Taxes paid by owners on the value of owner-occupied

... • This can be approximated by geometric depreciation with no mortality function (does not require a long times series of GFCF in order to apply the mortality function) • Geometric depreciation rate is written as D/L (declining balance rate/average service life of the asset). • In OECD countries a va ...

... • This can be approximated by geometric depreciation with no mortality function (does not require a long times series of GFCF in order to apply the mortality function) • Geometric depreciation rate is written as D/L (declining balance rate/average service life of the asset). • In OECD countries a va ...

World trade interdependencies: a New ... perspective

... Technically, we derived the second matrix by applying an algorithm to scale our merchandise trade matrix so that each country’s total services exports and service imports equal the figures from the IMF Balance of Payments Statistics. By basing this estimation on our merchandise trade matrix, we assu ...

... Technically, we derived the second matrix by applying an algorithm to scale our merchandise trade matrix so that each country’s total services exports and service imports equal the figures from the IMF Balance of Payments Statistics. By basing this estimation on our merchandise trade matrix, we assu ...

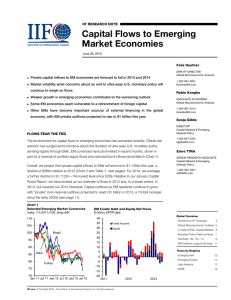

Capital Flows to Emerging Market Economies

... purchases should occur before year-end, with QE3 expected to end in mid-2014. The outlook for emerging economy growth may benefit from a pick-up in domestic demand, helped by substantial past monetary policy stimulus, but the prospects for a reacceleration in overall growth are limited. In particula ...

... purchases should occur before year-end, with QE3 expected to end in mid-2014. The outlook for emerging economy growth may benefit from a pick-up in domestic demand, helped by substantial past monetary policy stimulus, but the prospects for a reacceleration in overall growth are limited. In particula ...

3. terms, definitions and explanations[1]

... This publication presents a set of data that specifies and summarises the expenditure and revenue of the general government sector in the years 1995–2013. The government sector includes the institutional units and bodies that produce and provide public and community non-market services, and are main ...

... This publication presents a set of data that specifies and summarises the expenditure and revenue of the general government sector in the years 1995–2013. The government sector includes the institutional units and bodies that produce and provide public and community non-market services, and are main ...

Managing Capital Flows in Asia: An Overview of Key Issues

... transactions. Meanwhile, economic policy and structural changes from the standpoint of developing economies can be categorized into two broad groups: those that are country-specific, or “pull” factors; and those that are external to the country and beyond its control, or “push” factors. One set of “ ...

... transactions. Meanwhile, economic policy and structural changes from the standpoint of developing economies can be categorized into two broad groups: those that are country-specific, or “pull” factors; and those that are external to the country and beyond its control, or “push” factors. One set of “ ...

Economic growth, trade balance and balance-of - FGV-EESP

... America suggests that even though there are different periods of external adjustment, it has not been possible to reject the main proposition of Thirlwall´s Law. In other words, no single economy is immune from its external sector constraint. Our approach suggests that Latin American economies need ...

... America suggests that even though there are different periods of external adjustment, it has not been possible to reject the main proposition of Thirlwall´s Law. In other words, no single economy is immune from its external sector constraint. Our approach suggests that Latin American economies need ...

This PDF is a selection from a published volume from... Economic Research

... 5. If one views the effect of financial development on saving as that of asset markets on consumption, the arguments about the wealth effect of asset market performance as well as the balance sheet effects can be relevant to our discussion. However, our main focus in this chapter is to examine the medi ...

... 5. If one views the effect of financial development on saving as that of asset markets on consumption, the arguments about the wealth effect of asset market performance as well as the balance sheet effects can be relevant to our discussion. However, our main focus in this chapter is to examine the medi ...

mmi03-westermann 223302 en

... the post-liberalization period, even if we do not condition on the occurrence of crises. Panel regressions reveal that credit growth is positively correlated with the ratio of N-to-T output, with changes in the real exchange rate, and with investment growth. However, credit growth is not significan ...

... the post-liberalization period, even if we do not condition on the occurrence of crises. Panel regressions reveal that credit growth is positively correlated with the ratio of N-to-T output, with changes in the real exchange rate, and with investment growth. However, credit growth is not significan ...

