Brazil_en.pdf

... considerable inflows of foreign exchange. In the first 10 months of 2007, the overall balance of payments surplus more than tripled relative to the same period in 2006 (from US$ 23.1 billion to US$ 78 billion) and the current account surplus rose to US$ 6 billion (0.5% of GDP), on the basis of a tra ...

... considerable inflows of foreign exchange. In the first 10 months of 2007, the overall balance of payments surplus more than tripled relative to the same period in 2006 (from US$ 23.1 billion to US$ 78 billion) and the current account surplus rose to US$ 6 billion (0.5% of GDP), on the basis of a tra ...

Economics Chapter 18 Economic Development and

... • Foreign direct investment is the establishment of an enterprise by a foreigner. Foreign Portfolio Investment • Foreign portfolio investment is the entry of funds into a country when foreigners make purchases in the country’s stock and bond markets. ...

... • Foreign direct investment is the establishment of an enterprise by a foreigner. Foreign Portfolio Investment • Foreign portfolio investment is the entry of funds into a country when foreigners make purchases in the country’s stock and bond markets. ...

... transport prices index. The category exerting the strongest upward pressure on prices was food and nonalcoholic beverages (2.48%), owing to a drought that hurt food production in some parts of the country. The national employment rate rose from 53.1% to 54.0%; but an even greater increase in labour ...

Bahamas_en.pdf

... to US$ 1.191 billion, as a result of a drop in external payments for construction services and an increase in net travel receipts. Although tourism revenues contracted as the sector weakened, this was compensated by a fall in residents’ overseas travel spending in response to worsening conditions. T ...

... to US$ 1.191 billion, as a result of a drop in external payments for construction services and an increase in net travel receipts. Although tourism revenues contracted as the sector weakened, this was compensated by a fall in residents’ overseas travel spending in response to worsening conditions. T ...

Document

... exports recover. The completion of the MCC program will be a negative factor but the increase in government capital expenditure in the 4th quarter of 2009 and budgeted for 2010 should work in the opposite direction • A mild pick up in inflation, due in part to tax changes and the impact of the appre ...

... exports recover. The completion of the MCC program will be a negative factor but the increase in government capital expenditure in the 4th quarter of 2009 and budgeted for 2010 should work in the opposite direction • A mild pick up in inflation, due in part to tax changes and the impact of the appre ...

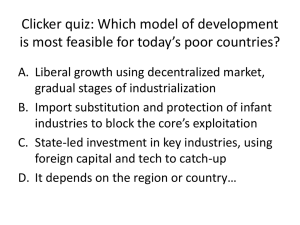

Clicker quiz: Which model of development

... Clicker quiz: Which model of development is most feasible for today’s poor countries? A. Liberal growth using decentralized market, gradual stages of industrialization B. Import substitution and protection of infant industries to block the core’s exploitation C. State-led investment in key industrie ...

... Clicker quiz: Which model of development is most feasible for today’s poor countries? A. Liberal growth using decentralized market, gradual stages of industrialization B. Import substitution and protection of infant industries to block the core’s exploitation C. State-led investment in key industrie ...

Indian Economic Reforms

... • India is in an enviable position among developing countries • Fear of competition is receding – confidence among Indian industries in their ability to compete in the world market. • Success of IT is spilling over to manufacturing • India’s standing as an economic power in the South Asian region an ...

... • India is in an enviable position among developing countries • Fear of competition is receding – confidence among Indian industries in their ability to compete in the world market. • Success of IT is spilling over to manufacturing • India’s standing as an economic power in the South Asian region an ...

This PDF is a selection from an out-of-print volume from... Bureau of Economic Research

... good measure financing current public and private consumption rather than productive investment. But how should external borrowing be analyzed in an economic framework? In particular, is Brazil's debt too large? Is it worth making the extreme growth sacrifice Brazil has chosen in the 1981 recession ...

... good measure financing current public and private consumption rather than productive investment. But how should external borrowing be analyzed in an economic framework? In particular, is Brazil's debt too large? Is it worth making the extreme growth sacrifice Brazil has chosen in the 1981 recession ...

Does Capital Mobility Finance or Cause a Current Account

... of the pegged exchange rate regime; inconsistent trinity; selection of exchange rate regime. ...

