Material handling Qualit ...

... 11. The Inground Sprinkler Supply sells sprinkler systems suited for large or small yards. The company has decided to adopt an activity-based costing system. Last year the company incurred $1,000,000 in overhead costs related to the following activities: Activity Purchasing Material handling Qualit ...

Chapter 16

... another supplier, offering a price of R345 per pair of sunglasses, provided that orders are placed in batches of at least 100 units each. In such a case, however, additional store space would be required, costing R700 per month. The lead time for delivery would remain five working days. Required: (a ...

... another supplier, offering a price of R345 per pair of sunglasses, provided that orders are placed in batches of at least 100 units each. In such a case, however, additional store space would be required, costing R700 per month. The lead time for delivery would remain five working days. Required: (a ...

merchandising company

... a. periodic inventory system only. b. a perpetual inventory system only. c. both a periodic and perpetual inventory system. d. neither a periodic nor perpetual inventory system. Chapter ...

... a. periodic inventory system only. b. a perpetual inventory system only. c. both a periodic and perpetual inventory system. d. neither a periodic nor perpetual inventory system. Chapter ...

Managerial accounting

... Managers should ask questions such as the following. 1. What costs are involved in making a product or ...

... Managers should ask questions such as the following. 1. What costs are involved in making a product or ...

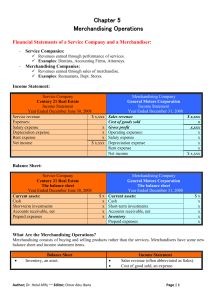

Chapter 5 Merchandising Operations

... Suppose liberty Sales Co. engaged in the following transactions during June of current year: Purchased inventory on credit terms of 1/10 net eom (end of month), $1,600. Returned 40% of the inventory purchased on June 3. It was defective. Sold goods for cash, $920 (cost, $550). Purchased goods for $5 ...

... Suppose liberty Sales Co. engaged in the following transactions during June of current year: Purchased inventory on credit terms of 1/10 net eom (end of month), $1,600. Returned 40% of the inventory purchased on June 3. It was defective. Sold goods for cash, $920 (cost, $550). Purchased goods for $5 ...

Atomic Dog Publishing, Inc.

... The terms manufacturing and production are used interchangeably to represent the activities and processes used in making tangible products. The broader term operations describes processes used in the making of both tangible and intangible products. Manufacturers and service providers differ in: ...

... The terms manufacturing and production are used interchangeably to represent the activities and processes used in making tangible products. The broader term operations describes processes used in the making of both tangible and intangible products. Manufacturers and service providers differ in: ...

Document

... Melting Department of McDermott Steel Inc. Inventory in process, July 1, 500 tons: Direct materials cost, 500 tons ...

... Melting Department of McDermott Steel Inc. Inventory in process, July 1, 500 tons: Direct materials cost, 500 tons ...

Advanced Accounting, Canadian Edition (Fayerman)

... group one year and not sold by the end of the year, then we need to consider how this affects the following year’s consolidated accounts. • The profit will become realized when the inventory is sold to an external party (in the next financial year). • As inventory is a current asset you should assum ...

... group one year and not sold by the end of the year, then we need to consider how this affects the following year’s consolidated accounts. • The profit will become realized when the inventory is sold to an external party (in the next financial year). • As inventory is a current asset you should assum ...

Real-Time Artificial Intelligence for Scheduling and Planning Make

... Examples of such general knowledge overrides include the system recommending the use of a specific subcontractor when the operations manager knows that they just filed for bankruptcy. Materials Planning Historically, materials planning has been done by MRP (Materials Requirements Planning) systems, ...

... Examples of such general knowledge overrides include the system recommending the use of a specific subcontractor when the operations manager knows that they just filed for bankruptcy. Materials Planning Historically, materials planning has been done by MRP (Materials Requirements Planning) systems, ...

fixed manufacturing costs in beginning inventory

... treats all costs except those related to variable direct materials as costs of the period in which they were incurred • only variable direct material costs are inventoriable • since all other production-related costs are expensed on the income statement, management is less motivated to increase inve ...

... treats all costs except those related to variable direct materials as costs of the period in which they were incurred • only variable direct material costs are inventoriable • since all other production-related costs are expensed on the income statement, management is less motivated to increase inve ...

File - LHS Business Classes

... average inventory has been sold and replaced in a given period of time. It is the most effective way to measure how well inventory is being managed. ...

... average inventory has been sold and replaced in a given period of time. It is the most effective way to measure how well inventory is being managed. ...

