Economic environment - World Trade Organization

... privatization programme was launched in 198918 and since 1996, 12 State enterprises have been privatized, including Air Sénégal and SONATEL, the national fixed telecommunications operator. Nine large enterprises are currently included in the privatization programme and other enterprises may be added ...

... privatization programme was launched in 198918 and since 1996, 12 State enterprises have been privatized, including Air Sénégal and SONATEL, the national fixed telecommunications operator. Nine large enterprises are currently included in the privatization programme and other enterprises may be added ...

part 3: decision-makers in the financial system

... For analytical purposes, the economy is divided into four major sectors: 1) households; 2) businesses; 3) government; and 4) the foreign sector. The household sector includes persons and unincorporated businesses. The business sector includes both non-financial private corporations, and financial co ...

... For analytical purposes, the economy is divided into four major sectors: 1) households; 2) businesses; 3) government; and 4) the foreign sector. The household sector includes persons and unincorporated businesses. The business sector includes both non-financial private corporations, and financial co ...

- International Growth Centre

... growth in the economy which has the effect of reducing current inflation as a consequence of lower future inflation expectation. However if they believe is that the debt will be paid for via seignorage (either as a result of past experience or the spending is not generating the needed growth to supp ...

... growth in the economy which has the effect of reducing current inflation as a consequence of lower future inflation expectation. However if they believe is that the debt will be paid for via seignorage (either as a result of past experience or the spending is not generating the needed growth to supp ...

shifts in global economics 2012

... As the second decade of the 21st century unfolds and the world exits from the 2008–09 financial crisis, the growing clout of emerging markets is paving the way for a world economy with an increasingly multi-polar character. The distribution of global growth will become more diff use, with no single ...

... As the second decade of the 21st century unfolds and the world exits from the 2008–09 financial crisis, the growing clout of emerging markets is paving the way for a world economy with an increasingly multi-polar character. The distribution of global growth will become more diff use, with no single ...

Relationship of Sino-US Trade Balance and RMB Exchange Rate

... falling”. Meanwhile, the twin surplus of China's international balance of payment, especially the influence of exchange rate on trade, has always been the hot topic for policymakers. From 2005 to the end of 2008, nominal exchange rate of RMB against US dollar appreciated 15.22% cumulatively. In rece ...

... falling”. Meanwhile, the twin surplus of China's international balance of payment, especially the influence of exchange rate on trade, has always been the hot topic for policymakers. From 2005 to the end of 2008, nominal exchange rate of RMB against US dollar appreciated 15.22% cumulatively. In rece ...

Lecture Notes 1

... the level of government spending on savings and the current account. Recall that government spending is completely useless (from the point of view of the consumers) in the economy. For the households, an increase in government spending is equivalent a reduction in their output (income). Hence, with ...

... the level of government spending on savings and the current account. Recall that government spending is completely useless (from the point of view of the consumers) in the economy. For the households, an increase in government spending is equivalent a reduction in their output (income). Hence, with ...

How did the Foreign Debt Trigger the Argentine

... contracts in force. In any case, what raised doubts about the dollar-peso fixed parity was actually the maladjustment of the real exchange rate rather than the attempts to redress the imbalance. The stagnation of exports Most of the technical papers that deal with the Argentine Crisis, especially th ...

... contracts in force. In any case, what raised doubts about the dollar-peso fixed parity was actually the maladjustment of the real exchange rate rather than the attempts to redress the imbalance. The stagnation of exports Most of the technical papers that deal with the Argentine Crisis, especially th ...

Document

... increase in transfer payments increases autonomous spending and output; The multiplier of transfer payments is smaller than that of government purchase. ...

... increase in transfer payments increases autonomous spending and output; The multiplier of transfer payments is smaller than that of government purchase. ...