Currency Outlook-Why the JPY won`t weaken

... yield differentials, and HSBC’s risk on – risk off (RORO) factor. The notable change over the last couple of months has been the resurgence of the RORO factor, shown in red in the chart. The JPY may be a diminished safe haven because of the distorting influence of the Bank of Japan’s aggressive mone ...

... yield differentials, and HSBC’s risk on – risk off (RORO) factor. The notable change over the last couple of months has been the resurgence of the RORO factor, shown in red in the chart. The JPY may be a diminished safe haven because of the distorting influence of the Bank of Japan’s aggressive mone ...

LECTURE 10

... Host-Country Benefits 3. balance of payments effects - a country’s balance-ofpayments account is a record of a country’s payments to and receipts from other countries. •The current account is a record of a country’s export and import of goods and services •Governments typically prefer to see a curr ...

... Host-Country Benefits 3. balance of payments effects - a country’s balance-ofpayments account is a record of a country’s payments to and receipts from other countries. •The current account is a record of a country’s export and import of goods and services •Governments typically prefer to see a curr ...

Budget Surpluses (Deficits) and the Federal Debt: How Are They

... The amount of debt held by the trust funds sets an aggregate limit on how much can be spent. Most trust funds hold U.S. Treasury securities; they represent total assets for a specific program (such as Social Security) but not assets of the government as a whole.3 When there is an offbudget surplus, ...

... The amount of debt held by the trust funds sets an aggregate limit on how much can be spent. Most trust funds hold U.S. Treasury securities; they represent total assets for a specific program (such as Social Security) but not assets of the government as a whole.3 When there is an offbudget surplus, ...

Chapter 4 - uc-davis economics

... By focusing only on labor and capital, Leontief ignored land abundance; Should have distinguished skilled versus unskilled labor (since it would not be surprising to find that U.S. exports are intensive in skilled labor); The data for 1947 may by unusual, The U.S. was not engaged in complete ...

... By focusing only on labor and capital, Leontief ignored land abundance; Should have distinguished skilled versus unskilled labor (since it would not be surprising to find that U.S. exports are intensive in skilled labor); The data for 1947 may by unusual, The U.S. was not engaged in complete ...

Foreign Direct Investment and Exchange Rates: A Case Study of

... Net FDI inflows (constant 2000, Billions of US dollars) from the United States to the countries are treated as the regressand. The data are available form Bureau of Economic Analysis, US Department of Commerce. Appendix 2 presents US FDI trends in the countries. In the 1990s FDI flows to the countr ...

... Net FDI inflows (constant 2000, Billions of US dollars) from the United States to the countries are treated as the regressand. The data are available form Bureau of Economic Analysis, US Department of Commerce. Appendix 2 presents US FDI trends in the countries. In the 1990s FDI flows to the countr ...

NBER WORKING PAPER SERIES ESTIMATED MACROECONOMIC EFFECTS OF DEFICIT TARGETING

... The model of firm behavior is somewhat more involved. The theory will not be discussed in detail here. The main estimated equations have the following features. Prices and wages affect each other and are affected by demand conditions. In addition, the price of imports has an important effect on dome ...

... The model of firm behavior is somewhat more involved. The theory will not be discussed in detail here. The main estimated equations have the following features. Prices and wages affect each other and are affected by demand conditions. In addition, the price of imports has an important effect on dome ...

frenchdavis2001financialcrisis_en.pdf

... Moreover, recent crises have been radically different from those typical from the 1940s to the 1970s, which, in Latin America, displayed three major features that have been absent or relatively less important in recent experiences. First, past crises involved large fiscal deficits that were financed ...

... Moreover, recent crises have been radically different from those typical from the 1940s to the 1970s, which, in Latin America, displayed three major features that have been absent or relatively less important in recent experiences. First, past crises involved large fiscal deficits that were financed ...

M-19

... domestic prices constant in the two countries). Conversely, when a country’s currency depreciates, its goods abroad become cheaper and foreign goods in that country become more expensive. Appreciation of a currency can make it harder for domestic manufacturers to sell their goods abroad and can incr ...