Chapter 24 Stock Handling and Inventory Control

... average inventory has been sold and replaced in a given period of time. It is the most effective way to measure how well inventory is being managed. ...

... average inventory has been sold and replaced in a given period of time. It is the most effective way to measure how well inventory is being managed. ...

CH09-Ops - Oakton Community College

... including facility location, facility layout, materials requirement planning, purchasing, just-in-time inventory control and quality control. ...

... including facility location, facility layout, materials requirement planning, purchasing, just-in-time inventory control and quality control. ...

MgtOp 452 Supply Chain Management

... c. All companies involved in the supply chain want to maximize their respective profits by increasing revenue, decreasing cost and meeting customers’ demand. However, companies may employ different strategies in order to achieve this goal. Some of them focus on customer satisfaction and quick delive ...

... c. All companies involved in the supply chain want to maximize their respective profits by increasing revenue, decreasing cost and meeting customers’ demand. However, companies may employ different strategies in order to achieve this goal. Some of them focus on customer satisfaction and quick delive ...

Cost Of Goods Sold - McGraw Hill Higher Education

... computations -- periodically or perpetually • The cost flow assumption used to trace the movement of costs into and out of inventory. The cost flow assumption need not parallel the physical movement of goods. ...

... computations -- periodically or perpetually • The cost flow assumption used to trace the movement of costs into and out of inventory. The cost flow assumption need not parallel the physical movement of goods. ...

Task Team of FUNDAMENTAL ACCOUNTING School of Business

... temporary Purchases account to record the cost of merchandise purchased. When financial statements are prepared under the periodic system, the cost of goods sold and merchandise inventory are determined, in part, by conducting a physical count of inventory on-hand. In contrast, a perpetual inventory ...

... temporary Purchases account to record the cost of merchandise purchased. When financial statements are prepared under the periodic system, the cost of goods sold and merchandise inventory are determined, in part, by conducting a physical count of inventory on-hand. In contrast, a perpetual inventory ...

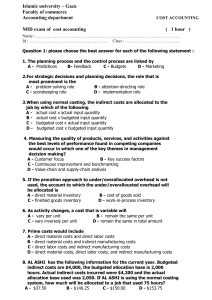

Question 1: please choose the best answer for each of the following

... ( direct material cost and direct labor cost are distribution for each kind as a percentage of quantity produced ). At the end of 2006 (AP) unsuccessfully bid for a large institutional contract. Its bid was reported to be 40% above the winning bid. As a result of its review process of lost contract ...

... ( direct material cost and direct labor cost are distribution for each kind as a percentage of quantity produced ). At the end of 2006 (AP) unsuccessfully bid for a large institutional contract. Its bid was reported to be 40% above the winning bid. As a result of its review process of lost contract ...

291 Manufacturing Facilities

... widely and facilities are arranged on a functional basis. Metal, plastic and woodworking industries where non-standard products are processed are examples of job shops. Between the extremes of job shops and flows shops is the batch shop. In batch shops, product variety is lower; batch sizes are larg ...

... widely and facilities are arranged on a functional basis. Metal, plastic and woodworking industries where non-standard products are processed are examples of job shops. Between the extremes of job shops and flows shops is the batch shop. In batch shops, product variety is lower; batch sizes are larg ...

PPT

... automated and gives real time information Periodic Inventory Calculate inventory at the end of the period Update COGS at the end of the period Still used, usually in smaller companies that don’t want to spend ...

... automated and gives real time information Periodic Inventory Calculate inventory at the end of the period Update COGS at the end of the period Still used, usually in smaller companies that don’t want to spend ...

رقم الطالب في كشف الحضور:....... دراسات محاسبية باللغة الإنجليزية عدد

... 18. Accountants believe that the write down from cost to market should not be made in the period in which the price decline occurs. 19. An error that overstates the ending inventory will also cause net income for the period to be overstated. 20. If inventories are valued using the LIFO cost assumpti ...

... 18. Accountants believe that the write down from cost to market should not be made in the period in which the price decline occurs. 19. An error that overstates the ending inventory will also cause net income for the period to be overstated. 20. If inventories are valued using the LIFO cost assumpti ...

inventory_and_production_management

... • Distinguish between variable and fixed costs. • Understand how to determine product costs, set prices, and reduce costs. • Understand inventory management. • Understand how to forecast inventory needs. • Understand the costs associated with managing inventory. (continued) ...

... • Distinguish between variable and fixed costs. • Understand how to determine product costs, set prices, and reduce costs. • Understand inventory management. • Understand how to forecast inventory needs. • Understand the costs associated with managing inventory. (continued) ...