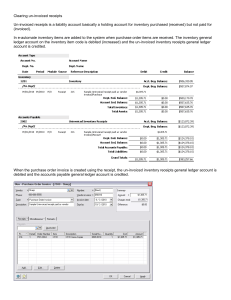

Understanding un-invoiced receipts

... If the invoice is recorded using a vendor invoice instead of a vendor purchase order invoice then the accounts payable account may appear correct but the charges used on the vendor invoice create double costs and the purchase order receipt does not get cleared out. Unfortunately, this may not be rec ...

... If the invoice is recorded using a vendor invoice instead of a vendor purchase order invoice then the accounts payable account may appear correct but the charges used on the vendor invoice create double costs and the purchase order receipt does not get cleared out. Unfortunately, this may not be rec ...

First Release In 2014 non-financial corporations almost doubled the

... Surplus in transactions with the rest of the world increased by more than 61% in 2014. Non-financial corporations almost doubled the surplus. Despite the drop in net lending, households contributed most to the surplus of the total economy. Slovenia again recorded a surplus in transactions with the r ...

... Surplus in transactions with the rest of the world increased by more than 61% in 2014. Non-financial corporations almost doubled the surplus. Despite the drop in net lending, households contributed most to the surplus of the total economy. Slovenia again recorded a surplus in transactions with the r ...

Structural and Cyclical Factors of Greece`s Current Account

... 2. Related literature and methodology The theoretical literature explaining the determinants of the current account is often based on the identity of the current account being equal to the difference between domestic saving and investment.3 Most researchers use this identity to determine the struct ...

... 2. Related literature and methodology The theoretical literature explaining the determinants of the current account is often based on the identity of the current account being equal to the difference between domestic saving and investment.3 Most researchers use this identity to determine the struct ...

Back to the Future: Latin America’s Current Development Strategy

... significant increase in remittance flows that has taken place since 2002. It responds to an important increase in illegal immigration flows from Latin America to the rest of the world. Remittances have benefited most Latin American economies. But the positive effect of remittances on the current acc ...

... significant increase in remittance flows that has taken place since 2002. It responds to an important increase in illegal immigration flows from Latin America to the rest of the world. Remittances have benefited most Latin American economies. But the positive effect of remittances on the current acc ...

monetary ingration and country risk of the eu newcomers bulgaria

... The large and increasing deficit on current account is a consequence of the fixed exchange rate of the lev to the appreciating euro. After the economic crisis of 1996/97 the Bulgarian government decided to peg its currency to the euro. The aim of this measure was to import stability. Indeed the intr ...

... The large and increasing deficit on current account is a consequence of the fixed exchange rate of the lev to the appreciating euro. After the economic crisis of 1996/97 the Bulgarian government decided to peg its currency to the euro. The aim of this measure was to import stability. Indeed the intr ...

HSC Economics Sample Answers (2011)

... Sample answer: Regulations are laws enacted by governments that govern economic behaviour. Regulations may prohibit or limit activities that damage the environment. In Australia for example, there is a ban on the sale of leaded petrol in order to eliminate the negative externalities associated with ...

... Sample answer: Regulations are laws enacted by governments that govern economic behaviour. Regulations may prohibit or limit activities that damage the environment. In Australia for example, there is a ban on the sale of leaded petrol in order to eliminate the negative externalities associated with ...

Power Relations and American Macroeconomic Policy, from .

... accelerated development of the countries in the capitalist orbit. This geopolitical factor made the USA operate the international monetary and financial system in a very benign way from the point of view of stimulating the growth of the other central countries. It is for this reason that the Bretton ...

... accelerated development of the countries in the capitalist orbit. This geopolitical factor made the USA operate the international monetary and financial system in a very benign way from the point of view of stimulating the growth of the other central countries. It is for this reason that the Bretton ...

Brazil Update Q4 2014

... companies, political parties and politicians have arisen based on the statements of a former Petrobras’ executive director, who made a plea-bargain deal with the Federal Police after his arrest. He has alleged that contractors have formed a cartel overcharging Petrobras on projects and paid a 3% com ...