... of the pegged exchange rate regime; inconsistent trinity; selection of exchange rate regime. ...

wiiw wiiw Policy Note/Policy Report 2: The crisis in Eastern Europe

... In that context, dealing with the current problems in the New Member States (NMS) and the Future Member States (FMS) are in part the responsibility of the EU, but cannot be addressed by the EU, at least not in a straightforward way. In the case of NMS, there is at least a forum to discuss these pro ...

... In that context, dealing with the current problems in the New Member States (NMS) and the Future Member States (FMS) are in part the responsibility of the EU, but cannot be addressed by the EU, at least not in a straightforward way. In the case of NMS, there is at least a forum to discuss these pro ...

doc

... currency. A horizontal line at the intersection of the curves can mark off the Yintercept, labeled P*.] The exchange rate is overvalued when the price is below P*, the market-clearing level. It then takes less local currency (say, pesos) to buy foreign currency (say, dollars) than would be the case ...

... currency. A horizontal line at the intersection of the curves can mark off the Yintercept, labeled P*.] The exchange rate is overvalued when the price is below P*, the market-clearing level. It then takes less local currency (say, pesos) to buy foreign currency (say, dollars) than would be the case ...

HOT MONEY AND COLD COMFORT

... of access to international capital markets. Fiscal austerity follows, often as the price of IMF intervention to stabilize the situation, economic growth is stunted, many businesses fail because they do not have sources of dollar revenue to service their suddenly very expensive dollar-denominated deb ...

... of access to international capital markets. Fiscal austerity follows, often as the price of IMF intervention to stabilize the situation, economic growth is stunted, many businesses fail because they do not have sources of dollar revenue to service their suddenly very expensive dollar-denominated deb ...

Highlights of Colombia Economic analysis 2007 and forecast 2008 Foto: David Cárdenas

... During 2007, the Central Bank increased interest rates in five occasions in order to control inflation and “avoid the overheating of the economy”, given the increase of internal demand, consistent with the high usage level of installed capacity, as reported by the EOIC. The 90-day term deposit (DTF) ...

... During 2007, the Central Bank increased interest rates in five occasions in order to control inflation and “avoid the overheating of the economy”, given the increase of internal demand, consistent with the high usage level of installed capacity, as reported by the EOIC. The 90-day term deposit (DTF) ...

Chapter 8

... • Quantitative easing low interest rates • High corporate taxes • Double taxation on money earned in foreign countries • Interest earned on reserves held at the Fed • Large fines paid to Treasury by big banks • Interest on national debt • Expectation of lower prices • Lengthy and detailed laws ...

... • Quantitative easing low interest rates • High corporate taxes • Double taxation on money earned in foreign countries • Interest earned on reserves held at the Fed • Large fines paid to Treasury by big banks • Interest on national debt • Expectation of lower prices • Lengthy and detailed laws ...

Paraguay_en.pdf

... terms of trade had worsened by 19.4% year-on-year. External demand contracted, since demand was down also in Paraguay’s main trading partners (MERCOSUR countries). Up to October, earnings from merchandise exports declined by 29.9% compared with the same period in 2009. This was counterbalanced, howe ...

... terms of trade had worsened by 19.4% year-on-year. External demand contracted, since demand was down also in Paraguay’s main trading partners (MERCOSUR countries). Up to October, earnings from merchandise exports declined by 29.9% compared with the same period in 2009. This was counterbalanced, howe ...

Demand Function

... Americans must buy foreign currency in order to buy foreign bonds Changes in bond interest rates affect foreign exchange rates If US interest rates rise, ALL ELSE UNCHANGED, foreigners will demand more US bonds and therefore more US dollars; Americans will also hold on to dollars more, so supply wil ...

... Americans must buy foreign currency in order to buy foreign bonds Changes in bond interest rates affect foreign exchange rates If US interest rates rise, ALL ELSE UNCHANGED, foreigners will demand more US bonds and therefore more US dollars; Americans will also hold on to dollars more, so supply wil ...

SIMON FRASER UNIVERSITY Department of Economics Econ 345 Prof. Kasa

... 1. A depreciation of the (real) exchange rate increases net exports. 2. Equilibrium in the foreign exchange market predicts that interest rates and exchange rates (defined as the price of foreign currency) are negatively correlated. 3. According to the Balassa-Samuelson theory of real exchange rates, ...