... domestic prices constant in the two countries). Conversely, when a country’s currency depreciates, its goods abroad become cheaper and foreign goods in that country become more expensive. Appreciation of a currency can make it harder for domestic manufacturers to sell their goods abroad and can incr ...

Document

... In the early 1990s, outlays started to decline relative to GDP, while revenues increased deficit declined and, by 1998, created a budget surplus What turned a hefty deficit into a surplus, and why has the surplus slipped lately? Tax increases during the elder President Bush and President Clinton t ...

... In the early 1990s, outlays started to decline relative to GDP, while revenues increased deficit declined and, by 1998, created a budget surplus What turned a hefty deficit into a surplus, and why has the surplus slipped lately? Tax increases during the elder President Bush and President Clinton t ...

This PDF is a selection from an out-of-print volume from... of Economic Research

... respectively. (He uses medium Industry Bank Loans and foreign currency loans to estimate total long-term loans for export promotion.) The major source of domestic long-term funding, the Korea Reconstruction Bank, had access to only limited funds through the government. Furthermore, the slowdown of a ...

... respectively. (He uses medium Industry Bank Loans and foreign currency loans to estimate total long-term loans for export promotion.) The major source of domestic long-term funding, the Korea Reconstruction Bank, had access to only limited funds through the government. Furthermore, the slowdown of a ...

How the Crisis Has Changed the Economic Policy Paradigm

... Yellen, 1 January 2009 at American Econ. Association ...

... Yellen, 1 January 2009 at American Econ. Association ...

Redalyc.Financialization, income distribution and the crisis

... In mid 2006 house prices in the United States started to decline. With hindsight, that marks the beginning of the crisis, even if it attracted little attention at the time. Rapidly rising house prices, and the mortgage lending that came with it, had been the basis of a boom driven by credit-financed ...

... In mid 2006 house prices in the United States started to decline. With hindsight, that marks the beginning of the crisis, even if it attracted little attention at the time. Rapidly rising house prices, and the mortgage lending that came with it, had been the basis of a boom driven by credit-financed ...

This PDF is a selection from an out-of-print volume from... of Economic Research Volume Title: The International Transmission of Inflation

... Our aim in this chapter is to present evidence on two issues: the relative contributions to inflation in each of these countries of domestic and of international factors, and the relative importance of the channels through which the international factors have operated. The difficulty that arises in ...

... Our aim in this chapter is to present evidence on two issues: the relative contributions to inflation in each of these countries of domestic and of international factors, and the relative importance of the channels through which the international factors have operated. The difficulty that arises in ...

Can We Predict the Next Capital Account Crisis?

... maturity) in the corporate, banking, and government sectors, political uncertainty, global cyclical and financial conditions, and general market sentiment. This unwieldy set of potential indicators makes it difficult to compare their information content using standard regression techniques. To remed ...

... maturity) in the corporate, banking, and government sectors, political uncertainty, global cyclical and financial conditions, and general market sentiment. This unwieldy set of potential indicators makes it difficult to compare their information content using standard regression techniques. To remed ...

Financial Development and Capital Account Openness. What Links between Them?

... Generally, with a sound and robust banking system, a certain degree of credit expansion will be beneficial to the economic growth even the credit expansion caused by capital inflow. Because not only the banking itself will actively internalize the repaying pressure arouse by credit expanding, but al ...

... Generally, with a sound and robust banking system, a certain degree of credit expansion will be beneficial to the economic growth even the credit expansion caused by capital inflow. Because not only the banking itself will actively internalize the repaying pressure arouse by credit expanding, but al ...

Lesson 6-1 - Huber Heights City Schools

... Concept: Matching Expenses with Revenue When revenue from business activities and expenses associated with earning that revenue are recorded in the same accounting period. ...

... Concept: Matching Expenses with Revenue When revenue from business activities and expenses associated with earning that revenue are recorded in the same accounting period. ...

... denominated in the national monetary unit. Because all modern governments issue currency denominated in their own monetary units, monetary economics has blurred the distinction between the monetary unit as an abstract unit like the yard, and the store of value, analogous to the yardstick. History pr ...

![3. terms, definitions and explanations[1]](http://s1.studyres.com/store/data/009861377_1-7f9dd587af700c75642cf13f2f9b82d7-300x300.png)