... companies, political parties and politicians have arisen based on the statements of a former Petrobras’ executive director, who made a plea-bargain deal with the Federal Police after his arrest. He has alleged that contractors have formed a cartel overcharging Petrobras on projects and paid a 3% com ...

Budget Deficits and Debt---A Summary of the Bank`s 1995 Symposium

... For many developing and transition economies, however, access to credit markets is limited. For these countries, budget cuts can have a large effect on money creation and hence a beneficial impact on inflation. Another channel through which lower deficits might help reduce inflation—for larger count ...

... For many developing and transition economies, however, access to credit markets is limited. For these countries, budget cuts can have a large effect on money creation and hence a beneficial impact on inflation. Another channel through which lower deficits might help reduce inflation—for larger count ...

Full text

... due to tighter financial conditions in the wake of a stronger U.S. dollar and higher global interest rates. The outlook could easily change depending on the policies that materialize. The baseline forecast assumes that: U.S. fiscal policy unfolds broadly as anticipated while the Federal Reserve cont ...

... due to tighter financial conditions in the wake of a stronger U.S. dollar and higher global interest rates. The outlook could easily change depending on the policies that materialize. The baseline forecast assumes that: U.S. fiscal policy unfolds broadly as anticipated while the Federal Reserve cont ...

Economic Models The selection of variables

... • Is the current economy experiencing a NED? • How would a change in fiscal policy that lowered t0 affect the NED? • Under what circumstances could this result in a natural employment surplus in the future? • How does your argument relate to the national savings rate, including both government savin ...

... • Is the current economy experiencing a NED? • How would a change in fiscal policy that lowered t0 affect the NED? • Under what circumstances could this result in a natural employment surplus in the future? • How does your argument relate to the national savings rate, including both government savin ...

James Tobin - Prize Lecture

... The historic terrain of macro-economic theory is the explanation of the levels and fluctuations of overall economic activity. Macro-economists have been especially interested in the effects of alternative fiscal, financial, and monetary policies. With the publication of J. M. Keynes’s General Theory ...

... The historic terrain of macro-economic theory is the explanation of the levels and fluctuations of overall economic activity. Macro-economists have been especially interested in the effects of alternative fiscal, financial, and monetary policies. With the publication of J. M. Keynes’s General Theory ...

Business Review Jan-June 2010

... recourse arise (a) when the country is having serious current account imbalances and is unable to meet its external payment obligations out of its own generated resources including the normal flows from external sources such as Foreign Direct Investment (FDI), disbursements of loans, etc. or (b) whe ...

... recourse arise (a) when the country is having serious current account imbalances and is unable to meet its external payment obligations out of its own generated resources including the normal flows from external sources such as Foreign Direct Investment (FDI), disbursements of loans, etc. or (b) whe ...

Devaluation of the Naira: Implication for Businesses in Nigeria

... needed skill and innovation to drive productivity. To boost productivity, the private sector must play a leading role in encouragement of research and development by funding research and linking up with the various institutions in the country. At the beginning of the slide in oil price, governme ...

... needed skill and innovation to drive productivity. To boost productivity, the private sector must play a leading role in encouragement of research and development by funding research and linking up with the various institutions in the country. At the beginning of the slide in oil price, governme ...

Global currency trends through the financial crisis

... the increased risk factors associated with trading over this ...

... the increased risk factors associated with trading over this ...

Answers to Questions: Chapter 6

... 17. The behavior of government spending as a percent in natural GDP behaved quite similarly during FDR’s New Deal starting in 1933 as it has since the start of the Obama Stimulus Program. In both cases, there were slight declines in the ratio as any increases in the ratio of Federal spending to natu ...

... 17. The behavior of government spending as a percent in natural GDP behaved quite similarly during FDR’s New Deal starting in 1933 as it has since the start of the Obama Stimulus Program. In both cases, there were slight declines in the ratio as any increases in the ratio of Federal spending to natu ...