... 1. A depreciation of the (real) exchange rate increases net exports. 2. Equilibrium in the foreign exchange market predicts that interest rates and exchange rates (defined as the price of foreign currency) are negatively correlated. 3. According to the Balassa-Samuelson theory of real exchange rates, ...

Guyana_en.pdf

... For example, while the volume of sugar exports increased, the average export price declined because of European price cuts in October 2009. As a result, export earnings for sugar were US$ 118.9 million, or 10.8% below the 2008 value. Similarly, rice exports increased in 2009 but the average export p ...

... For example, while the volume of sugar exports increased, the average export price declined because of European price cuts in October 2009. As a result, export earnings for sugar were US$ 118.9 million, or 10.8% below the 2008 value. Similarly, rice exports increased in 2009 but the average export p ...

1 Forthcoming in Journal of Globalization and Development

... world reserve asset would depend on the broader use of SDRs. However, this would make the transition more costly for the U.S. and it is therefore likely to face greater resistance in this country. So, in the short-term it may be useful to concentrate on reforming the global reserve system, which mea ...

... world reserve asset would depend on the broader use of SDRs. However, this would make the transition more costly for the U.S. and it is therefore likely to face greater resistance in this country. So, in the short-term it may be useful to concentrate on reforming the global reserve system, which mea ...

Belize_en.pdf

... similar period last year. This upturn was driven by growth in domestic credit and inflows from tourism and merchandise exports. However, money growth slowed in the second half of the year, dampened by the impact of the hurricane, leading to fairly stable overall growth. Credit expanded to productive ...

... similar period last year. This upturn was driven by growth in domestic credit and inflows from tourism and merchandise exports. However, money growth slowed in the second half of the year, dampened by the impact of the hurricane, leading to fairly stable overall growth. Credit expanded to productive ...

GOAL 9 MONSTER REVIEW Measuring the Economy GDP – Gross

... 14. Setting a ________________ places a limit on the amount of goods that are imported into a country. 15. What terms means removing government regulations from business? 16. Today, what term is used to describe a country that is primarily agricultural? 17. Today, what term is used to describe count ...

... 14. Setting a ________________ places a limit on the amount of goods that are imported into a country. 15. What terms means removing government regulations from business? 16. Today, what term is used to describe a country that is primarily agricultural? 17. Today, what term is used to describe count ...

Chapter 3 The International Monetary System

... – International floating exchange rate system instituted in 1973. • System supposed to reduce economic volatility and facilitate free trade. – Floating rates would offset international differences in inflation. – Real exchange rates would stabilize given gradual changes in underlying conditions affe ...

... – International floating exchange rate system instituted in 1973. • System supposed to reduce economic volatility and facilitate free trade. – Floating rates would offset international differences in inflation. – Real exchange rates would stabilize given gradual changes in underlying conditions affe ...

Chapter Seven Answers

... When sales are made to foreigners there is initially a net increase in resources available to the economy and foreign owners may introduce new technology to the economy. In subsequent years the outflow of dividends to the foreign owners will be a negative influence on the CAD, largely beyond the con ...

... When sales are made to foreigners there is initially a net increase in resources available to the economy and foreign owners may introduce new technology to the economy. In subsequent years the outflow of dividends to the foreign owners will be a negative influence on the CAD, largely beyond the con ...

EOCT Study Guide

... exports minus the value of its imports. If positive (exports greater than imports) a nation has a trade surplus, if negative (imports greater than exports) a nation has a trade deficit. o Balance of Payments is the value of all economic transactions (not just exports/imports). It includes net export ...

... exports minus the value of its imports. If positive (exports greater than imports) a nation has a trade surplus, if negative (imports greater than exports) a nation has a trade deficit. o Balance of Payments is the value of all economic transactions (not just exports/imports). It includes net export ...

NBER WORKING PAPER SERIES CHINA CURRENT ACCOUNT IMBALANCES

... produce any effects on the policies and current account imbalances of either China or the United States. More recently, the action has shifted from policies explicitly directed by the IMF to policies developed by the G20 countries at their periodic meetings on the theory that, for domestic political ...

... produce any effects on the policies and current account imbalances of either China or the United States. More recently, the action has shifted from policies explicitly directed by the IMF to policies developed by the G20 countries at their periodic meetings on the theory that, for domestic political ...